What is Arbitrum?

Arbitrum is a layer 2 scaling solution for Ethereum that offers a number of benefits including rollups which aim to maintain compatibility with Ethereum and smart contracts that are also compatible on the bytecode level despite several aspects of the Arbitrum system working differently to the Ethereum Virtual Machine (EVM). Trustless security, scalability that makes higher throughput possible, and cheaper costs per transaction are also benefits brought about by Arbitrum.

Arbitrum mainnet launch was in August 2021 and popular decentralized finance (DeFi) platforms including Uniswap, Aave, Balancer, Curve, SushiSwap and Band Protocol are already leveraging Arbitrum in order to increase throughput and lower fees for their users. Arbitrum is designed to improve the capabilities of Ethereum smart contracts by improving speed and scalability while enhancing privacy features. While it relies on Ethereum layer 1 security, Arbitrum allows developers to run unmodified EVM contracts and Ethereum transactions on a second layer. It uses transaction rollups to record batches of submitted transactions on the Ethereum main chain. These transactions are then executed on a more cost-efficient and scalable layer 2 sidechain.

The company behind Arbitrum is called Offchain Labs which is supported by several notable investors including Lightspeed Venture Partners which led a round of series B funding in which $120 million was raised.

Popular Projects in the Arbitrum Ecosystem

GMX (GMX)

A decentralized perpetual exchange, GMX allows its users to trade Bitcoin, Ethereum and other digital currencies with the option of using up to 30x leverage. This can all be done directly from the user’s wallet.

GMX supports zero price impact trades and has low swap fees. What’s unique about the DEX is that it can save traders costs since it allows them to enter and exit positions with minimal spread and zero price impact. Traders can also get the optimal price without incurring additional costs. GMX offers dynamic pricing that is supported by Chainlink Oracles along with TWAP pricing from leading volume DEXs.

A trader can also significantly reduce liquidation risks because an aggregate of high-quality price feeds is what actually determines when liquidations occur. This is advantageous since it keeps positions safe from temporary wicks. A multi-asset pool that earns liquidity providers fees from leverage trading, market making, swap fees, and asset rebalancing supports trading on GMX.

GMX is the platform’s utility and governance token. Users can also stake GMX tokens and receive different rewards such as Escrowed GMX, Multiplier Points, and ETH Rewards. GMX tokens can be traded on exchanges such as Binance, Bybit, KuCoin, and Kraken.

Read our full review of GMX Exchange.

Beefy Finance (BIFI)

A decentralized, multi-chain yield optimizer platform, Beefy Finance allows its users to earn compound interest on their digital assets. Beefy automatically maximizes user rewards from different liquidity pools and automated market makers across DeFi through a range of investment strategies executed through smart contracts.

Beefy Finance offers vaults in which users stake their crypto assets. Depending on the investment strategy tied to the specific vault, the deposited funds will automatically increase through a process of compounding arbitrary yield farm reward tokens back into the initially deposited asset. The advantage with using vaults such as these is that user funds are never locked in any vault and users can always withdraw their funds at any time.

The native governance token of Beefy Finance is $BIFI and dividend-eligible revenue shares are paid in these tokens. Holders of BIFI tokens earn profits that are generated by Beefy Finance and have the ability to vote on proposals. Beefy.Finance supports wallets such as MetaMask, TrustWallet, and WalletConnect and users can hold their tokens in these wallets. BIFI tokens are available on exchanges such as 1inch Exchange, PancakeSwap and Binance.

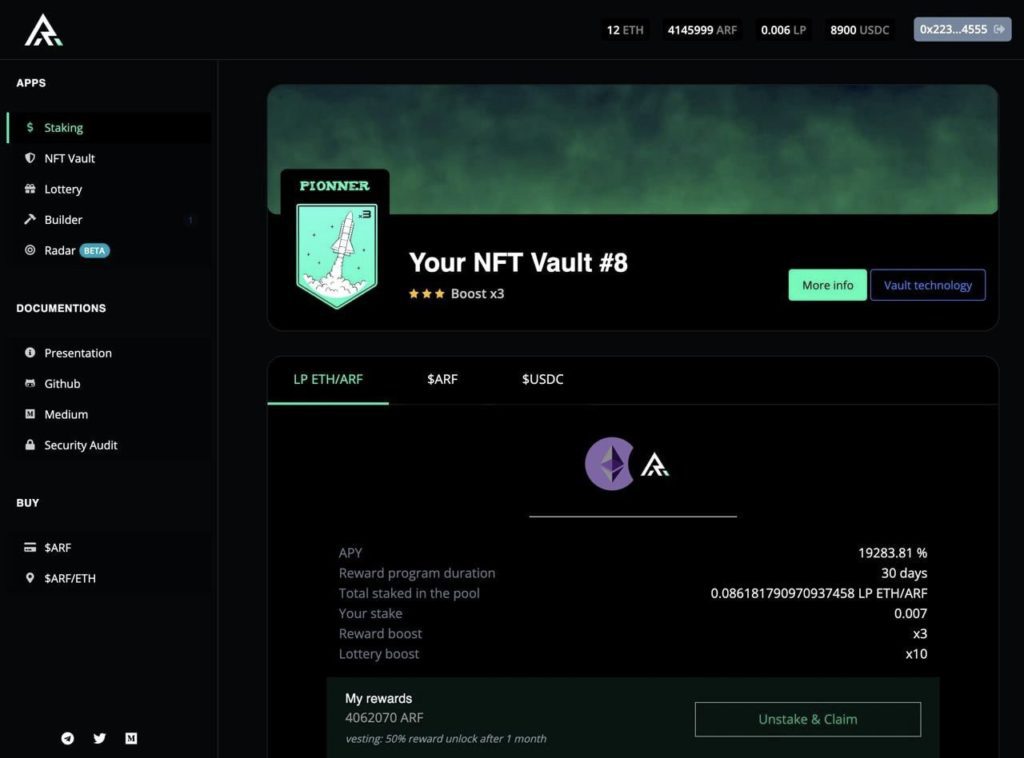

ArbiRiseFinance (ARF)

ArbiRiseFinance is effectively a set of tools for DeFi users on Arbitrum. It consists of ArbiStaking which is a secured staking system with multiple pools. Users can stake $ARF tokens which enables them to gain passive income and participate in protocol governance decisions. Described as a reflect token (a reflection is essentially the payment of a reward to holders of tokens in the native token) ARF is said to help build advanced mechanisms of redistribution and also low gas usage fees. ARF tokens are distributed as incentives for the community to provide liquidity and hold the token through staking pools.

Arbi also offers ArbiNFT which is a vault technology designed to store, fund Secure Asset Fund for Users (SAFU) and stake. ArbiRadar is a feed that is aimed at detecting new tokens coming into the ecosystem. ArbiHelp provides educational content to assist users on how to use Arbitrum properly. ArbiLottery is a lottery to reward ARF token holders who are automatically entered into a lottery each time a million dollars of volume is reached. ARF tokens can be traded on Sushiswap (Arbitrum One).