How to Maximise Crypto Profits from Presales: Top 10 Projects to Watch

2024’s Top Crypto Presales: Innovative Blockchain Projects to Keep on Your Radar.

Crypto presales, the exciting stage where tokens are offered before a full public launch, represent one of the most lucrative opportunities for investors in the blockchain space. Unlike regular token sales or trading on established exchanges, presales allow you to buy tokens at a lower price, often leading to significant profits once they hit the broader market. However, navigating this space requires insight, strategy, and a bit of luck. In this guide, we’ll dive deep into how you can profit from crypto presales, with tips on how to spot promising projects and maximize your returns while minimizing risks.

What Are Crypto Presales?

Before we jump into the profit strategies, it’s essential to understand what a crypto presale is. In the simplest terms, a crypto presale is a fundraising event for a blockchain project, typically occurring before the token becomes publicly available. Think of it as an Initial Coin Offering (ICO) or Initial DEX Offering (IDO), but with early-bird pricing. During this stage, the project sells tokens directly to investors at a discount, usually to raise initial capital or liquidity for further development.

Why It’s Lucrative: You’re buying the token at a significantly lower price than its expected listing price on an exchange. If the project succeeds, the token’s value often skyrockets, providing early investors with a hefty profit.

Spotting a Profitable Presale: What to Look For

Not all crypto presales are created equal. Some projects fizzle out, while others deliver massive returns. Here’s what you need to focus on to identify the winners:

Team and Experience

One of the most critical indicators of a project’s success is the team behind it. Are they experienced in blockchain technology or their respective industry? Have they previously worked on successful projects? Look for transparent teams with credible backgrounds.

Technology and Use Case

A strong use case and innovative technology are crucial. Projects with real-world applications, particularly those solving significant problems in finance, supply chain, gaming, or data privacy, are more likely to succeed. Ensure that the whitepaper outlines a clear roadmap, addressing how the project will achieve its goals.

Partnerships and Backers

Strong partnerships and institutional backers provide credibility. If a project is supported by well-known investors, venture capital firms, or influential figures in the crypto space, it’s a good sign. It shows confidence from entities that have performed due diligence on the project.

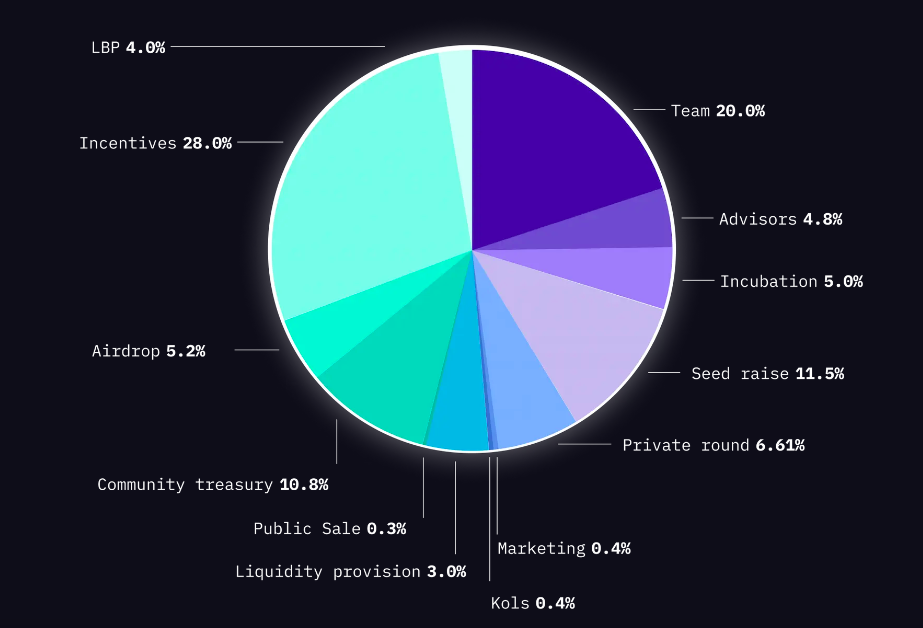

Tokenomics

Tokenomics refers to the economic model of the token, including the supply, allocation, and how it will be distributed. A well-thought-out tokenomics structure ensures that the token’s value has room to grow, with limited inflationary risks. Watch out for projects with low circulating supply and clear utility for the token within the ecosystem.

