What is Jupiter Decentralized Exchange?

Jupiter serves as a decentralized exchange aggregator on Solana, offering an array of exchange services. These include the Swaps tool, a Payments API for specifying output token amounts, Limit Orders, and Dollar-Cost Averaging (DCA) options. Jupiter also provides integration support for Decentralized Exchanges (DEXes) through the Jupiter Terminal and offers guidelines for token visibility on their platform.

The perpetual exchange is an innovative LP-to-trader platform on Solana, offering leverage up to 100x. By leveraging LP pool liquidity and oracles, it ensures zero price impact, zero slippage, and deep liquidity. Oracles support stable market operations during liquidations and stop-loss events, mitigating the risks of position bankruptcy and LP pool fund loss. Users can open and close positions with a single step, removing the need for additional accounts or deposits. Integration with Jupiter Swap allows any Solana token to be used for opening positions.

The LP pool is integrated into Jupiter, providing liquidity to the Solana ecosystem. Jupiter users can utilize the LP pool’s liquidity for swaps.

How to Trade on Jupiter DEX

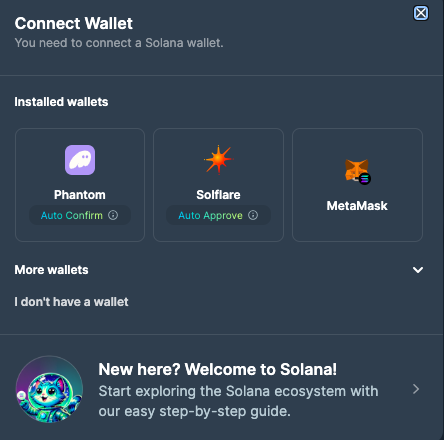

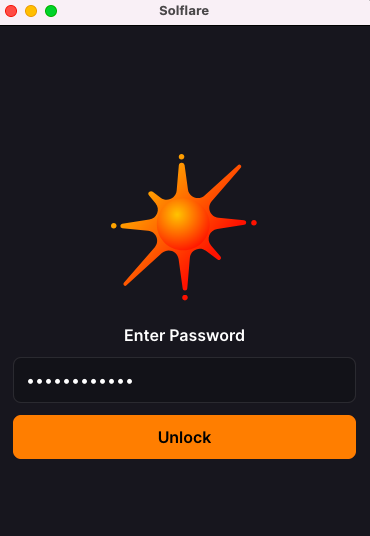

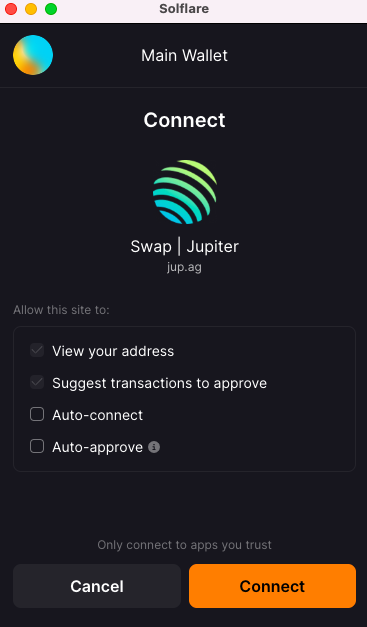

Connect your web3 wallet.

In this demonstration, we’ll be using Solflare.

Once your wallet is connected, you can proceed to swap, use the perpetual trading functions, supply liquidity etc.

