Cryptocurrency trading bots explained simply

Crypto trading bots are essentially software programs that assist traders with automating their crypto trading strategies. According to research published by the University of Cambridge’s Centre for Alternative Finance, the number of crypto asset users exceeded 101 million unique users across 191 million accounts opened at service providers as of Q3 2020.

Chappuis Halder & Co. estimates that the total number of active digital currency traders in the world is between 51.2 and 52.4 million. Supposing these stats are accurate, one could assume a sizable portion of active traders use automated bot trading to either buy and sell digital assets at opportune times, reduce risk and losses in addition to increasing revenue and profits.

Ultimately, algorithmic trading is meant to save traders time and money. Another advantageous element when it comes to automated trading is that a trader is able to remove emotions out of the equation which is generally the downfall for most traders. Using automated trading allows a trader to execute their strategies without making spur of the moment decisions based on hype or FOMO for example.

So what exactly is involved in automated trading using crypto trading bots?

Automated trading applications enable users to manage their crypto exchange accounts in one place. Most crypto trading bot programs also allow users to trade a range of cryptos such as Bitcoin and Ethereum with greater ease.

Every successful crypto trader has their own strategies and approach to how they maximise profit potential, whether that’s through taking advantage of market sentiment, sensitive information, price movements or volatility, and so forth. With automated bot trading, a trader can simply apply their strategies – fundamentals & technicals into a trading algorithm or strategy that acts as a set of rules that, together, define when the trades should be executed. In short, bots simply make it easier to automate the analysis and interpretation of market statistics. Because crypto markets work around the clock 24/7/365 automated trading is becoming increasingly popular since this means that the bots can carry out trades even as a trader sleeps.

What types of crypto trading bots are widely used?

There is a wide range of crypto trading bots available on the market. However, a lot of the more sophisticated trading bots work as essentially three moving parts i.e.

- Signal generation or market data analysis

- Risk allocation or market risk prediction

- Trade execution or buying and selling the digital assets

The list below highlights some of the most popular crypto trading bots available. Each trader has to do their own research to find reliable tools that meet their individual automated trading needs. It is well worth knowing however, that some of the most important things to look out for when choosing the best automated crypto trading bot are aspects around the bot’s reliability, security, usability, and profitability.

1) Gunbot

Founded in 2016, Gunbot offers software licenses along with the add-ons (e.g. users can use Gunboat to execute trades sent as TradingView email alerts)

The company also provides the necessary technical support to license owners, for their installation and operation. According to Gunboat, their software is able to execute several precoded trading strategies on autopilot. Users can also easily customize their trading style and Gunboat will buy and sell coins based on the users’ set strategies.

Gunbot supports Windows, Mac, Linux and ARM so traders can pretty much execute their practised trading strategies from a range of computer devices and they don’t need to be sophisticated devices either since the latest version of Gunbot demands very low resources to run. Users can pay for your automated crypto trading bot from Gunbot using Bitcoin, Ethereum, Litecoin and Dash. In order to get your Gunbot license activated, all the user would need to do is log into their exchange e.g. Kraken, Bittrex, Cex.io, Binance, Poloniex, Bitmex, KuCoin, Huobi, Bitfinex, or Coinbase Pro.

From there they’d simply need to create an API key. Upon successfully purchasing Gunbot, the user will get an email asking for their API key, and that’s how they will be able to activate their license. Gunbot comes with more than 14 precoded strategies including TSSL, Gain,Ping Pong, Bollinger Bands, Stepgain, Ichimoku, Emotionless and more. Users have the ability to also tweak the default parameters and create their own crypto trading strategies using Gunbot.

Source: Gunboat

2) Trality

Founded in 2018 by Moritz Putzhammer and Christopher Helf, Trality is a platform for people interested in algorithmic trading. Trality enables its platform users to program algorithmic trading programs or bots. Typically a user is provided with various programming models, however, Trality is not a crypto trading platform since it does not accept or receive, transmit or place any trade orders. All crypto trading takes place on third-party exchanges and Trality simply acts as a provider of software for programming, testing and deploying i.e. live-, mirror- and paper-trading bots created by the users.

