RogueX Review: How to get Blast Airdrop

RogueX Revolution: AMM w/ Perpetual Trading & Dynamic Liquidity

What is RogueX?

RogueX pioneers with an AMM that integrates perpetual trading features into its liquidity pools, boosting asset efficiency and facilitating leveraged trading for a broad array of tokens, including memecoins.

RogueX represents an advanced AMM engineered to leverage dormant assets in conventional AMM liquidity pools. It transcends typical spot trading by embedding perpetual trading mechanisms within the same pools, fostering a vibrant trading milieu that enhances user engagement while promoting a resilient ecosystem. The platform melds a potent liquidity reward system, a vote-lock governance structure, and an intuitive user interface.

Spot and Perpetual Trading

RogueX endorses two principal trading modalities: spot and perpetual trading, both harmonized within a unified liquidity pool. The platform’s spot trading infrastructure is predicated on the Uniswap V3 framework.

In Uniswap V3, liquidity is optimized around the prevailing price point, allowing traders to execute purchases and sales of digital currencies at immediate market rates. RogueX’s perpetual trading innovation utilizes counterpart funds to provide users with augmented leverage.

The liquidity dynamics within RogueX’s pool are influenced by trading behaviors, expanding with perpetual trading losses and contracting as profits are realized and extracted.

This strategic liquidity adjustment sustains market equilibrium and availability of funds for covering trading positions.

Spot Trading

RogueX’s spot trading platform is anchored in Uniswap V3’s design, embracing its core trading ethos. This adoption ensures a consistent and intuitive trading experience, reflecting Uniswap V3’s established decentralized exchange standards.

RogueX capitalizes on liquidity pools for direct cryptocurrency pair trading, offering ample liquidity and reduced slippage. By aligning with Uniswap V3’s principles, RogueX guarantees a familiar and efficient trading environment.

How to Use the Testnet Swap Feature

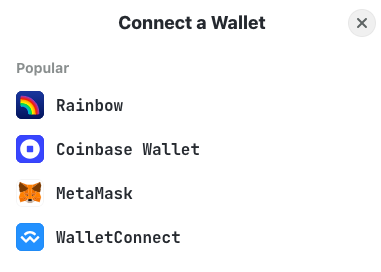

Connect your web3 wallet e.g. MetaMask.

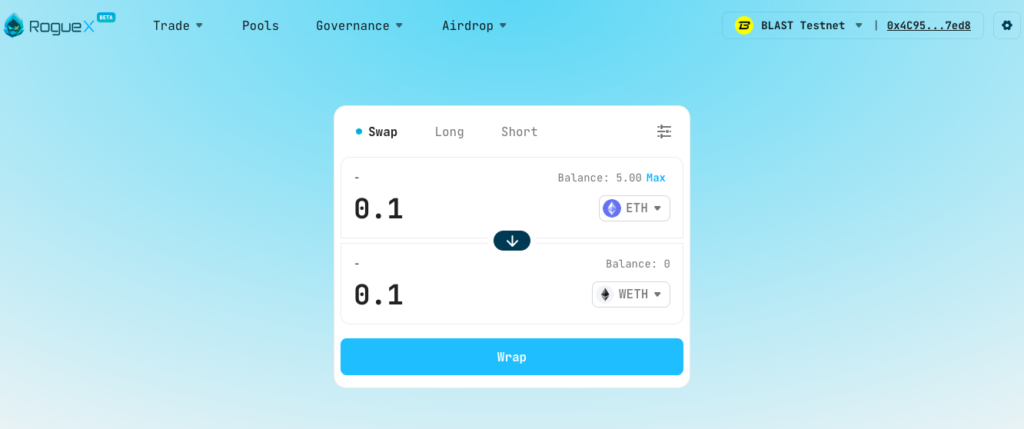

Choose the assets you wish to swap. In this example, we are swapping ETH for WETH.