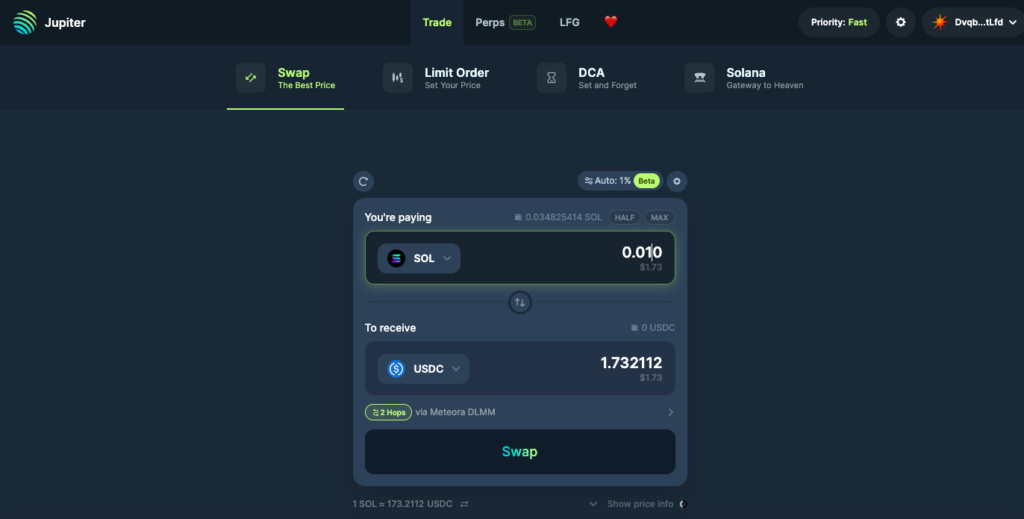

How to Swap on Jupiter Exchange

Select the assets and amount you wish to swap.

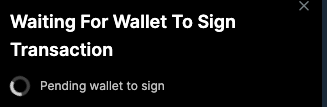

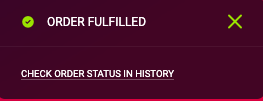

Click ‘Swap’ and sign the transaction.

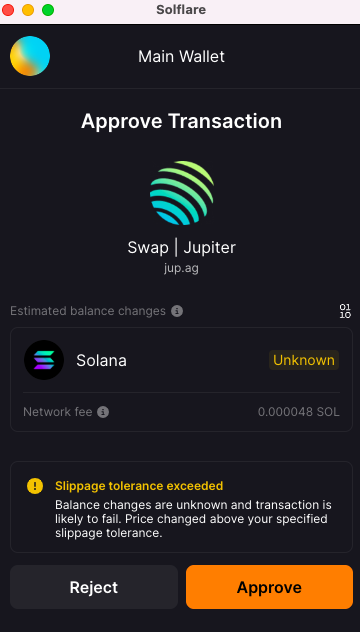

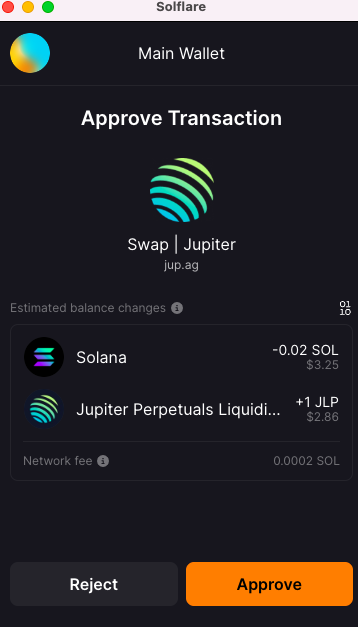

Approve the transaction.

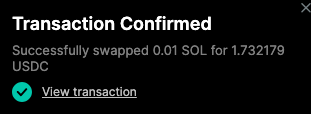

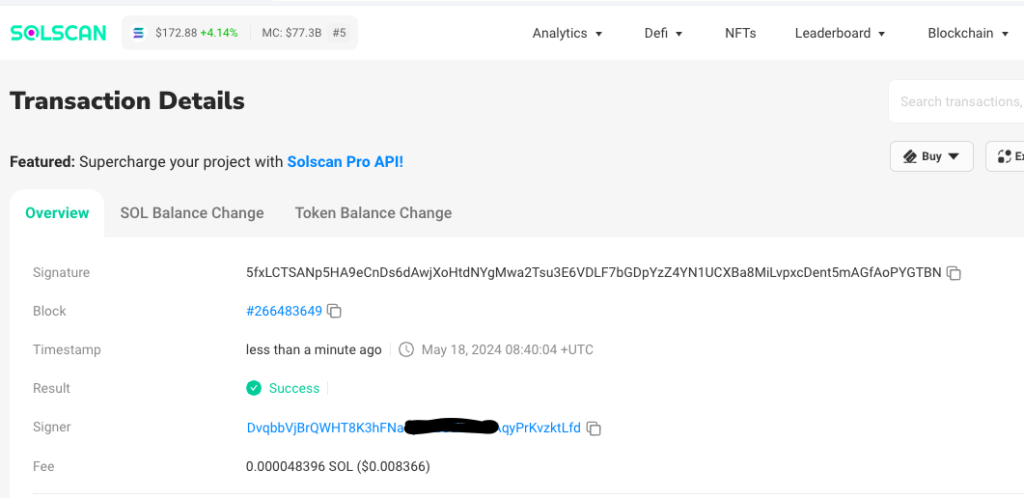

Once the transaction is approved, you can verify on the transaction on the block explorer.

