A decentralized exchange (DEX) is a type of cryptocurrency exchange that operates without a central authority, allowing users to trade cryptocurrencies directly with one another. In a DEX, trades are executed via smart contracts on a blockchain, such as Ethereum or Binance Smart Chain, providing a more transparent, secure, and censorship-resistant trading environment compared to centralized exchanges.

Key features of decentralized exchanges include:

- Non-custodial: DEXs do not hold users’ funds or private keys. Instead, users retain control of their cryptocurrencies in their own wallets, reducing the risk of hacks and theft that can occur in centralized exchanges.

- Decentralization: There is no central authority controlling the exchange, which prevents censorship and ensures that trading can continue even if a single node or server fails.

- Anonymity and privacy: Users can trade on DEXs without providing personal information or going through a lengthy verification process, ensuring privacy and potentially reducing the risk of identity theft.

- Transparency: All transactions on a DEX are recorded on the blockchain, making them publicly accessible and auditable.

- Open-source: Decentralized exchanges are typically open-source, allowing developers to contribute, audit, and improve the codebase.

Gains Network (gTrade) GNS Token

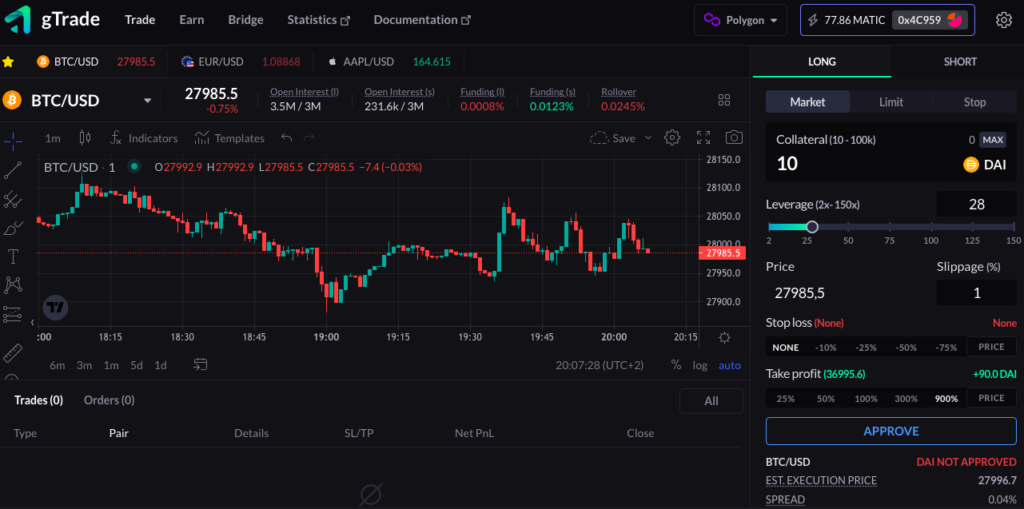

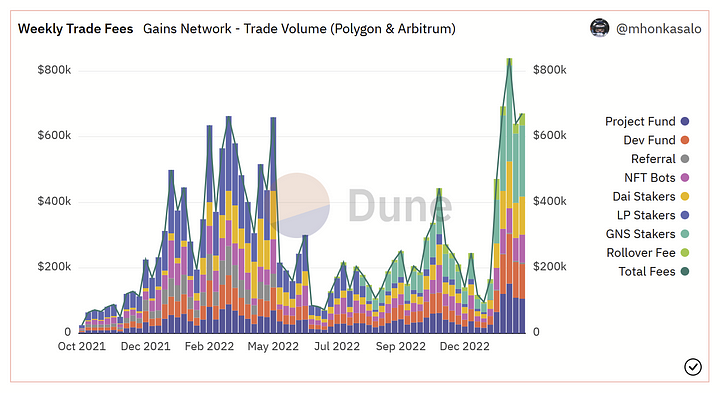

Gains Network created gTrade, a decentralized leveraged trading platform that is liquidity-efficient, powerful, and user-friendly.

The platform’s distinct synthetic architecture enables gTrade to be more capital efficient than any existing platform, offering low trading fees and an extensive range of leverages and pairs: up to 150x on cryptocurrencies, 1000x on forex, 50x on stocks, and 35x on indices.