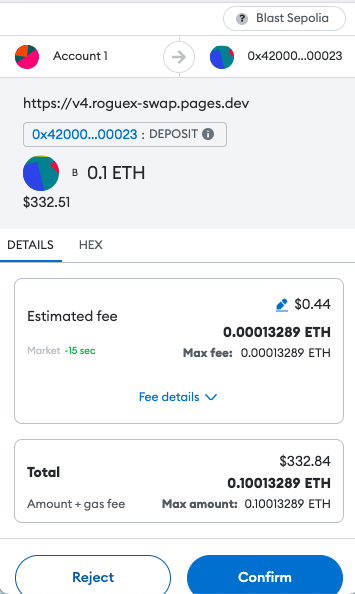

Pay the gas fee.

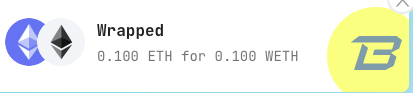

Once fee is paid, your transaction is processed.

Once fee is paid, your transaction is processed.

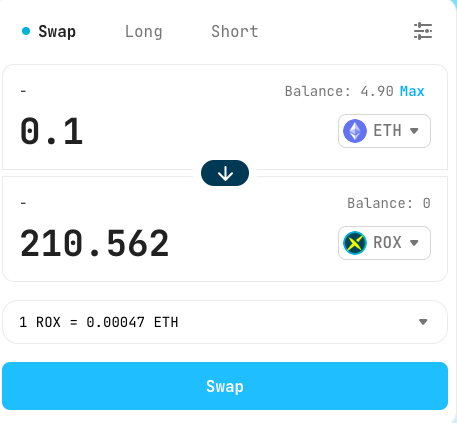

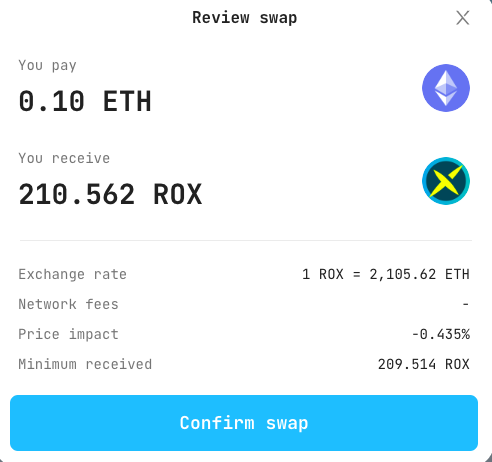

Let’s perform another swap. This time we’ll swap ETH for $ROX – the RogueX native token.

Confirm the swap.

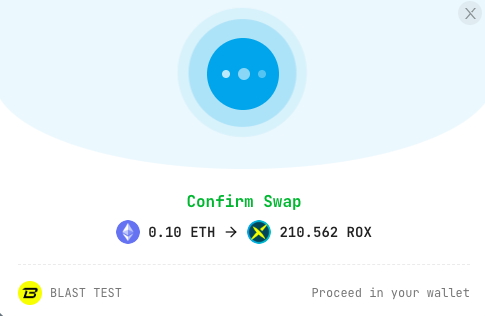

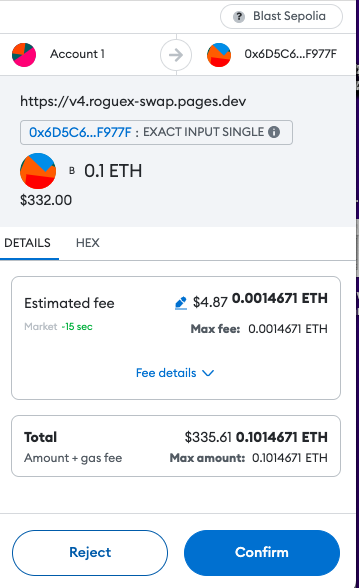

Pay the gas fee.

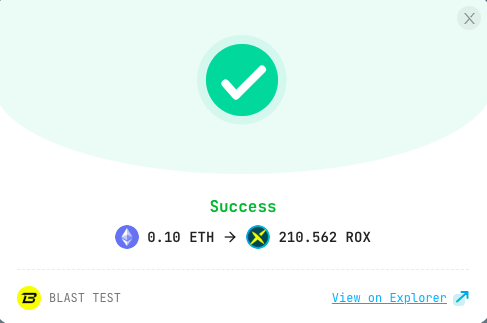

Once your transaction is processed, you’ll be notified.

