How to Build a Bulletproof Crypto Trading Strategy in 2025

From Charts to On-Chain Data: Trade Smarter.

Crypto trading in 2025 is no longer about simple chart patterns and moonshot bets. With AI-infused markets, memecoin mania, and unpredictable macro forces, traders need smarter, more resilient strategies. This guide will help you build a bulletproof trading strategy that thrives in both chaos and calm.

Why 2025 Is a Whole New Game

“Markets change, but edges evolve. 2025 demands precision and adaptability.”

Here’s what makes 2025 dramatically different from previous years:

| 🔍 Trend | 📈 Impact on Traders |

|---|---|

| AI-Powered Trading Bots | AI tools are automating everything from scalping to liquidation tracking |

| Memecoin Microcycles | Meme assets now pump and dump in hours, requiring ultra-fast execution |

| Macro Volatility | Geopolitical shifts, interest rate swings, and election year chaos = elevated uncertainty |

| DeFi & On-Chain Intel | On-chain data is no longer optional — it’s alpha |

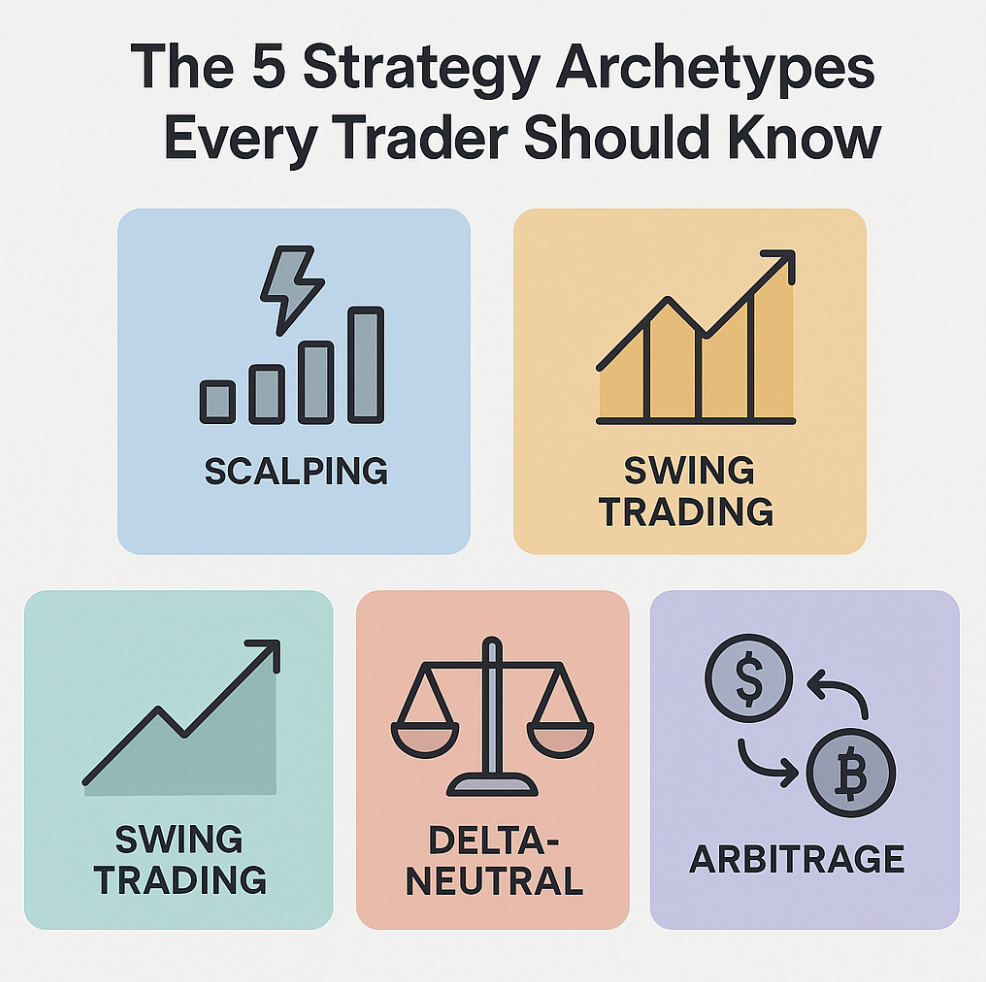

The 5 Strategy Archetypes Every Trader Should Know

You don’t need to trade everything. But you need to master one thing well. Below are five time-tested strategy models dominating 2025:

1. Scalping

-

Timeframe: 1-5 minutes

-

Goal: Capture micro price movements

-

Tools: Order book depth, low latency CEXs, TradingView

-

Risk: High fees, overtrading

2. Swing Trading

-

Timeframe: 1-7 days

-

Goal: Play trend reversals and momentum

-

Edge: Combines TA with macro catalysts (FOMC, CPI)

-

Tools: RSI, Fib levels, MACD

3. Trend-Following

-

Timeframe: Days to weeks

-

Goal: Ride established momentum (BTC trend, AI altcoins)

-

Strategy: MA crossovers, Ichimoku, TrendSpider

-

Bonus: Combine with funding rate analysis

4. Delta-Neutral

-

Timeframe: Passive yield strategy

-

Goal: Earn funding without directional risk

-

Example: Short perps / long spot, or LPing in range-bound AMMs

-

Perfect for: Bear markets or sideways chop

5. Arbitrage

-

Timeframe: Seconds to minutes

-

Goal: Capture price inefficiencies across venues

-

Types: Triangular, cross-exchange, DeFi vs CEX arb

-

Tools: Flashbots, MEV scanners, DLN

Combining Technical & On-Chain Intelligence

In 2025, TA alone is not enough. Smart traders blend on-chain forensics with traditional technicals.

| 🔧 Tool Type | 🛠️ Popular Platforms | 🧠 Use Case |

|---|---|---|

| Technical | TradingView, TrendSpider, ChartGPT | Pattern recognition, breakout setups |

| On-Chain | Arkham, Lookonchain, Nansen | Whale moves, smart money tracking |

| Hybrid | Coinalyze | Open interest + chart confluence |

| Sentiment | Santiment, LunarCrush | Social mentions, trader sentiment shifts |

🔍 Pro Tip: When TA and on-chain agree (e.g., breakout + whale inflows), conviction is highest.

Platforms to Execute Your Strategy in 2025

Choosing the right exchange is 50% of your success. Here’s a quick breakdown of the best platforms for various strategies:

Automation with Bots: The Do’s & Don’ts

Bots can amplify your edge — or drain your portfolio. Here’s how to use them wisely:

✅ The Do’s

-

Backtest strategies using real historical volatility

-

Use API keys with IP whitelisting for safety

-

Start with paper trading mode (e.g. via 3Commas)

-

Monitor bot logs and performance daily

❌ The Don’ts

-

Don’t buy bots from random Telegram groups

-

Avoid over-optimized AI bots with no transparency

-

Never auto-trade memecoins — manual control is better

-

Don’t use leverage + bot + no stop loss (instant liquidation)

Trade Less, Think More

In this AI-meme-macro-driven environment, your strategy is not just your edge — it’s your identity.

-

Pick a core strategy

-

Learn from every loss

-

Leverage data, don’t drown in it

-

Use tech, but never outsource judgment

“The best traders in 2025 won’t be the fastest. They’ll be the most adaptive.”

Strategy Builder Toolkit

| 🧰 Element | ✅ Your Setup |

|---|---|

| Strategy Type | Trend-Following + Delta-Neutral |

| Platform | Binance for Perps, BloFin for Copy |

| Tools | TradingView + Arkham |

| Automation | Smart bot with capped risk |

| Risk Model | 2% per trade, 5% max daily drawdown |