Blast Futures Exchange (BFX) Review

Perpetual Futures Exchange with Native Yield on Blast Network.

What is Blast Futures Exchange (BFX)?

The Blast Futures Exchange (BFX) stands as a pioneering Perpetual Futures Exchange that integrates native yield directly. Offering a straightforward, user-friendly trading interface coupled with automatic yield generation, BFX patrons benefit from up to 5% interest on their balances automatically. It is recognized as the globe’s most secure, liquid global derivatives exchange, providing round-the-clock access to global markets from any location worldwide.

BFX Platform Features

Blast Futures combines the best features of centralized exchange (CEX) trading and decentralized exchange (DEX) native yield farming, providing a comprehensive solution that meets all trading requirements while ensuring a smooth and efficient trading experience.

Incorporating native yield, Blast Futures emerges as the first high-performance futures exchange to do so, ensuring that balances compound automatically, thus continuously working for the user.

Offering the best trader experience, Blast Futures has developed an all-encompassing trading platform that includes native yield, seamless onboarding, advanced charting, advanced orders, and more.

How Blast Functions

Blast introduces auto-rebasing for ETH balances on L2, supporting both EOAs and smart contracts, with smart contracts having the option to opt-in. This functionality extends to USDB, Blast’s native stablecoin, enhancing its usability.

Following the Ethereum Shanghai upgrade, Blast could automatically transfer L1 staking yields to users through rebasing ETH on L2, with future plans to incorporate Blast-native solutions or other third-party protocols.

USDB yield is sourced from MakerDAO’s on-chain T-Bill protocol, with options for redemption back to USDC, highlighting potential future expansions in protocol partnerships.

Blast stands out as the sole Ethereum L2 solution providing native yield for ETH and stablecoins, deriving yield from ETH staking and RWA protocols and automatically passing it back to users. Unlike other L2s offering 0% default interest rates, Blast offers 4% for ETH and 5% for stablecoins.

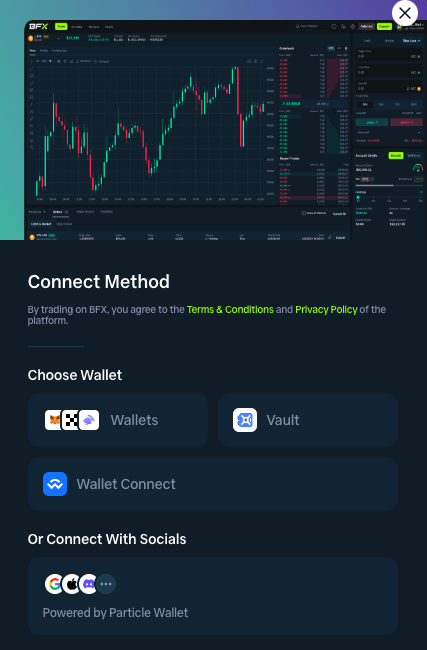

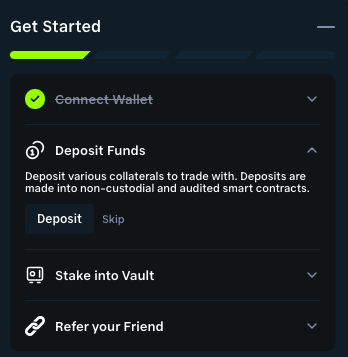

How to Use BFX

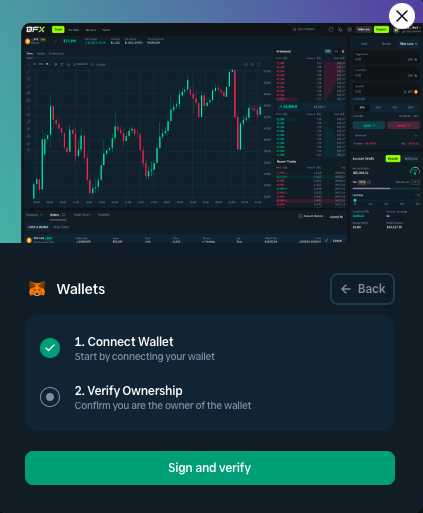

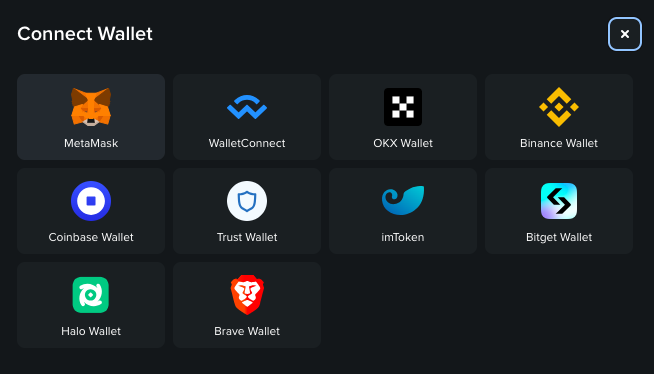

Connect your web3 wallet.

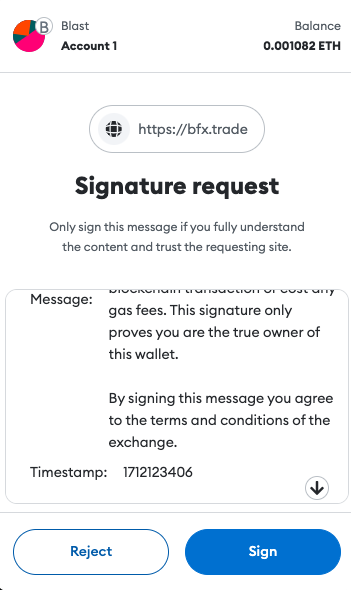

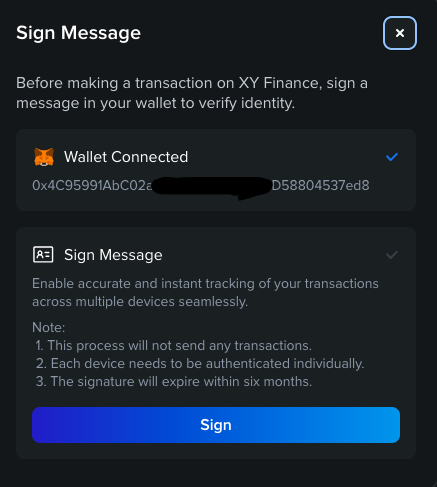

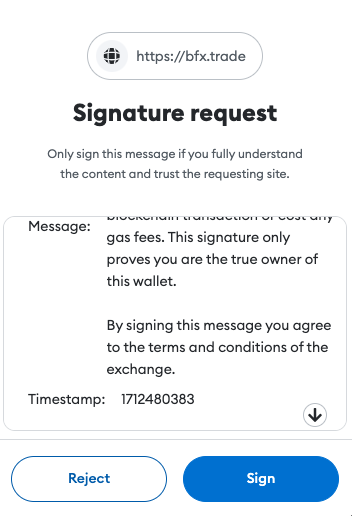

Once you connect your wallet, sign a signature to verify ownership of the wallet.