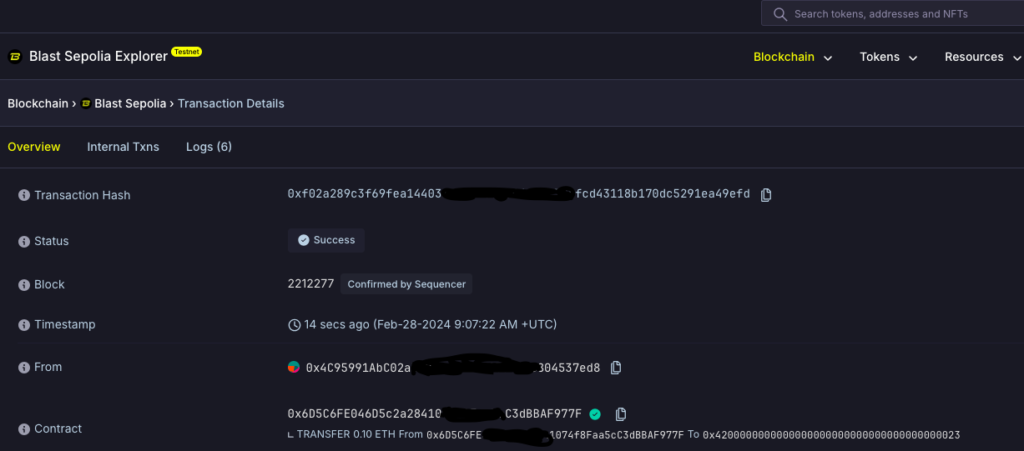

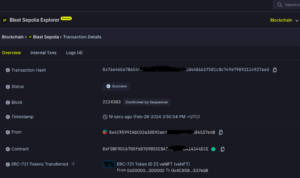

You can also verify transactions on the Blast block explorer.

Perpetual Trading

Perpetual Trading

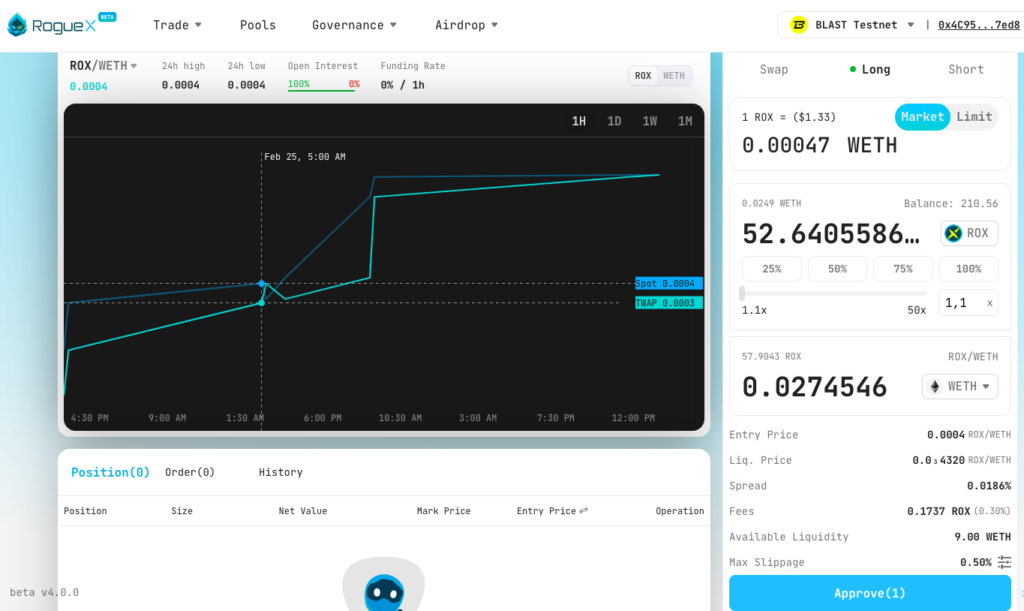

To trade perps, simply navigate to the Perp tab. Choose the type of order you’d like Market or Limit. Select whether you want to go LONG or SHORT.

