Ledn

Ledn is a platform operated by Ledn Inc. which acts as the provider of users’ savings accounts – if they reside in the United States, Ledn (USA) Inc., a Wyoming corporation, and if they reside in any other country, Ledn Hodl I LP, a limited partnership formed under the laws of the Province of Ontario, Canada.

Ledn offers a suite of products that enable users to earn extra yield. Their credit products make it possible for users to keep their bitcoin and access dollars, or use the borrowed funds to purchase more crypto assets. With a Ledn Savings Account, users can withdraw their funds at any time without penalty. Likewise, they can pay back their loans at any time without penalties. Ledn processes all withdrawal requests quickly and strives to have users’ bitcoin in their wallet within 24-72 hours.

Ledn references Coindesk’s bitcoin price index in order to determine loan-to-value ratios for Ledn loans. Ledn requires all borrowers to provide identity information for their KYC and AML policies. They however, do not run a credit check on customers. With the Ledn Bitcoin savings account clients have the potential to earn interest on their bitcoin holdings. In order for Ledn to generate this interest, it works with its primary institutional borrower, Genesis, which offers institutions the ability to borrow digital currencies such as Bitcoin and stable coins such as USDC in large sums with flexible terms. Ledn is backed by some top investors including:

Users can access Ledn via a smartphone or computer device. In order for a user to apply for a savings account, they must have a Ledn Account and have completed the KYC verification process. Only then are they able to apply for a savings account by simply clicking the “Deposit” button on the “BTC Savings” or the “USDC Savings” page of the platform or by otherwise requesting to use or open a savings account.

Once a user’s savings account is activated, they are able to transfer crypto assets that are supported on the platform into the wallet at the deposit address. Interest is calculated daily based on the crypto assets that are held in the user’s account as of 11:59:59 p.m. EST. Deposits start earning interest on the first day after they are received

Savings Account Interest Rates

Eligible Digital Asset | Balance Amount | Annual Percentage Yield (APY) |

BTC (Tier 1) | 0 – 2 | 6.10% |

BTC (Tier 2) | > 2 | 2.25% |

USDC | > 0 | 9.00% |

Withdrawals and Fees

Users can make a complete or partial withdrawal of their crypto assets ie. BTC or USDC that is held in their savings account at any time. In doing so, they’d cease earning interest on the digital assets that they have requested to withdraw even if it may take up to 7 days to fully process withdrawal requests. When transferring funds internally, between Ledn accounts, no fees are charged. However, there are fees applicable when trying to transfer digital assets to an external Ledn account.There is no minimum balance required to earn interest, however, accounts are still subject to withdrawal minimums of 0.0005 BTC (Bitcoin Savings) and 10 USDC (USDC Savings). There is no minimum balance required to earn interest, however, accounts are still subject to withdrawal minimums of 0.0005 BTC (Bitcoin Savings) and 10 USDC (USDC Savings).

Eligible Digital Asset | Withdrawal Limit | Withdraw Fees |

BTC | 100 BTC per 7-day period | Miner fees only |

USDC | 1,000,000 USDC per 7-day period | 10 USDC |

StormGain

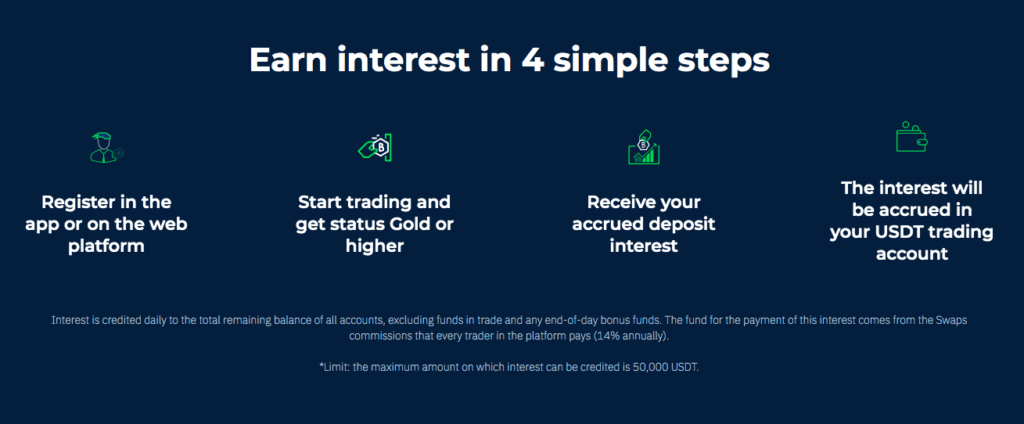

StormGain LLC registered in St. Vincent and the Grenadines operates the StormGain mobile platform which is available on Apple’s AppStore and Google’s Playstore. To be eligible for the programme, StormGain users have to acquire a loyalty status level for the first time, provided that the annual interest to funds benefit applies.

Users can earn interest on the balance of participating’ StormGain accounts on the day of first-time status acquisition. Interest is credited within 30 days from the start date of the loyalty programme and a user’s loyalty programme status determines the amount of interest that is paid to them. Calculation of the interest takes place daily on the basis of the account balance as at 21:00 GMT. The amount of interest payable is calculated using the total remaining balance of all accounts, excluding funds in trade and any end-of-day bonus funds.

