What is Vela Exchange?

Vela Exchange stands as a community-centric, decentralized platform for perpetual trading, enabling participants to engage with the DeFi ecosystem. It offers an array of synthetic assets, paired with exceptional customer support, a feature often missing in on-chain services.

The platform allows trading in various cryptocurrencies, FOREX, and precious metals, utilizing isolated margin. It continuously evolves its asset offerings based on user input. Participants have the opportunity to contribute liquidity or enhance their trading skills alongside others, preparing for upcoming trading competitions.

What Makes Vela Unique?

The Vela Exchange trading platform provides significant upside over centralized exchanges with fair, equitable access to platform rewards, self-custody of assets, and zero requirement for a centralized clearing house.

While legacy decentralized applications and exchanges continue to deal with high execution costs, low performance, and other trade inefficiencies, Vela Exchange was built as a ‘next gen’ platform to overcome familiar DEX issues including front-running, slippage, asset limitations, and lack of risk management features.

How to Vela Exchange Works

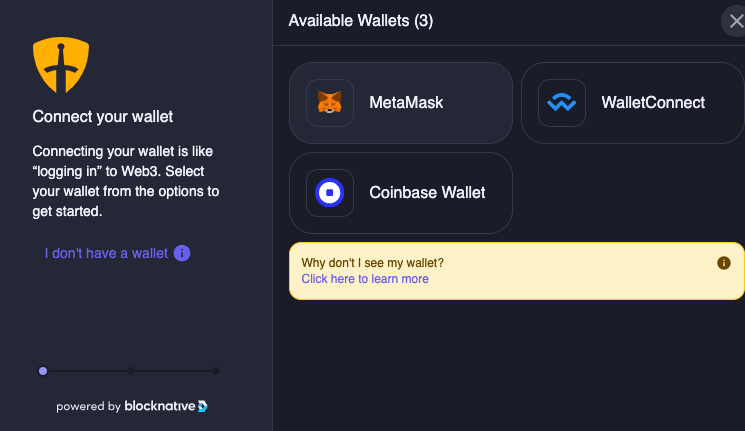

Users can setup their new Vela Exchange account by connecting to the application with any of the support wallets.

The very first time that a new user connects to the Vela Exchange, they will be asked for a referral ID. This is an optional, one-time opportunity to give referral credit to another wallet address, for which they will earn a small portion of fees produced from a referees trading account.

Users are encouraged to personalize their Vela Exchange profiles, enhancing their visibility on trading leaderboards. They also have the option to receive SMS or email alerts regarding important trading positions, with all opt-in data securely encrypted and stored on high-availability enterprise servers.

How to Deposit Funds to Vela Exchange

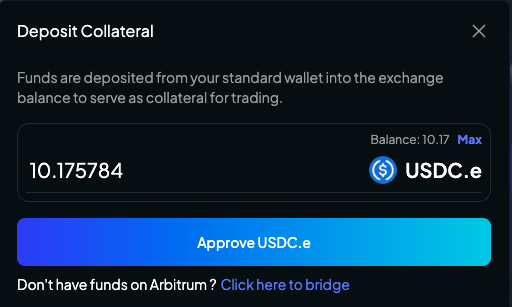

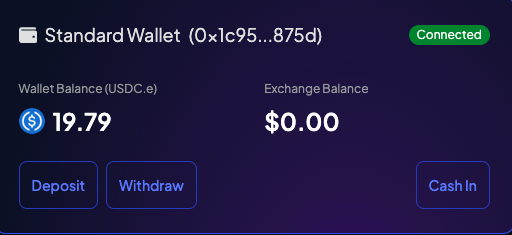

Vela Exchange’s vault contract is underpinned by the USDC.e stablecoin. Though the infrastructure supports various stable assets, it currently focuses on the bridged USDC to streamline collateral and liquidity processes. Users enjoy self-custody of their trading balances and can manually withdraw funds in case of front-end issues.

The platform simplifies the deposit and withdrawal process, offering direct wallet transfers, multi-chain deposits, and easy fiat conversion.

Fiat Conversion and Multi-chain Deposits

In collaboration with Transak, Vela Exchange facilitates direct fiat conversions within the application. It allows users to link their broader financial network seamlessly with the exchange. All KYC processes, limitations, and transaction procedures are managed by Transak and its partners.