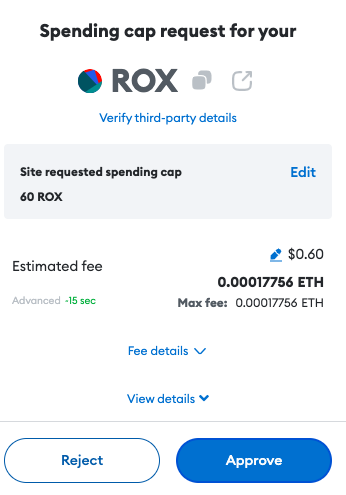

Choose the type of order you’d like Market or Limit. Select whether you want to go LONG or SHORT.  Set the spending cap.

Set the spending cap.  RogueX expands into perpetual trading, offering a derivatives product that allows price speculation on cryptocurrencies without owning them. Perpetual contracts facilitate gains in varied market conditions. With RogueX, the perpetual trading framework includes sophisticated tools for risk management and profit maximization.

RogueX expands into perpetual trading, offering a derivatives product that allows price speculation on cryptocurrencies without owning them. Perpetual contracts facilitate gains in varied market conditions. With RogueX, the perpetual trading framework includes sophisticated tools for risk management and profit maximization.

The platform allows leverage, enabling significant market position control beyond the initial investment. This feature enhances potential returns and risks, appealing to traders desiring greater market engagement.

RogueX’s Perpetual Trading Features

Enhanced Leverage Options: The platform affords magnified trading volumes beyond initial investments, catering to traders desiring market depth.

Decentralized Perpetual Pair Creation: RogueX advocates a decentralized model for establishing leveraged perpetual pairs, offering unique market access.

RogueX’s blended trading environment promotes a nuanced trading experience, aligning spot and perpetual modalities within a cohesive ecosystem.