If a user’s status changes during the 30 days when interest accrues, the interest rate will be changed accordingly for the remaining days of programme activity.

The amount of interest due will then be transferred in USDT to the client’s USDT StormGain account. All interest accrued by the user will be paid in a lump sum 30 days following the date on which interest began accruing. Interest is not paid on any amounts above USD 50,000. If the balance of a StormGain user’s account exceeds USD 50,000, interest will only be paid on a maximum of USD 50,000.

CoinLoan

With CoinLoan, users of the platform can borrow, swap and grow their digital assets. CoinLoan is operated by CoinLoan OÜ, a company which is duly registered and active in the Republic of Estonia.

For users to access and use their accounts, CoinLoan identifies the users by their email address and password. If the user represents a legal entity on behalf of which they would like to set up a corporate account, CoinLoan will identify the user as the signatory for the entity. Users would need to KYC first in order to qualify for corporate onboarding.

CoinLoan’s interest account is an account for deposits in crypto assets that allows the user to earn an annual percentage yield on the listed crypto assets held in their interest account. The annual percentage yield used is the real rate of return earned on the user’s interest account by taking into account the effect of compounding interest.

Users are able to deposit funds to their interest accounts by transferring funds to the deposit address from their account at CoinLoan. Deposit operations are processed instantly and users are entitled to make orders at any time, however, CoinLoan shall process withdrawals daily at 14:00 UTC, before interest accrual. Users reserve the right to make withdrawals partially or in full at any time. Users’ interest will be calculated daily as long as any funds are available on their interest account and the accrued interest is added to the account balance on the 1st day of the following month.

Users also reserve the right to withdraw all their funds and leave their balance at a zero rate. The APY calculation and accrual will be subject to stop at the date of the withdrawal. Interest is accrued daily at 14:00 UTC on a compound basis to all interest accounts that have a non-zero basis. An APY accrual transaction is created with a pending status, which will be executed on the first day of the following month. Compounded APY will be credited to the user’s interest account on the first day of the month at 15:00 UTC. The accrued APY will be calculated and paid to two digits after the decimal point of the crypto assets in the same currency as the deposit has been made. Any digits beyond that will be truncated. Once APY has been credited to the user’s interest account, they will earn APY on it in future months.

CoinLoan charges no fees for withdrawals and interest account operations.

BlockFi

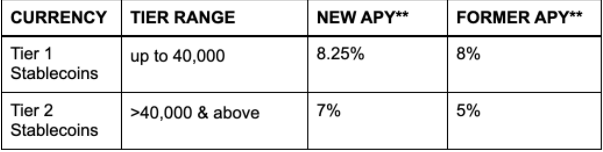

Users with a BlockFi interest account can earn up to 8.25% APY on their crypto assets. Interest accrues daily and is paid monthly. There are no hidden fees and no minimum balances. By putting crypto assets to work, users can earn a further $250 crypto bonus with a transfer of $100 or more in crypto.

BlockFi continually sets rates based on market dynamics for lending and borrowing. Beginning this October 1, 2021 BlockFi made changes to interest payable on deposits made in the BlockFi Interest Account (BIA) especially deposits of stablecoins ie. USD Coin (USDC), Gemini Dollar (GUSD), Paxos Standard (PAX), Multi-Collateral Dai (DAI), Binance USD (BUSD), and Tether (USDT).

Check out the full BlockFi review.

Nexo

Nexo’s earn interest offering allows users to earn interest on certain crypto assets topped up into the savings wallet of their Nexo account. Users are also capable of having multiple active Nexo earn interest products running simultaneously although interest will be accrued separately on each Nexo earn interest product that the user chooses.

Users may opt for a Nexo earn interest product for a flex term or for a fixed term. If a user opts for a Nexo earn interest product for a fixed term, they are not able to terminate the agreement prematurely or withdraw their crypto assets before the expiry of the fixed term. Users can however opt for automatic renewal once the term has expired.

The interest earned accrues on the deposited digital assets at a certain rate, as of the expiry of 24 hours of their topping up into the savings wallet of a user’s Nexo account. Interest can be earned in the same currency deposited or in NEXO tokens. The Interest shall be compound when earned in-kind and simple when earned in NEXO tokens. Higher interest is accrued on a user’s crypto assets when earned in NEXO tokens. Interest is calculated on a daily basis, at a certain time on each calendar day, on the basis of the actual number of days elapsed in a 365-day year. If the interest is accrued in NEXO tokens, the USD equivalent of the in-kind interest on the relevant crypto assets is converted into NEXO tokens.

Interest earned for the flex term will be credited to the user’s Nexo account at a certain time on each calendar day, but no earlier than the start time. The Interest for the Nexo earn interest offering for a fixed term will be credited to the user’s Nexo account on the date of expiry of the relevant fixed term.

Read the full Nexo review. Check out the full guide on how to earn interest with decentralised finance (DeFi).