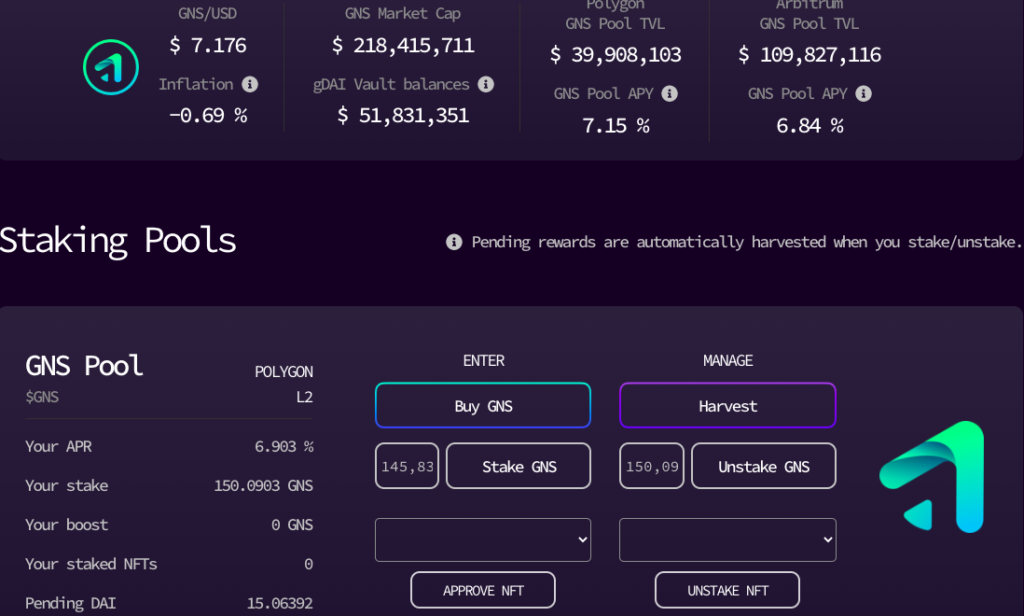

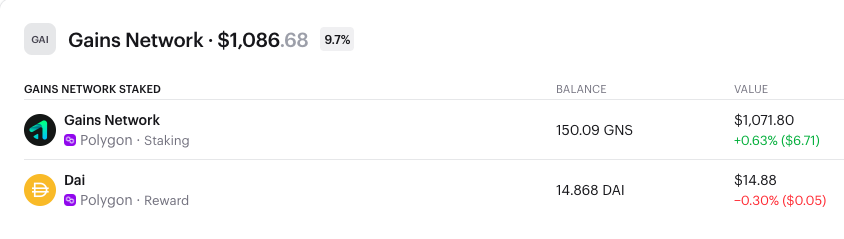

The protocol is centered around the ecosystem’s ERC20 utility token (GNS) and ERC721 utility token (NFTs). GNS and the NFTs are designed for active use within the platform (utility) and to enable ownership of the protocol through revenue capture and governance. This includes GNS holders receiving platform fees through Single Sided Staking, GNS burning utilizing platform revenue, NFT holders benefiting from reduced spread and enhanced rewards, as well as NFT bots executing limit orders and liquidations.

GNS Token Utility

The liquidity efficiency of the DAI vault is supported by minting rewards for NFT bots and affiliates, which allows the DAI to stay within the vault. This contributes to stability by minimizing vault drawdowns and maintaining its over-collateralization.

When the DAI vault becomes adequately overcollateralized, providing a suitable buffer for DAI vault stakers, it can be burned to counter the inflation caused by NFT bot and affiliate rewards.

This approach ensures that early community supporters won’t have their platform interest percentages diluted by a large whale in the future, creating an equal playing field for community support.

As a backstop for traders winning on gTrade, $GNS can be minted to recollateralize the gDAI vault (with a maximum inflation rate of 18.25% per year).

Additionally, it will serve as one of the primary means for governing the protocol.

