Top 5 Optimism Ecosystem Tokens

What is Optimism & What are the Top Projects Built on the Blockchain?

What is Optimism?

At the heart of Optimism is a framework known as the Optimistic Rollup. Essentially, an “Optimistic Rollup” is a sophisticated term for a blockchain structure that leverages the security measures of another “master” blockchain. Rather than operating its own consensus mechanism, like PoW or PoS, Optimistic Rollups utilize the consensus system of their parent chain. For OP Mainnet, Ethereum serves as this foundational blockchain.

Top 5 Cryptos in the Optimism Ecosystem

$KWENTA

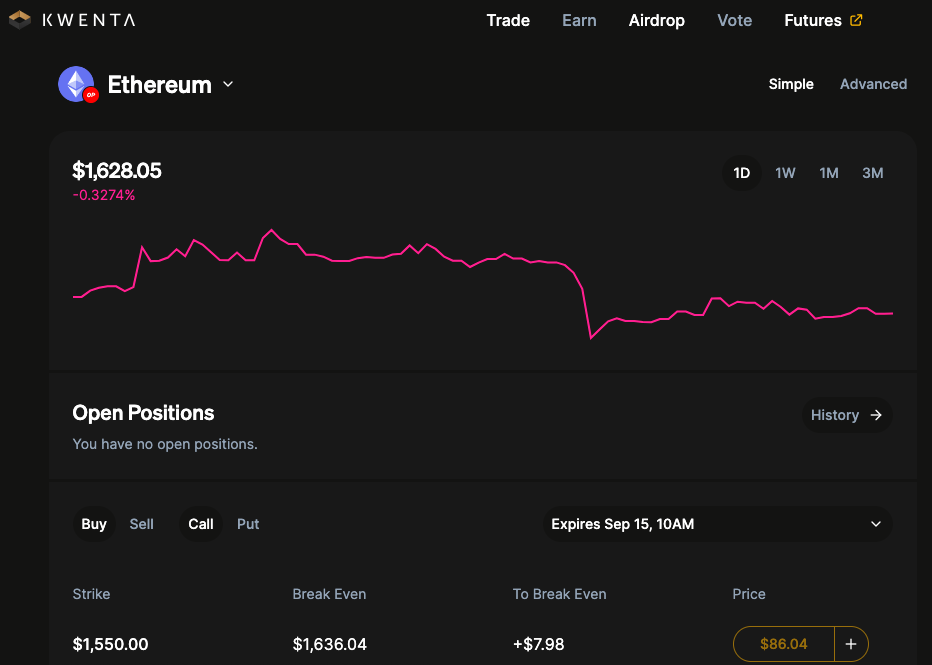

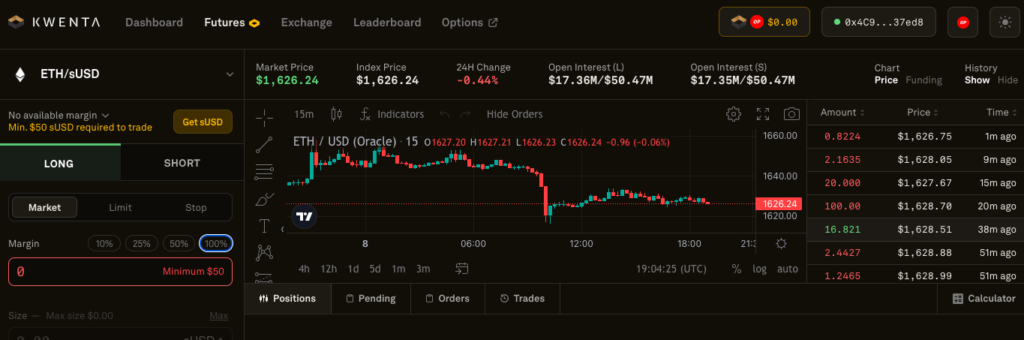

Kwenta is a web-native decentralized exchange overseen by a global community. It aims to democratize financial tools to level the playing field in finance. Operating on the Optimism layer, Kwenta provides a platform for decentralized derivatives trading, including perpetual futures and options on a range of commodities, currencies, cryptocurrencies, and more.