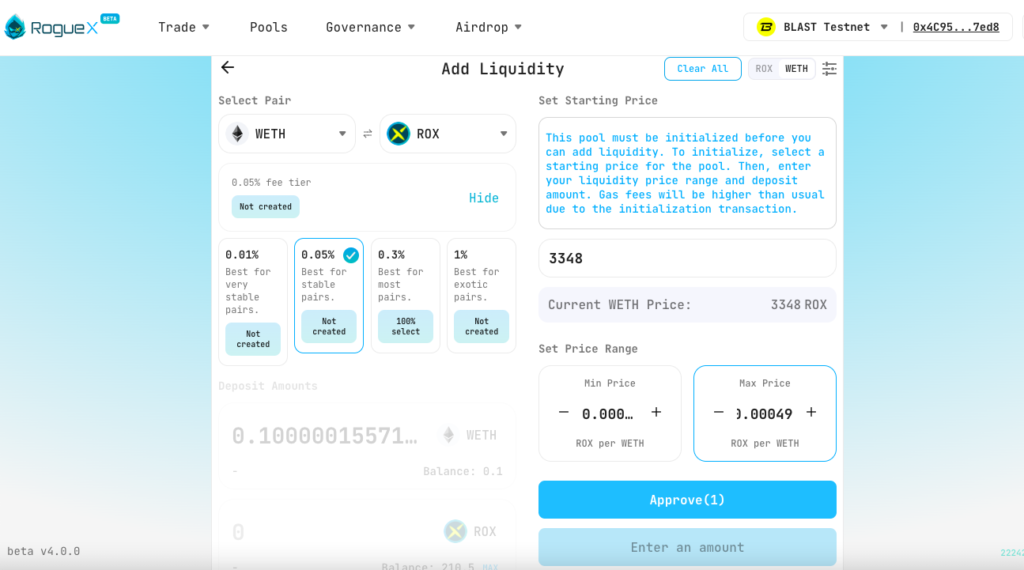

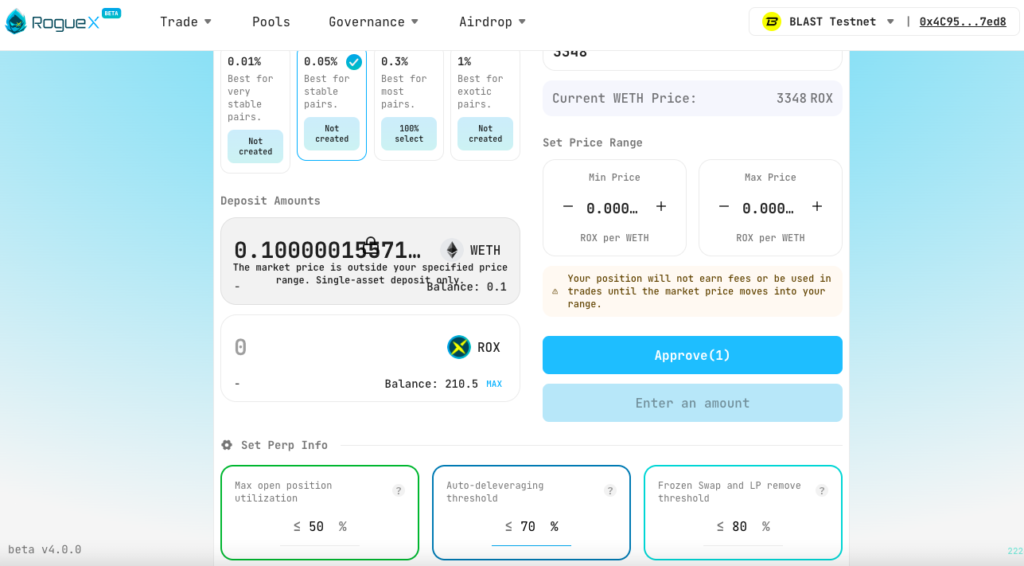

How to Provide Liquidity on RogueX

Go to Pools to create a liquidity pool.

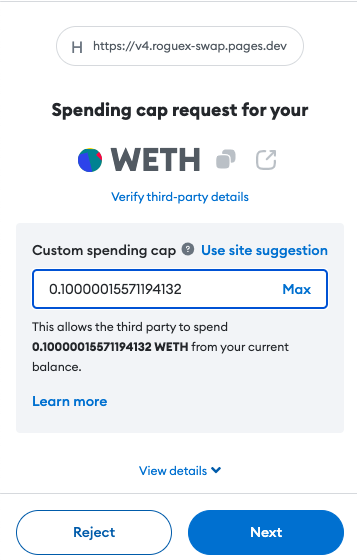

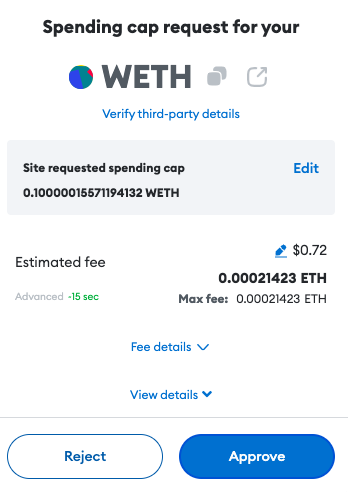

Set the spending cap.

Set the spending cap.

Liquidity Optimization

Liquidity Optimization

RogueX distinguishes itself by activating latent funds in Uniswap-v3-like pools, improving liquidity and capital efficiency. Its contracts pinpoint and mobilize these resources to favor both liquidity providers and traders.

Through proactive fund employment, RogueX betters trading conditions and elevates LP yields, enhancing liquidity provider engagement.

Resource Allocation and Trading Dynamics

RogueX’s contracts dynamically manage resources, aligning liquidity with market demands. It adjusts reserve allocations, fee distribution, and profit/loss sharing to sustain an adaptive and competitive market stance.

Automated Liquidity Management

RogueX’s ALM, inspired by the Gamma protocol, automates liquidity provisioning, optimizing fund deployment within designated ranges, streamlining liquidity management for enhanced market responsiveness.