Community Engagement

An active, engaged community often signals a strong foundation for future growth. Check platforms like Twitter, Telegram, Discord, and Reddit to gauge community involvement. A vibrant and supportive community can propel a project to success through organic promotion and usage.

Examples of Popular Presales 2024

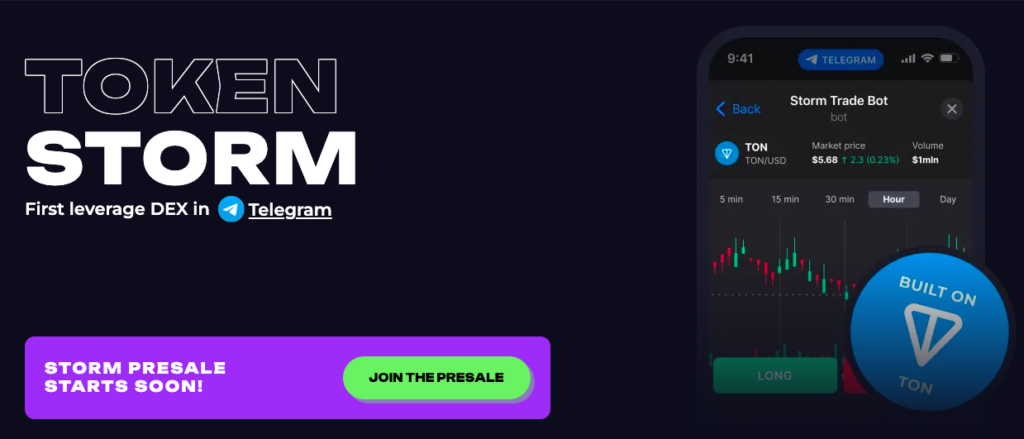

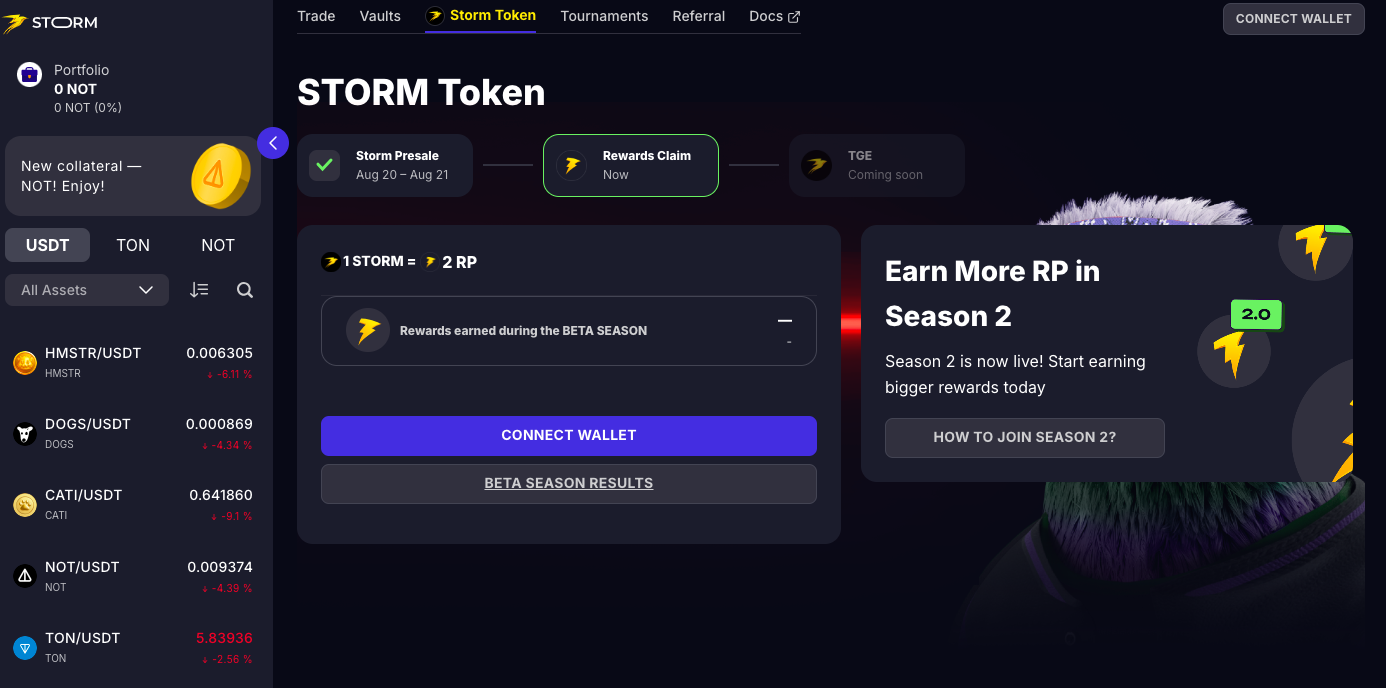

1. Storm Trade

Storm Trade is a social-first derivatives platform leveraging Telegram for seamless trading.

- Overview: Built on the TON blockchain, Storm Trade offers cryptocurrency, forex, equities, and commodities trading directly within Telegram.

- Project Highlights:

- Leverage up to x50, squad trading tournaments, and NFT collection.

- Liquidity pools with high annual returns and instant I/O capabilities.

- Backers: Supported by Magic Square, Tonstarter, BullPerks, and more.

2. StakeLayer: Revolutionizing Bitcoin Utility in DeFi

StakeLayer is a pioneering project designed to dramatically enhance the functionality of Bitcoin within the DeFi ecosystem. It aims to integrate Bitcoin more deeply into decentralized finance by enabling it to participate in securing networks and expanding its use beyond mere currency or store of value. This integration addresses a significant gap in Bitcoin’s current utility across public blockchain networks, leveraging its foundational role in the cryptocurrency space.

Key Features

- BTC Mirror Mechanism: Allows Bitcoin holders to actively participate in DeFi and CeFi, creating opportunities for yield without transferring assets off-chain.

- Mixed Proof of Stake (PoS) Mechanism: Employs Bitcoin as a security measure for network operations, diversifying the security models of participating networks.

- Restaking Opportunities: Enables Bitcoin holders to “restake” their BTC, engaging in network security or other reward-generating activities akin to PoS cryptocurrencies.

- Vault System: Features a comprehensive system of primary and secondary vaults that aggregate yields and optimize returns on staked assets.