Functions you can perform on Kwenta:

- Acquire or divest an expanding array of synthetic assets

- Engage in trades using up to 25x leverage

- Stake KWENTA tokens to earn inflationary rewards

Advantages of Using Kwenta:

- Enjoy low gas fees and almost immediate transactions through Optimism

- 100% on-chain trading

- Price data secured by Chainlink oracles

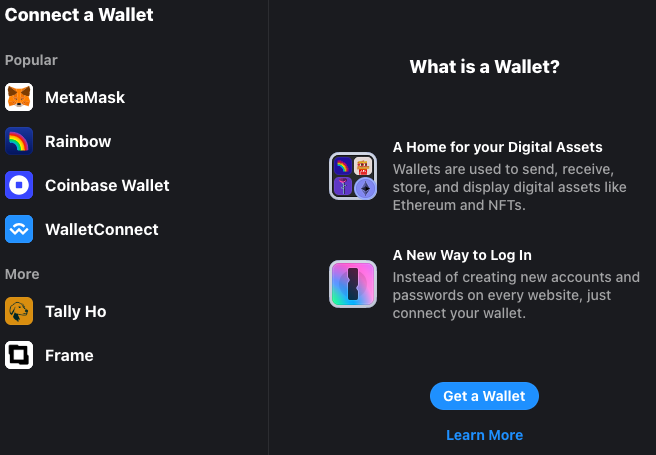

To get started on Kwenta, you will need:

- A Web3 wallet

- ETH for transaction fees and sUSD for trading on the Optimism L2 network

Distinctive Features of Kwenta:

- Utilizes decentralized Chainlink oracles for pricing

- Lacks a traditional order book

Instead, Kwenta taps into the Synthetix debt pool to provide ample liquidity, facilitating trade executions at any price level. The system is reliant on a stable and immutable coin like sUSD.

$KWENTA tokens are available on platforms like MEXC, Bitget, and CoinEX.