Creating a bot on Trality is quite straightforward. When a user clicks the” Create Bots” tab, they are offered the tools to create and store their own bots on the platform using the tools provided. Users are provided with standard settings of a source code or templates on which they can create a bot. Users can back-test during the process of creating a bot and tutorials are also offered.

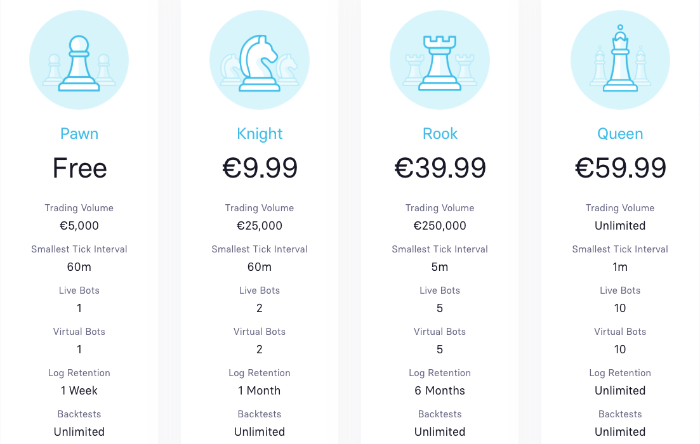

Another great feature offered by Trality is the possibility for users to follow bots from other users on the platform. How it works is that the bots which are followed send trading signals to the follower’s account. A software solution on the platform then subsequently forwards these signals to the respective cryptocurrency exchange utilized by the user for their crypto trading. With Trality users can also live trade on connected digital currency exchange and users also have four different pricing and subscription models to choose from.

Source: Trality

3) Cryptohopper

Based out of the Netherlands, Cryptohopper is a developer of software that enables users to trade in digital currencies using a crypto trading automated bot. The software referred to as ‘Hopper’ makes it possible for traders to earn money on their exchange of choice in an automated fashion. For instance, users of Cryptohopper can automatically buy and sell Bitcoin, Ethereum, Litecoin and many other digital currencies. Traders are able to feed their signals and trading tactics and configure the software in such a way that it will automatically buy crypto assets on the basis of the information from those signals.

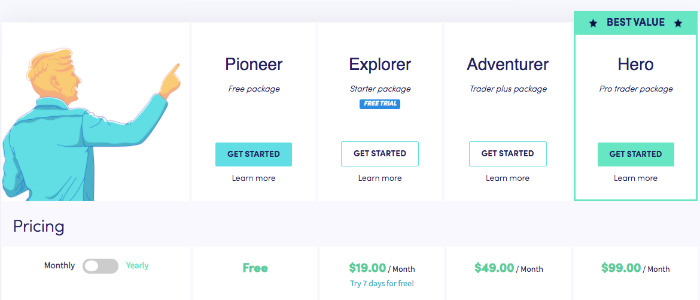

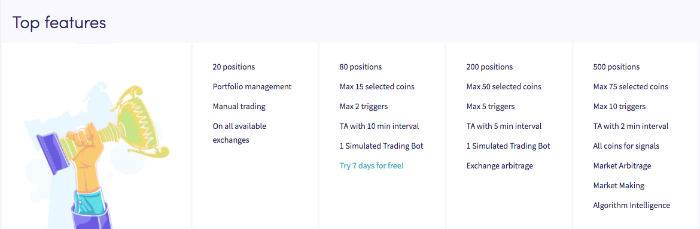

Users of Cryptohopper need to purchase a subscription in order to use the software. These subscriptions are typically offered for a fixed amount per month and/or per year and Cryptohopper offers a range of packages, all differing in the amount of positions, selected coins, frequency of scanning the stock market and the amount of support from Cryptohopper.

Users can obtain access upon activating their subscription and Cryptohopper has a help desk where users are able to make inquiries or ask questions related to their platform or software. What’s great about Cryptohopper is that they make it explicitly clear in their terms of service that even though they provide user tutorials for their own and related products, they do not offer crypto trading advice or financial advice in general. When users connect their Hopper to a Signaller, they are taking their own risk since Cryptohopper does not provide the Signallers.