How to Stake $ROX & Participate in Governance

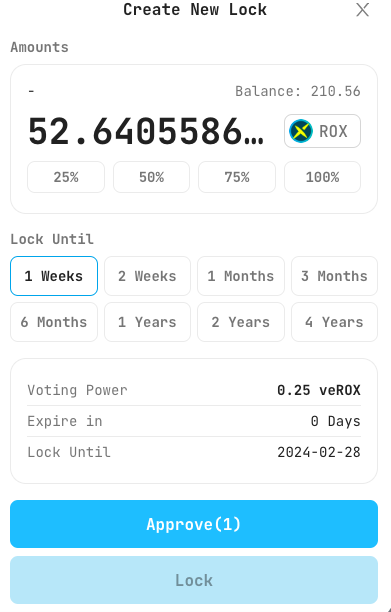

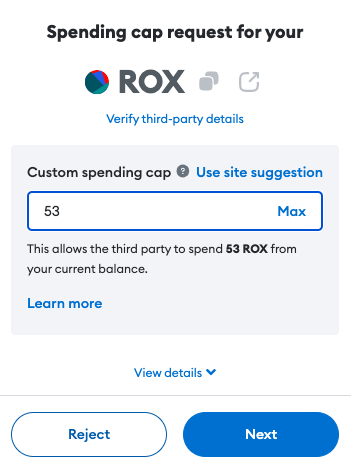

Go to the Governance tab and create a New Lock. Set your spending cap.

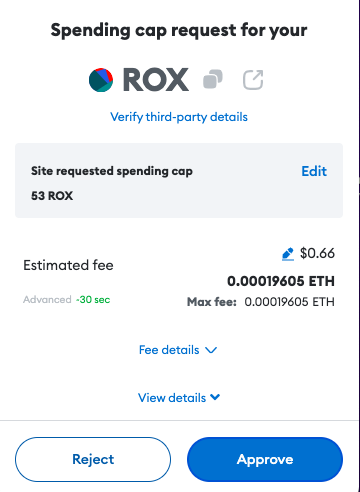

Set your spending cap.

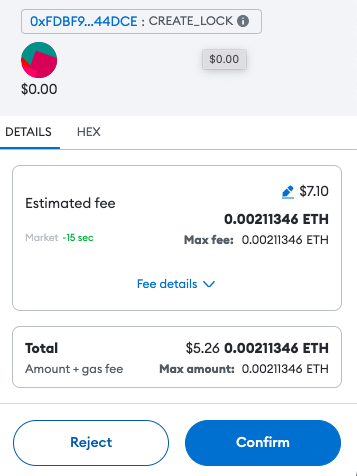

Confirm the transaction in your wallet and pay the gas fee.

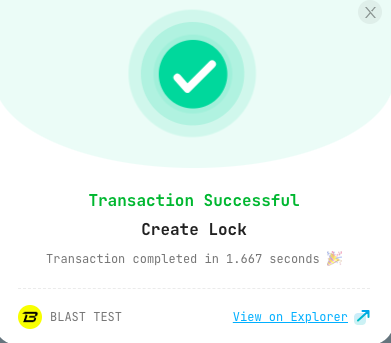

Confirm the transaction in your wallet and pay the gas fee.  You’ll be notified if your LOCK has been successful.

You’ll be notified if your LOCK has been successful.

$ROX Token Explained Simply

$ROX serves as the core ERC-20 utility token of the protocol, fulfilling three primary purposes: Elevating liquidity and enhancing trading conditions via farming incentives.

Facilitating decentralized governance to steer platform evolution, with a commitment to authentic decentralization. Stimulating greater trading volume and fee generation with trade-to-earn incentives. veROX, an ERC-721 governance token, is obtained through the commitment of $ROX tokens for a duration of up to one year, bestowing voting rights upon holders.

As the lock-in period progresses, veROX holdings methodically diminish to nil, encouraging ongoing participation from stakeholders. These holdings can be modified, segmented, or exchanged within secondary marketplaces.