$SONNE

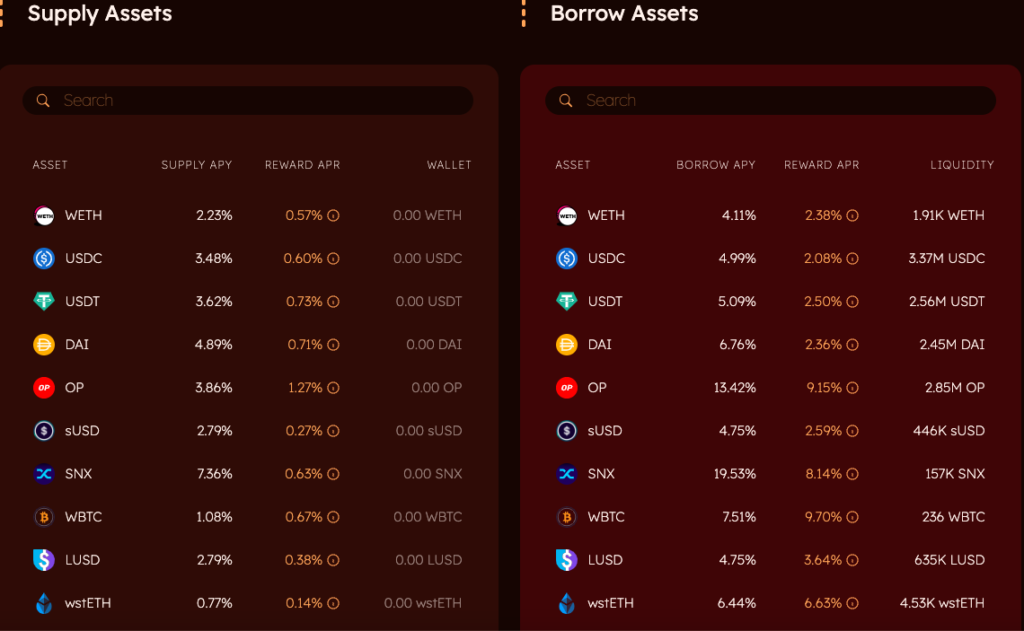

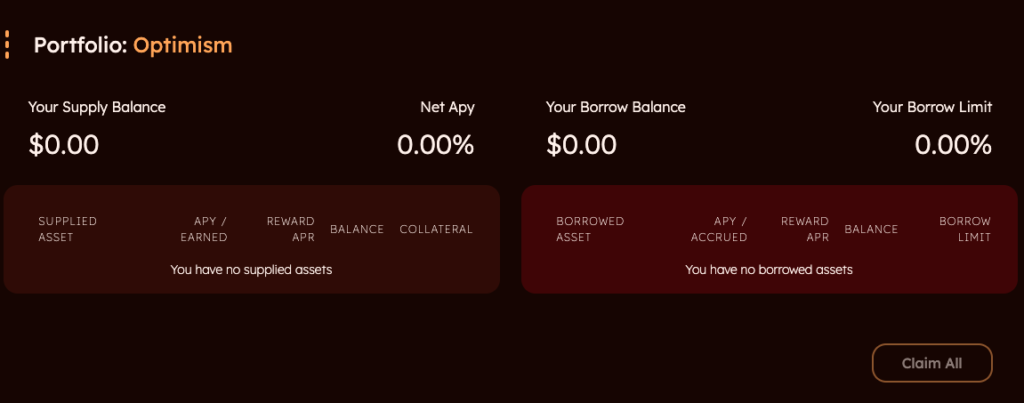

Sonne Finance operates as a decentralized, custodial-free lending platform. The protocol serves individuals, organizations, and other protocols, providing open-source, permissionless, and Optimistic financial services.

Functionalities within Sonne Finance:

- Asset deposits

- Collateral-based borrowing

Sonne Finance is an EVM-compatible lending and borrowing platform initially launched on Optimism and later broadened to Base.

Much like existing platforms such as Compound Finance and AAVE, Sonne Finance allows users to lend and borrow a variety of supported assets. It features high-liquidity money markets that adapt incentives dynamically for:

- wETH

- USDC

- USDT

- DAI

- OP

- sUSD

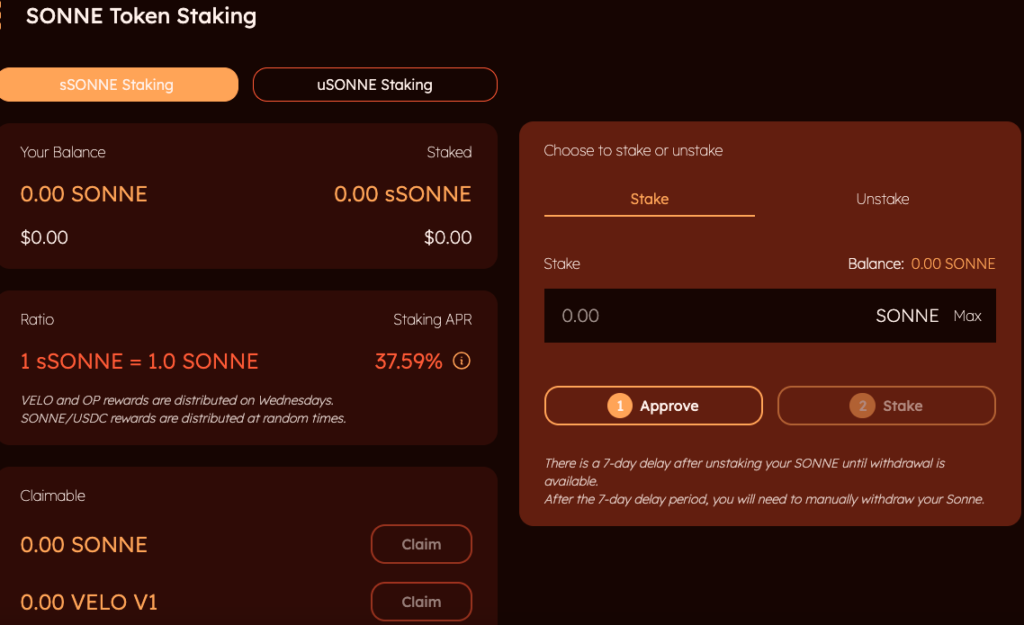

Staking and Revenue Sharing

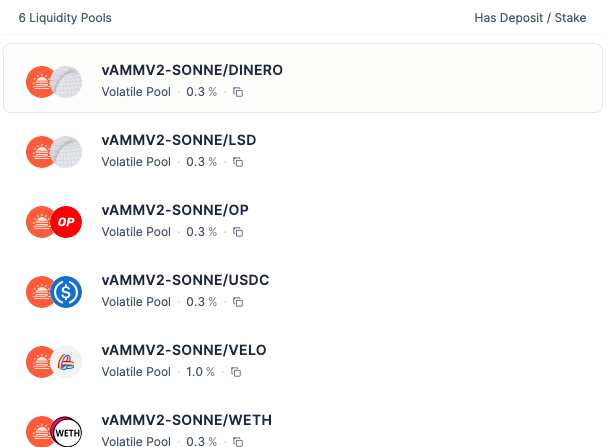

Sonne Finance uses sSONNE and uSONNE to represent staked versions of their token. Staking is primarily designed to distribute protocol revenues and VELO rewards among the stakers.