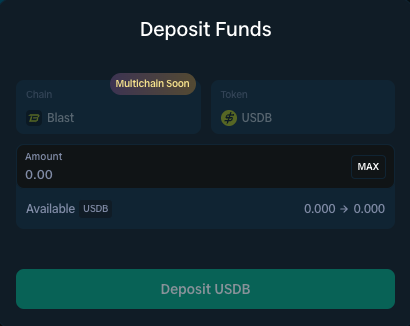

Once your wallet is connect, you can proceed to deposit funds.

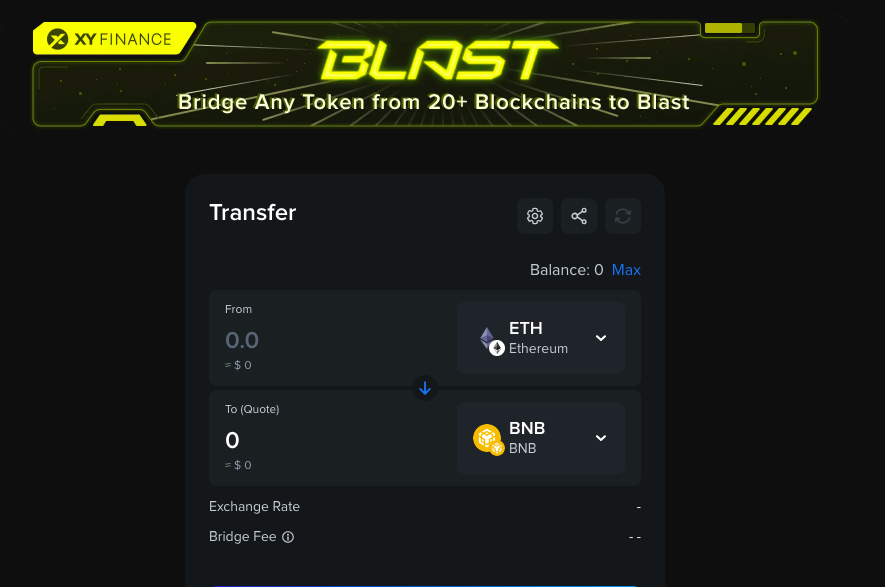

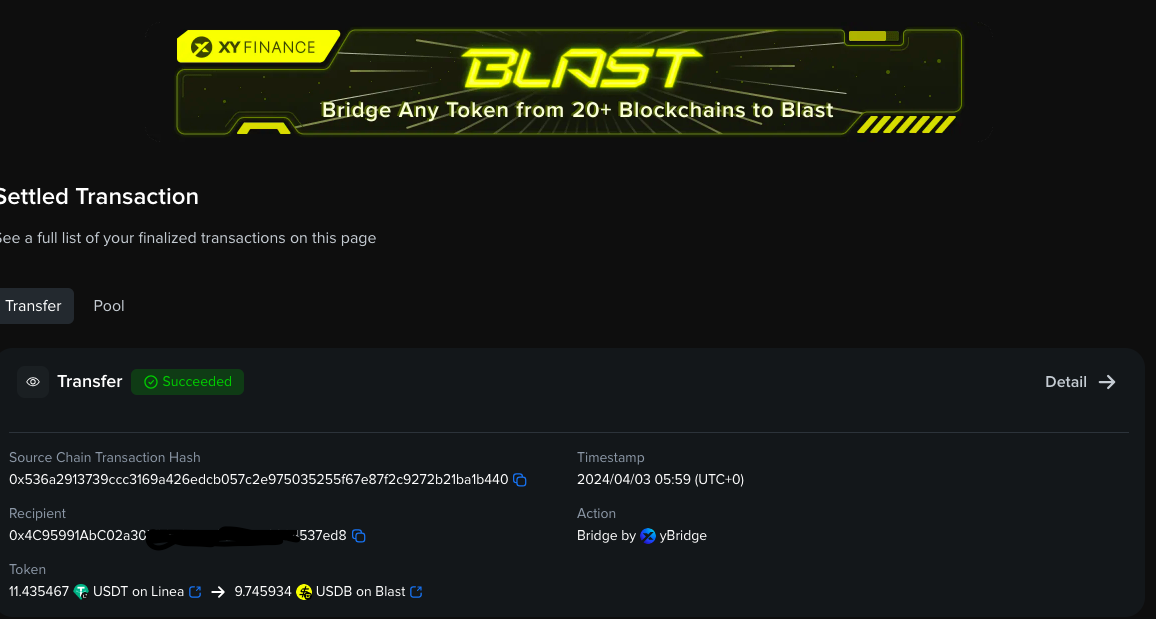

To have funds available, we are gong to bridge some assets to the Blast network using XY Finance.

Connect your wallet XY Finance.

Sign message to confirm ownership.

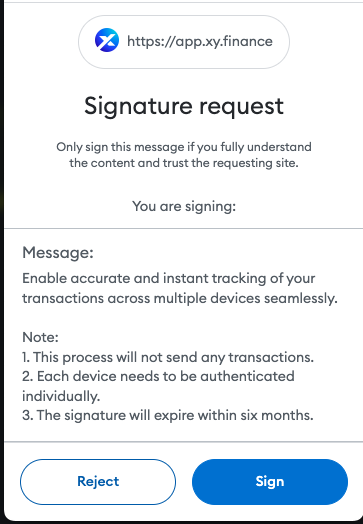

Choose the destination chain i.e. Blast.

Choose the destination chain i.e. Blast.