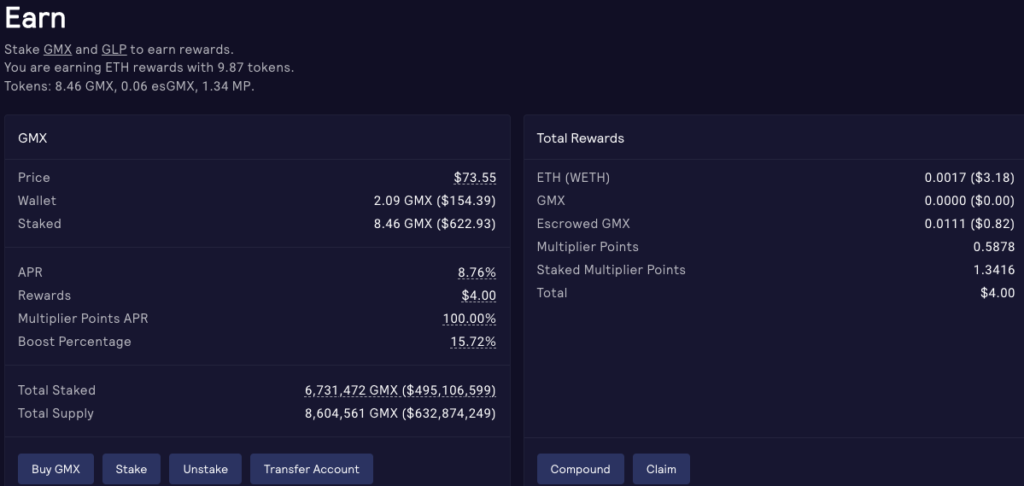

GMX

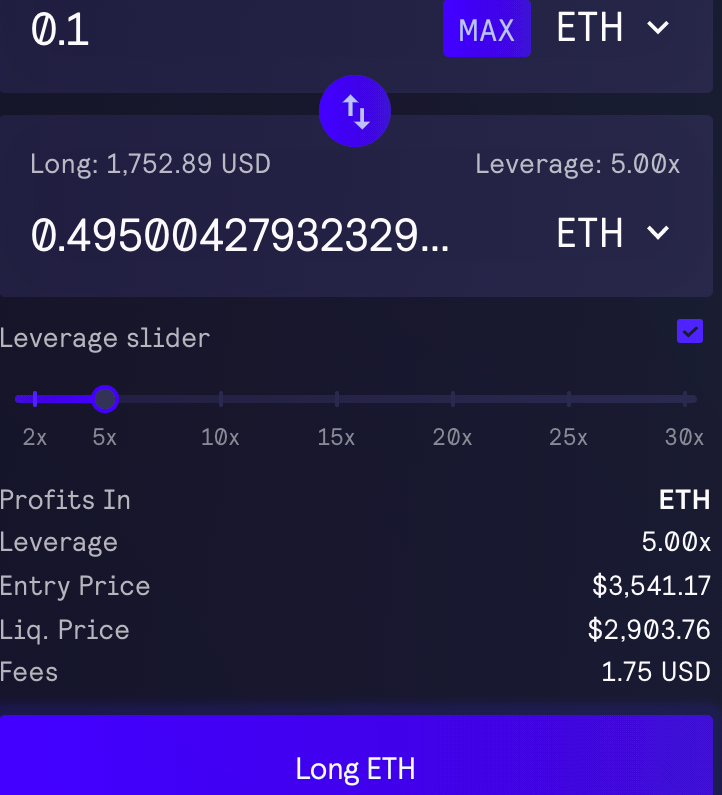

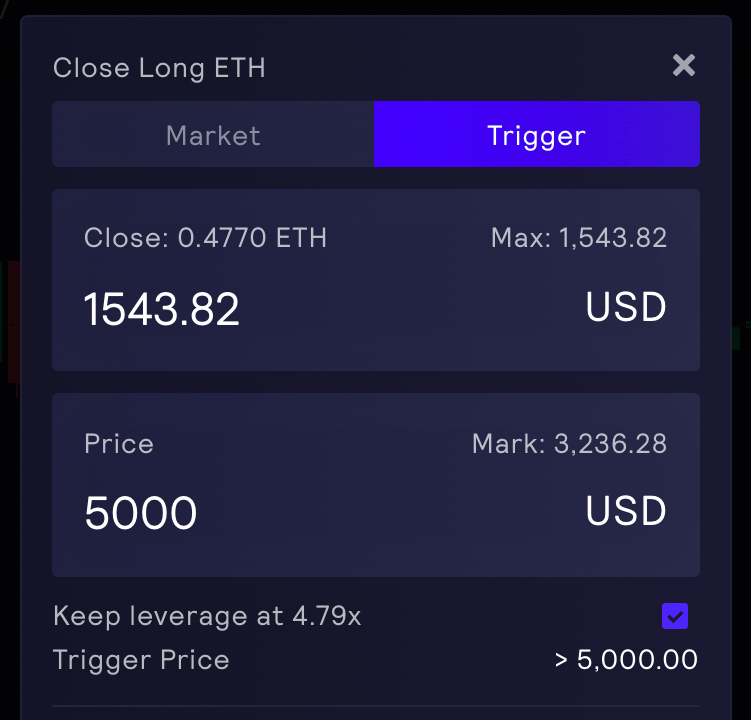

GMX is a decentralized spot and perpetual exchange offering low swap fees and zero price impact trades.

A unique multi-asset pool supports trading and generates fees for liquidity providers from market making, swap fees, and leverage trading.

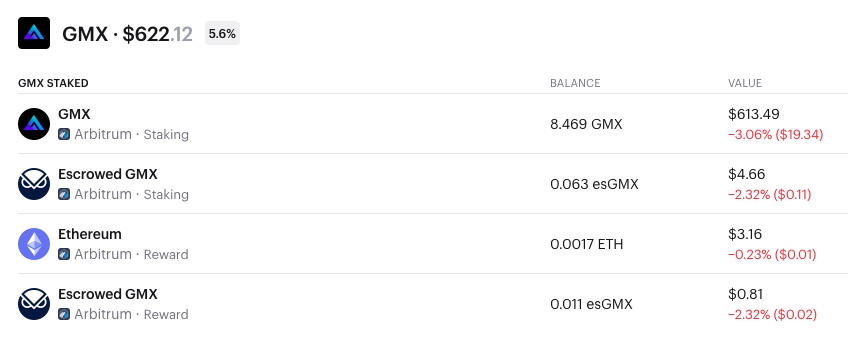

30% of fees generated from swaps and leverage trading are converted to ETH/AVAX and distributed to staked GMX tokens.

Staking on Arbitrum results in ETH rewards, while staking on Avalanche yields AVAX rewards. Note that distributed fees are calculated after deducting referral rewards and network costs for keepers, which are typically around 1% of total fees.

