Top 5 Chromia Ecosystem Crypto Tokens

Popular Digital Assets in the Chromia Blockchain Ecosystem.

1) Chromia (CHR)

An open source public blockchain, Chromia’s development was spearheaded by Swedish company Chromaway AB. Postchain is the technology that precedes Chromia which was targeted at enterprise clients.

As a standalone Layer-1 blockchain and EVM compatible Layer-2 enhancement for Ethereum and Binance Smart Chain, Chromia is designed to augment existing decentralised applications by enabling the creation of scalable dApps with better data handling, and even fee structures that can be tailor-made for different use cases.

Chromia makes it easy for people to build decentralized apps in the real world. The Chromia blockchain development team is focusing on several key verticals including applications for gaming, enterprise, DeFi, and fair applications tackling sustainability issues. It complements Ethereum quite well and can be a Layer 2 to Ethereum that makes use of cheaper and faster development times and transactions.

Chromia utilises relational blockchain architecture and a tailored programming language called Rell which is essentially designed to code and function much like SQL, and to allow developers to leverage the security and tamper-proof qualities of blockchain all the while handling and storing data as efficiently as possible through the use of relational databases. Chromia is flexible in that it can be used as a private, public or hybrid blockchain.

Every dApp that runs on Chromia effectively operates on its own sidechain that is rooted within the primary blockchain. This enables applications to easily scale and also affords the developer a variety of fee structure choices. An example would be an app that for instance makes it possible for users to pay transaction fees using Chromia’s native token CHR and on the other hand having an app could choose to stake the tokens and reserve computational power, allowing unlimited transactions and zero fees. CHR tokens act as platform currency and they are useful for paying hosting fees, staking in the ecosystem to earn rewards or gain voting rights, etc.

There are a variety of applications built on Chromia including the popular game My Neighbor Alice, a DeFi options trading platform called Hedget, and even a government land registry initiative called LAC PropertyChain. A new non-fungible token (NFT) standard called Chromia Originals is being introduced to Chromia and it is meant to function as a native standard on Chromia’s chain in addition to being a kind of enhancement layer for existing ERC-721 and BEP-721 tokens. These ongoing developments on the Layer-2 solutions are being developed in tandem with My Neighbor Alice.

Chromia has a decentralised explorer which is meant to allow users the ability to actually see transactions and activities on other chains. Chromia also offers Chromia Vault and the main function is to help users easily manage their tokens and decentralised applications on the Chromia blockchain.

2) My Neighbor Alice (ALICE)

My Neighbor Alice is a game within which players can buy or own virtual islands or collect and create and communicate. It’s an ideal game for collectors and traders of non-fungible tokens (NFTs). ALICE is the native utility token of the My Neighbor Alice ecosystem and these tokens can be found on exchanges such as FTX, Huobi, and Binance, among others. It’s also one of the top play to earn cryptos.

3) Bella (BEL)

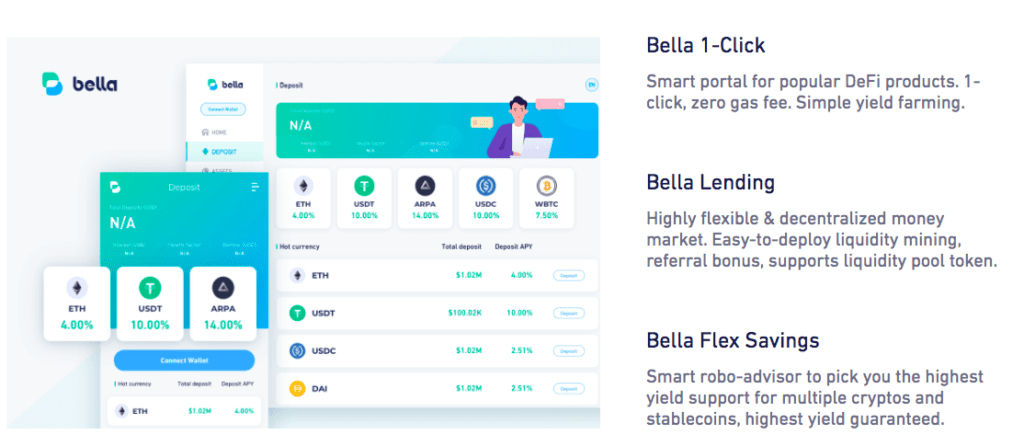

The first project that was taken to the masses via Binance’s Launchpool platform and backed by well-known crypto VC firms such as Arrington XRP Capital and Ledger Capital, Bella protocol was created to provide a suite of DeFi products that are designed to make crypto banking simpler and more accessible. Bella Protocol is also focused on creating improved user experiences, eliminating exorbitant transaction fees and improving transaction fees.