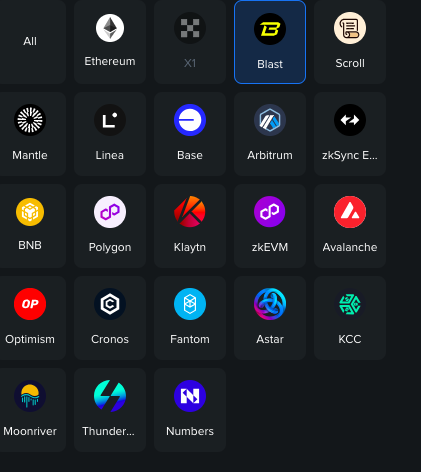

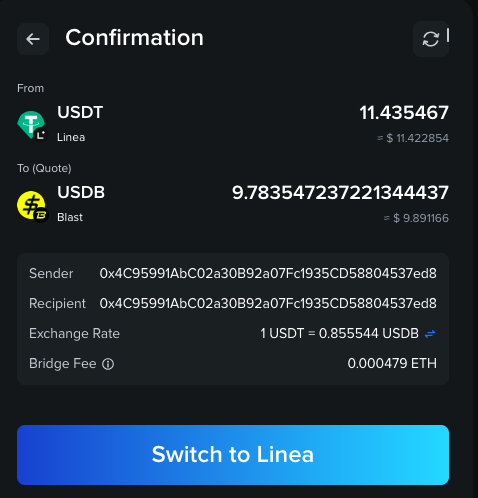

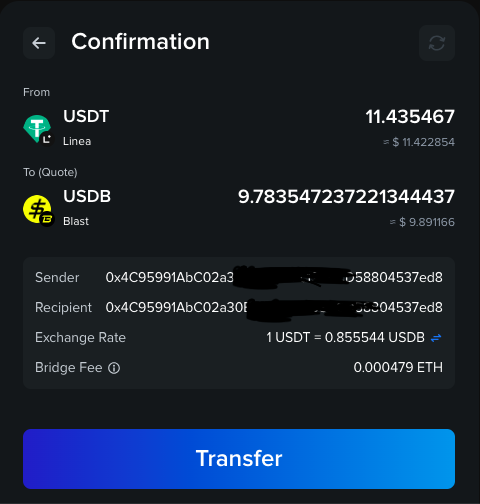

For this demonstration, we are going to bridge USDT on Linea to USDB on Blast.

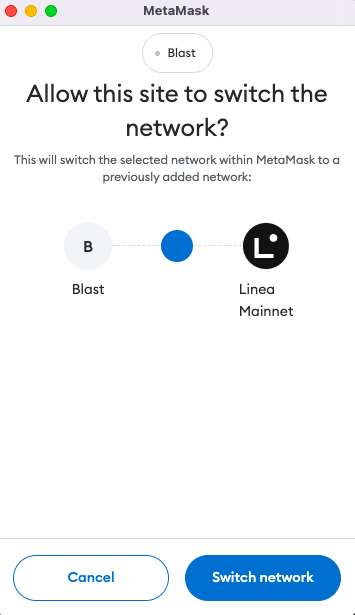

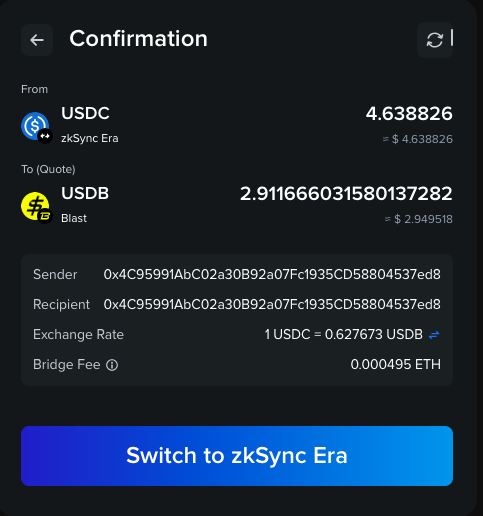

Make sure your wallet is using the correct network.

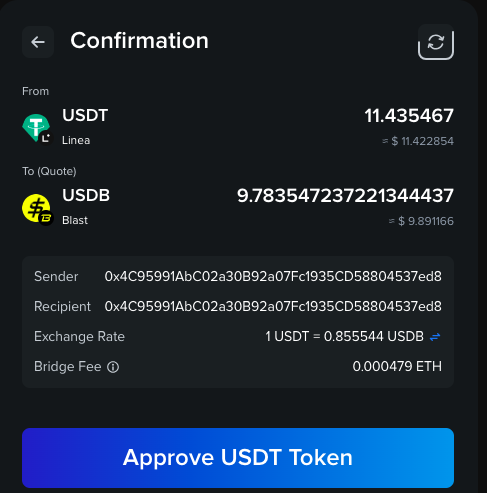

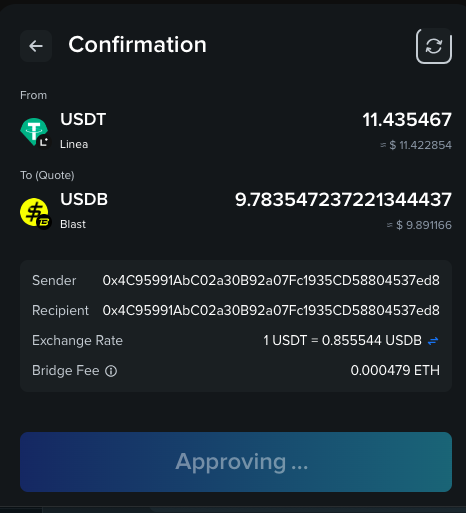

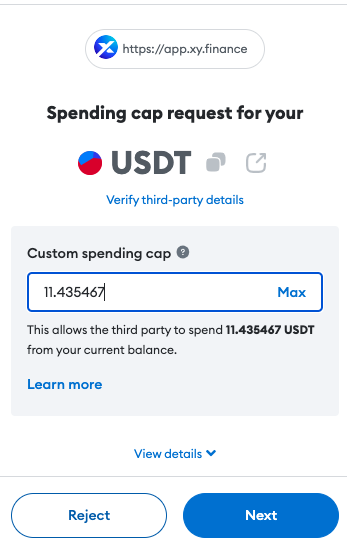

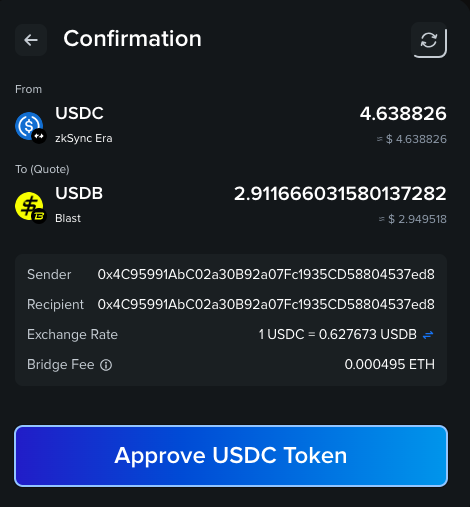

Approve the asset transfer.

