What is Rage Trade?

Rage Trade emerges as a groundbreaking composable and omni-chain perpetuals protocol, constructed atop Uniswap v3. Its ambition is to evolve into the premier ETH perpetual market player in terms of liquidity and composability, exploiting cutting-edge UNI v3 vault methodologies. These methodologies capitalize on the underutilized LP tokens to foster profound liquidity.

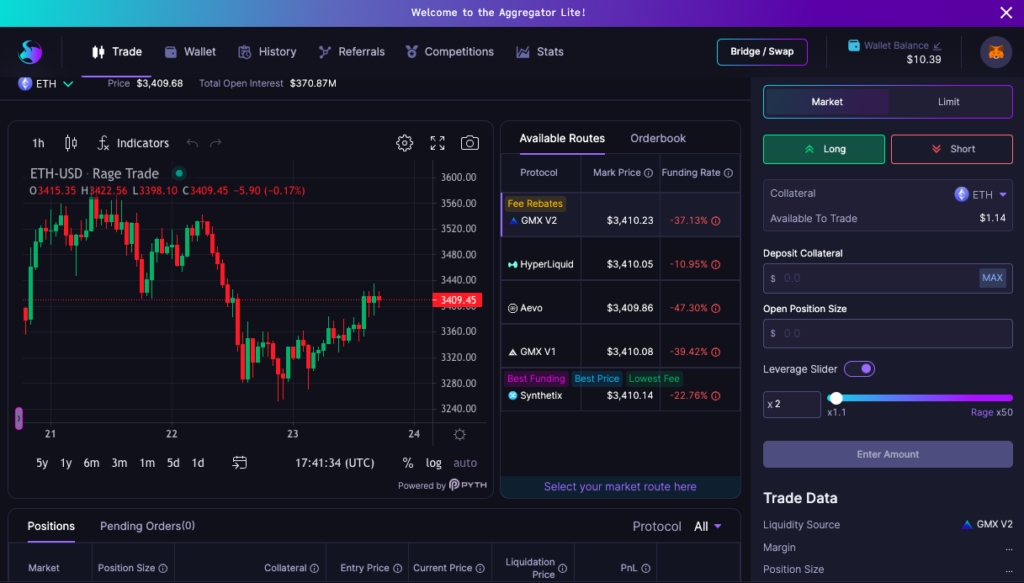

As a versatile perpetual aggregator and a prime broker, Rage Trade transforms on-chain trading dynamics, blending centralized exchange conveniences with decentralized platform security and transparency. Through adept order routing, it guarantees superior trading results for its clientele, prioritizing user-friendly interfaces and stringent security measures.

Why Use Rage Trade?

Endorsement for Rage Trade comes from renowned crypto investment entities, pseudonymous figures, and angel investors, including OKX Ventures, Primitive Ventures, Robot Ventures, and more.

Operational Mechanics of Rage Trade

Central to Rage Trade’s liquidity strategy are its “80-20 vaults,” instrumental in amplifying returns and offering a more passive LP engagement for participants.

Participants inject their extant LP stakes into Rage Trade, pooling LP tokens from diverse origins, including Curve‘s Tri-Crypto, GMX‘s GLP, or DPX-ETH from SushiSwap. Subsequently, Rage Trade maintains a minimum of 80% of each LP stake within the originating protocol, allocating at most 20% for concentrated liquidity provision on Uniswap v3. This tactic not only mirrors Uniswap v2’s benefits but also accrues extra yields through fees from concentrated liquidity positions.

How to Use Rage Trade

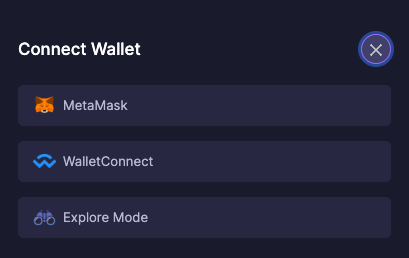

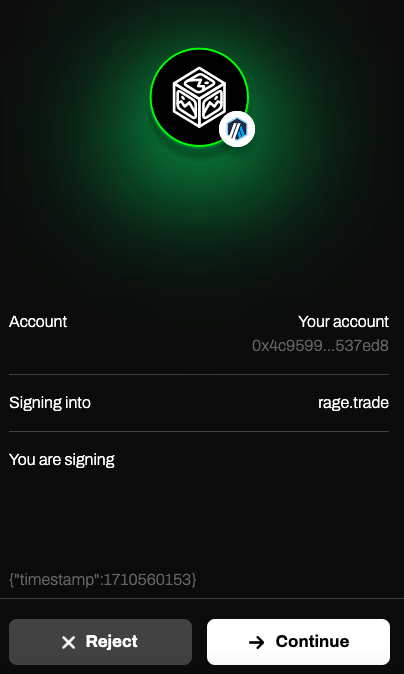

Connect your web3 wallet.