Stakers receive 100% of generated protocol revenue and VELO rewards. The revenue is accrued through fees that vary based on the risk associated with different pools.

Two separate pools are available for staking:

- sSONNE, where rewards are employed to purchase SONNE tokens from the market for redistribution to sSONNE stakers.

- uSONNE, where rewards are spent on purchasing USDC from the market for redistribution to uSONNE stakers.

Rewards are disseminated to stakers on a weekly cycle, in line with Velodrome Finance epochs, with the first rewards issued a week following protocol rollout.

By offering top-tier incentives for money markets and having the deepest liquidity, Sonne Finance aspires to become the leading lending platform on both Optimism and Base.

$SONNE tokens can be found on exchanges such as Bitget, BingX, MEXC, CoinEx, and Uniswap v3 (Optimism).

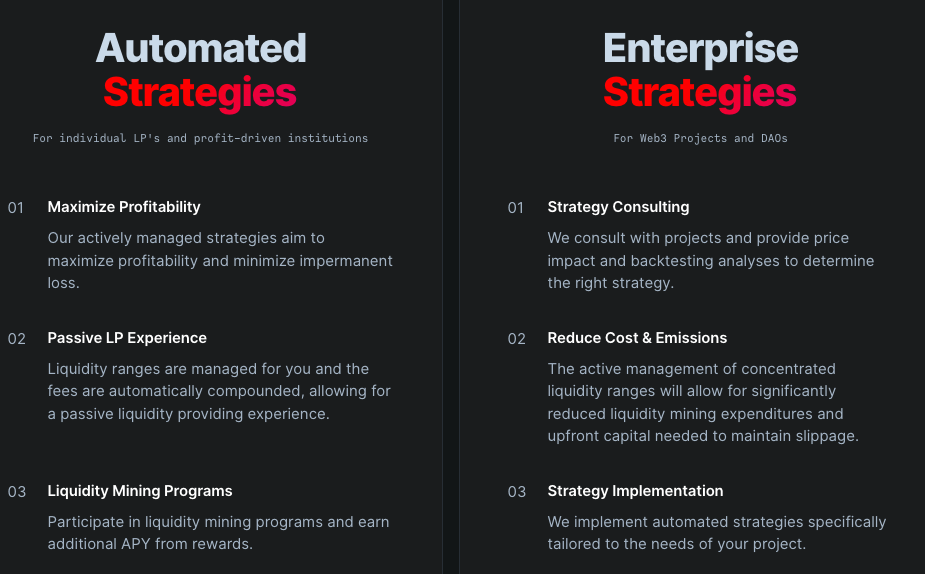

$GAMMA

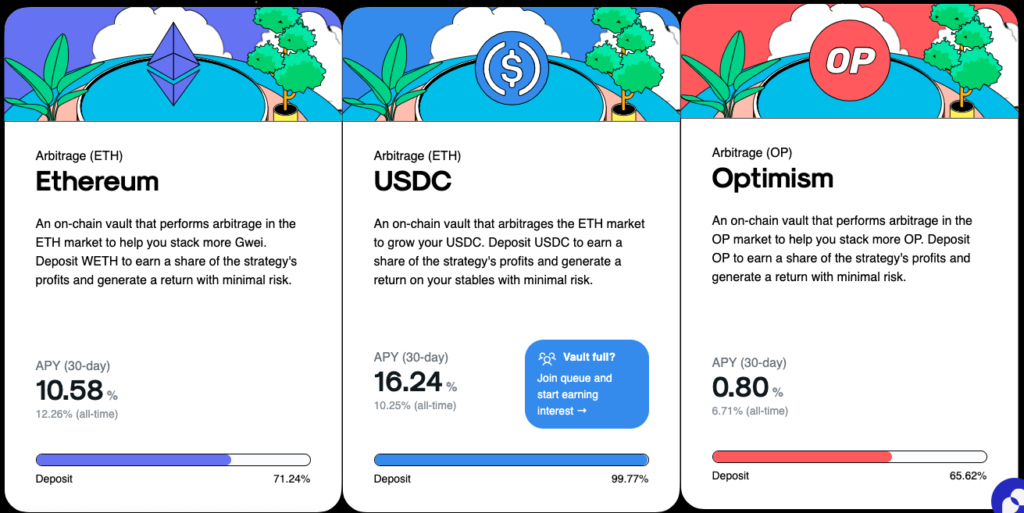

Gamma serves as a specialized protocol focused on active liquidity management as well as crafting market-making strategies. Designed for non-custodial, dynamic, and automated handling of concentrated liquidity, Gamma is accessible via a web-based application.