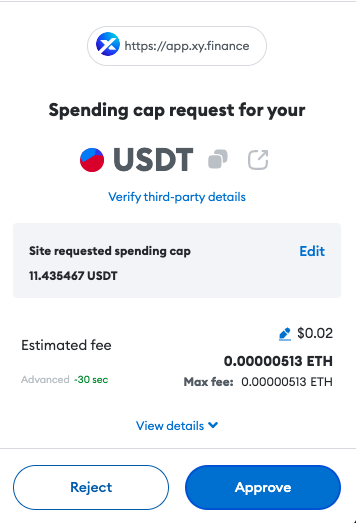

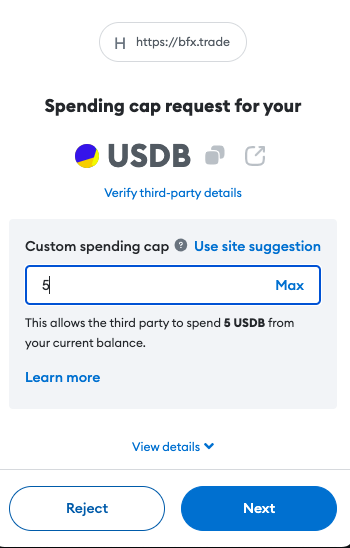

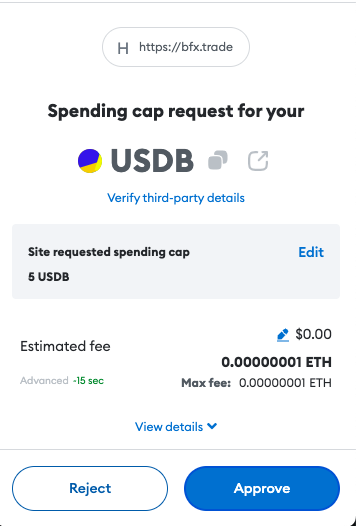

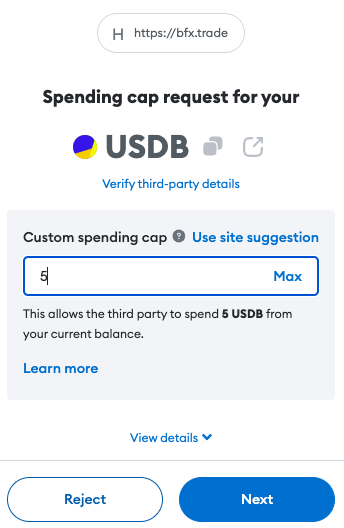

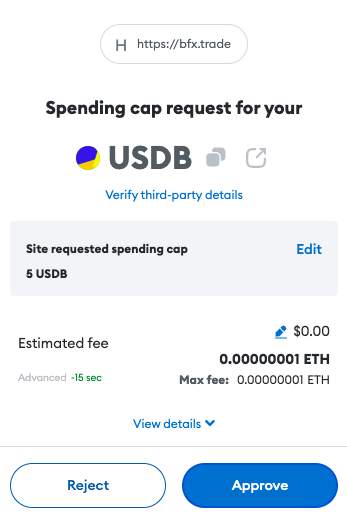

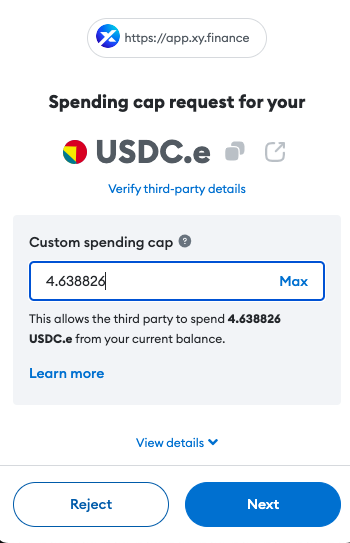

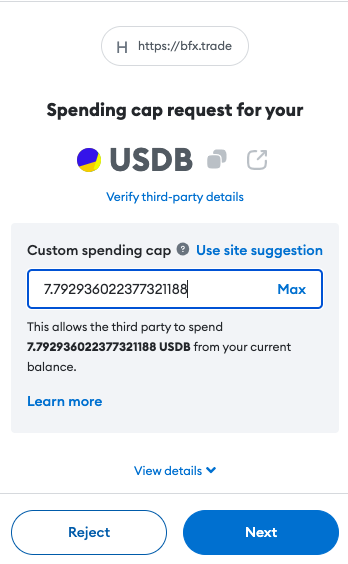

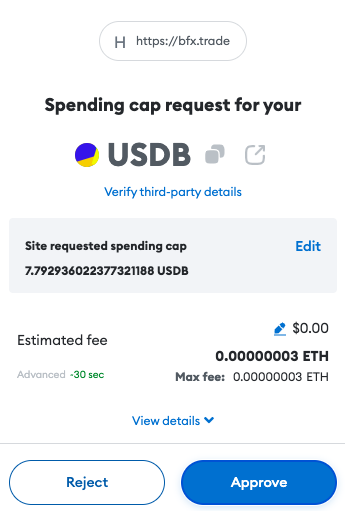

Set the spending cap.

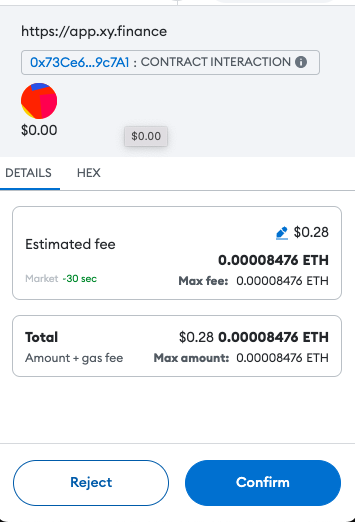

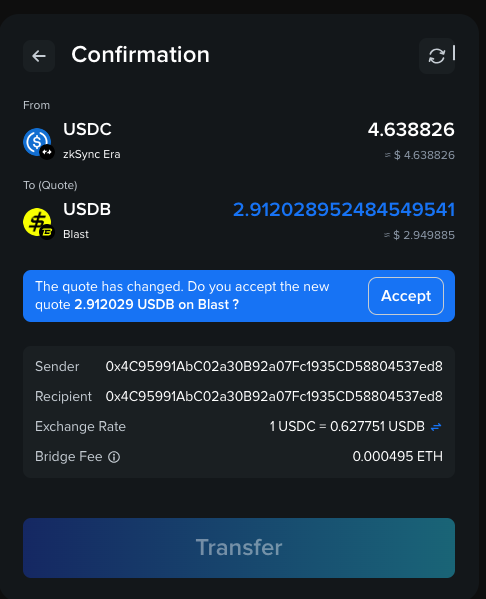

Pay the transaction gas fee.