How to Trade Perpetual Contracts on Jupiter Decentralized Exchange

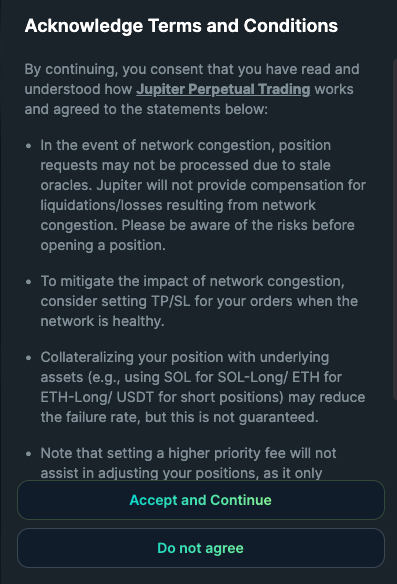

Currently, the platform supports the three main blue-chip markets: SOL, ETH, and BTC. First, you need to read the terms and conditions. Accept and continue if you agree.

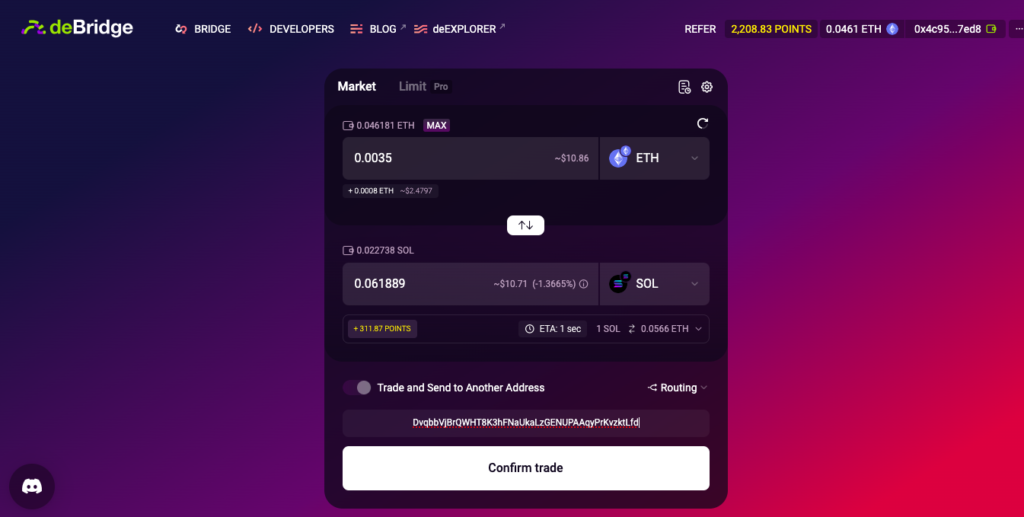

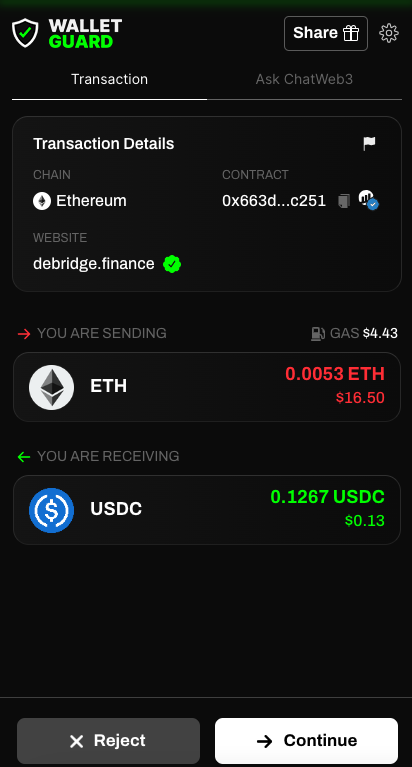

To ensure that we have funds to trade with, we are going to bridge some funds to Solana using deBridge.