Vela Exchange also boasts a multi-chain deposit feature, supporting seven EVM chains including Ethereum, Optimism, Avalanche, Polygon, BNB Chain, Fantom, and Moonbeam. This feature enables users to transfer liquidity from various ecosystems to the platform effortlessly.

The multi-chain interface supports an array of tokens and stablecoins, with transactions trackable via the Axelarscan Explorer. This tool provides a comprehensive view of deposit progress and associated costs.

For Arbitrum ecosystem users, Vela Exchange’s Multi-chain Gas feature offers an easy way to acquire gas tokens, allowing exchanges from various EVM compatible chains.

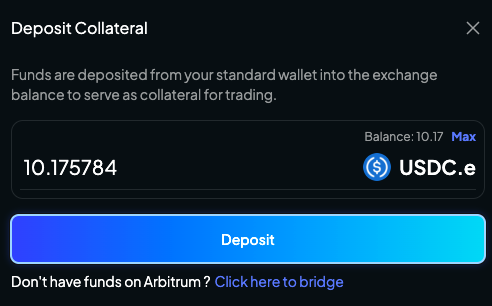

To get started on Vela, simply deposit the base asset i.e. USDC on Arbitrum from your non-custodial wallet to the exchange platform’s wallet.

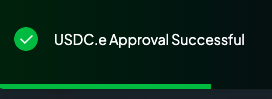

Approve the smart contract.

You can then proceed to deposit.

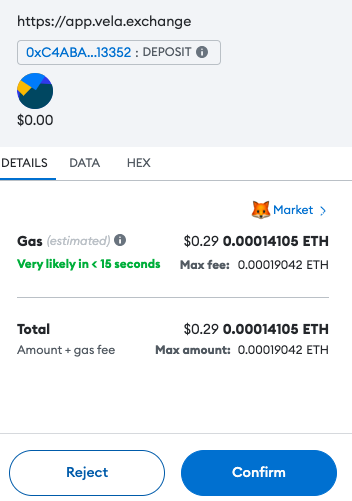

Pay the gas fee.

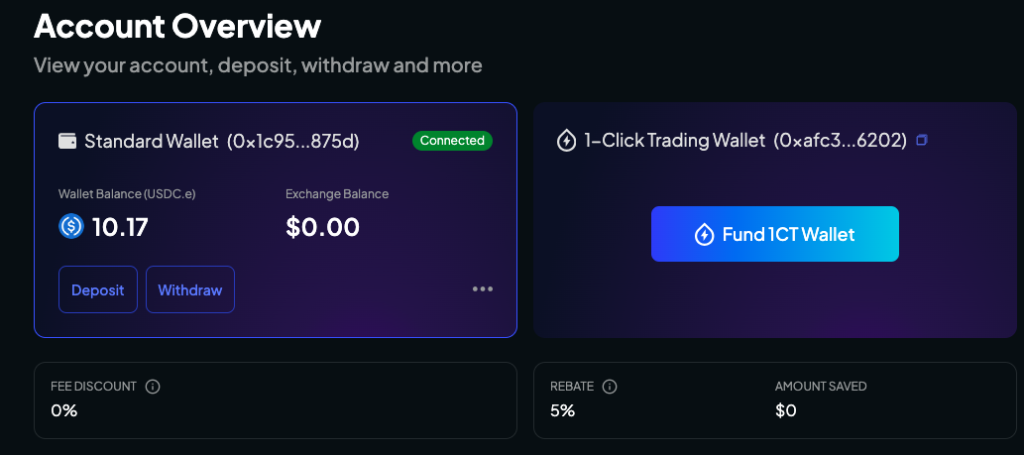

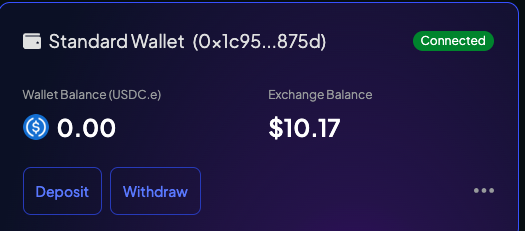

Once the process is completed, you can view the exchange balance on the dashboard.

Now you can begin trading.