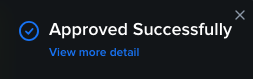

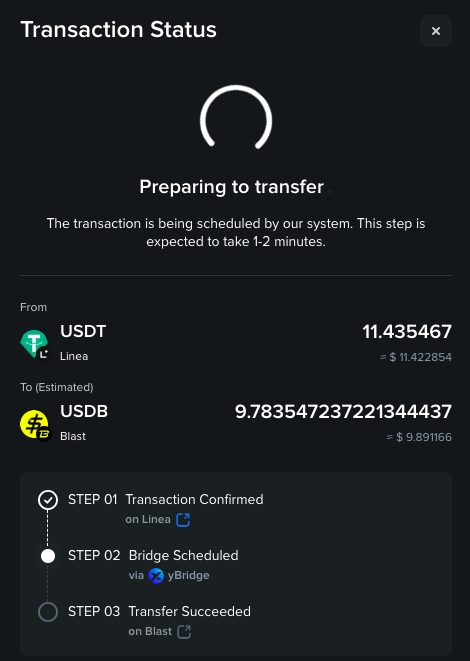

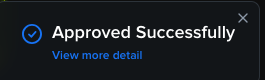

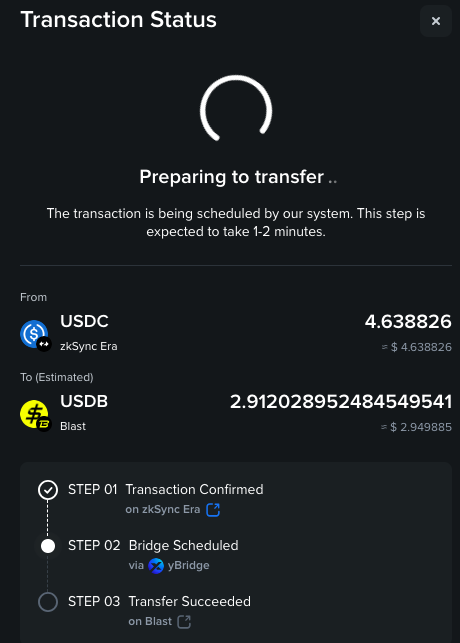

Once the gas fee is paid the transfer is initiated.

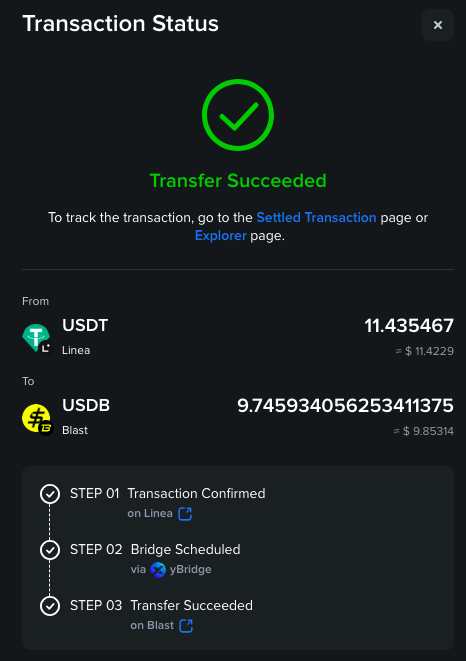

Once the transaction has been processed your funds will be available on Blast.

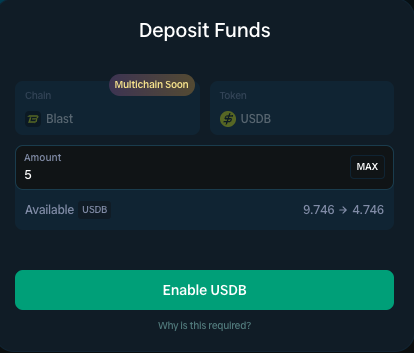

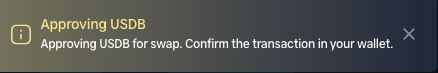

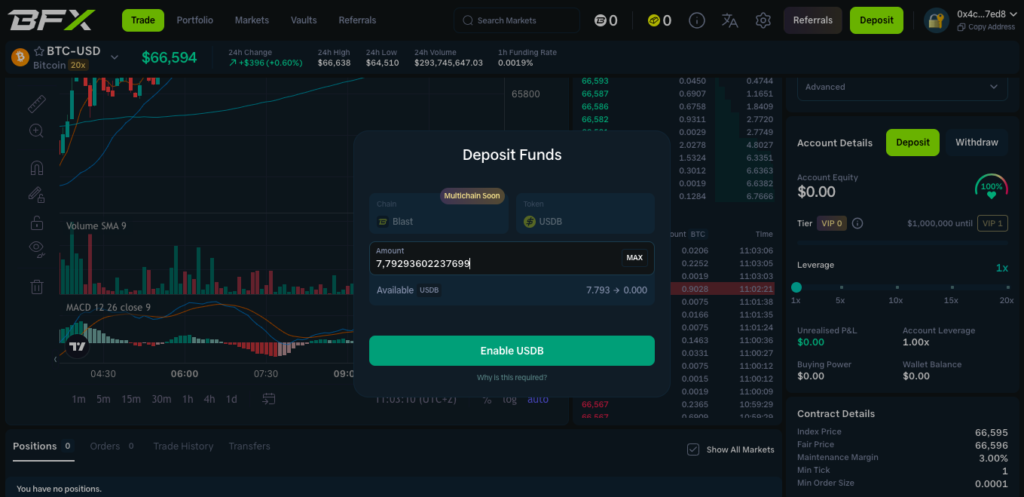

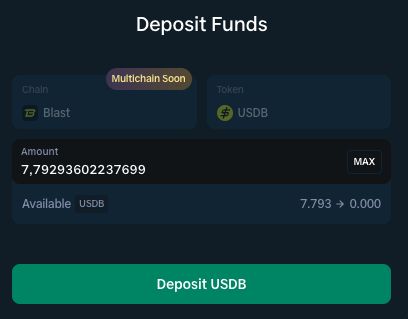

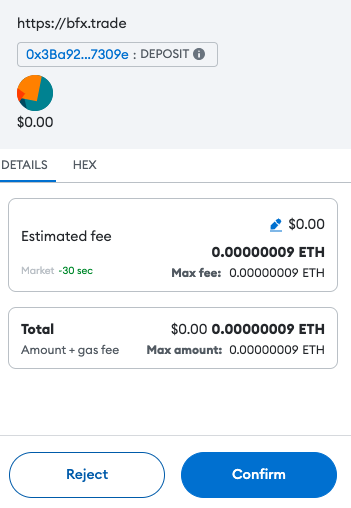

Now that we have funds on Blast L2, we can proceed to deposit into the BFX platform.

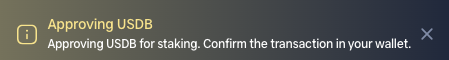

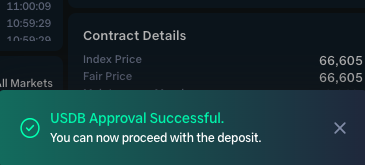

Set spending cap and pay fee.