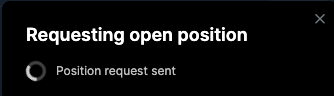

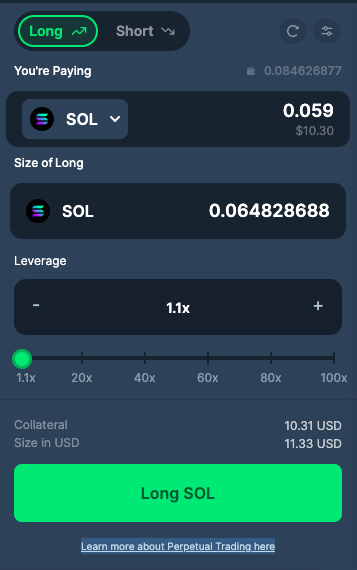

Now that our wallet is funded, we can proceed to place our LONG/SHORT position. The Trade tab is where all the trading action happens. Users can trade long or short on the three main blue-chip markets: SOL, ETH, and WBTC, with leverage up to 100x.

In this demonstration, we are going to take a LONG SOL-PERP trade.

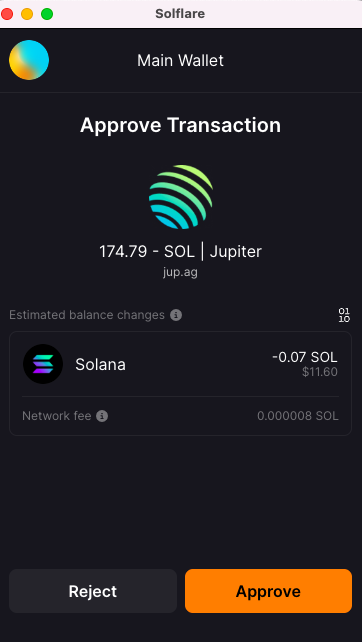

Approve the transaction.

Choose your collateral size and amount of leverage you wish to use. Users can increase their trading size with leverage ranging from 1.1x to a maximum of 100x. Users can choose to go ‘Long’ or ‘Short’ on the respective market.

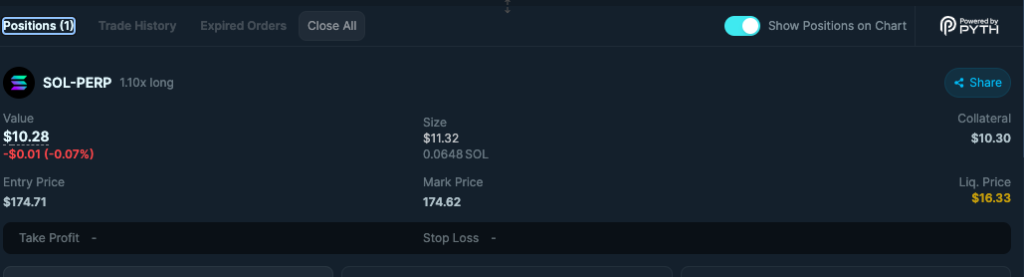

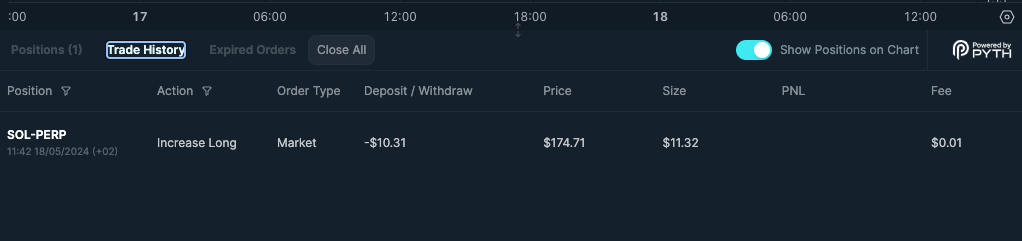

You’ll be able to view your positions and trade history on the dashboard. This section provides an order summary with all the information and stats calculated.