How to Trade on Vela Exchange

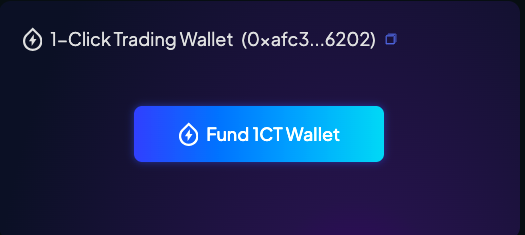

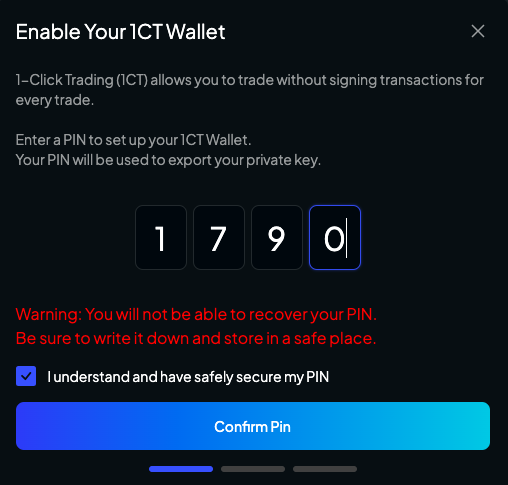

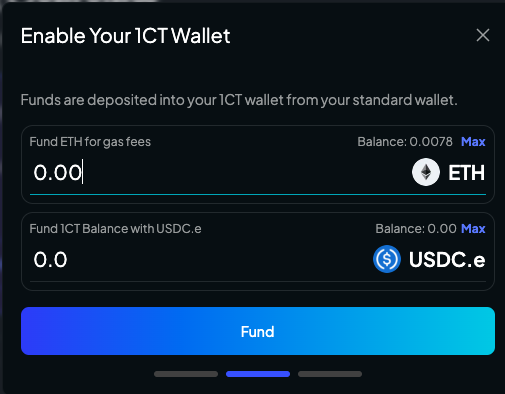

1-Click Trading

Vela Exchange introduces a simplified trading process with its 1-click trading feature. This reduces the need for multiple transaction confirmations, streamlining the on-chain order process. Benefits like fee reductions from staking or NFTs are also applicable to the user’s 1-click trading wallet.

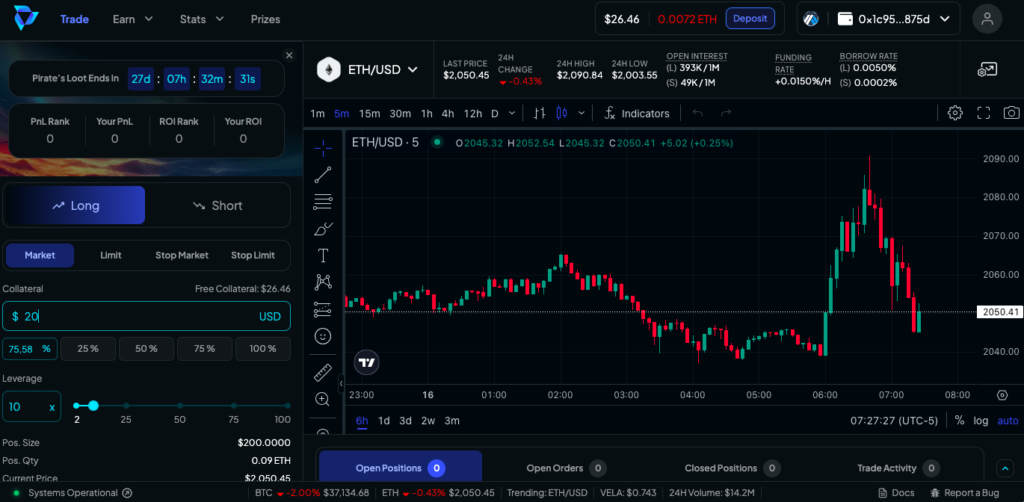

If you wish to just go straight to trading without setting up 1-click trading, just go to the TRADE tab on the dashboard. Be advised that the minimum requirement to open a trade is $20.