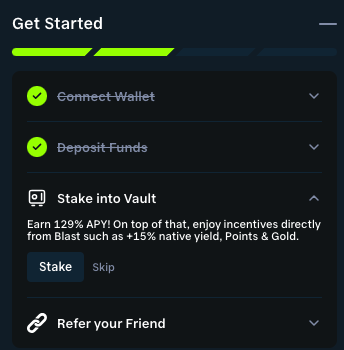

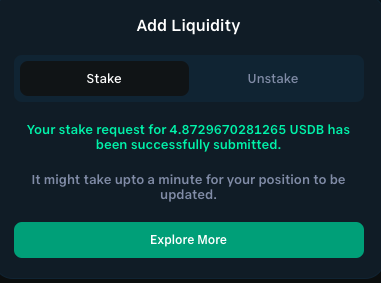

How to Stake on BFX and Earn Rewards

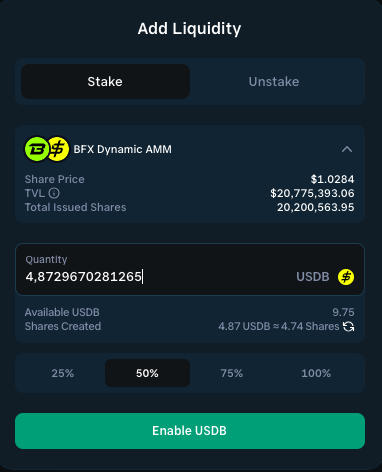

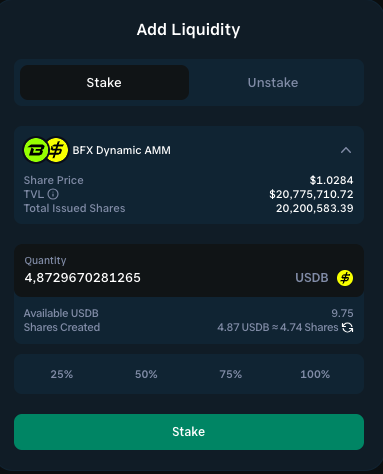

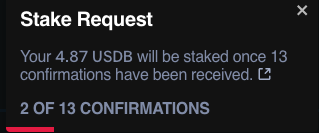

Choose the asset and amount you wish to stake.

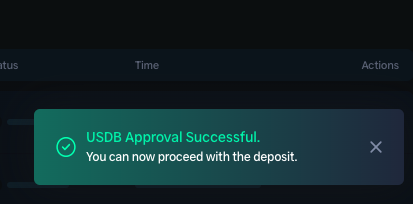

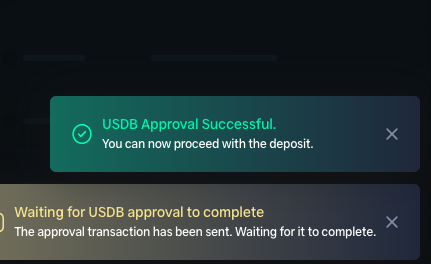

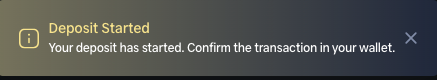

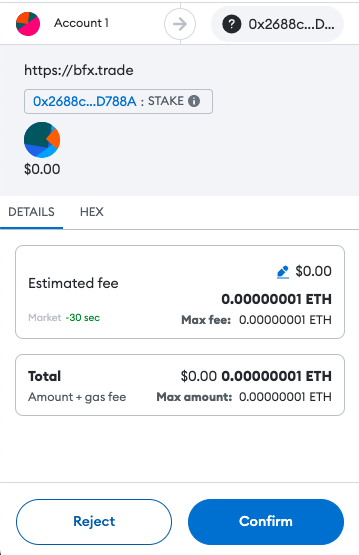

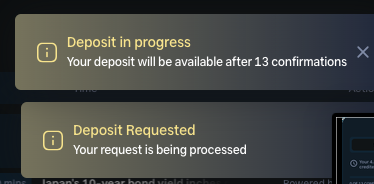

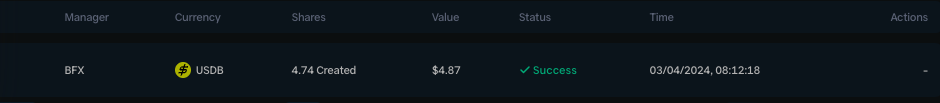

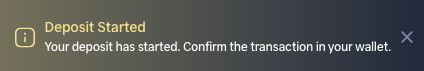

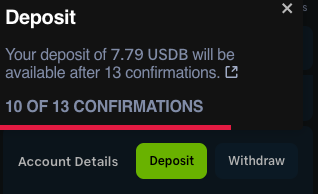

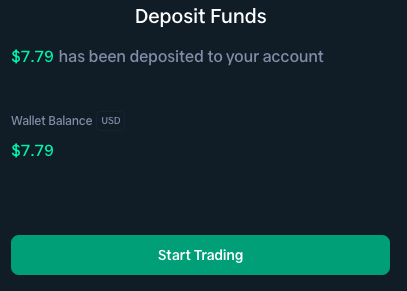

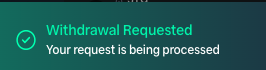

Your deposit should be in progress.

You’ll be notified once your assets are staked successfully.

![]()

How to Trade on BFX

How to Trade on BFX

To enable trading, make sure you deposit funds for your trades first.

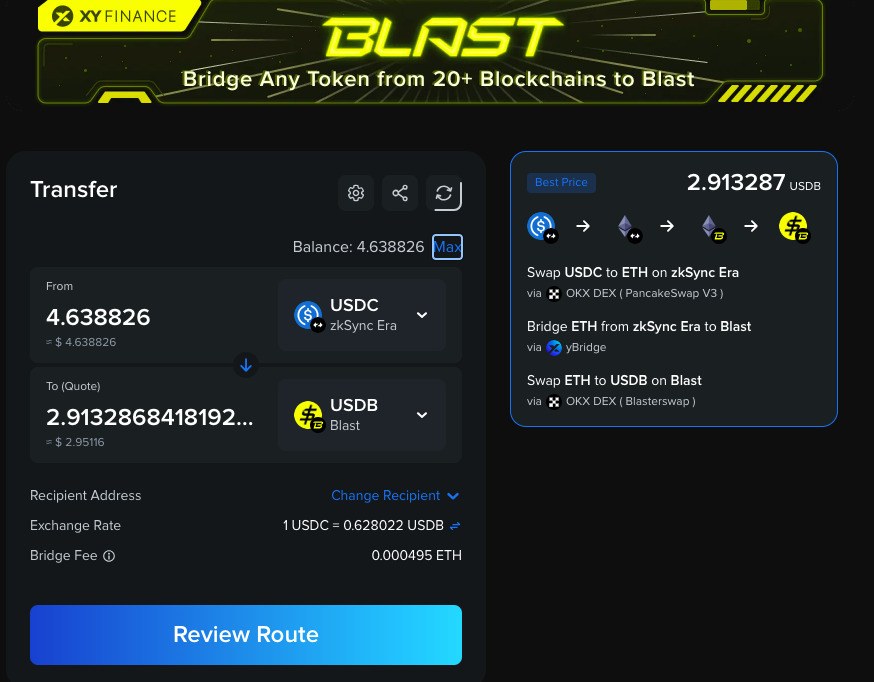

We are going to quickly bridge assets to Blast once again.

