Uphold – the company, leadership and business model

Uphold HQ Inc., Uphold Europe Limited, Uphold Worldwide Ltd. and Uphold International Equities, Inc. are wholly-owned subsidiaries of Uphold Ltd. Uphold HQ Inc. is a FinCEN Registered Money Services Business (MSB) in the United States. Uphold Europe Limited is registered with the FCA as an EMD Agent of Optimus Cards UK Ltd. in the United Kingdom. Fiat currencies and digital assets are offered through Uphold HQ Inc. Economic interests in securities are offered through Uphold International Equities, Inc.

Uphold was founded by Halsey Minor, one of the digital media pioneers, known for starting CNET in 1993, the first comprehensive consumer-facing technology content publisher. He is the founder or co-founder of the technology companies such as the virtual reality startup Live Planet and VideoCoin. JP Thieriot is Chief Executive Officer of Uphold Inc., previously serving as the company’s Vice-Chairman for five years, and Co-founder of the Universal Protocol Alliance. Notable Uphold partners include UTRUST, Ledger, Brave Software, BitGive, and at least 12 others. To date, they’ve acquired JNK Securities, Scytale, Bitnet, and Cortex MCP.

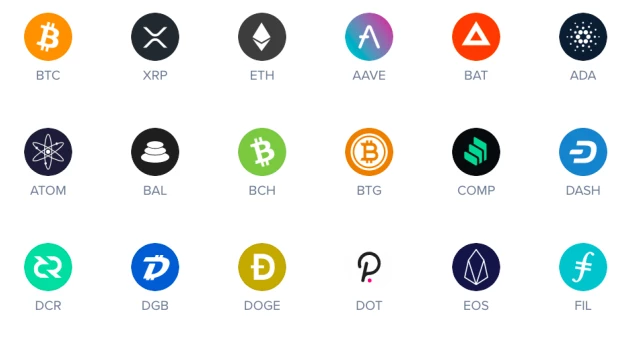

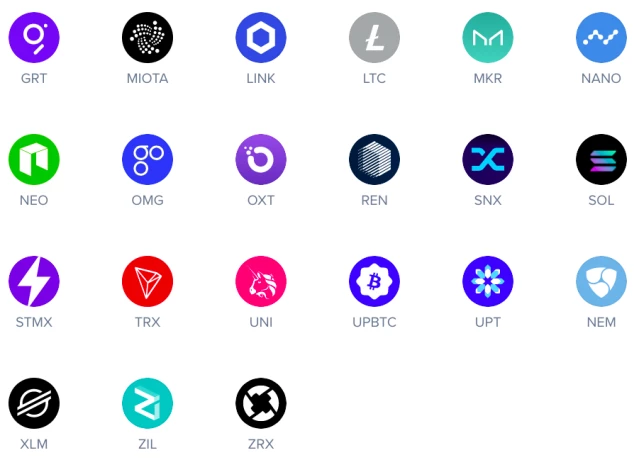

Uphold offers a mobile app that’s available on both Android and iOS. All transactions on the Uphold platform are self-directed by customers. Uphold offers 46 digital currencies, including majors, alt-coins, emerging tokens, and stablecoins.

Source: Uphold

In order to use the Uphold platform, you must set up an account as a user. When creating an Account, you will be asked to set up an email and password, and you will be required to set up two-factor authentication (2FA). Uphold’s competitors are the likes of Coinbase, Abra and Robinhood.

Positives

- Uphold uses commission-free pricing. Commission-free on Uphold means that users get an all-inclusive, guaranteed price that includes a small spread of typically 50-100bps (0.5-1.0%) on cryptocurrencies, but sometimes as low as 40bps (0.4%) depending on the individual trading behavior and volumes. Uphold’s competitive pricing is driven by a sophisticated new trading engine hooked up to 3x the number of exchanges it was before, enabling them to source assets at better prices.

- Uphold offers intuitive account purchase and funding options, instant transfers, one-step ordering, and automatic currency conversions.

- They offer innovative products designed to make investing more accessible and easier including the Uphold Card.

- Uphold also offers an AutoPilot feature designed to make it easier for users to purchase their favorite digital assets on a daily, weekly, or monthly basis. This feature allows users to schedule recurring transactions.

Negatives

- As a regulated financial services company, Uphold is required to identify all users for legal, regulatory and compliance purposes prior to you using their platform. Some people in the crypto community see this as a negative as they would rather opt for decentralised platforms where their identities can be better protected.