Escrowed GMX

Escrowed GMX (esGMX) has two uses:

- Staking for rewards, similar to regular GMX tokens

- Vesting to become actual GMX tokens over a one-year period

- Each staked Escrowed GMX token earns the same amount of Escrowed GMX and ETH/AVAX rewards as a regular GMX token.

Keep in mind that Escrowed GMX (esGMX) is not intended for transfer unless conducting a full account transfer. The GMX or GLP amount required to vest esGMX is unique per account and capped at the rewards received by that account. Do not purchase esGMX off the market or OTC, as you won’t be able to vest them.

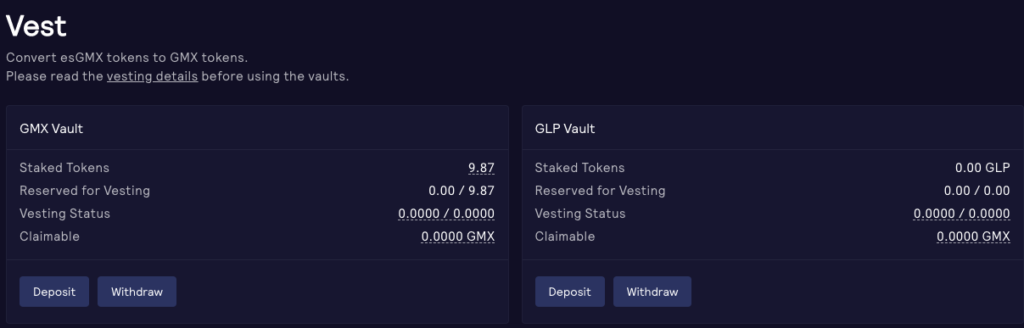

Vesting

Escrowed GMX (esGMX) tokens can be converted into GMX tokens through vesting, accessible on the Earn page.