Central to Gamma is the concept of the vault. Essentially, a vault is a non-custodial contract that manages a pool of liquidity through specific strategies. These vaults generate LP tokens, which can be employed for both internal and external incentives. Additionally, Gamma offers an analytics toolset to help users assess their financial positions.

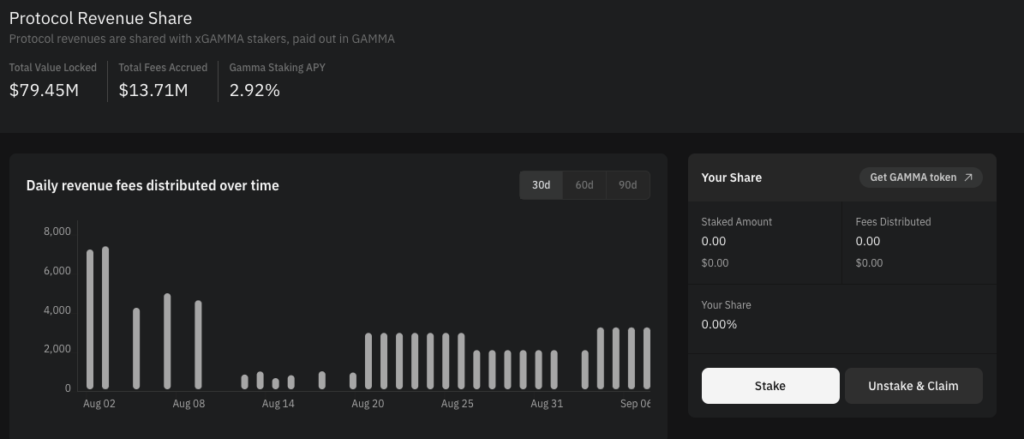

While the GAMMA token is staked, stakers have the opportunity to earn a portion of fees generated across all of Gamma’s vaults. Unlike directly injecting liquidity into a specific vault to earn fees, those who stake GAMMA tokens are entitled to a percentage of fees collected from all vaults managed by Gamma.

xGAMMA serves as the fundamental staking token and the main vehicle for value accrual within the GAMMA ecosystem. Rather than incurring high gas costs for individual fee distribution, these fees get pooled, allowing stakers to own a percentage of this pool. When GAMMA tokens are staked, users receive xGAMMA, indicative of their stake in the pool. Importantly, this is a non-inflationary mechanism, as the distributed GAMMA is bought from the open market.

$GAMMA tokens can be traded on exchanges such as KuCoin, Uniswap (v2), and CoinEX.

