Top 3 Huobi ECO Chain (Heco) Tokens

Popular crypto assets in the Huobi ECO Chain (Heco) Ecosystem.

What is Heco Chain?

Huobi Open Platform’s first product was launched in December 2020 and it was the Huobi ECO Chain (Heco). This apparently decentralised, energy-saving public chain is optimised for high-efficiency. It is said to be compatible with smart contracts and is designed to support high-performance transactions. The native token of Heco’s ecosystem is Huobi’s HT token which utilises the HPoS consensus mechanism. Heco is meant to improve the efficiency of Ethereum by Layer2, and supplement and while also empowering the Ethereum ecosystem.

Source: https://www.hecochain.com/

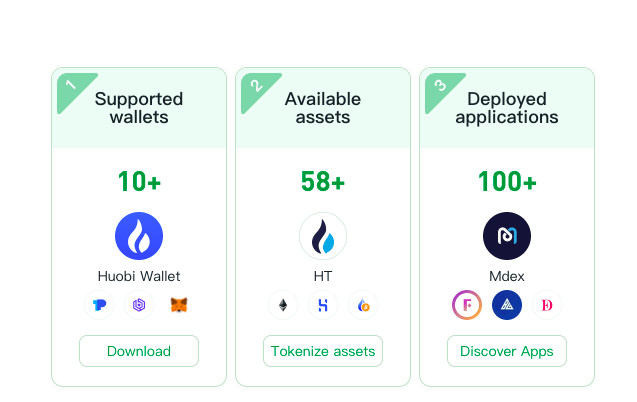

Heco is seen as a cost efficient public chain that Ethereum developers can get started with easily since smart contracts are seamlessly compatible. Heco has also built a DeFi ecosystem which includes wallets, assets, and app rankings. Within the Heco ecosystem are projects with their own crypto tokens and we’ll cover three of the most popular ones below:

MDEX (MDX)

Designed for users and developers, MDEX implements an automated market maker that makes low slippages for trades possible and promotes good market depth and high yields for transaction and liquidity miners. This makes MDEX quite attractive for DeFi projects. MDEX also enables the trade of assets supported by the Huobi and Heco networks. Protocols such as Balancer, Aave, Chainlink and Yearn Finance have already started liquidity mining on MDEX.

Cross-chain transaction protocols including Ethereum, Binance Smart Chain, and Heco are supported by MDEX which now ranks top of all decentralised exchanges ahead of SushiSwap, 1inch Exchange and PancakeSwap. Users are able to use MDEX Bridge to realise cross-chain interoperability between ETH, BSC, and HECO.

MDEX has five main offerings i.e:

- Swap – which includes transaction mining.

- Liquidity mining – users can earn MDX token rewards by staking LP after adding liquidity on HECO or BSC.

- Boardroom – which supports LP and single token staking to obtain MDX rewards.

- IMO – based on MDEX’s decentralised initial offering swap mechanism.

- Fun buyback – users can receive rewards after contributing MDX into a burning pool if the random number they are assigned matches the pre-designated winning number.

MDX tokens can be traded on Huobi, MDEX, Gate.io and other exchanges.

LendHub (LHB)

LendHub is described as a decentralised lending platform that is based on Heco and supports the pledged lending of multiple digital assets that are available on the Heco chain. Users are able to acquire LHB rewards by simply borrowing on LendHub. LendHub is effectively a debit and credit protocol that is seen as a modification of Compound. It is meant to provide debit and credit mining capabilities for LHB tokens. LHB token effectively serves as native currency of the LendHub platform, and makes possible the easy transfer of value between Heco assets through pledged lending.

More than 80% of LHB tokens are said to be distributed among the platform users. The total supply of LHB tokens is 1 billion and the reported daily output is around 460k. Each Heco block produces 16 LHB, of which 14.4LHB are allocated in the lending market, according to each market. The deposit and borrowing ratio is allocated, and the other 1.6 are allocated to the pledge mining market. This means each pool is evenly allocated. The token allocation ratio may be adjusted in a dynamic fashion depending on future market conditions. LHB tokens can be traded on exchanges such as Huobi, MDEX and others.

FilDA (FILDA)

FilDA is one of the first Heco-powered cross-chain lending DeFi projects to provide users with deposit, lending and liquid mining services. FilDA runs on Heco and is described as a decentralised banking platform that contains a banking protocol that facilitates the lending and borrowing of assets. It supports around 20 different assets including the stablecoin HUSD and HBTC – a standard ERC20 token issued by Huobi and said to be backed by 100% BTC. This decentralised banking protocol is modelled on Compound.

It also comes with a staking protocol that allows the locking of assets in order to enable users to earn rewards and that protocol is based on the Harvest Finance model. In essence, the two protocols make it possible for users to deposit crypto-assets in order to earn interest at dynamic rates since interest rates are determined algorithmically by supply and demand. FilDA also makes it possible to borrow a range of other crypto assets with no fixed terms. In addition, users can also stake crypto pairs in liquidity pools to earn rewards that are paid out in FILDA tokens.

FilDA assets are integrated through a token contract that is supposed to represent the HRC20 compatible account balance that is provided to the protocol. By minting fTokens, users can perform operations such as earning interest through a fToken conversion rate and they can also use fToken as collateral. FilDA operates automatically on smart contracts to create a cross-chain money market. Currently on Heco, it may also be deployed on Ethereum and other public chains in the future.