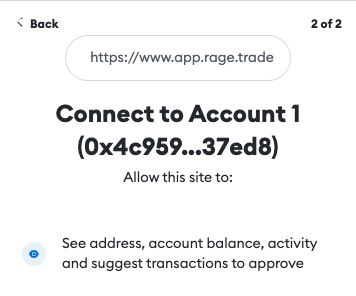

Connect your web3 wallet. In this demonstration, we’ll be using MetaMask wallet.

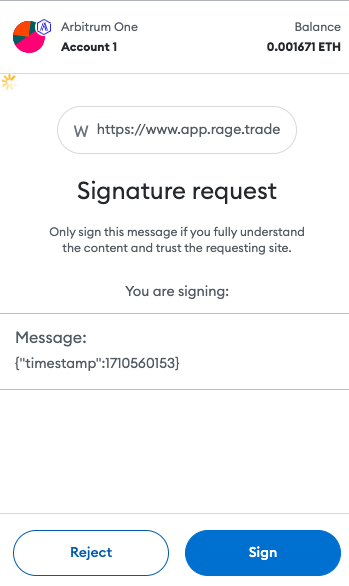

In this demonstration, we’ll be using MetaMask wallet. You may be required to sign a message.

You may be required to sign a message. Make sure you’re using a compatible chain such as Arbitrum.

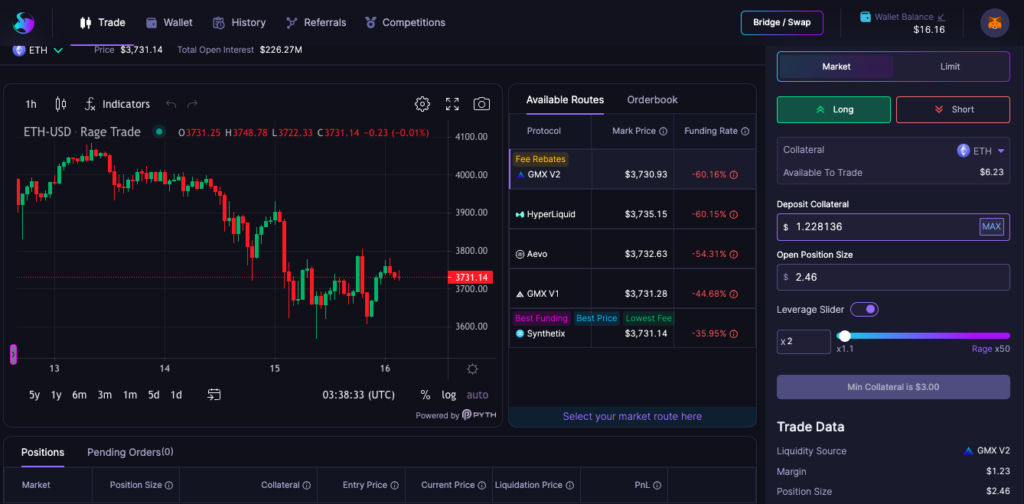

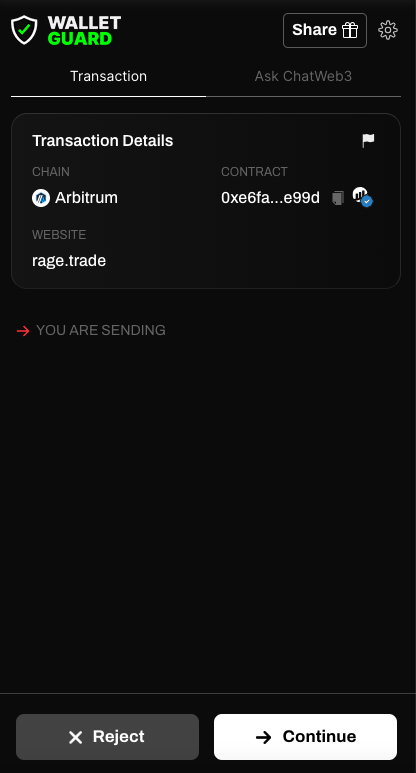

Make sure you’re using a compatible chain such as Arbitrum.  Once you’ve given the necessary permissions for your wallet to interact with the Rage Trade smart contracts, you can proceed to take trading positions.

