1) Terra (LUNA)

A decentralised financial payment network running on a proof of stake blockchain, which is different from a proof of work blockchain based system, Terra makes use of a basket of fiat-pegged stablecoins that are algorithmically stabilized by its reserve currency Luna in order to enable programmable payments and the development of open financial infrastructure. Terra stablecoins offer users worldwide low-fee instant settlements. There are over 2 million active payment users according to Terra and over US$1 billion transacted annually.

LUNA tokens are the reserve currency of the Terra platform and they represent a validator’s mining power. Validators stale LUNA tokens in order to generate blocks on the Terra chain to receive mining rewards. LUNA tokens also function as governance tokens since LUNA holders are also able to submit and vote on governance proposals.

LUNA tokens have three main use cases:

- LUNA tokens offer Terra blockchain validators an incentive through rewards

- Users can mine Terra transactions through staking LUNA

- LUNA tokens make price stability of Terra stablecoins possible

LUNA tokens can be traded on exchanges such as KuCoin and Huobi.

2) TerraUSD (UST)

An algorithmic, yield-bearing stablecoin that is pegged to the US Dollar by Terra LUNA, Terra USD (UST) is a decentralised and algorithmic stablecoin that is issued on the Terra blockchain.

UST has a minting mechanism that is ideal for decentralised finance protocols. By simply integrating TerraUSD as a payment method, it can be easily added to crypto wallets. UST is also popular when used in decentralised applications (DApps), for example, it is used as a pricing benchmark by platforms that mint fungible synthetic assets and track real-life asset prices.

TerraUSD (UST) enables better scalability and offers passive income opportunities since holders can earn yield from DeFi protocols with it. TerraUSD also enables the connectivity between blockchain ecosystems since with dropship, TerraUSD is integrated into several decentralised exchange and DeFi platforms, and most importantly, moves assets between chains. LUNA supply and demand determine the value of TerraUSD. UST tokens can be found on exchanges such as Bitfinex, Gate.io, Coinbase, Uniswap and many others.

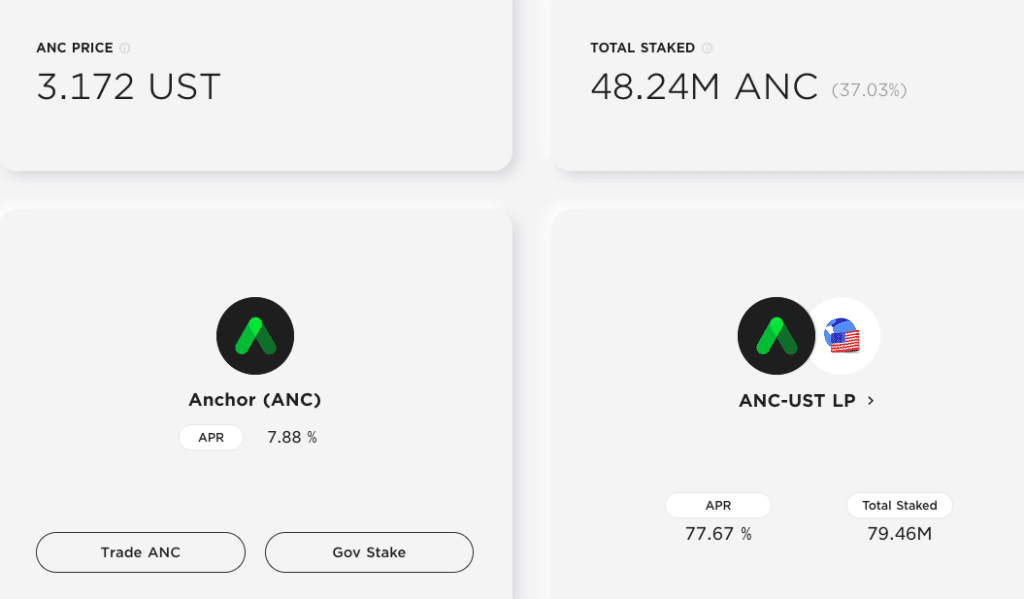

3) Anchor Protocol (ANC)

The Anchor Protocol creates a fully decentralized fixed income instrument by using the ANC token incentives and governance, diversified staking yields, and money markets. The governance aspect is quite important since the target APY paid out to depositors is determined by it. Rewards are also paid out to users who stake ANC tokens.

Depositors are incentivized to lend Terra stablecoins to Anchor’s money market on the Anchor protocol. By incentivizing liquidators to observe and liquidate loans that become at risk of undercollateralization, the protocol works to prevent borrowers from accruing liabilities in excess of collateral value.

ANC tokens can be found on exchanges such as OKEx, Gate.io, KuCoin, and others.

4) Mirror Protocol (MIR)

Mirrored assets are essentially blockchain tokens which act as ‘mirror’ versions of real-world assets. They do this by reflecting the exchange prices on-chain. Incubated by Terra protocol, Mirror is a decentralized derivatives protocol that enables the creation of synthetic assets. Mirrored Assets or mAssets are what the synthetic assets are referred to as. Developed on the Terra blockchain, Mirror protocol has access to Binance Smart Chain and Ethereum via Terra Shuttle.

mAssets give investors a wider range of investment options and they mimic the price of any assets. The governance token for Mirror Protocol is MIR which was airdropped to holders of UNI and LUNA tokens and they can be staked in order to receive voting privileges or to earn a portion of the protocol’s collateralized debt position withdrawal fees. MIR is now distributed to liquidity providers through yield farming to the liquidity providers of mAssets.

MIR tokens can be traded on exchanges such as KuCoin, Binance, Huobi and Uniswap.

5) Pylon Protocol (MINE)

A DeFi framework for yield-based products and built by Terraform Labs (TFL) on the Terra blockchain, Pylon Protocol makes it possible to achieve long-term incentive alignment between service providers and users where rather than upfront expenditure, payment is rendered via cash flow.

Pylon consists of a suite of payments products and savings in DeFi and it builds on stable yield-bearing protocols the likes of Terra’s Anchor Protocol to be able to provide services that are powered by user deposits. Users are able to deposit Terra stablecoins into platforms that are integrated with Pylon Protocol and in exchange they receive platform-specific rewards. These rewards may include for example principal-protected investments, no-fee memberships, rental services, exclusive content, project token farms, etc.

Pylon Gateway is the flagship product of the protocol and it is essentially a decentralized project launchpad and crowdfunding-via-yield platform for Terra. On this platform users would be able to deposit TerraUSD (UST) for a designated vesting period in order to earn project tokens and have governance rights.

MINE is the Pylon native token and it is a CW20 token that originally launched on Pylon Gateway. MINE tokens serve as an incentives gateway that incentivizes users to make deposits into platforms that are powered by the Pylon Protocol. MINE’s primary use case however, is to enable holders of the token to engage in protocol governance and earn a portion of protocol yields that are generated across all Pylon platforms and projects.