Top 5 Crypto Options Trading Platforms: Complete Guide

Best Crypto Options Platforms Reviewed.

As the cryptocurrency market continues to evolve, traders are looking for more sophisticated financial tools to maximize profits and hedge against market volatility. One of the most popular advanced strategies is crypto options trading, which allows investors to speculate on the future price of cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) or hedge their portfolios against downturns. With numerous platforms offering crypto options, it’s important to understand which one suits your trading needs.

This guide highlights the best crypto options trading platforms, examining their features, fees, assets supported, and unique offerings.

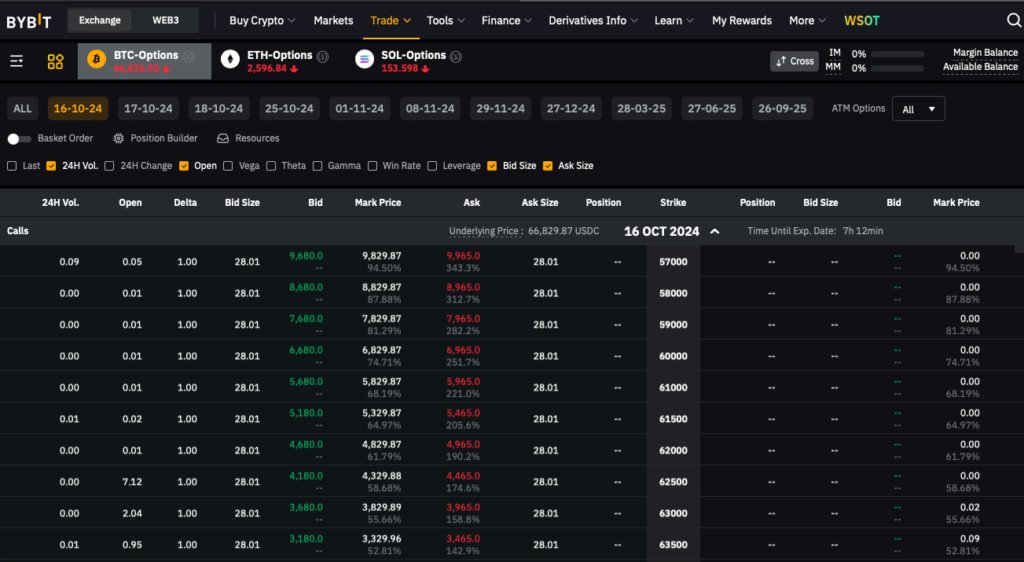

1. Bybit

Bybit is one of the most recognized platforms for crypto options trading, particularly popular for its flexibility and robust offerings. This platform allows traders to use up to 100x leverage, which appeals to high-risk traders looking to maximize profits on price movements.

Assets Supported: BTC, ETH

Fees:

- Maker Fee: 0.03%

- Taker Fee: 0.03%

- Delivery Fee: 0.015% (charged only when exercising an option)

Minimum Order Size: 0.01 BTC or 0.01 ETH

Max Leverage: 100x

Settlement: USDC

Why Choose Bybit?

- High leverage of up to 100x, allowing traders to take substantial positions with a smaller initial investment.

- Competitive fees, with caps on option fees to prevent excessive costs (fees cannot exceed 12.5% of the contract value).

- Simple settlement in USDC, a popular stablecoin, making the process straightforward for traders.

Bybit is ideal for both seasoned traders and those looking to explore high-leverage options trading.

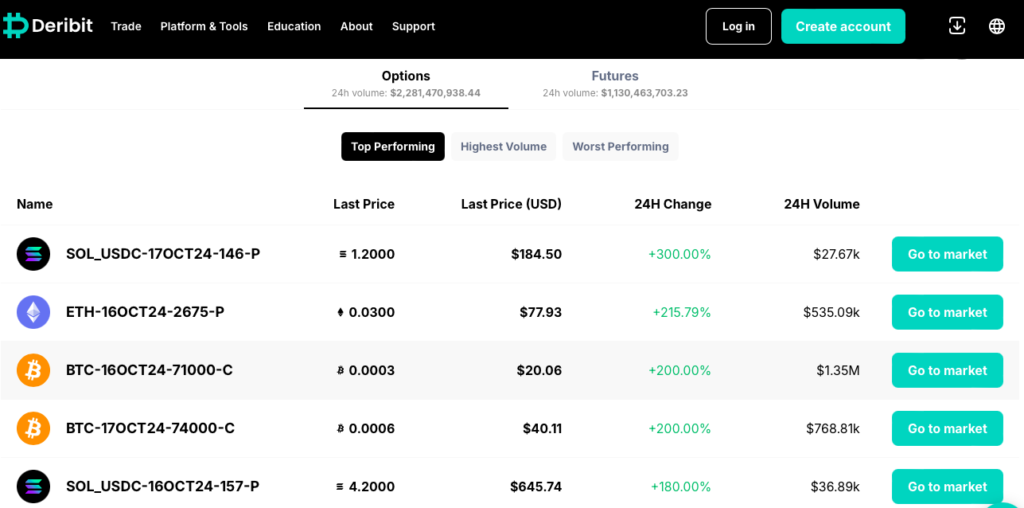

2. Deribit

Deribit is considered the largest and most liquid crypto options exchange, making it a go-to platform for advanced traders. The platform excels in offering deep liquidity and sophisticated tools for experienced traders.