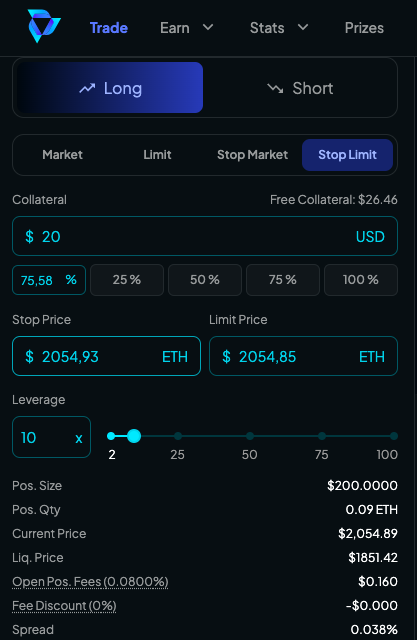

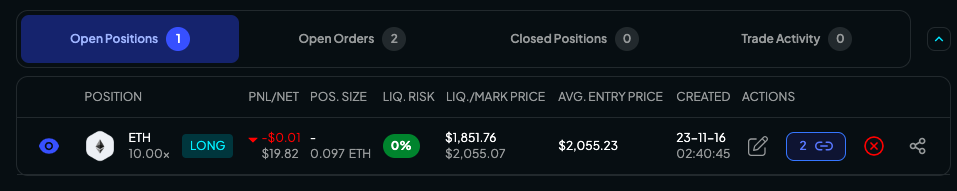

In this example, I decided to take a LONG position on ETH with 10X leverage as a Stop-Limit Order.

You can clearly see the liquidation price, fees, etc. on the dashboard.

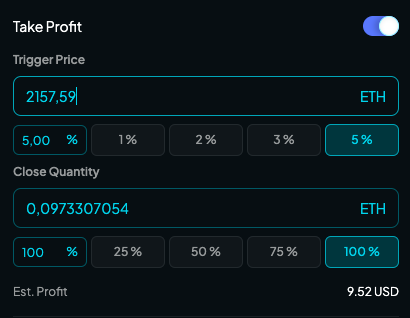

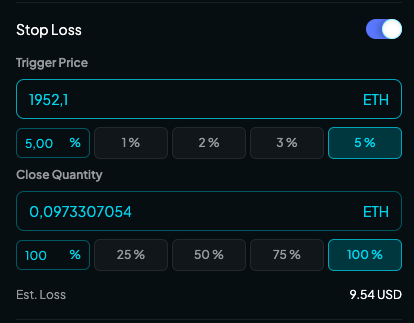

You can also set your ‘Take Profit”and Stop Loss” easily.

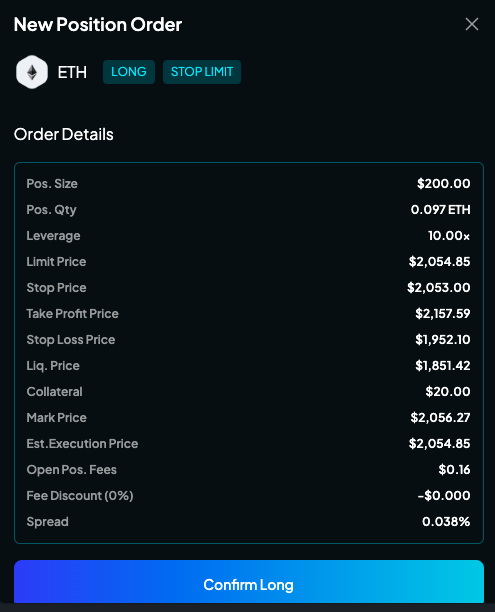

Proceed to confirm your position order.

Proceed to confirm your position order.

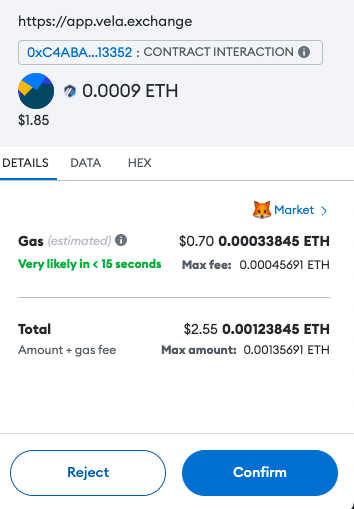

Pay the gas fee.

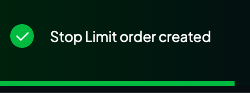

Your order will be confirmed.

You can view the open order on your dashboard.

How to Withdraw Crypto from Vela Exchange

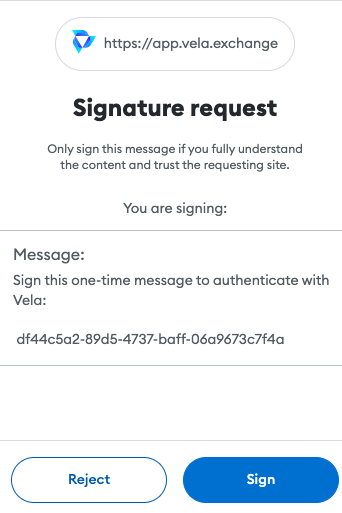

First, connect your wallet.