How to Provide Liquidity on Jupiter Exchange

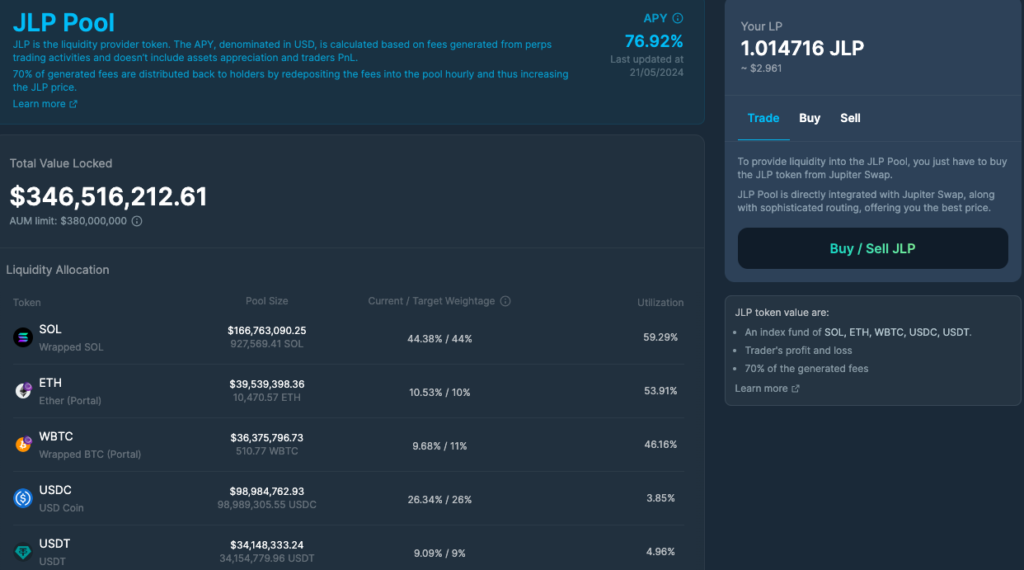

Users can become Liquidity Providers (LPs) by allocating their assets or tokens into the Jupiter Liquidity Provider Pool (JLP Pool) and receiving the JLP token in return. The JLP pool receives 70% of the fees, forming an APR for all JLP holders. This APR is collected within each JLP token whenever someone makes a trade. There is no need to “stake” or “harvest” your yield.

JLP is also an SPL token, meaning it can be transferred like any SPL token. AMM pools can also be set up for trading JLP tokens.

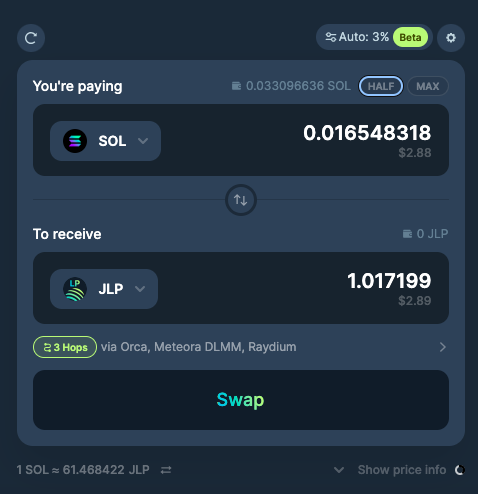

In this demonstration, we are going to provide a small amount of SOL and receive JLP.

Sign the transaction.

Approve the transaction.

You’ll be able to see the TVL and your liquidity position on the dashboard.

JLP is a liquidity token for the Jupiter Perpetuals platform, while JUP is the governance token for the entire Jupiter platform.

The best way to purchase or exit JLP is via Jupiter Swap. JLP, or the Liquidity Provider token, represents a meticulously constructed index of assets designed for swaps and leverage trading.

Liquidity providers serve a crucial role as counterparts to traders. When traders open leverage positions, they borrow tokens from the pool. Liquidity providers, in return, earn fees from these leverage trading activities, along with borrowing fees and earnings from swaps. As a JLP holder, you receive 70% of the fees generated by the trading exchange. This amount is directly reinvested into the JLP, increasing the price of JLP, and facilitating continuous compounding of yield and earnings.

How Jupiter Exchange Generates Fees and Yield

- Opening and Closing Fees of Positions

- Borrowing Fees of Positions

- Trading Fees of the Pool These fees are compounded into the pool hourly.