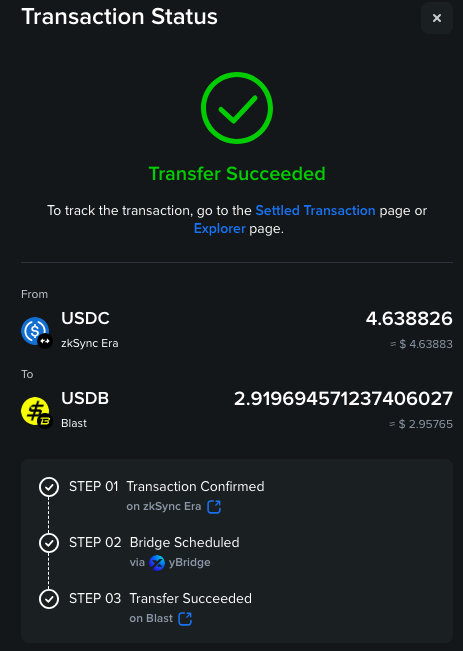

This time we’ll bridge USDC from zkSync network to USDB on Blast.

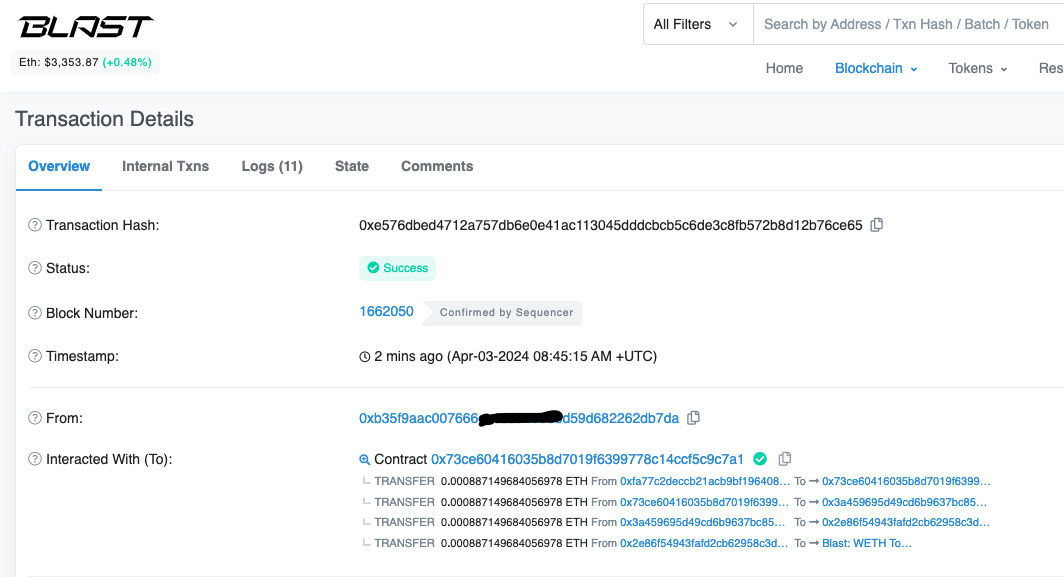

You can confirm your transfer on the block explorer.

Once you’ve bridged some assets to Blast, you can make a deposit to the BFX platform.

Set spending cap.

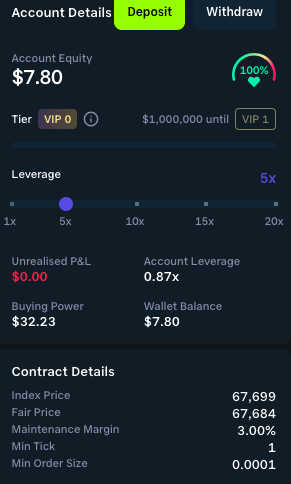

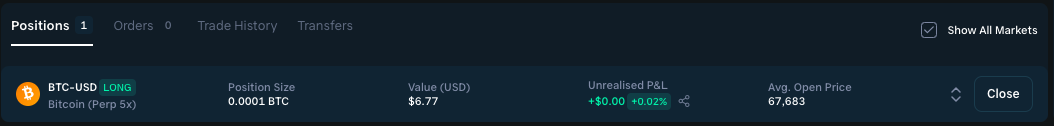

Now that funds are deposited, you can proceed to trade.  Open limit or market orders. Choose the amount of leverage you’re comfortable with.

Open limit or market orders. Choose the amount of leverage you’re comfortable with.

You can see your open positions on the dashboard.

How to Withdraw Crypto from BFX

How to Withdraw Crypto from BFX

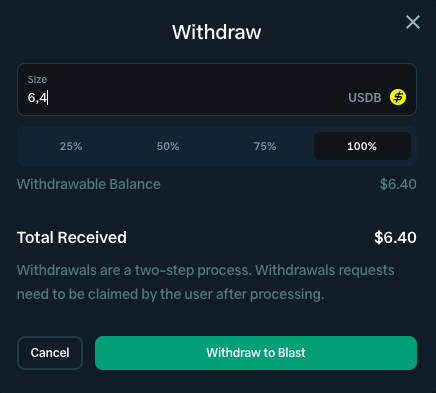

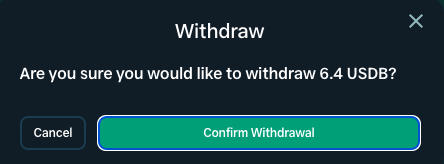

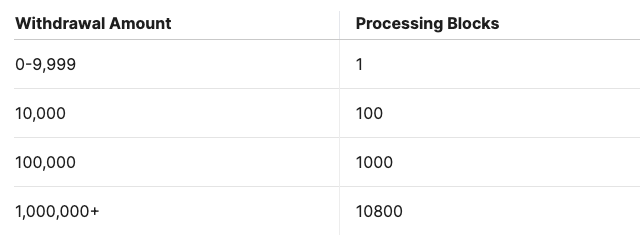

To withdraw collateral or profits from your trades, simply go to the Withdrawal panel.

Confirm the withdrawal.

Sign a signature.

![]()

You’ll simply be notified about the status of your withdrawal at each stage.

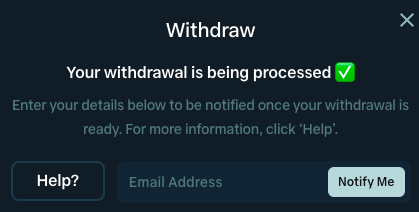

Pay the gas fee.

Your withdrawal will be processed.

What Makes BFX Unique?

In the pursuit of developing the ultimate perpetuals trading platform, Blast Futures Exchange identified three primary challenges to address:

-

Underperforming Assets: Unlike other perpetual future exchanges that lack automatic yield, BFX ensures that the value of assets does not depreciate over time, addressing a significant issue in the process.