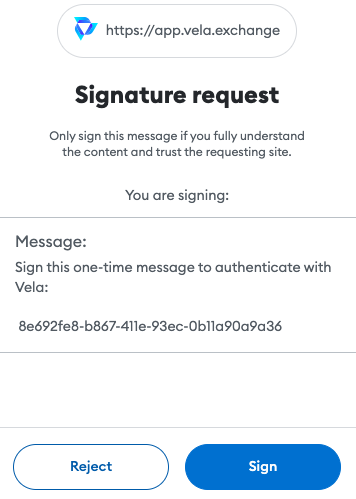

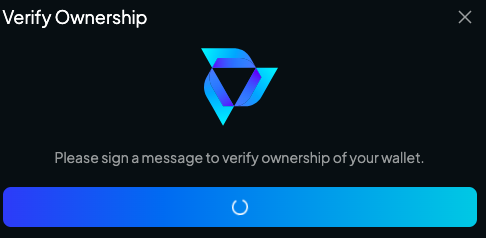

Sign a transaction to verify ownership of your wallet.

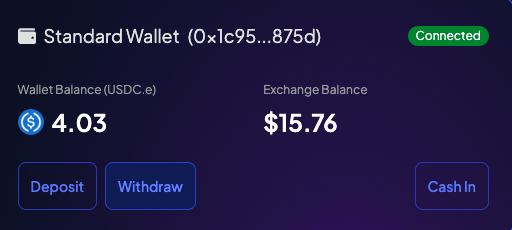

Navigate to the dashboard where you can see the wallet balance.

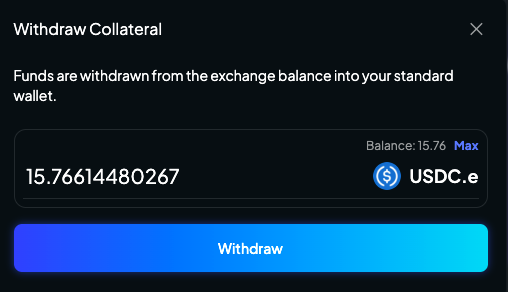

Choose how much you wish to withdraw.

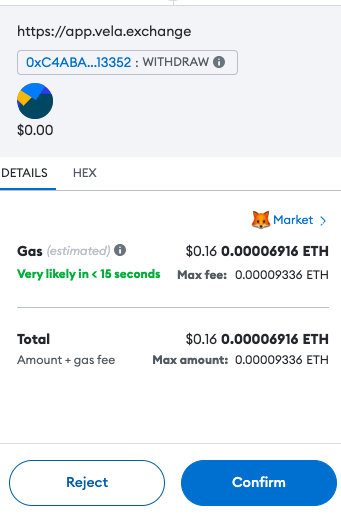

Pay the gas fee.

Your withdrawal will then be processed.