Upon initiating vesting, the average amount of GMX or GLP tokens used to earn the esGMX rewards will be reserved.

Multiplier Points

Multiplier Points reward long-term holders without inflation.

When staking GMX, you receive Multiplier Points every second at a fixed rate of 100% APR. Staking 1000 GMX for one year earns 1000 Multiplier Points.

By pressing the “Compound” button on the Earn page, Multiplier Points can be staked for fee rewards. Each Multiplier Point boosts ETH/AVAX APRs at the same rate as a regular GMX token.

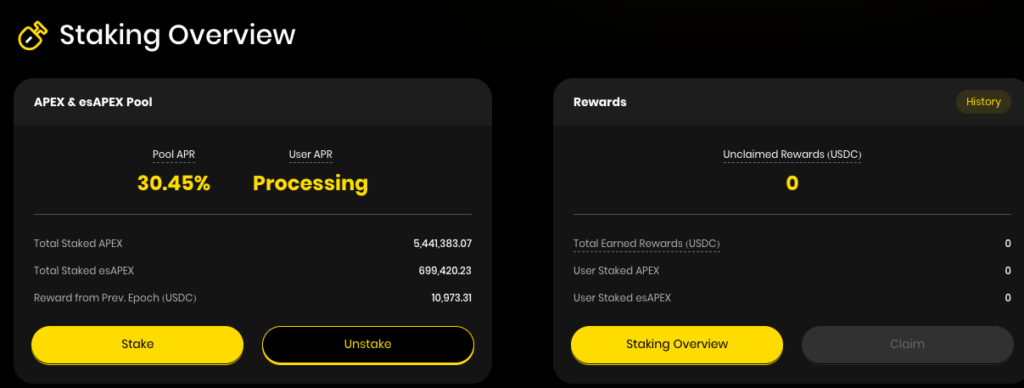

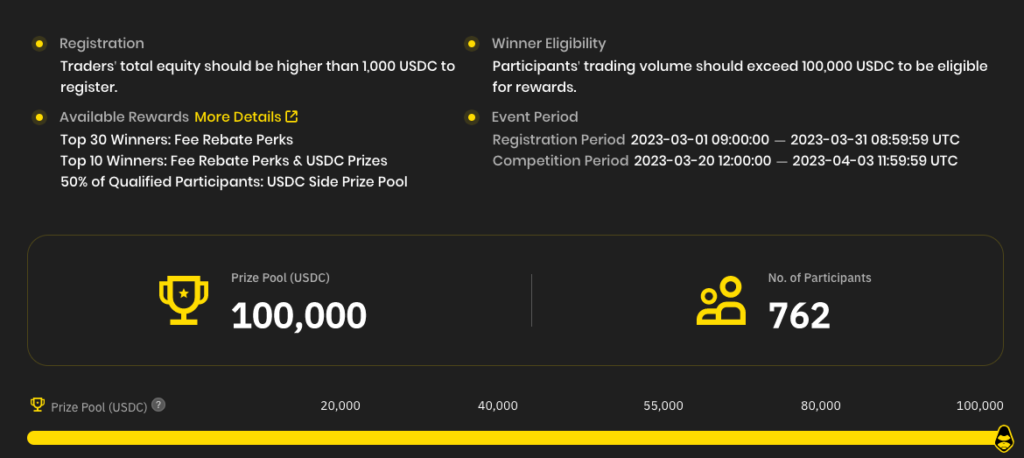

ApeX Pro (APEX Token)

ApeX Pro is a non-custodial trading platform providing boundless cross-margined perpetual contracts within a novel social trading framework for its metacommunity. It is designed to offer unlimited access to the perpetual swaps market through its order book model while maintaining speed, efficiency, security, and transparency regarding traders’ assets. By integrating StarkWare’s Layer 2 scalability engine StarkEx and Validium, ApeX Pro delivers cross-margined perpetual contracts featuring multi-chain support, low fees, deep liquidity, and optimal security.