Assets Supported: BTC, ETH

Fees:

- Maker Fee: 0.03%

- Taker Fee: 0.03%

- Minimum Order Size: 0.1 BTC (BTC options), 1 ETH (ETH options)

Max Leverage: 100x

Settlement: In the underlying cryptocurrency (BTC or ETH)

Why Choose Deribit?

- The leading exchange for liquidity, allowing traders to execute large trades without significant price slippage.

- Advanced trading tools, including a comprehensive order book and detailed market analytics, cater to professional traders.

- An insurance fund to mitigate risks, adding an extra layer of security for traders.

Deribit’s platform might be complex for beginners, but it is unmatched for those who need a professional-grade options trading experience.

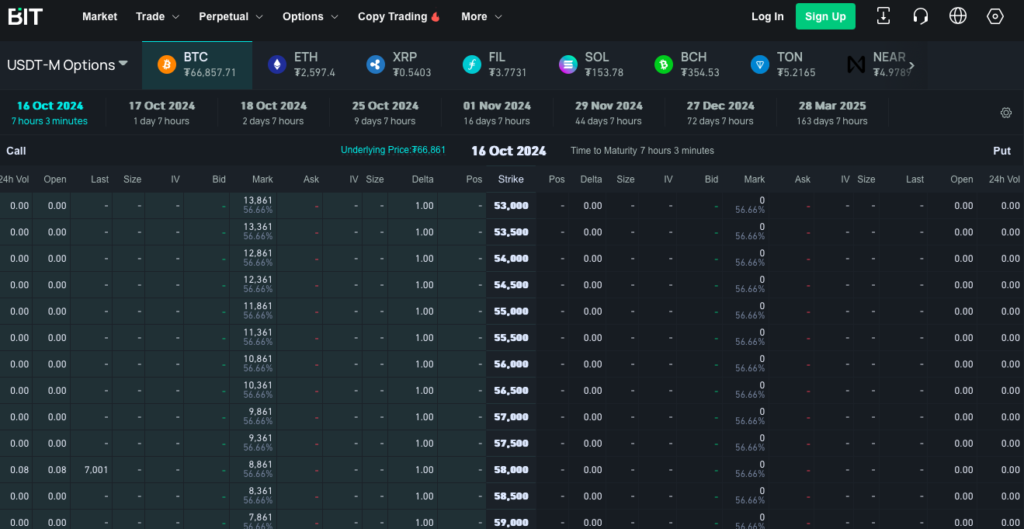

3. BIT Crypto Exchange

BIT Crypto Exchange distinguishes itself by offering both USD-margined and coin-margined options, allowing traders to settle their contracts in fiat or cryptocurrency. This flexibility, along with low fees, makes it a solid option for diverse traders.

Assets Supported: BTC, ETH, FIL, NEAR, BCH, XRP, ADA, TON

Fees:

- Maker Fee: 0.02%

- Taker Fee: 0.05%

- Delivery Fee: 0.015% for non-daily options

Minimum Order Size: 0.01 BTC (USD-margined), 0.1 BTC (coin-margined)

Max Leverage: 10x

Settlement: USD or in the underlying cryptocurrency

Why Choose BIT Crypto Exchange?

- Offers a variety of expiration dates, from daily to quarterly, enabling short-term and long-term trading strategies.

- Traders can select from several strike prices with lower increments, such as $50 for ETH options, providing precision.

- Profitable options are settled automatically, ensuring no missed opportunities for earnings.

BIT is particularly suited for traders who want flexibility in settlement options and a platform that supports more assets beyond BTC and ETH.

