Automate Your Trades – No Coding Required! How to Use No-Code Platforms & AI to Simplify Trading

Trade Like a Pro Without Coding: Master No-Code and AI for Automated Success.

In the fast-paced world of cryptocurrency and stock trading, automation has become a game-changer. It allows traders to execute strategies with speed, precision, and consistency – qualities that are difficult to achieve manually. However, the traditional route to automating trades often involves coding, which can be a barrier for those without programming skills. Fortunately, the rise of no-code platforms and AI tools has democratized access to automated trading, enabling even those without coding expertise to design and deploy sophisticated trading strategies. This article explores how to automate trades without knowing how to code, focusing on the use of no-code platforms and AI tools.

The Rise of No-Code Platforms

No-code platforms are software solutions that allow users to create applications or automate processes without writing a single line of code. These platforms use intuitive drag-and-drop interfaces, pre-built templates, and user-friendly dashboards to make complex processes accessible to non-programmers.

In the context of trading, no-code platforms have opened up new possibilities for retail traders and investors. They allow users to automate trading strategies, backtest them against historical data, and even integrate with multiple exchanges—all without the need for programming knowledge.

Key Features of No-Code Trading Platforms

-

Drag-and-Drop Interface: Create trading strategies by simply dragging and dropping predefined blocks that represent different trading actions, conditions, and indicators.

-

Pre-Built Strategies and Templates: Access a library of pre-built trading strategies and templates that can be customized to suit your specific needs.

-

Backtesting and Simulation: Test your strategies against historical market data to see how they would have performed in real-time scenarios.

-

Real-Time Data Integration: Connect to multiple data sources and exchanges to get real-time market data, ensuring that your automated strategies are always up-to-date.

-

Conditional Logic: Use simple conditional logic (if-then statements) to create complex trading rules without coding.

-

API Integrations: Connect with popular cryptocurrency exchanges, brokers, and other financial services through APIs, allowing for seamless execution of trades.

Popular No-Code Platforms for Trading Automation

Several no-code platforms have emerged, each offering unique features to help traders automate their strategies. Here are a few of the most popular ones:

TradeSanta: A cloud-based trading platform that allows users to automate their crypto trading strategies using pre-built bots. It supports multiple exchanges and offers an easy-to-use interface for strategy creation.

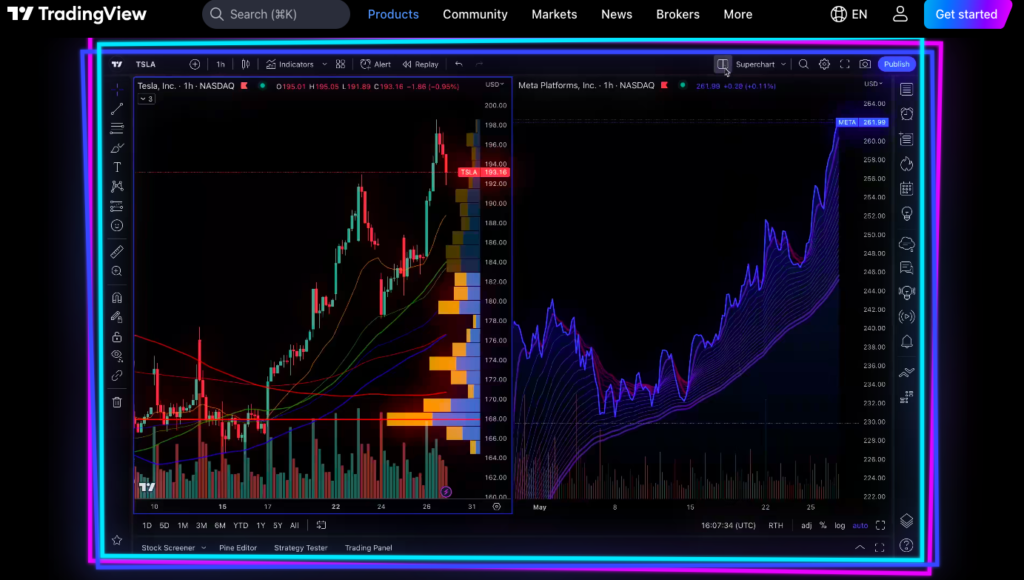

TradingView: While not entirely no-code, TradingView offers a powerful scripting language called Pine Script that is beginner-friendly. It also integrates with no-code tools to automate trading strategies directly from its charting platform.

Cryptohopper: A comprehensive no-code platform that enables traders to create and automate trading strategies across multiple exchanges. It offers a wide range of technical indicators and the ability to backtest strategies.

Zorro Trader: A no-code trading platform designed for both beginners and advanced traders. It supports algorithmic trading, backtesting, and even machine learning applications.

Pionex: This platform offers built-in trading bots with a no-code interface, making it easy for users to automate their trades with just a few clicks.

Leveraging AI Tools for Automated Trading

In addition to no-code platforms, AI tools are increasingly being used to enhance automated trading strategies. These tools leverage machine learning algorithms to analyze market data, predict trends, and optimize trading strategies in real-time.

Key AI Tools for Trading Automation

-

Signal Processing and Predictive Analytics: AI tools can process vast amounts of market data, identify patterns, and generate trading signals based on predictive analytics.

-

Sentiment Analysis: AI can analyze news, social media, and other sources to gauge market sentiment, helping traders make informed decisions.

-

Reinforcement Learning: AI models can learn from past trades and continuously improve their strategies through reinforcement learning, adapting to changing market conditions.

-

Automated Risk Management: AI tools can dynamically adjust risk parameters, such as position sizing and stop-loss levels, based on real-time market data.

Popular AI Tools for No-Code Trading Automation

Kavout: An AI-powered trading platform that uses machine learning models to analyze market data and generate trading signals. It integrates with various trading platforms and brokers.

Alpaca: A commission-free trading platform that offers AI-driven tools for automated trading. It provides a simple API that can be used with no-code platforms to automate trades.

Numerai: An AI-powered hedge fund that crowdsources trading strategies using machine learning models. Traders can contribute their strategies without needing to code them.

TrendSpider: A technical analysis tool that uses AI to automate chart analysis and identify trading opportunities. It integrates with various brokers and trading platforms.

Steps to Automate Your Trades Without Coding

-

Choose a No-Code Platform: Start by selecting a no-code platform that fits your trading needs. Consider factors like supported exchanges, available features, and ease of use.

-

Define Your Trading Strategy: Outline your trading strategy, including the assets you want to trade, entry and exit criteria, risk management rules, and target profit.

-

Use Drag-and-Drop Tools: Utilize the drag-and-drop interface of your chosen platform to create your strategy. Use predefined blocks and templates to build your trading logic.

-

Integrate AI Tools: Enhance your strategy by integrating AI tools that can provide predictive analytics, sentiment analysis, or automated risk management.

-

Backtest Your Strategy: Before going live, backtest your strategy against historical data to ensure it performs as expected under various market conditions.

-

Deploy and Monitor: Once satisfied with the backtest results, deploy your strategy in the live market. Continuously monitor its performance and make adjustments as needed.

Conclusion

The advent of no-code platforms and AI tools has revolutionized the way traders approach automation. By eliminating the need for coding skills, these technologies have made it possible for anyone to design, test, and deploy sophisticated trading strategies with ease. Whether you’re a beginner looking to dip your toes into automated trading or an experienced trader seeking to optimize your strategies, no-code platforms and AI tools provide a powerful solution to enhance your trading success.

Automating trades without knowing how to code is no longer a distant dream – it’s a reality that can be accessed with just a few clicks. Embrace these tools, and take your trading to the next level.