Yield Revolution: Blast Ignites DeFi with Native ETH & Stablecoin Returns

Beyond L2: Blast Unveils a New DeFi Paradigm with Integrated Yield & Gas Sharing.

What is Blast?

Blast stands out as the sole Ethereum Layer 2 (L2) solution offering built-in yield for ETH and stablecoins, eliminating the need to interact with separate DeFi protocols. This native yield feature unlocks unique opportunities for both users and developers.

Yield Sources:

- ETH Staking: Blast leverages the post-Merge Ethereum staking capabilities, currently utilizing Lido, to automatically distribute 4% yield to users holding ETH on the L2.

- Real-World Assets (RWA): Blast’s stablecoin, USDB, earns 5% yield by integrating with MakerDAO’s on-chain T-Bill protocol, connecting Blast to real-world assets.

Addressing the Yield Gap

Traditionally, L2s lack native yield, forcing users to sacrifice potential returns by moving assets off the L1 chain. Blast bridges this gap by delivering these yields directly on the L2, offering:

- Higher Returns: Compared to the 0% yield on most L2s, Blast’s 4% and 5% yields are significantly more attractive.

- Convenience: Users avoid the hassle of interacting with external DeFi protocols and enjoy automatic yield accrual.

- Inflation Protection: Blast’s yields match or exceed current L1 staking and stablecoin returns, mitigating inflation effects.

What Makes Blast Unique?

Blast has a unique architecture:

- EVM-Compatible Optimistic Rollup: Maintains compatibility with existing Ethereum tools and DApps.

- Auto-Rebasing: Both ETH and USDB balances automatically grow with accrued yield, simplifying user experience.

- Flexible Design: The community can vote to integrate alternative staking solutions or RWA protocols in the future.

Unlocking New Possibilities

This native yield opens doors for:

- DApp Innovation: Developers can leverage Blast’s yield to create novel DeFi applications and business models impossible on other L2s.

- Reduced Gas Fees: DApps have the option to share gas revenue with users, potentially lowering transaction costs.

While Blast offers promising features, it’s crucial to remember that:

- The project is still in its early stages and may face unforeseen challenges.

- Alternative L2 solutions exist, each with its own advantages and disadvantages.

- Thorough research and risk assessment are essential before using any L2 or DeFi platform.

Blast presents a compelling proposition for users seeking higher returns and frictionless DeFi experiences on Ethereum’s L2. However, careful consideration and due diligence are necessary before participating in this innovative platform.

Building With Blast: What’s Possible

Blast’s unique yield-generating architecture unlocks a plethora of innovative DeFi applications across various categories. Here’s a glimpse into the possibilities:

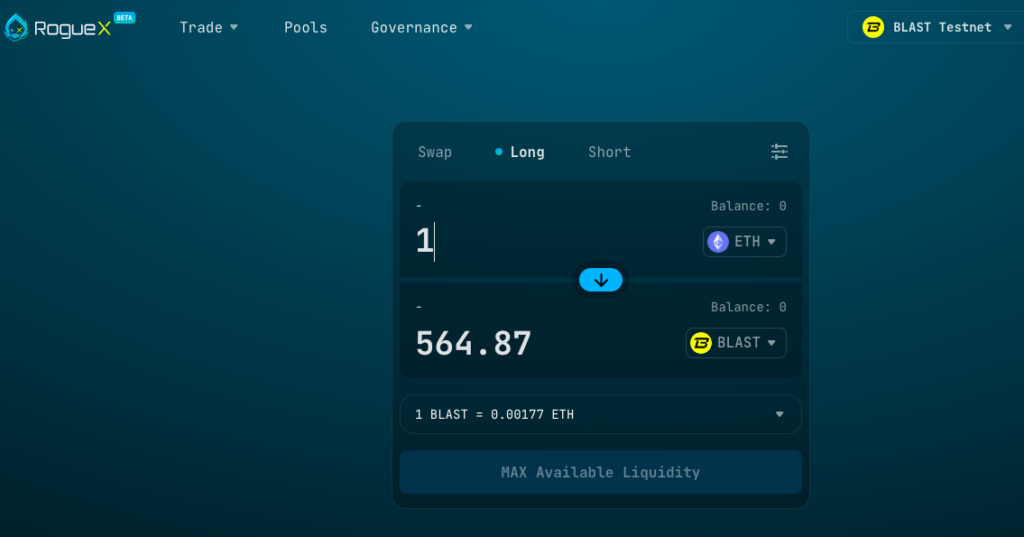

Perpetual Swaps:

- Earn yield on deposited assets (USDB, ETH, WETH) without trading fees.

- Monetize deposits and gas fees to offer zero trading fees, similar to Robinhood.

- Reward top traders with yield and gas fees through lottery-style distributions based on trading volume.

- Direct yield from takers to makers, incentivizing liquidity provision.

- Share yield, gas fees, and trading fees with token holders for sustainable growth.

- Boost LP yield by adding yield from users to vault depositors.

Spot Exchanges:

- Reward LPs with yield on their deposited assets.

- Automatically rebalance LP positions with accrued yield.

- Distribute yield from LP positions to traders through lottery-style systems.

- Share yield, gas fees, and trading fees with frontend administrators and token holders, enabling perpetual zero fees.

Lending Protocols:

- Enhance capital efficiency for borrowers by offering yield from their collateral to lenders.

- Improve debt health by automatically adding yield from collateral positions back to those positions.

- Increase liquidity and reduce opportunity costs for lenders by adding LP position yield back to those positions.

NFTs/Gaming:

- Mint NFTs via bonding curves, monetizing deposits and aligning incentives between creators and holders.

- Direct gas fees to creators, maximizing their earnings.

- Create automatic treasury growth for NFT projects like NounsDAO through yield.

- Offer “free” NFT minting by holding deposits in escrow and earning yield on them.

- Develop on-chain games where playing costs involve holding deposits that earn yield, effectively making them free-to-play.

- Create NFT perpetual products that share yield with users.

SocialFi:

- Reduce user opportunity costs by sharing yield on deposits in FriendTech-like platforms.

- Monetize through yield instead of trading fees in FriendTech platforms, improving liquidity and aligning incentives.

GambleFi:

- Create fairer on-chain games by monetizing through yield instead of rake (e.g., daily fantasy sports, poker, coin flip games).

- Enhance PoolTogether by adding native yield and Blast Points to winning rewards.

Infrastructure:

- Develop Solidity libraries that simplify yield sharing for developers, reducing user deposit opportunity costs.

- Build Telegram bots that offer zero trading fees and monetize through user yield, providing a competitive edge.

This is just a sampling of the possibilities fueled by Blast’s unique yield-generating capabilities. As the DeFi ecosystem evolves, we can expect even more innovative applications to emerge, unlocking new frontiers in decentralized finance.