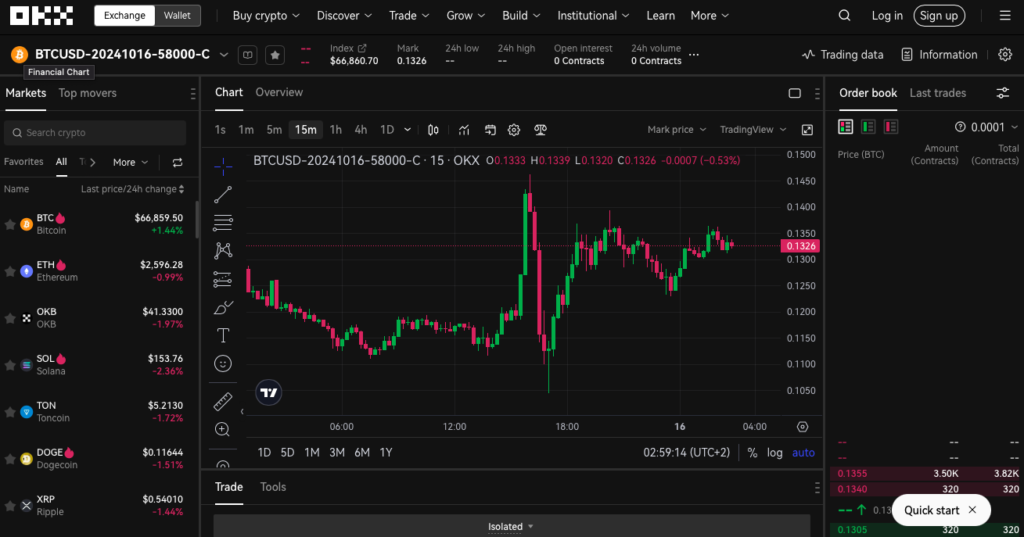

4. OKX

OKX is a highly reputable platform that caters to both retail and institutional traders. Offering a wide range of options with daily, bi-daily, and monthly expiration dates, OKX provides low fees and high leverage opportunities.

Assets Supported: BTC, ETH

Fees:

- Maker Fee: 0.02%

- Taker Fee: 0.03%

- Exercise Fee: 0.02% for non-daily options

Minimum Order Size: 0.01 BTC or 0.1 ETH

Max Leverage: 100x

Settlement: In the underlying cryptocurrency (BTC or ETH)

Why Choose OKX?

- Offers a broad selection of expiration windows, from daily to quarterly options, making it versatile for all types of traders.

- The low fee structure makes it cost-effective, especially for high-frequency traders.

- An accessible demo account allows users to practice their options trading strategies without risking real capital.

OKX is an ideal platform for both newcomers to options trading and experienced traders looking for a platform with robust features and global reach.

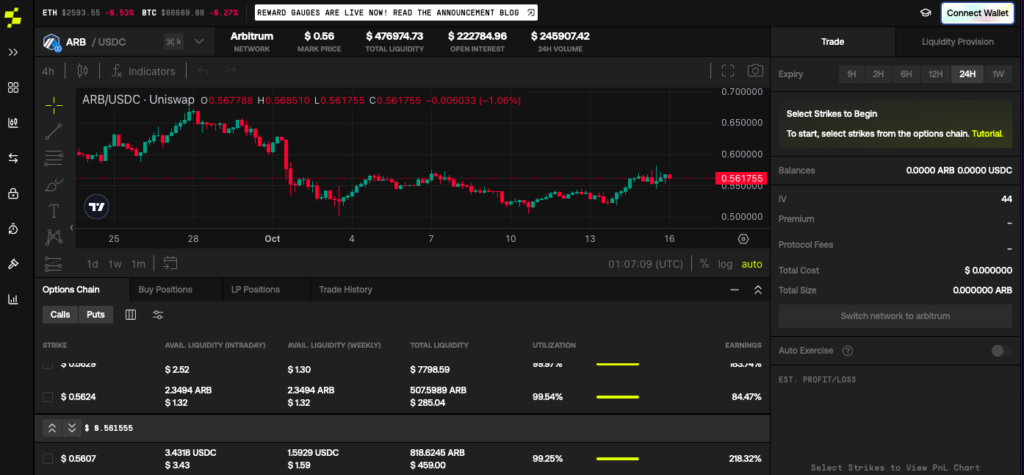

5. Stryke

Stryke is a decentralized platform that offers options trading in several cutting-edge crypto assets, including popular DeFi tokens like WBTC and GMX. It stands out for its CLAMM (Concentrated Liquidity Automated Market Maker) system, which allows traders to customize their risk.

Assets Supported: WBTC, WETH, stETH, ARB, GMX, CRV, CVX, MATIC

Fees: 30% of the options premium

Minimum Order Size: None

Max Leverage: 100x

Settlement: In the underlying cryptocurrency

Why Choose Stryke?

- Decentralized governance and a focus on synthetic tokens make it a good choice for DeFi enthusiasts.

- High-risk, high-reward options allow traders to maximize profits in short-term speculative markets.

- Unique CLAMM feature introduces innovative liquidity management strategies.

Stryke is perfect for traders who want to venture into the world of decentralized finance and explore synthetic assets.

Key Considerations for Choosing a Crypto Options Platform

- Supported Assets: Ensure the platform supports the cryptocurrencies you want to trade.

- Fees: Compare trading fees, delivery fees, and any additional costs like liquidation fees or exercise fees.

- Leverage: If you’re looking to amplify your positions, check the platform’s leverage offerings.

- KYC and Restrictions: Some platforms may require identity verification, while others may not be available in certain countries.

- Liquidity: Look for platforms with high liquidity to avoid slippage and ensure smooth trade execution.

- Interface and Tools: Whether you’re a beginner or an advanced trader, the platform’s tools and user interface should align with your experience level.

Conclusion

Crypto options trading offers a flexible way to speculate on price movements, hedge risks, or earn passive premiums through selling strategies. Platforms like Bybit, Deribit, and OKX are ideal for traders looking for high leverage and low fees, while BIT Crypto Exchange and Stryke provide more diverse asset offerings and unique trading mechanisms. No matter your preference, choosing the right platform depends on your trading goals, risk tolerance, and the assets you wish to trade.