StarkEx, a Layer 2 scalability engine developed by StarkWare, utilizes STARK-proofs, a type of zero-knowledge proof. Employing StarkEx’s cryptographic proofs for transaction validation and Validium, ApeX Pro is set to achieve rapid transaction processing and some of the lowest gas fees in the DeFi space. Engineered for higher liquidity and enhanced network interoperability, users can access non-custodial trading for ETH, ERC-20, and EVM-compatible tokens.

ApeX Pro combines the security and transparency of a decentralized exchange (DEX) with the speed and usability of centralized exchanges (CEXs). The order book model bridges the gap between users accustomed to order books in their trades and a permissionless trading platform.

Maximum Security

StarkWare’s STARK proofs, a form of ZK rollup technology, ensure on-chain data availability and integrity for a fully non-custodial protocol. Built on the Ethereum network, this Layer 2 architecture publishes zero-knowledge proofs to Ethereum smart contracts for verification. Transactions are uniquely packaged for on-chain publishing, with only balance changes visible for data privacy-conscious traders.

Preserving Privacy

The upgraded protocol enhances ApeX Pro’s trade settlement capacity and secure transaction validations on the trading platform, without compromising traders’ personal transaction data and activities.

Lower Fees, Greater Leverage & Instant Settlement

Trades can be executed with up to 30x leverage at minimal costs, allowing for increased earnings, reduced starting capital, and optimized trade sizes. ApeX Pro delivers a trading experience as fast as a centralized exchange.

Multi-Chain Support

ApeX Pro supports ETH, ERC-20 tokens, and tokens from EVM-compatible chains, enabling cross-chain deposits and withdrawals.

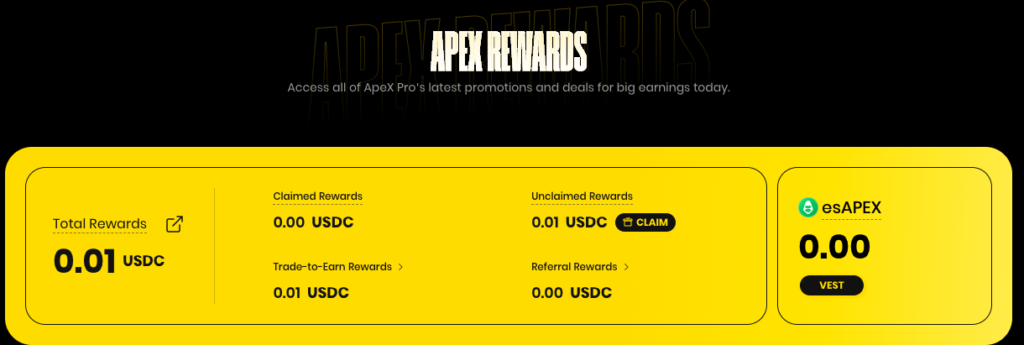

APEX Token

The ApeX Protocol is backed by the APEX token, which grants governance rights, and the BANA token, a trade-to-earn reward token on ApeX Pro.

The total supply of APEX is divided, with 23% allocated to the core team and early investors, and 77% reserved for participation rewards, ecosystem development, and liquidity bootstrapping. Part of the APEX supply contributes to the creation of BANA, a rewards token for ApeX Pro’s trade-to-earn events.

APEX holders participate in governance, protocol incentivization, and staking, granting community members control over governance and protocol parameters.

BANA Token

BANA is a reward token distributed during regular, weekly trade-to-earn events on ApeX Pro:

Initially minted with 25,000,000 APEX, locked for a minimum of 12 months.

At the initial minting event, 25,000,000 APEX generates a supply of 25,000,000,000 BANA with an initial redeem rate of 0.001.

Following the lock-up period, BANA holders can convert BANA to APEX pro-rata (based on the amount of BANA burnt during the event in the Buy & Burn Pool).

Allocation is determined by a combination of fees, open interests, and the BANA-USDC.

Get started on gTrade ($GNS), GMX ($GMX) and ApeX Pro ($APEX).