Avalanche (AVAX)

Avalanche is an open-source platform and blockchain network created by Ava Labs for launching decentralized applications (DApps) and deploying smart contracts. Avalanche offers very fast transaction times and low fees. The Avalanche network is said to consist of multiple blockchains. It apparently uses a proof of stake consensus mechanism to achieve high throughput and it is estimated that the network can process well over 4500 transactions per second.

Source: Avalanche

It supports interoperable blockchains so for example, The Avalanche-Ethereum Bridge (AEB) makes it possible to easily transfer Avalanche and Ethereum assets between the two blockchains. Developers can also build their own virtual machines. The Ethereum Virtual Machine for instance runs fully on Avalanche.

The Avalanche project has had notable support from investors such as Polychain Capital and Andreesen Horowitz. In 2020, the project was also able to secure funding through its public launch of the AVAX token. The tokens can be traded on exchanges such as Binance and Huobi.

Chainlink (LINK)

Chainlink is a permissionless framework for building oracles. Decentralized oracle networks that actively operate using the Chainlink protocol make up the Chainlink network. The ecosystem includes dApps, blockchains, independent oracles, data providers and node operators.

The network also helps developers to build blockchain applications using real-world inputs and outputs by enabling smart contracts to connect to off-chain data sources. It also serves as an abstraction layer for data providers, enabling them to easily sell their existing APIs to any blockchain network. The Chainlink network is utilized by popular DeFi applications including yEarn, Aave, and Synthetix.

The main means of transactional exchange on Chainlink is the LINK token. It aligns with ERC-20 token standards based on the Ethereum blockchain. LINK tokens can be traded on various digital currency exchanges including Bittrex, Gemini, Binance, and Huobi.

Dai (DAI)

DAI is a decentralized Ethereum-based stablecoin whose price is soft-pegged to the U.S. dollar. Its development and issuance is managed by the Maker Protocol and the decentralized autonomous organization MakerDAO. Multi-collateral Dai is collateralized by a mix of digital currencies which are deposited into smart contract vaults each time new Dai is minted.

What makes it possible for Maker to make Dai a Stablecoin is its Target Rate Feedback Mechanism (TRFM). This is described as an automatic mechanism that is employed by the Dai stablecoin system to effectively ensure its stability is maintained. Since the target price of a single Dai is US$1, the target rate is what determines the required price fluctuation of Dai over time to be able to reach the target price when the market swings. It’s important to note that when the TRFM engages, the fixed peg ratio of 1 DAI to $1 USD is broken. This is essential for getting the price of Dai back to where it ought to be fixed. For instance, if the target price of Dai goes below $1 USD, the TRFM is increased such that it pushes the price of Dai back up and subsequently makes the generation of Dai through collateralized debt positions (CDPs) more expensive.

The development of Dai is the responsibility of the decentralized community and the issuance and burning of Dai tokens is recorded publicly and managed by self-enforcing smart-contracts. This makes the system transparent and resilient. Dai tokens are available on Binance, Coinbase, Uniswap, and other exchanges.

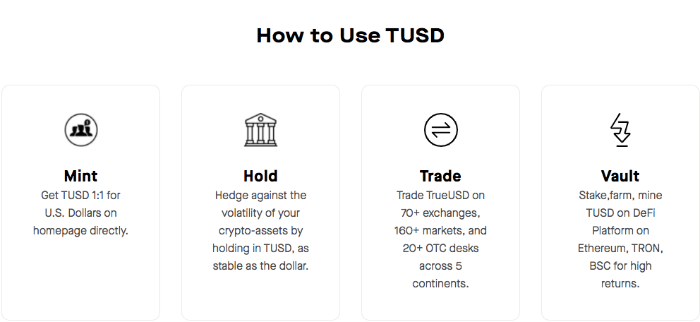

TrueUSD (TUSD)

Launched by TrustToken, TrueUSD is described as the first regulated stablecoin backed by cash, other cash equivalents, liquid investments, and short-term government securities that are denominated in USD. It is important to note that TUSD is not legal tender but it is redeemable for the underlying reserves that are held in escrow accounts managed by an independent fiduciary network that includes banks, depository institutions and trust companies through the platform.

Source: TrueUSD

There are two versions of TUSD – an ERC-20 token issued on Ethereum and TUSDB – a BEP-2 token issued on Binance Chain. TrueUSD can be traded on many exchanges including OKEx, Huobi, Binance, Changelly, Curve and others.

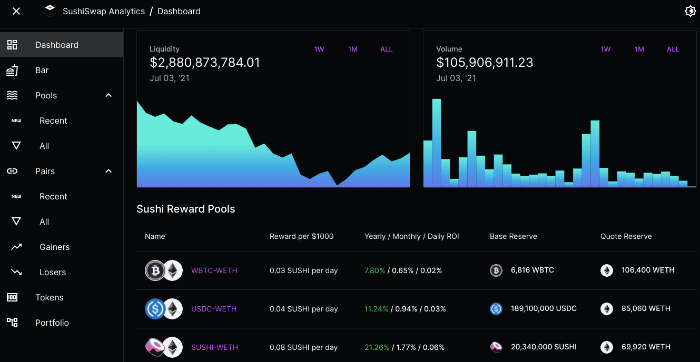

SushiSwap (SUSHI)

SushiSwap is an automated market maker (AMM) that is widely used in DeFi and through which automated trading liquidity is set up between any two crypto assets. It launched as a fork of Uniswap. Sushi has an exchange that makes it possible to trade up to one hundred ERC-20 tokens. It was recently announced that SushiSwap will be expanding to the Avalanche smart contract platform.

Source: Sushi

SUSHI tokens entitle users to governance rights. Exchange commissions per trade on SushiSwap is about 0.3% when a user joins a liquidity pool. About 90% of the fee is disbursed as profits to liquidity providers. The running of SushiSwap is now in the control of Sam Bankman-Fried, CEO of the FTX derivatives exchange and also Alameda Research – a quantitative trading startup. SUSHI tokens can be traded on exchanges such as Coinbase, Bitfinex, FTX, Binance, Huobi and others.