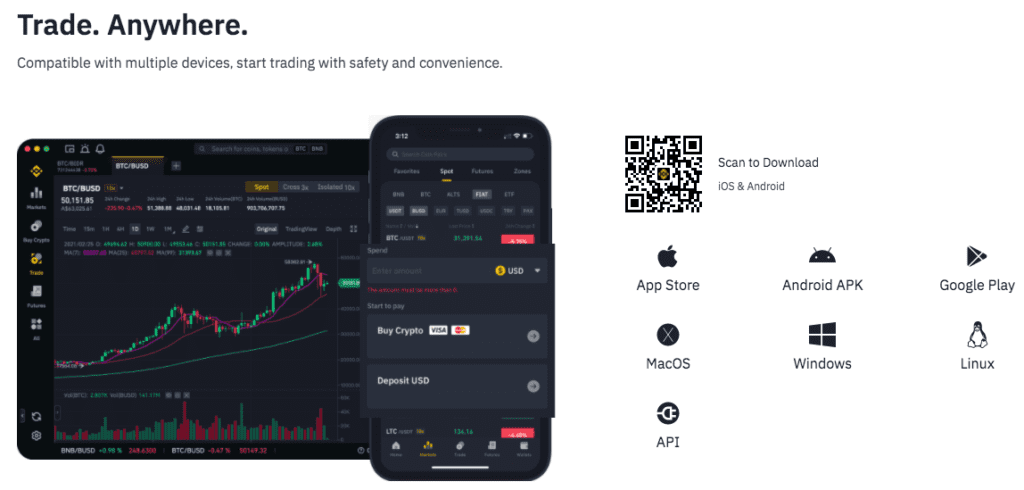

1) Binance Coin (BNB)

Issued by Binance exchange, BNB was first created as an ERC-20 token on the Ethereum blockchain and was later migrated over to Binance Chain becoming the chain’s native coin.

The Binance exchange offers users a spot market, futures market, and decentralized exchange and its ecosystem of decentralized, blockchain-based networks has made it unrivalled.

According to the company, they launched BNB with the intention of it being used for paying discounted fees on the Binance platform. In addition, BNB would also function as the native token that powers the Binance Chain. Other use cases of the BNB token include VIP tiers which are given to users with account balances in BNB and those that have trading volumes that surpass certain thresholds. BNB is also used for what is referred to as dust conversion which is whereby non-tradable balances of different cryptos a user may have on the Binance exchange are converted into BNB for greater liquidity and utility. BNB tokens are also used in the Initial Exchange Offering lottery.

2) Uniswap (UNI)

The governance token for Uniswap is UNI which makes it possible for its holders to take part in the governance of the Uniswap protocol. Uniswap is a DEX that is popular for ERC-20 token swaps and users only need an Ethereum based wallet such as Metamask and they can easily begin trading with other users of the platform in a decentralised fashion and global scale. On Uniswap there is no token listing process, so in fact that means any ERC-20 token can essentially be launched with the tiny caveat that they require a liquidity pool for traders to use. Read the full guide to Uniswap here.

3) FTX (FTT)

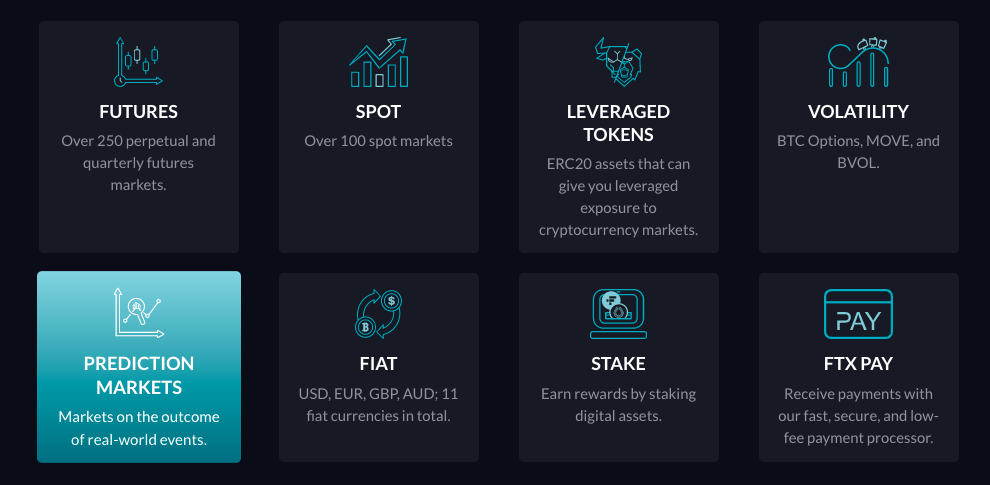

The native cryptocurrency token of the crypto derivatives trading platform FTX is FTT. As one of the largest and most popular crypto futures platforms, FTX is highly rated and stands out amongst its formidable competitors such as BitMEX and Deribit.

FTX focuses heavily on the trading of derivatives and offers over 100 different digital assets including BTC, LTC, ETH, and XRP for futures trading. Additionally, FTX offers the Leveraged Tokens service which allows traders to put leveraged positions without the need to trade on margin.

Holders of FTT tokens have an opportunity to receive a fraction of exchange fees that the platform charges users. They also receive a fraction of the liquidation insurance fund, and FTT holders can also use the token as collateral and utilise the token in order to receive tighter OTC spreads on FTX.

FTT tokens are available on many exchanges including Huobi, Binance, FTX, HitBTC and others.

4) OKEx (OKB)

OKB Coin is the OKEx blockchain and exchange’s native token. OKEx is one of the largest crypto exchanges in the world and its OKB has over 10 trading pairs. OKB token can also be used to facilitate spot trading and derivatives trading. OKB tokens can be traded on exchanges such as FTX, Huobi, OKEx, HitBTC, etc.

OKB token has a pivotal role within the OKEx ecosystem as it makes it possible for holders to receive up to 40% discount on transactions. OKEx platform users can also make use of the opportunity to create passive income by investing their OKB tokens through OKEx Earn which allows stakers of the tokens to receive yield.

5) PancakeSwap (CAKE)

CAKE is effectively PancakeSwap’s governance token. PancakeSwap is an automated market maker and DeFi app that makes it possible for users to exchange tokens, provide liquidity through yield farming and earn fees. PancakeSwap is also a Binance Smart Chain-based DEX.

Users of PancakeSwap can trade BEP20 tokens or they can provide liquidity to the exchange in order to earn fees, or stake liquidity pool tokens as a means to earn CAKE which can in turn be staked and more CAKE can then also be earned. CAKE tokens can be traded on both centralised and decentralised exchanges such as Binance and FTX or from PancakeSwap, etc.