-

Poor Liquidity: The exchange tackles the issue of limited markets and shallow liquidity found in existing Automated Market Maker (AMM) based and orderbook-based perpetual decentralized exchanges (DEXs), which restricts profit-making opportunities and new token listings.

-

Inadequate Trader Experience (UI/UX): Recognizing the significant barrier presented by complex and challenging user interfaces in the DeFi space, BFX focuses on eliminating these hurdles to facilitate easier access for potential new users into the DeFi ecosystem.

Introducing a Dynamic Market Maker strategy, the exchange simplifies liquidity provision using an oracle-based approach that leverages up-to-the-millisecond market information for accuracy, making liquidity provision straightforward, flexible, and efficient.

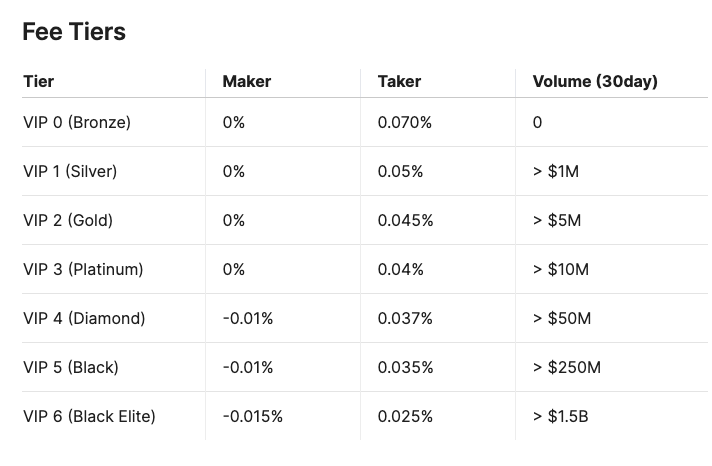

Incentives & Fees on BFX

BFX is dedicated to rewarding users through the distribution of 100% of Blast Points & Gold, based on trading volume and platform engagement. It introduces a perpetuals orderbook exchange with native yield, offering an unprecedented 15% yield on balances, similar to a high-yield savings account.

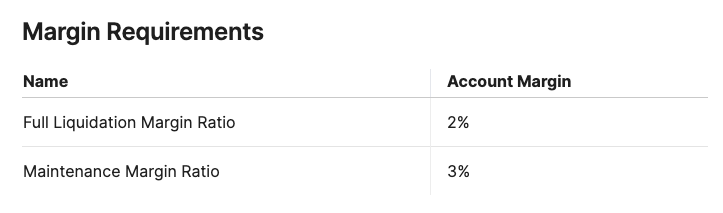

Emphasizing competitive trading fees, innovative liquidity solutions like the Dynamic AMM Vault, and a comprehensive insurance fund to mitigate risks, BFX prioritizes user experience and security. It also details withdrawal processes, ensuring transparency and ease for users.

Emphasizing competitive trading fees, innovative liquidity solutions like the Dynamic AMM Vault, and a comprehensive insurance fund to mitigate risks, BFX prioritizes user experience and security. It also details withdrawal processes, ensuring transparency and ease for users.

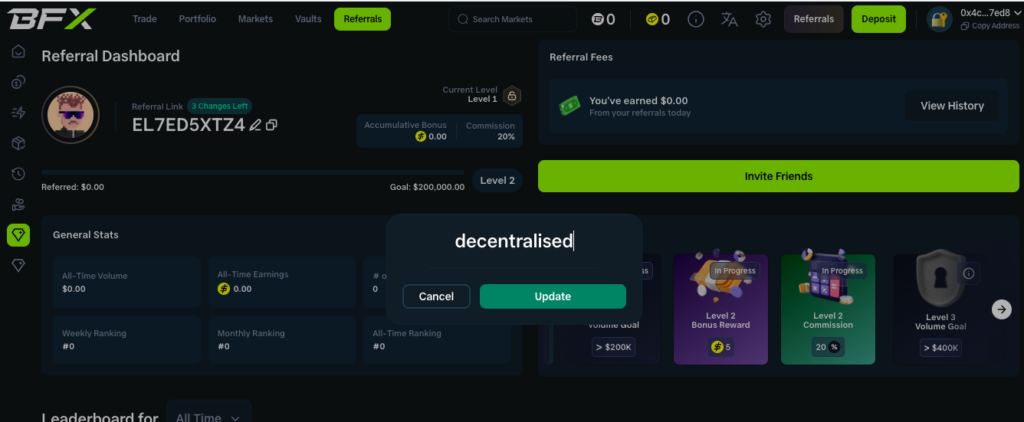

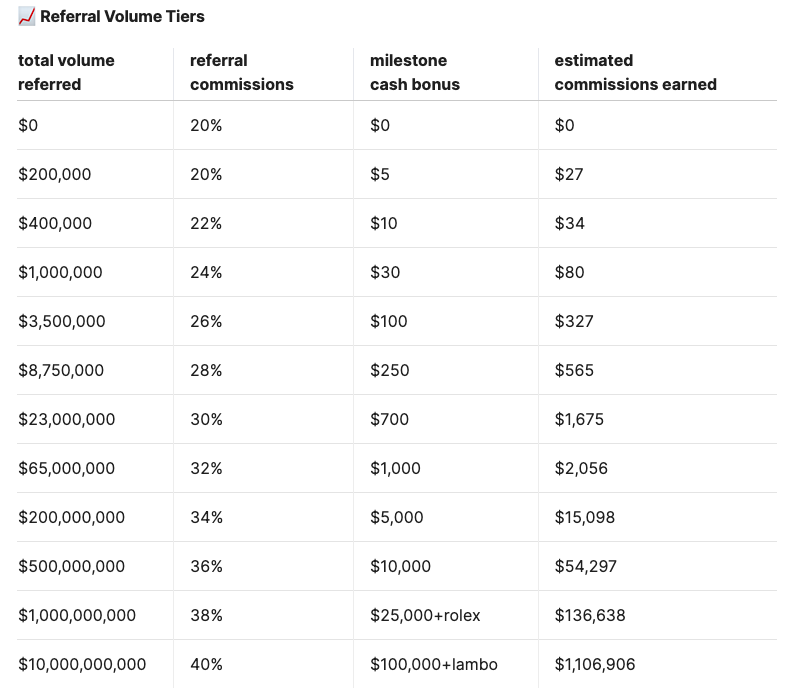

BFX Referral Program

The platform encourages user engagement through a referral program offering significant rewards, including bonus points, cash rewards, and even a Lamborghini for top referrers.

With a focus on community, engagement, and innovation, Blast Futures Exchange invites users to a comprehensive trading experience that blends the best of centralized and decentralized trading platforms, setting a new standard in the perpetual futures market.