- Strategy Manager Backend: An automated backend that dynamically allocates assets across various yield-generating opportunities to maximize investor returns.

Technological Innovation StakeLayer’s platform is underpinned by a robust technological framework that ensures seamless integration of Bitcoin into DeFi. It includes:

- EVM Compatibility: Ensures that existing Ethereum-based DeFi applications can operate within the Bitcoin ecosystem, leveraging Bitcoin’s security and liquidity.

- On-Chain Mirror Mechanism: Utilizes smart contracts to mirror Bitcoin assets on-chain, enabling their participation in blockchain-based financial activities without leaving secure wallets.

Potential Impact The introduction of StakeLayer could have a profound impact on the broader blockchain and cryptocurrency sectors. By enabling Bitcoin to function within PoS mechanisms and participate in diverse financial activities, StakeLayer not only enhances Bitcoin’s utility but also strengthens the overall infrastructure of DeFi. It provides a new avenue for Bitcoin holders to generate passive income, thus increasing the asset’s attractiveness and potential market value.

Tokenomics StakeLayer has a total token supply of 5 billion $STAKE tokens, distributed across various channels to support development, community engagement, and ecosystem growth:

- Presale: 20% (1 billion $STAKE)

- Community and User Incentives: 30% (1.5 billion $STAKE)

- Development Fund: 15% (750 million $STAKE)

- Team and Advisors: 10% (500 million $STAKE)

- Strategic Partnerships and Ecosystem Expansion: 10% (500 million $STAKE)

- Liquidity Pool: 10% (500 million $STAKE)

- Marketing and Community Growth: 5% (250 million $STAKE)

StakeLayer represents a significant innovation in the blockchain space, offering new functionalities for Bitcoin and promising enhancements for the DeFi ecosystem. Its focus on security, yield generation, and strategic integration positions it as a potential key player in the future landscape of decentralized finance.