$LYRA

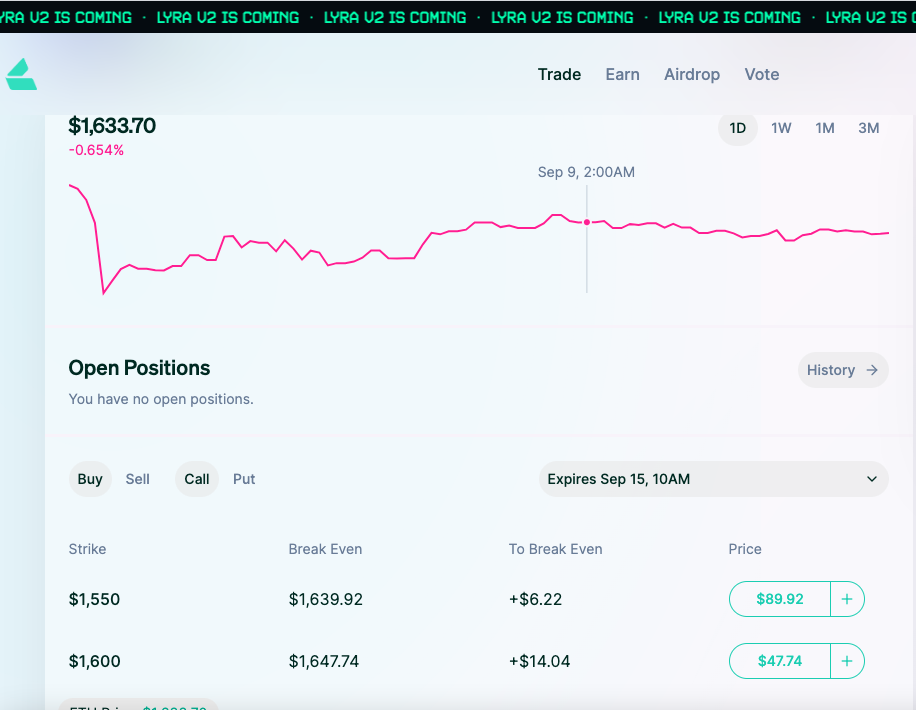

Lyra Protocol is a collection of smart contracts that function as an automated market maker specifically for options trading on ERC-20 tokens within the Optimistic Ethereum Blockchain. Lyra employs the first market-driven, skew-adjusted pricing model to ensure accurate pricing of options. This enables traders to engage in buying and selling options against a liquidity pool, while also actively hedging the risks faced by liquidity providers. This proactive risk management encourages greater liquidity flow into the protocol.

Lyra serves two main categories of users: liquidity providers and options traders. Liquidity providers can deposit either sUSD or USDC into Lyra’s Market Maker Vaults (MMVs) designated for specific assets. These vaults then facilitate two-sided options markets for that asset, with liquidity providers earning fees from options trades.

On the other hand, traders can use Lyra to either purchase or offload options via the MMVs. Traders pay fees, expressed as the bid-ask spread, as a remuneration to liquidity providers for supplying liquidity.

The native LYRA token serves multiple purposes, including:

- Acting as a deposit in the security module for protocol backstopping.

- Facilitating governance voting to allocate network resources.

- Offering incentives for both traders and liquidity providers.

$LYRA tokens can be traded on platforms such as SushiSwap, Uniswap(v3 Optimism), Bancor, Velodrome, etc.

$PERP

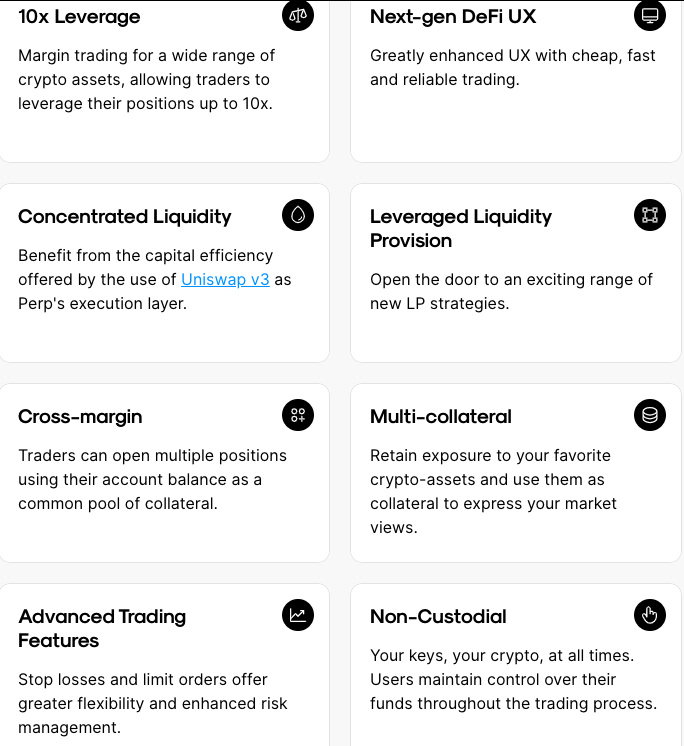

Perpetual Protocol aims to provide anyone with leveraged access to the crypto market. It’s an innovative, decentralized, and non-custodial trading platform. Perpetual Protocol integrates virtual Automated Market Makers (vAMMs) to ensure guaranteed liquidity, offering a trading experience that is completely decentralized and trust-free.

Users can engage in perpetual swaps, earn yields, and contribute to the future of DeFi through this Optimism-based protocol. Unlike traditional centralized exchanges, which use an order book model, Perpetual Protocol employs its vAMM for trades.

Perpetual Protocol incorporates a Decentralized Exchange (DEX) specifically for futures trading. This allows users to take long or short positions with up to 10X leverage on an ever-expanding list of assets like BTC, ETH, DOT, SNX, YFI, and more. All trading is non-custodial and on-chain, ensuring users maintain ownership of their assets. The platform’s vAMMs are designed to be market-neutral and fully collateralized.

Perpetual Protocol hopes to create an accessible perpetual contracts trading ecosystem and achieve this by utilizing its vAMM solution, which provides ample liquidity and minimizes slippage, thereby offering an optimal trading environment.

$PERP token can be traded on platforms such as Binance, Coinbase, KuCoin, etc.