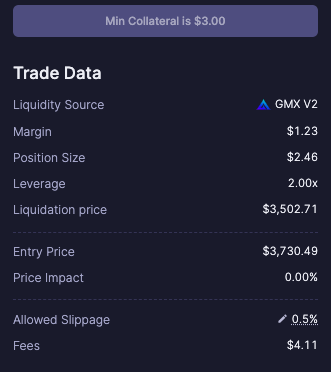

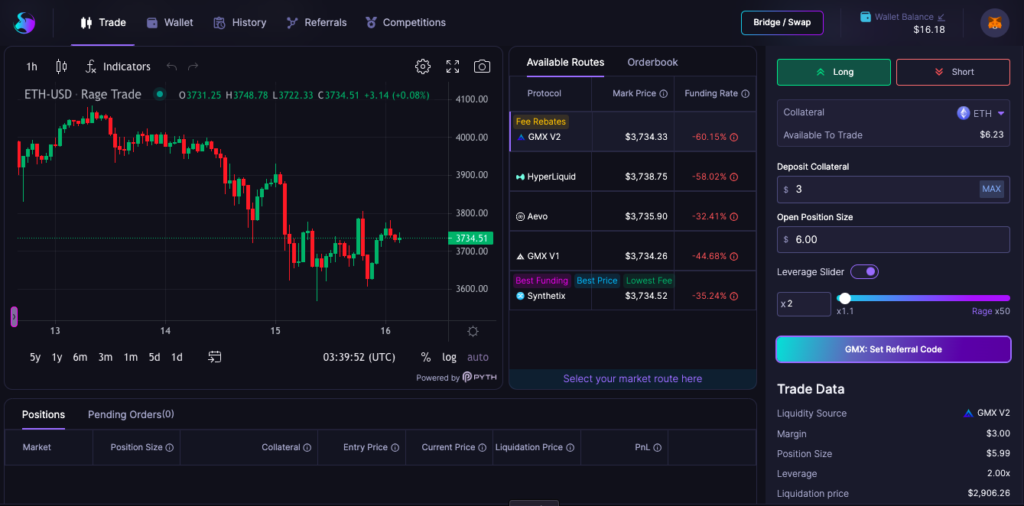

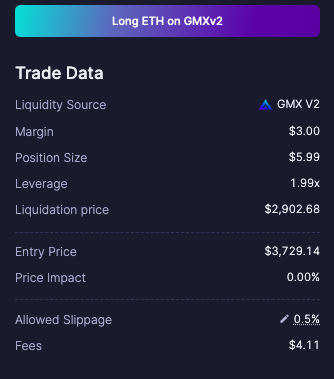

Once you’ve given the necessary permissions for your wallet to interact with the Rage Trade smart contracts, you can proceed to take trading positions.  Rage Trade is great because it allows you as a trader to have insight into the liquidity sources for your trades, the margin and position size, the amount of leverage and clearly states the liquidation price so that you can effectively gauge the risk associated with your position. Other metrics include entry price, price impact, slippage and fees for the transaction. These are necessary tools for anyone looking to become a successful trader.

Rage Trade is great because it allows you as a trader to have insight into the liquidity sources for your trades, the margin and position size, the amount of leverage and clearly states the liquidation price so that you can effectively gauge the risk associated with your position. Other metrics include entry price, price impact, slippage and fees for the transaction. These are necessary tools for anyone looking to become a successful trader. Choose position size.

Choose position size.  Give wallet permissions.

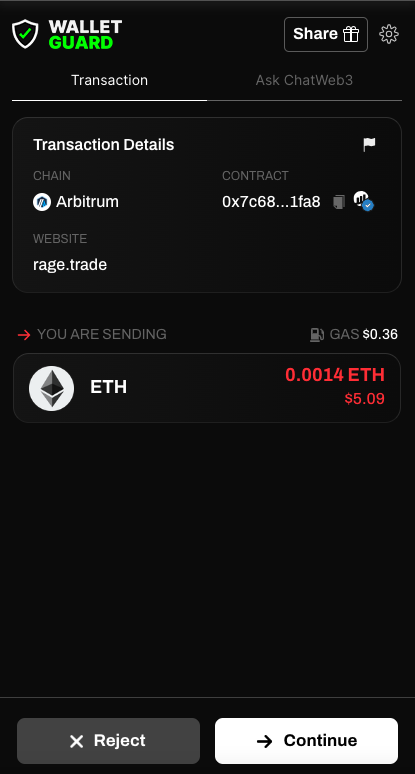

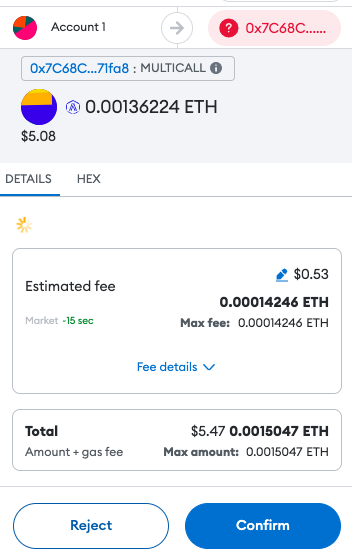

Give wallet permissions.  Pay the gas fee.

Pay the gas fee.

