Cryptocurrencies have made us rethink the social contract that binds our global society together. Changing our ideas and even ideals around how we store value, how we exchange that value and the ways in which we establish the accountability that is necessary to facilitate trade.

Blockchain technology has been front and centre of this shift because it has made faster peer-to-peer and censorship resistant cross-border exchanges possible. It has also provided a solution to how broader financial inclusivity can be achieved through opening up markets with low-barriers of entry and enabling micro transactions.

According to research, more than 7 million – or over 5 percent of U.S. households -remain unbanked. Nearly 20 percent more have bank accounts, but still rely on more costly financial services such as money orders, check-cashing services, and payday loans.

Such statistics in what is supposed to be the most advanced nation in the world leaves one wondering how bad the situation is for people in developing nations. So not only are digital assets pushing the value of innovation upstream, they are even starting to pave the way for institutional and policy changes that could facilitate faster adoption.

Admittedly, uptake of digital assets currently remains relatively low due to a number of issues including regulatory uncertainties and how sophisticated it is still for most people to access DeFi protocols that generally don’t have easy-to-use customer interfaces. Nonetheless, numerous sources all highlight that the market is expected to continue on an exponential growth trajectory.

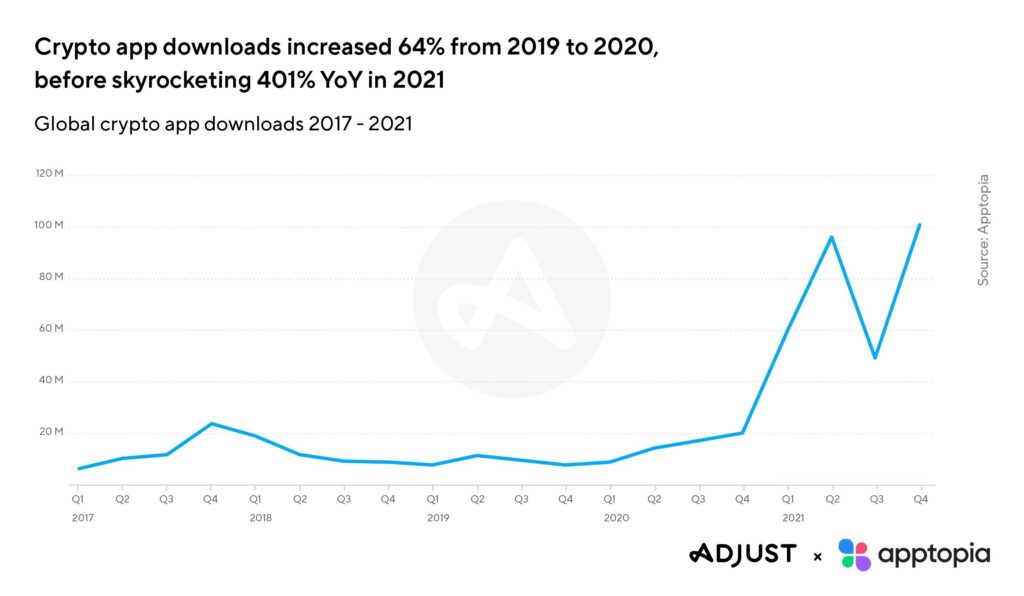

According to Adjust & Apptopia’s 2021 research findings, crypto app installs surged past 400% year-on-year with growth expected to continue to rise. They also reported that crypto apps actually beat stock trading apps on user engagement as well.

Some of the most used exchange apps include Binance, Coinbase and Crypto.com. Some of the most used web3 wallets include Trust and MetaMask wallets.

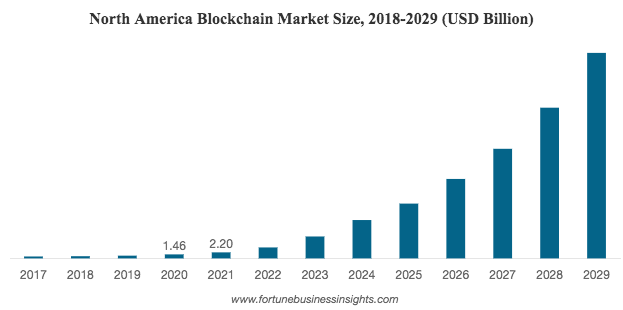

At this point most advanced nations have started to look into how they can even issue their national fiat currencies as central bank digital currencies (CBDCs) on the blockchain. According to Grand View Research, Inc. the global blockchain technology market size is expected to grow at a compound annual growth rate (CAGR) of 85.9% from 2022 to 2030.

Countries such as The Bahamas, Nigeria, and countries in the Eastern Caribbean Union for example have already launched their CBDCs in an effort to create their own form of digital currencies meant to help speed transactions and serve people without bank accounts.

