Top 5 Decentralized Exchange Tokens 2024

Top Decentralized Exchange Tokens: Analysis and Prospects.

In the evolving landscape of decentralized finance (DeFi), exchange tokens play a pivotal role. This article explores the top five decentralized exchange (DEX) tokens, delving into their features, tokenomics, and potential in a bull crypto market.

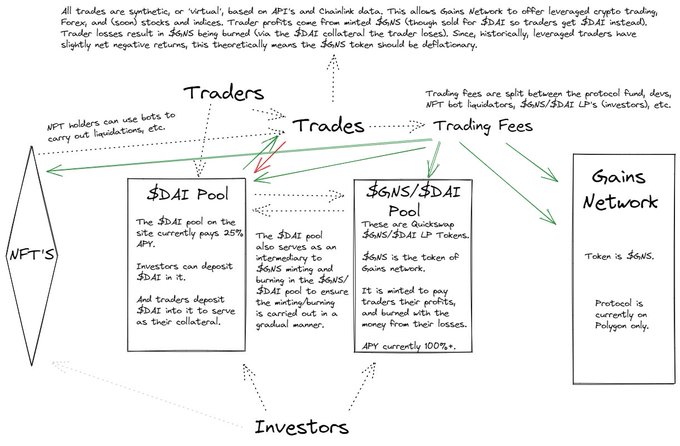

Gains Network (gTrade) – $GNS Token

Platform Features:

- gTrade, developed by Gains Network, is a decentralized leveraged trading platform.

- It offers high leverage options, up to 150x for crypto and 1000x for forex trades.

- Synthetic assets and decentralized loans are key components.

- The platform uses Chainlink network for data aggregation, ensuring reduced slippages and accurate market predictions.

Tokenomics:

- GNS has a maximum supply of 100,000,000 tokens, with 38,500,000 allocated for farming.

- Its unique model involves using DAI for trading, which is then converted to GNS and burned, applying deflationary pressure on the token.

Incentives and NFTs:

- GNS NFTs offer benefits like staking rewards, reduced spreads, and the ability to run bots for rewards.

- Gains Network plans to integrate these NFTs into a future Metaverse space.

Price and Market Data (as of last update):

- Price: $4.06

- Market Cap: $123,708,118

- Circulating Supply: 30,453,619 GNS

Prospects:

- The platform’s high leverage options and unique tokenomics suggest potential growth during a crypto bull market. Its deflationary approach could drive up the token’s value.