Choose to Long or Short.

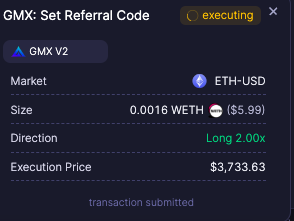

Choose to Long or Short. Confirm the trade.

Confirm the trade. Pay the gas fee.

Pay the gas fee.

Once your position is opened, you’ll be able to view it under “Positions”.

Once your position is opened, you’ll be able to view it under “Positions”.

Principal Insights

Rage Trade is primarily a perpetual swap framework with an emphasis on ETH perpetual swaps’ liquidity. Introduced in 2022, it harnesses a novel “recycled liquidity” concept, underpinned by Uniswap v3 technology. It employs an “80-20 vaults” architecture, enhancing returns and enabling passive LP participation. Participants can channel their LP assets into Rage Trade, optimizing concentrated liquidity on Uniswap v3 and harvesting additional yields.

Distinguished Features of Rage Trade

Aggregated Liquidity

Engage with expansive, consolidated liquidity across various perps and chains simultaneously.

EOA Wallet Compatibility

The streamlined version integrates seamlessly with preferred EOA wallets, facilitating immediate trading post-wallet connection.

Optimized Trading Pathways

Inputting order specifics instantly reveals the optimal trading routes, based on criteria like price, fees, funding rates, and fee discounts.

Advanced Bridging

Facilitates effortless collateral transitions across chains or between collateral forms, supporting seamless swaps among numerous crypto assets over 15+ EVM chains, ensuring consistent margin availability.

Comprehensive Referral Program

Earn from an amalgamated interface on Rage, with a dual-tiered referral system:

Primary Rewards – gain a portion of the trading fees paid by your referrals.

Secondary Rewards: Profit from the trading incentives your referrals accrue from their subsequent referrals, fostering communal benefits. GMX v2 – ARB Rebates Enhancement

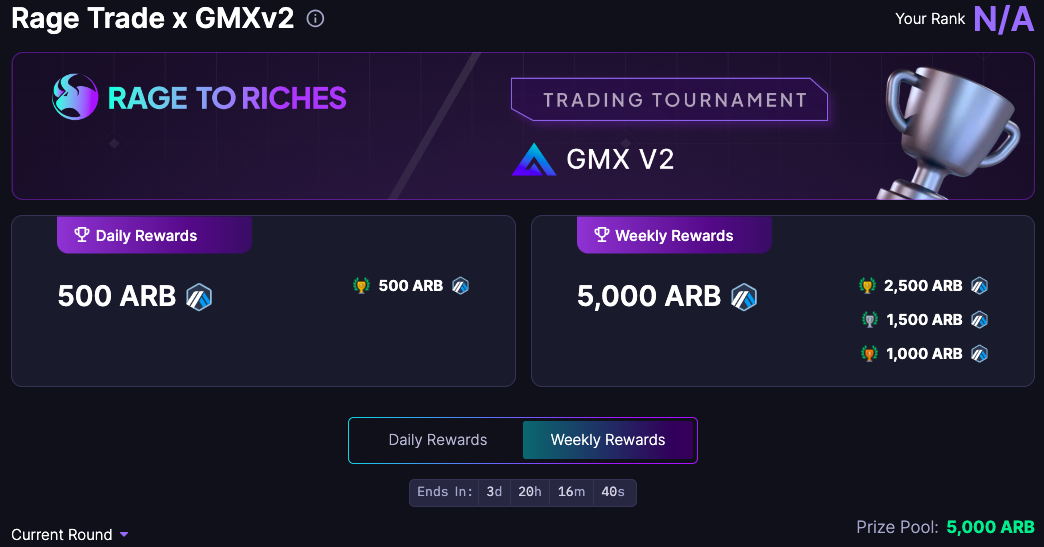

GMX v2 – ARB Rebates Enhancement

Rage inaugurated its fee rebate scheme for GMX v2 trades on Wednesday, 3 January 2023, detailed as follows:

Eligibility and Payouts

Engaging in GMX v2 trading via Rage Trade qualifies participants for rebates, disbursed weekly in $ARB tokens every Wednesday, reflecting the prior week’s trade fees.

Rebate Dynamics

Upfront charges apply at trade initiation or closure, with subsequent weekly fee reconciliations resulting in $ARB reimbursements. GMX and Rage propose rebates up to 75% and 25% respectively on trading fees, aiming to minimize opening and closing charges substantially.

Rebate Allocation Rules

Weekly $ARB token rebate caps exist. Below-cap situations yield a 25% Rage rebate. Exceeding the cap triggers proportional Rage rebate adjustments.

Rebate Monitoring

The “Claim” section under “Wallet” tab provides rebate tracking, summarizing total fees, GMX rebates, and Rage contributions.