Source: Cryptohopper

4) 3Commas

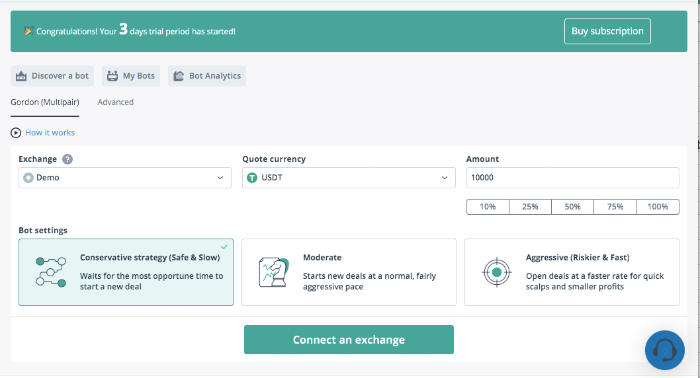

3commas is most certainly one of the most popular web-based crypto trading bots. Available on Android and iOS, 3Commas enables 24/7 automated trading and offers users the access to sell and buy coins within a single window making it’s interface very user friendly. Users can copy other bot settings with 3Commas and it supports backtesting, dollar-cost-averaging (DCA), offers detailed analytics, and even custom TradingView signals. Users of 3Commas have the advantage of being able to track multiple orders on a variety of digital asset exchanges, develop and also execute their most lucrative trading strategies.

3Commas is a software as a service (SaaS) company which makes it possible for traders to utilize different functionalities for better and more efficient management of their digital asset holdings across different accounts, including SmartTrade terminal and automated trading bots.

3commas has announced some key collaborations with crypto giants such as Binance to ensure users can be afforded the most convenient trading conditions through Binance’s digital asset management and security infrastructure. Under their broker program, users can create a free Binance account and utilize tools from the 3commas platform. Users can also get a free 3-day trial to use 3Commas.

Source: 3Commas

Some of the unique features 3Commas offers traders is the opportunity to simultaneously take profit and stop loss their digital currency orders. With 3Commas, users can maximize profit by allowing themselves to simultaneously establish the price point at which they wish to sell to make a profit and the price point at which they wish to sell in order to stop losses. This can be done via the aforementioned SmartTrade terminal.

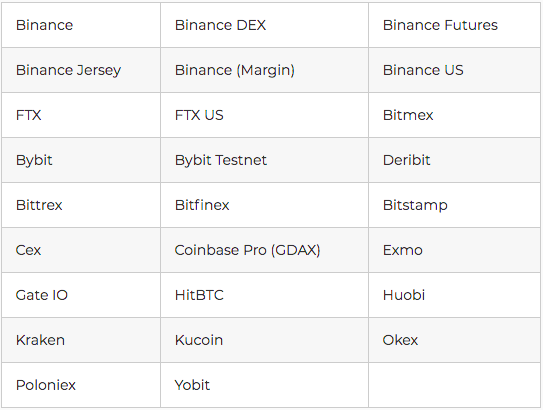

Furthermore, 3Commas enables users to set up advanced order types such as trailing take-profit and stop-loss orders. With 3commas, users can also set up advanced orders even in digital currency exchanges that may not support them. 3commas supports 26 exchanges including:

Source: 3Commas

5) Stacked

Stacked was founded by Joel Birch and its based out of Chicago US, operated by Stacked Labs, LLC and backed by CoinFund and Alameda Research StackedInvest.com is a smart automated crypto investing platform that offers automated trading tools, mobile application and web-content to help traders be more efficient in executing their trades across a wide range of crypto trading platforms.

Stacked is not a digital asset trading platform but rather a software that connects users’ existing exchange accounts. Earlier this year, Stacked announced that it has acquired Alertatron.com – another software provider for automated algorithmic trading in the digital currency space. With Alertatron, users can also generate signals from TradingView and from those signals then automate trading at FTX, Bybit, Deribit, or Binance Futures.

On the recently released Stacked V2, users can add filters, sort by Profit & Loss (PnL), time on the platform, and more, in order to figure out what their winning strategy is. Find out more about the new platform features. If you’re a crypto trader looking to manage your assets or invest in pre-built portfolios and strategies from leading hedge funds and traders, then Stacked may be the platform for you.