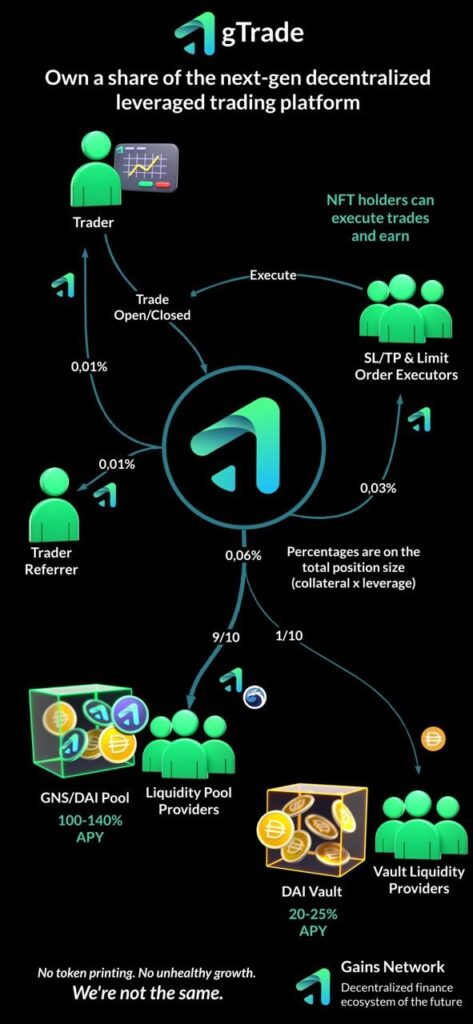

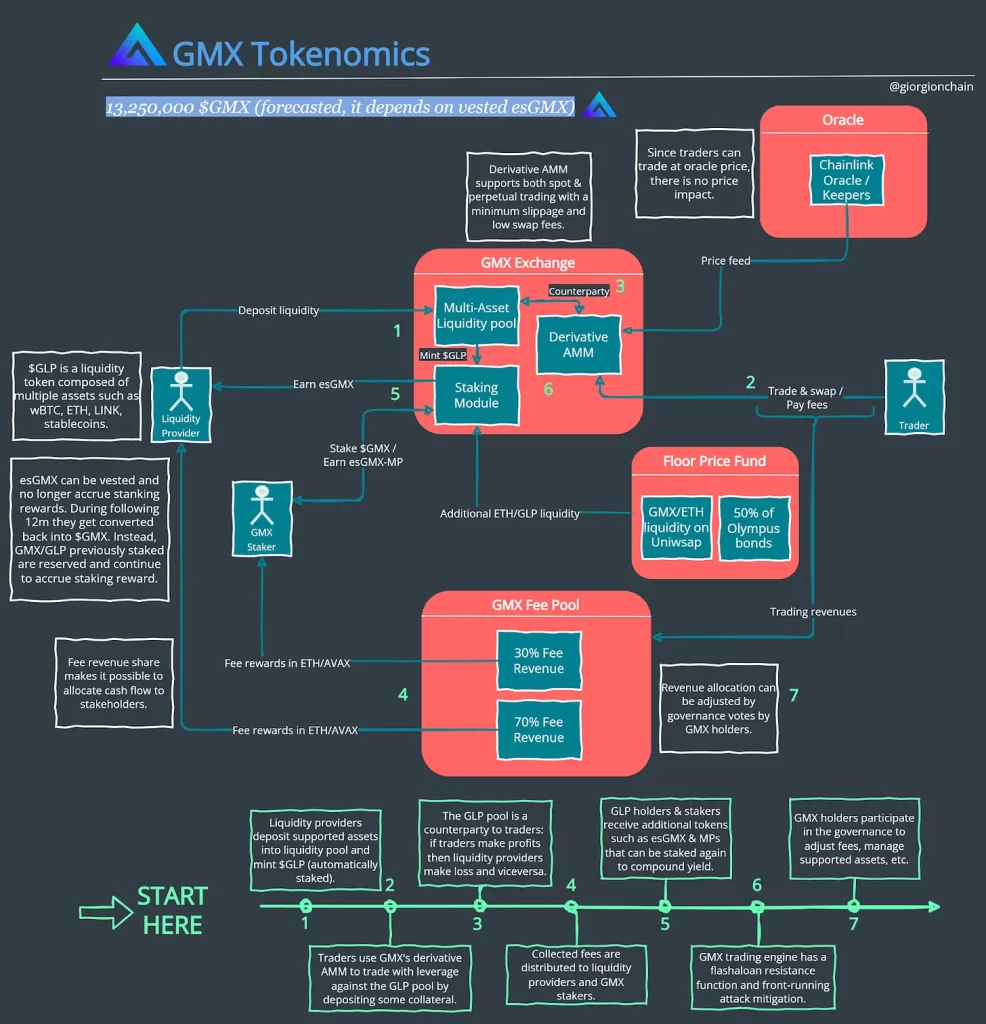

GMX DEX & $GMX Token

A decentralized exchange (DEX) for trading perpetual cryptocurrency futures, has emerged as a significant player in the DeFi space, particularly for its unique features, tokenomics, and potential in a crypto bull market.

Key Features of GMX and Its Trading Platform:

-

Decentralized Trading: GMX enables trading of popular cryptocurrencies like BTC and ETH with up to 50X leverage, providing a decentralized approach to leverage trading without the need for traditional order books used by centralized exchanges (CEXs).

-

Multi-Asset Pool (GLP): GLP is a key element of GMX, acting as a multi-asset liquidity pool comprising stablecoins (about 50%) and major cryptocurrencies like BTC and ETH (the remaining 50%). This pool provides the necessary liquidity for leverage trading on GMX. Liquidity providers (LPs) can mint GLP tokens by depositing assets and earn about 25% to 31% interest depending on the blockchain (Arbitrum or Avalanche) they choose.