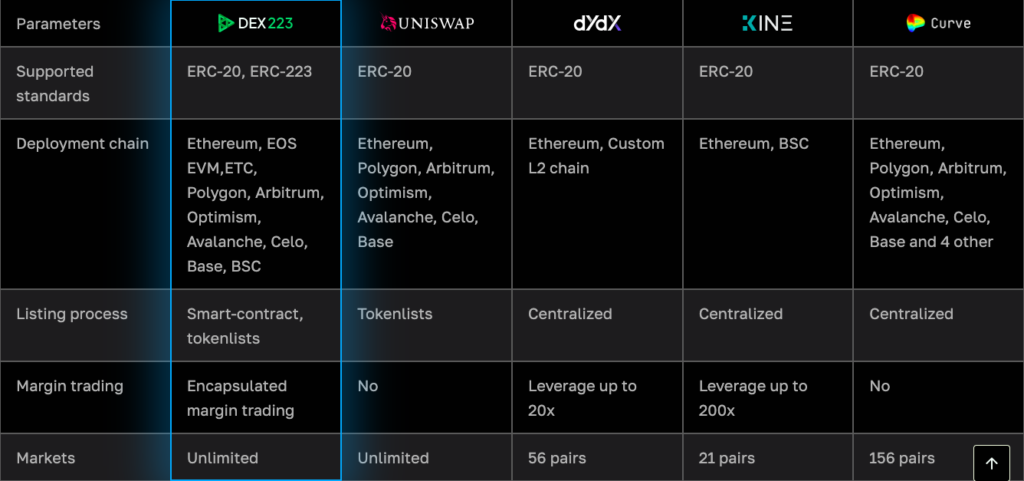

3. DEX223: Pioneering Speed and Security in Decentralized Exchanges

DEX223 is an innovative decentralized exchange (DEX) designed to enhance the trading experience by providing unparalleled speed and top-tier security. It leverages the Ethereum blockchain and employs the ERC-223 token standard to offer a seamless and efficient trading environment.

Key Features:

- High-Speed Transactions: DEX223 utilizes off-chain order books combined with on-chain settlements to facilitate rapid transactions, significantly reducing the waiting time associated with traditional DEXs.

- Enhanced Security: With advanced security protocols and decentralized infrastructure, DEX223 ensures that users’ assets are protected against cyber threats, making it as secure as digital Fort Knox.

- User-Friendly Interface: The platform offers an intuitive and straightforward interface, making it accessible for both beginners and experienced traders.

- Multi-EVM-Chain Support: DEX223 supports trading across multiple EVM-compatible chains, increasing its usability and reach within the crypto ecosystem.

Tokenomics:

- Token Name: D223 Token

- Total Supply: 1 billion D223

- Presale Allocation: 300 million D223

- Rewards and Incentives: 50% of the total supply

- Team and Advisors: 10% of the total supply, with a two-year vesting period to align team incentives with long-term project goals.

Utility: D223 tokens are integral to the DEX223 ecosystem with several key uses:

- Transaction Fees: Users can pay for trading fees at discounted rates using D223 tokens.

- Governance: Token holders have the right to vote on key platform decisions, including updates and feature additions.

- Staking Rewards: Users can stake D223 tokens to earn rewards, enhancing their passive income opportunities within the platform.

Team: The DEX223 team is comprised of experts in blockchain technology, cybersecurity, and financial markets, backed by advisors from leading blockchain projects. This diverse team ensures that DEX223 stays at the forefront of technology and market trends.

Conclusion: DEX223 is set to redefine the landscape of decentralized exchanges by offering a blend of speed, security, and user-centric features. Its innovative approach to DEX design, coupled with robust tokenomics and a clear strategic vision, positions it as a compelling project for investors and traders looking for a next-generation trading platform.