Overall Yield Calculation

It’s important to note that pool earnings and losses (index token appreciation/depreciation) are not factored into the overall yield calculation.

Risks Associated with Holding JLP

JLP is denominated in USD. During a bull market, JLP may not outperform SOL, ETH, or BTC. It is suggested to consider swapping stable tokens (USDC/USDT) into JLP to potentially benefit from yield generated by perpetual trading activities. However, this is not financial advice.

Some risks associated with holding JLP include:

- Profit and Loss (P&L) Dynamics: Traders’ P&L from perpetual trading impacts the JLP pool. If a trader incurs a net positive P&L, the losses are sourced from the JLP pool to compensate the trader. Conversely, if a trader’s P&L is net negative, the gains are deposited into the JLP pool for LP holders.

- Impermanent Loss: The JLP pool consists of both stable and non-stable tokens. Fluctuations in token prices can affect the value of JLP. As a result, users may find that their withdrawn tokens are worth less compared to their initial deposit. Additionally, deposit and withdrawal fees for the JLP Pool may further reduce the number of tokens withdrawn, particularly for shorter holding periods.

Can JLP go down? Yes, JLP in USD value will decrease when the fees generated are lower than the assets’ depreciation and payout from traders’ profit.

Adding/Removing Liquidity on Jupiter Exchange

When an LP adds liquidity to the JLP pool, they increase the amount of liquidity in the total TVL (Total Value Locked), enhancing the liquidity available for trading.

Liquidity providers (LPs) can acquire JLP by swapping for it on Jupiter Swap. Jupiter Swap will find the best price to acquire JLP, either by purchasing it on the open market or swapping into a desired asset and depositing that into JLP directly. Use Jupiter Swap for a seamless experience of acquiring JLP.

This process also applies to withdrawals; simply swap out of JLP into the desired asset. When depositing assets into the JLP pool, the protocol will price them in USD value.

JLP usually trades at a slight premium over the Virtual Price rate. This is due to the demand for JLP outweighing the TVL caps set for JLP. When TVL caps are raised, this premium closes. Swap for JLP when the caps are raised to minimize the premium paid.

Virtual Price, Market Price, and AUM Limit

- Virtual Price: Sum of all JLP Assets (in USD) / No. of JLP in circulation

- Market Price: Virtual Price + Market-assigned Premium (when AUM Limit is hit) Usually, users can mint new JLP or redeem (burn) them at the Virtual Price. However, when AUM Limits are hit, new minting of JLP is disabled to cap the amount of TVL in the pool.

When this happens, the demand for JLP on the market usually leads to a premium for JLP compared to the virtual price. Users may sell their JLP for the Market Price at any time. If the Market Price is below the Virtual Price, JLP tokens are redeemed (burned) at the Virtual Price instead of being sold at the market price.

Target Ratio and Fees

In the JLP pool, every token has a specific target ratio or weightage. Transactions involving the addition or removal of liquidity primarily adjust a token’s ratio in the pool to align it more closely with the predefined target. These transactions include JLP deposits, JLP withdrawals, and token swaps from the JLP pool. Transactions that move the token’s ratio away from the target incur additional fees, while instructions that move it closer to the target receive a fee discount. The fee is based on the swap fee.

During network congestion, position requests may not be processed due to stale oracles. Jupiter will not compensate for liquidations or losses resulting from network congestion. Users should be aware of these risks before opening a position.

- To mitigate the impact of network congestion, consider setting TP/SL for your orders when the network is stable.

- Collateralizing your position with underlying assets (e.g., using SOL for SOL-Long/ ETH for ETH-Long/ USDT for short positions) may reduce the failure rate, but this is not guaranteed.

- Setting a higher priority fee will not assist in adjusting your positions, as it only affects the position request and not the execution of the order.

Earn Tab

This is for passive users. They can join the liquidity pool and earn passive fees generated from trading activities.

Price Stats

This section provides a quick overview of real-time stats, including the current index price, 24-hour price movement, 24-hour highs, and 24-hour lows.

Token Selector (Input)

This input section allows users to select any SPL tokens as collateral to enter a position.

Price Chart

The real-time price chart, generated using Pyth Oracle price data, is displayed with the TradingView charting tool.