-

Trading Fees and Borrowing Costs: GMX offers competitive trading fees, generally ranging from 0.02% to 0.05%, and a borrowing fee model that is calculated hourly based on the assets borrowed from the GLP pool. For leverage trading, there is a 0.1% fee to open or close a position. Swap fees are also notably low at 0.33%.

-

Governance and Utility Token – $GMX: The GMX token functions as both a governance and utility token within the GMX ecosystem. It allows token holders to participate in the platform’s governance and enjoy benefits like reduced trading fees.

-

Staking and Rewards: Staking GMX tokens provides various rewards, including Escrowed GMX (esGMX) tokens, variable APR from trading fees, and multiplier points that boost APRs. These rewards are higher when the tokens are held for extended periods.

Tokenomics and Market Performance:

-

Supply Dynamics: The GMX token has a circulating supply of over 8.7M, with a maximum expected supply of 13.25M tokens. The token distribution includes allocations for migration, liquidity, marketing, and team incentives.

-

Market Performance: As of the last update, GMX was trading around $51.58. It has seen a significant trading volume, exceeding $130B, and has attracted over 283K users, making it a leading derivatives DEX on both Arbitrum and Avalanche blockchains.

Investment Perspective and Potential Growth:

-

User Experience and Adoption: GMX’s low fees, zero-price impact trades, and high leverage options make it an attractive platform for traders. This could lead to increased adoption and potentially higher token values in a bull crypto market.

-

Risks and Considerations: While GMX offers several advantages, potential investors should also consider the risks associated with high leverage trading and the overall volatility of the crypto market.

GMX, with its innovative approach to decentralized trading, its focus on liquidity and user experience, and its robust tokenomics, stands out as a DEX with potential for significant growth, especially in favorable market conditions. However, as with any investment in cryptocurrencies, it’s important to conduct thorough research and consider the inherent risks of the market.

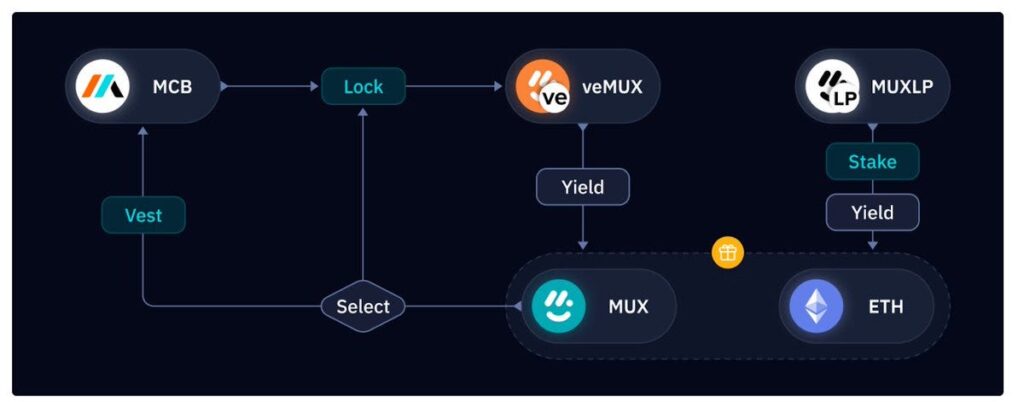

MUX Protocol – $MUX Token

MUX Protocol, formerly known as MCDEX, is a decentralized perpetual aggregator that has been making waves in the DeFi space. Let’s delve into its features, market performance, and tokenomics to understand its potential in a crypto bull market.

Key Features of MUX Protocol:

-

Decentralized Perpetual Aggregator: MUX Protocol stands out as the first decentralized perpetual aggregator, offering deep aggregated liquidity and optimized trading costs. It supports up to 100x leverage and provides diverse market options.

-

Unique Aggregator Features: The platform boasts smart position routing, aggregated positions, leverage boosting, and liquidation price optimization, which significantly enhance the trading experience.