4. Metropolis

A revolutionary ecosystem merging gamified commerce, AI technology, and culture into a vibrant virtual hub.

- Overview: At its core, Metropolis X offers a gamified marketplace where digital collectibles unlock real-world assets and experiences. Users can own virtual properties, run businesses, participate in AI-generated quests, and much more.

- Traction:

- $1.5 million in revenue in the first 12 months.

- 250k users and 150+ Key Opinion Leaders (KOLs) invested.

- 400+ signed partnerships, reaching over 300 million followers.

- Team: Includes notable names like Rashid Ajami, Rania Ajami, and Adam Hartwig.

- Backers: Supported by Outlier Ventures, Protocol Labs, and Cointelegraph Accelerator.

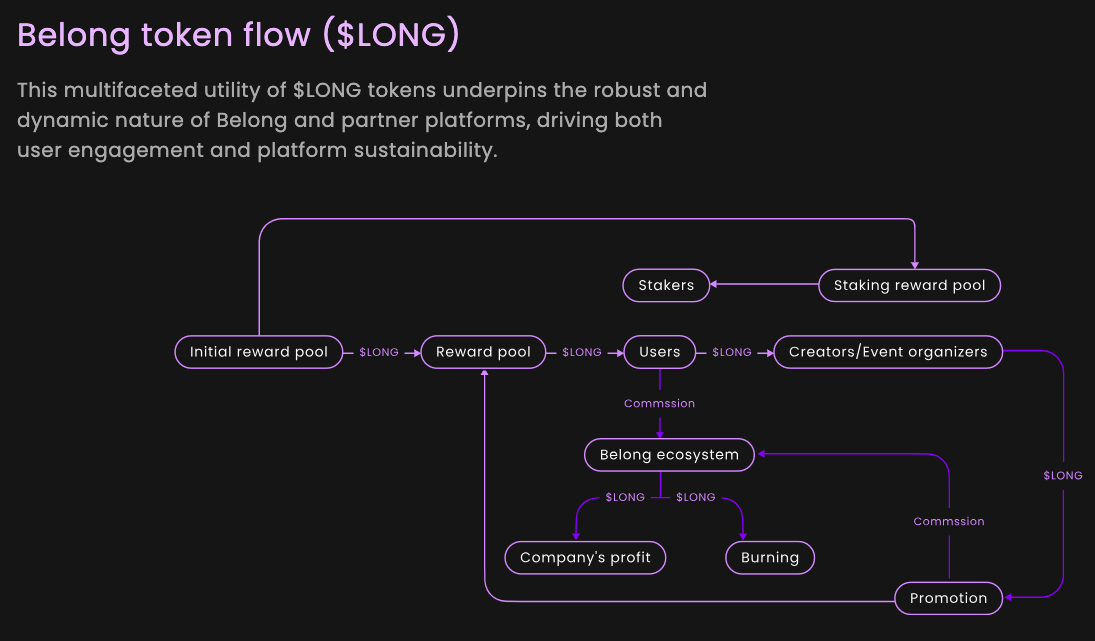

5. Belong

Revolutionizing access management for events, content, and real-world assets with a Web3-powered platform.

- Overview: Belong provides a branded, Web2-friendly solution for hospitality and event organizers, using NFTs for engagement, payments, and identity management.

- Key Features:

- Robust API and whitelabel apps for businesses.

- NFT-based token gating and easy payments via Apple Pay and Google Pay.

- Project Highlights:

- Top-ranked for “NFT tickets” on App Stores.

- Focused on operational profitability with a projected $2.5 million revenue in 2024.

- Investors: Founders of Decentraland, Bitfury Capital, and more.