Staking on Vela Exchange

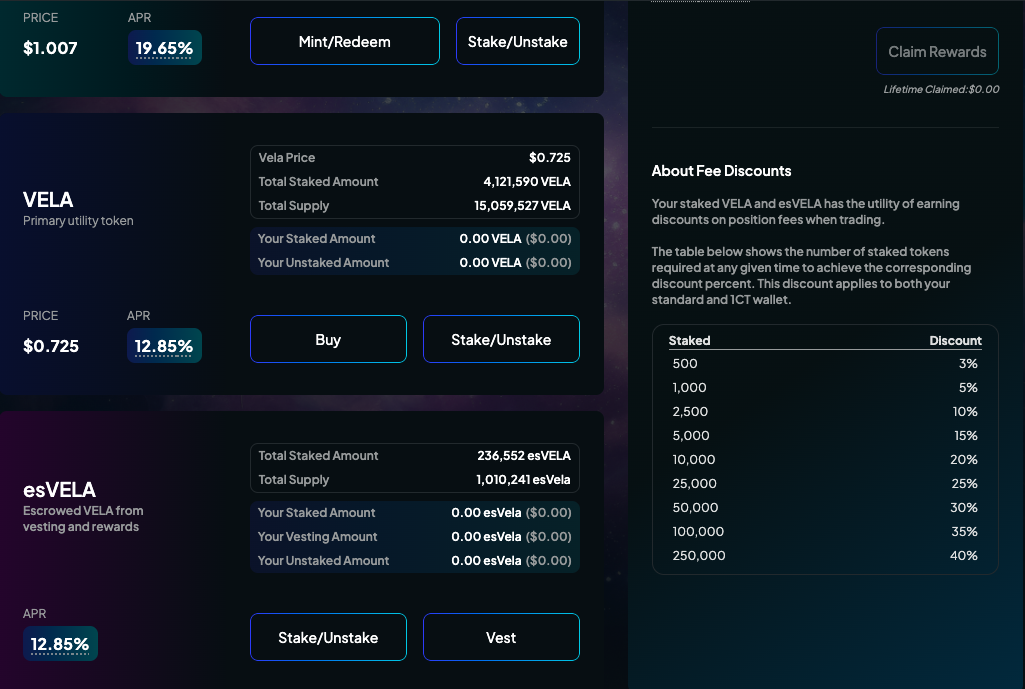

Vela Exchange allows users to stake their VELA, esVELA, and VLP tokens for additional rewards and access to platform benefits.

VLP Token

The VLP token serves as the liquidity provider token for Vela Exchange. It is based on USDC staking and can be redeemed at any time for the original asset. USDC.e (Arbitrum) or USDbC (BASE) can be staked to create VLP, allowing users to earn fees from the trading volume generated on the platform and the specific chain used.

VLP Contract Address: 0xC5b2D9FDa8A82E8DcECD5e9e6e99b78a9188eB05

Minting and Redeeming VLP

To mint VLP, users need to:

- Bridge USDC to Arbitrum/BASE using the Multichain Deposit feature.

- Stake USDC.e/USDbC directly from a Web3 wallet, specifying the desired amount of VLP.

There’s an ongoing promotion for minting and redeeming VLP with fees of 0.05% and 0.15%, respectively. Users can utilize the multichain functionality to mint VLP directly from six EVM compatible chains:

Redeeming VLP involves selecting the amount of VLP and choosing a stablecoin to redeem. Users can also whitelist wallets or contracts for staking on their behalf, paving the way for future cross-chain staking features.

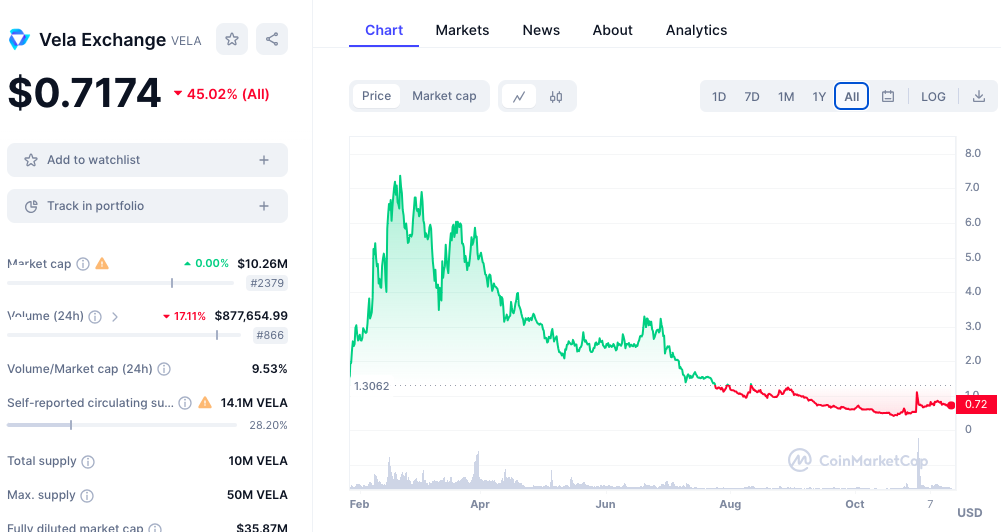

VELA Token

VELA is the primary utility token in the Vela Exchange ecosystem. It’s traded on Arbitrum through platforms like Camelot DEX, Ramses, Uniswap V3, and TraderJoe.

VELA Contract Address: 0x088cd8f5eF3652623c22D48b1605DCfE860Cd704

How to Buy VELA Token

To purchase VELA tokens on a DEX such as Camelot, simply connect your web3 wallet.