-

Security Measures: To ensure the safety of its users, MUX Protocol has implemented robust security measures, including ongoing bug bounty programs and smart contract audits.

-

Liquidity and Capital Efficiency: The protocol has innovated in the liquidity domain by allowing universal liquidity across deployed networks, which increases capital efficiency without moving pooled assets.

Market Performance and Tokenomics:

-

Price Performance: As of the latest update, MCB, the native token of MUX Protocol, has experienced significant fluctuations. It reached an all-time high of $67.86 in October 2021 but has since retraced considerably.

-

Circulating Supply Dynamics: The circulating supply of MCB is around 3,803,143, with a total supply of 4,803,144 tokens.

-

Market Sentiment: The community sentiment towards MUX Protocol is generally bullish, indicating a positive outlook among users and investors.

-

Risk Analysis: MCB is considered a moderately risky investment. It’s crucial to consider its recent price movements relative to trading volume and market capitalization when assessing its potential risks.

Investment Perspective:

-

Potential for Growth: Given its innovative features and focus on aggregated liquidity, MUX Protocol could see significant user adoption, especially in a favorable crypto market. Its unique approach to perpetual contracts and leveraged trading positions it well for growth.

-

Risks and Considerations: Like any investment in the volatile crypto market, potential investors should consider the inherent risks. The high leverage options, while attractive, also come with increased risk.

-

Community and Ecosystem: MUX Protocol’s rebranding and focus on multi-chain functionality signal its commitment to staying relevant and competitive in the evolving DeFi landscape.

In conclusion, MUX Protocol presents a compelling option in the DeFi space, especially for those interested in leveraged and perpetual trading. Its innovative features and strong community support paint a positive picture, but potential investors should balance this with an understanding of the associated risks.

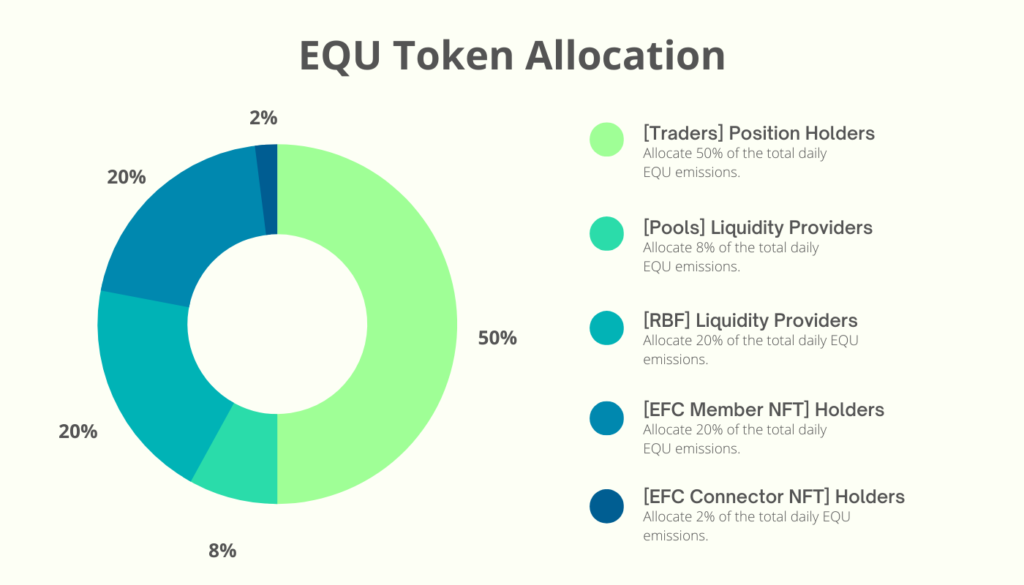

Equation $EQU Token

Equation, a decentralized perpetual exchange, operates on the Arbitrum blockchain with a focus on balance rate-based AMM for perpetual contracts. Its native token, EQU, has a maximum supply of 10 million, all of which are generated through various mining methods such as liquidity mining and referral mining, rewarding community users. This unique model of token distribution might be a key factor in driving interest and volume in the platform, especially in a bull crypto market.