- To ensure they remain in compliance with applicable reporting requirements in the jurisdictions in which Uphold operates, they may collect and verify your personal information including your legal name, address, government identification, date of birth, Social Security or taxpayer identification number, bank information or credit card information.

- Uphold won’t provide its services to persons who are residents of Cuba, DRC, Iran, Iraq, Myanmar, North Korea, South Sudan, Sudan, Syria Yemen or any other jurisdiction subject to US embargo, as detailed here, UN sanctions, available here, HM Treasury’s financial sanctions regime, available here, or EU sanctions, available here.

- Using the Uphold platforms is at your sole risk and Uphold assumes no responsibility for the underlying transaction of funds, or the actions or identity of any transfer recipient or sender. If any third party files a claim for a chargeback or they are otherwise informed of a dispute between you and another party, they are not responsible for intermediating, determining the veracity of claims or resolving the dispute, including disposition of any associated economic value of any assets.

- Their verification process can take a long time and their customer service is not very responsive.

Fees

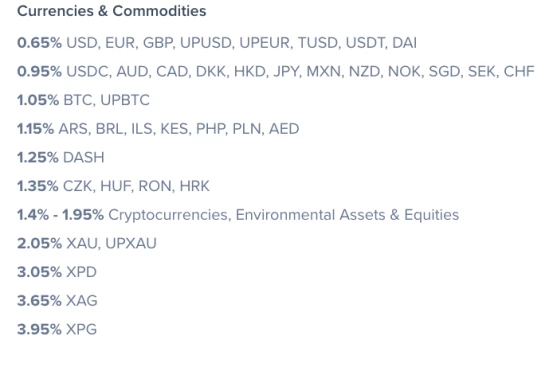

Uphold is not a free platform. They charge a spread every time you trade. Make sure you check rates at preview before you trade. Uphold’s pricing model is all-inclusive. This means that the price a user sees before they trade, is the price they pay when they trade. Their prices are locked in pre-trade which is not always the case on other exchanges. Uphold displays the current mid-market price on their charts; when a user trades, they receive the current bid or ask price depending on whether they are buying or selling. There is always a small difference between the mid-market and the bid/ask prices: it’s how order books on exchanges work. Uphold charges 0% deposit fees, 0% withdrawal fees, 0% trading commissions – but they do charge a spread. Network fees that are charged when users withdraw to external crypto wallets – are passed on at cost and may vary depending on network congestion.

Service Fees for Personal accounts

Cryptocurrencies

In the U.S. and Europe, Uphold’s spread is typically 0.8 to 1.2% on BTC and ETH.

- Their spread on the majors is typically around 1.8% in other parts of the world.

- Spreads can be significantly higher for low-liquidity cryptos and tokens including XRP, ZIL, OXT, UPT, DOGE and others. Check rates at Preview before you trade.

- Coordinated market activity such as Wall St Bets can distort markets. All the above spreads are likely to widen beyond those above during times of acute market stress.

Precious metals

Uphold’s spread is typically 3% on top of the bid-ask prices at our supplier.

Fiat currencies

Their spread is typically 0.2% between major national currencies such as EUR, USD, and GBP.

U.S. Equities

Uphold’s spread is typically 1.0%. For trading outside market hours, they add a small spread based on the stock’s volatility. A clock icon will appear when the U.S. public market is closed. U.S. market hours are 9.30am to 4pm ET on business days.

Service Fees for Business accounts

Web Wallet

Uphold accounts are free to customers who maintain active accounts. Funding your wallet is free doing so via a bank account, using bitcoin, or from another Uphold account. If using a Debit/Credit Card or China Union Pay to fund your account, a fee of 3.99% applies. To send and receive money is also free between Uphold customers. All customer-to-customer transfers are completely free of all fees, costs or limitations regardless of the amounts transferred, currency or frequency.

Convert & Buy

Uphold charges an exchange fee when a customer buys/converts between different currencies. This is based upon a percentage of the transaction value. Users may also notice a slight difference between the buy and sell price quote for the same currency pair at Uphold. This is because they include in the quote a Price Protection Fee. This small difference (usually less than 0.75% above or below the market rate) apparently allows them to provide a user with an instant and guaranteed quote no matter the market conditions or other factors that may affect Uphold’s ability to settle a user’s trade.

The fee to move funds off-platform via crypto is $2.99. To move funds off-platform via bank transfer costs around $3.99. 3rd party costs may apply, such as bank wire costs in some geographies or blockchain network fees.

Please note: this is their consumer and business account fee schedule; different fees apply to a business account using their API services. See API Transaction fees.