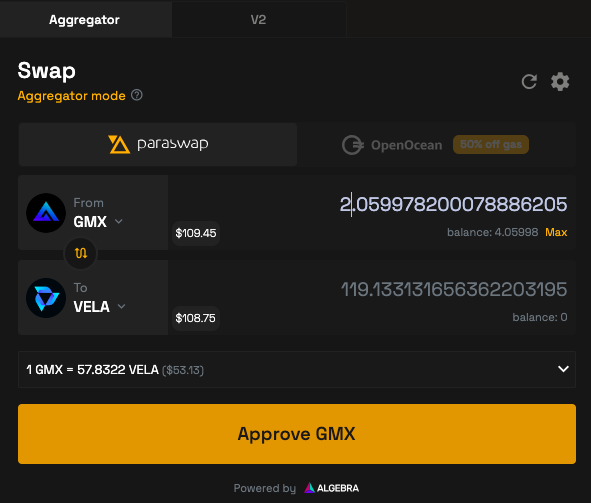

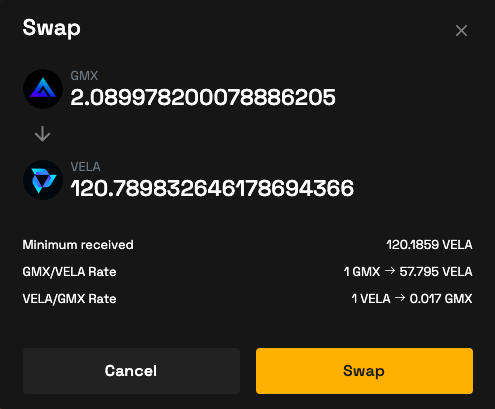

You can swap your preferred crypto for Vela. In this instance, we are swapping $GMX for $VELA.

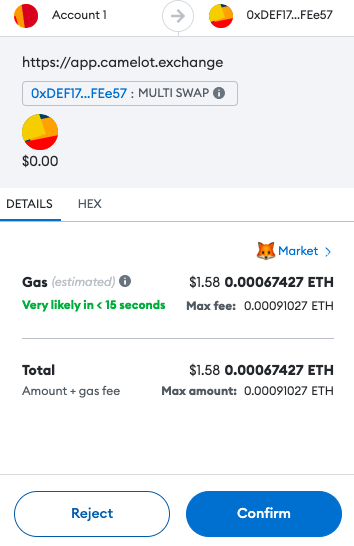

Pay the gas fee.

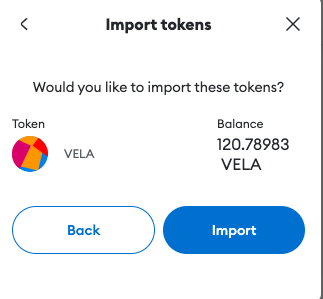

Make sure you import the contract address in your web3 wallet in order to view the balance or use DeFi tools such as Zerion.

esVELA Token

esVELA is an ‘escrowed’ variant of VELA, earned by staking VELA or esVELA. It can be vested linearly over 12 months and redeemed 1:1 for VELA.

esVELA Contract Address: 0x16535D4768ACD2E26dDd7383F0D811Bdcf61A313

Staking Rewards for VELA and esVELA

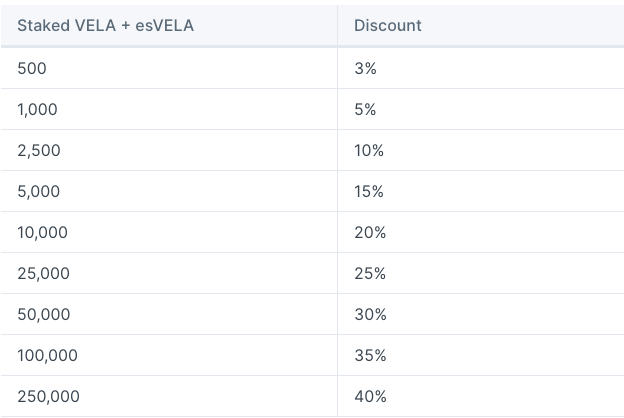

VELA & esVELA staking provides a share of fee-based rewards. Seven key benefits for stakers include:

- Discounted trading fees

- Earning esVELA from VELA buybacks, equivalent to 10% of perpetual fees

- Gaining 5% of perpetual exchange fees in USDC

- Receiving 40% of future spot exchange fees

- Additional esVELA from future spot fee buybacks

- 30% of future OTC trading platform fees

- Ecosystem rewards, varying based on the chain

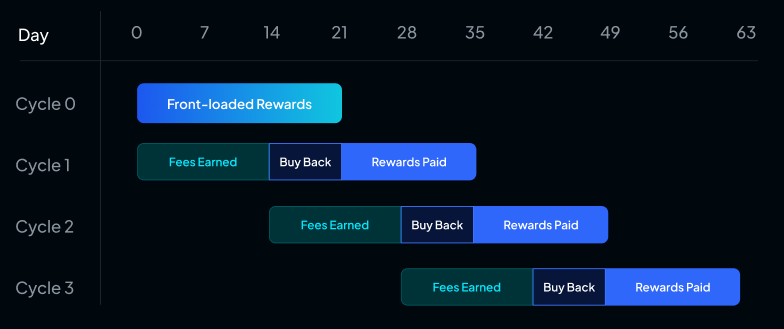

Reward Cycle 0 offers fixed esVELA rewards for VELA & esVELA stakers.

Vesting esVELA

esVELA can be vested in a contract to claim an equal amount of VELA over a 365-day period. Staked esVELA in this context doesn’t.

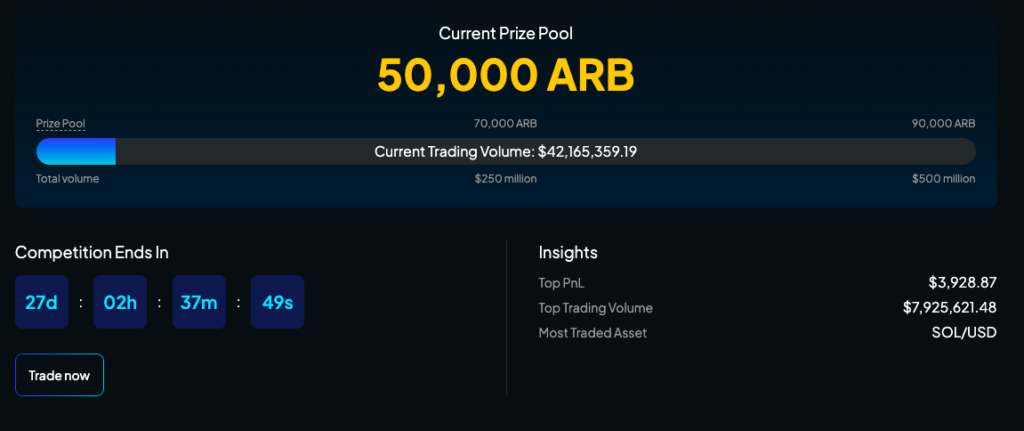

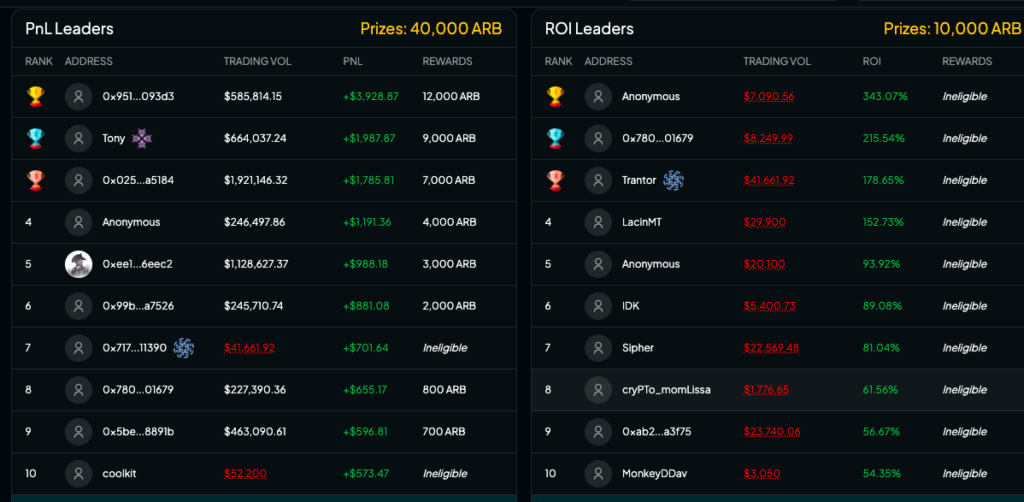

Trading Competitions on Vela

Vela offers a lot of incentives for traders.

Currently they have a Pirate Loot’s Trading Competition.

The competition rewards traders with the most PnL.