Key aspects of Equation’s EQU token and platform include:

-

Token Supply and Distribution: EQU has a total supply of 400,417 tokens and a maximum supply limit of 10 million tokens. The self-reported circulating supply is 64,015 EQU. The fully diluted market cap of Equation is estimated at around $389,325,967 to $426,875,458, according to different sources.

-

Market Performance: The price of EQU has seen fluctuations, with a recent peak at around $38.93 to $42.69. It reached an all-time high of $55.69 about six days ago from the latest data, indicating significant volatility and potential for growth.

-

Staking Model: Equation offers a staking model where users can stake EQU directly or stake EQU-ETH LP NFT from the Uniswap EQU-ETH pool. In return, they receive veEQU, a non-transferable token that entitles its holders to a share of 25% of the protocol’s trading fees and also grants them governance rights.

-

Earning EQU: There are multiple ways to earn EQU, including holding contract positions, providing liquidity to contract trading pools, the EQU/ETH pool on Uniswap, contributing to the Risk Buffer Funds, and through EFC Member and Connector NFT holders creating referral codes and minting Member NFT.

-

Security and Development: Equation’s focus on a decentralized perpetual exchange model, coupled with its innovative approach to AMM in derivatives trading, could position it as a notable player in the DeFi sector. However, there’s a need for continuous security measures and technological upgrades to maintain its relevance and user trust.

In terms of investment perspective, Equation‘s innovative approach, combined with the leverage options it offers (up to 200x) and its unique tokenomics, could attract significant interest from traders and liquidity providers in a bullish crypto market. However, potential investors should note the inherent risks due to market volatility and the experimental nature of DeFi projects.

Vela Exchange & $VELA Token

Vela Exchange, marked by its native token VELA, presents a compelling blend of decentralized and centralized exchange features. This hybrid approach aims to offer users the security and control of a decentralized exchange (DEX) with the user-friendliness of a centralized exchange (CEX).

Key Features and Tokenomics of Vela Exchange and VELA Token:

-

Hybrid Exchange Model: Vela Exchange integrates features from both DEX and CEX platforms, providing a seamless and secure trading experience. This includes user-friendly aspects of CEXs and the privacy and control associated with DEXs.

-

Unique Trading Features: Vela offers One Click Trading (1CT), enabling rapid trade execution, and on-chart trading for a more intuitive and efficient trading process. It also supports a variety of assets, including cryptocurrencies, foreign currencies, and precious metals.

-

Token Utility and Supply: The VELA token is integral to the Vela Exchange ecosystem, offering reduced transaction fees for holders who stake more tokens. As of September 2023, Vela’s token supply was capped at 50 million, with nearly 11.83 million already in circulation. The token distribution includes allocations for community incentives, growth, and development, among others.

-

Recent Developments and Price Surge: VELA recently experienced a significant price surge, attributed to a major staking update announcement. This update, which enhanced staking rewards by lowering the token amount required for each tier, led to a more than 120% increase in its price, reaching around $1.13.

-

Market Performance and Sentiment: As of the latest data, VELA was trading at around $0.82, with a market cap of approximately $12 million. The total supply of VELA tokens is 10 million, with a maximum supply of 50 million. VELA has an all-time high of $7.68 and an all-time low of $0.3568, indicating significant market volatility.

-

Staking and Governance Benefits: Staking VELA tokens allows users to earn a portion of the trading fees generated on the platform, fostering long-term participation and stabilizing overall liquidity. Additionally, VELA token holders can participate in governance, influencing the platform’s future through voting on key updates.

Potential in a Crypto Bull Market:

The innovative features and tokenomics of Vela Exchange could position it well for significant growth in a crypto bull market. The hybrid model offers a unique proposition in the market, potentially attracting a wide user base. The recent developments and community bullishness also suggest a positive outlook for VELA. However, investors should be aware of the inherent risks and volatility in the crypto market.

Vela Exchange’s approach to combining the best of DEX and CEX features, along with its robust tokenomics, makes it a notable platform in the decentralized finance space. Its focus on user experience, governance participation, and liquidity provision incentives could drive volumes and possibly appreciate the VELA token’s price in favorable market conditions.