Bella has a DeFi smart portal that is meant to improve user experience and it also offers a smart pool feature that is supposed to provide users with access to very desirable yields available in the DeFi market.

The BEL token serves as a reward token that makes it possible for the holders of the token to participate in the governance of the platform. BEL tokens can also be used in order to farm fee rewards from the network or get exclusive discounts on Bella protocol products e.g. the robo-advisor tool, and even for enabling holders to earn staking rewards.

4) APYSwap (APYS)

APYSwap is backed by the APYSwap Foundation which has the vision to create an ecosystem of products that allow users to be able to make transfers of assets, enabling them to manage those digital assets on as many EVM and non-EVM blockchains as practicable.

5) Hedget (HGET)

If you would like to know where to buy Hedget, the top exchanges for trading in Hedget are currently FTX, Gate.io, etc.

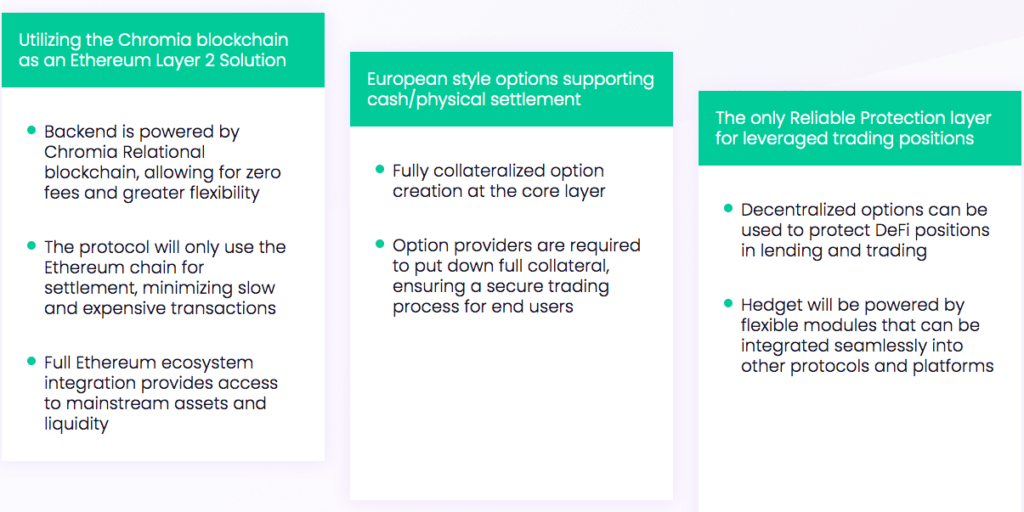

A decentralized and non-custodial cryptocurrency options protocol, Hedget is backed by investors and partners that include Chromia, and FTX. Developing next generation global decentralized options markets and bringing these solutions to the world of DeFi is what the community is striving for.

Hedget has implementations for both Binance Smart Chain and Ethereum. To make things even more exciting, there are plans to incorporate Chromia as a Layer 2 enhancement for the Ethereum platform. The team hopes to eventually lead the project to a next level phase of operating as a Decentralised Autonomous Organisation (DAO).

HGET is the native utility and governance token of the Hedget platform. It is issued on the Ethereum network as an ERC-20 contract and also has representation on a Chromia sidechain and on the Binance Smart Chain as well. HGET tokens can be staked to interact with the platform. Trading commissions on Hedget are also payable in HGET tokens.

HGET can also be utilised for the prevention of spamming of orders which can lead to API overloads and order book manipulation. There are staking requirements which can be increased as the monetary value and frequency of a user’s interactions increase. HGET tokens can also be used to purchase fully collateralized options as a hedge in case of capital insufficiency risk.

Hedget utilizes the Chromia blockchain as an Ethereum Layer 2 Solution and it’s backend is powered by Chromia Relational blockchain. The advantage with this is that it allows for more flexibility and zero fees. The protocol only uses the Ethereum chain for settlement, which means that there are minimal transactions that are slow and costly. The full integration they have with Ethereum ensures provision of access to mainstream assets and liquidity.