Other countries, notably Sweden, Jamaica and China are already testing CBDCs in pilot projects. China was in fact the first major economy to pilot a digital currency all the way back in April of 2020.

Recently, there have been reports circulating that The People’s Bank of China is planning to extend the trial of its digital currency to other major provinces including Guangdong.

According to reports, as of October last year, over 140 million people opened e-CNY wallets and over 62 billion yuan (US$9 billion) worth of transactions were carried out using the CBDC. India, the US and the Eurozone all have CBDCs in development.

So you’re probably wondering – with all these developments ongoing – what does this all mean for the future of finance and blockchain technology in general.

Well, let’s look at some of the trending use cases of blockchain technology to date and then we can look at some of the key areas of focus with the industry where the greatest opportunities could come from in the future, both from an investor/trader perspective but also also looking at some of the factors that could lead to mass adoption of cryptocurrencies and/or distributed ledger databases.

As mentioned at the beginning of this piece, the world is currently experiencing major shifts in narratives around almost all issues that affect the trajectory of human development including climate and the environment, global economics, geopolitics, health and technology, etc.

Tensions have certainly escalated since the recent pandemic and now with Russia at war in Ukraine and the world’s population growing increasingly distrustful of legacy powers and the institutions they have built – which are seen and often proved to be corrupt; the need for solutions that can keep the fabric of humanity together is crystal clear.

The important question becomes – will global volatility and imbalances among players with different economic interests result in the collapse of our current world order? Will increased multipolarity bring about more robustness in the global economic order?

One thing for certain, blockchain technology will play a major role in liberating or alternatively – in the worst case scenario – also play a crucial role in further subjugating individuals or entire populations. We’ve even seen concerns surface post the recent Ethereum Merge in relation to the over 51% of blocks validated on the Ethereum chain being censored.

Some of these developments can lead one to believe that some of the areas that show a positive outlook for blockchain technology application revenue growth in the coming years include apps and protocols providing solutions to key areas of the blockchain ecosystem infrastructure. According to CB Insights infrastructure & development is one of the only blockchain categories that showed deal growth in Q2 of this year. Areas forecasted to have reasonable growth include:

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management, etc.

Another major area of interest for is institutional investor involvement in DeFi. We’ve already seen the Bank for International Settlements’ Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions (IOSCO) issuing guidance confirming that stablecoin arrangements should observe international standards for payment, clearing and settlement systems. We’ve seeing major players like JP Morgan investing in critical DeFi infrastructure such as MetaMask. Projects such as Alkemi, for example, have already started working on solutions for facilitating professional DeFi for financial institutions to earn yields on digital assets.

Even some of the largest centralised entities in the crypto space like Coinbase have openly admitted that decentralized exchanges are some of the key threats to their business in their S-1. All this highlights the potential growth of DeFi.

DEXs such as Uniswap, Sushiswap, 0x, ParaSwap may continue to do well. This can mean that some investors or traders will find holding utility or governance tokens such as tokens like UNI or SUSHI in their portfolios an attractive bet.

Non-custodial decentralized peer-to-peer protocols such as Compound and Aave will likely do well as institutional investors seek stablecoin or crypto asset yield. Last year Aave, announced the launch of Aave Pro, which supposedly uses KYC’d pools to provide institutional investors with direct access to DeFi lending markets.

Yield farming is another area that could see huge institutional adoption uptake since it enables the staking of crypto assets in various non-custodial, DeFi protocols in order to earn high fixed or variable interest rates. Some of the popular ones include Yearn and Vesper.

DeFi derivatives will likely see increased interest from institutional players as well. This will be evident from an increase in trading volumes on platforms such as Gains Network which is a DeFi ecosystem on Polygon consisting of a leverage trading platform, staking pools and a bridge.

Look out for platform similar to Premia an automated options market bringing peer-to-pool trading and capital efficiency to DeFi options.

Decentralised derivatives exchanges such as Aboard are also ones to watch.

Insurance for DeFi is something that will likely become increasingly important so offerings such as Nexus Mutual and InsurAce may also see more user adoptions as people seek protection against smart contract risks, stablecoin depegging, hacks and other risks.

DeFi project tokens/coins that could be interesting to track how they perform in future include GNS, UMAMI, DPX, VSP, CRV, REN, BAL, LPC, BNT, PREMIA, ALK, DHT, BNT, OSQTH, NXM, HGET, LQTY, RIF, Ox, AAVE, AR, STX, UNI, FARM, and so many others. Please be advised that the token price performance does not always reflect the legitimacy or sustainability of crypto projects.

Promising blockchain ecosystems include Arbitrum, Polygon and Algorand.