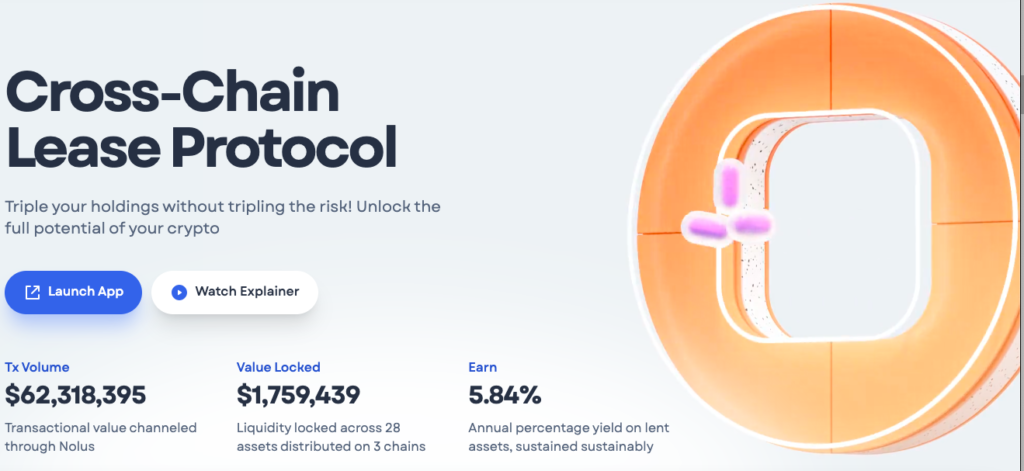

6. Nolus

A cross-chain DeFi money market that bridges lenders and borrowers with a unique leasing model.

- Overview: Offers up to 150% financing on initial investments, with a focus on interoperability and capital efficiency. Nolus aims to simplify cross-chain DeFi experiences for everyone.

- Project Highlights: Enhances capital efficiency by reducing high over-collateralization standards, and integrates with various DEXs for streamlined asset swaps.

7. Hats Finance

A decentralized Web3 security protocol that redefines security audits.

- Overview: Hats Finance uses a rewards-only payment model for audits, ensuring cost-effective and results-driven security. It also emphasizes permissionless participation and community engagement.

- Project Highlights:

- Trusted by major protocols like Safe, Liquity, and Stakewise.

- Over $800k paid to security researchers with more than 50 bug bounties deployed.

- Backers: Lemniscap, IOSG, Collider Ventures, and more.

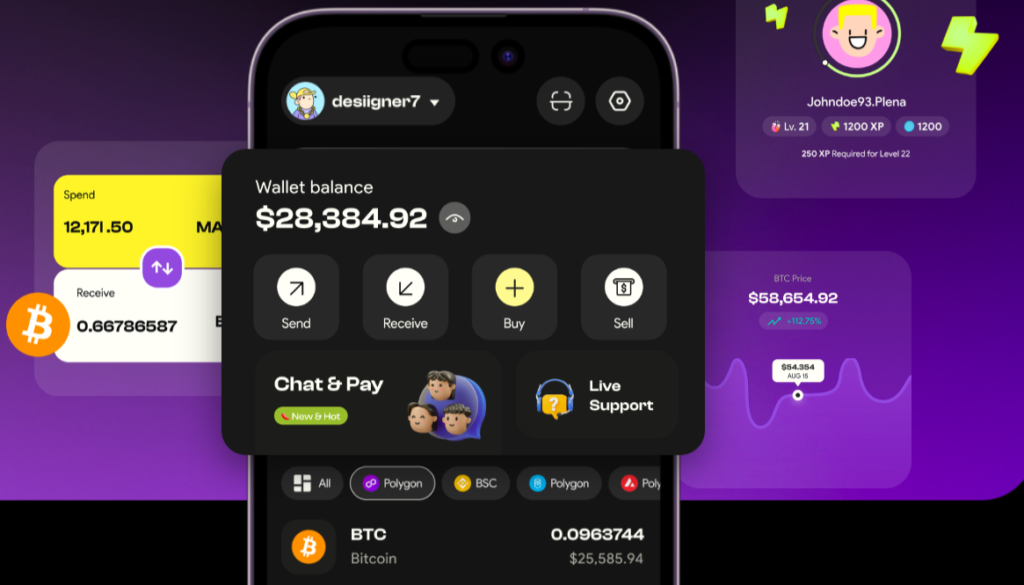

8. Plena Finance

A crypto super app accelerating DeFi with Account Abstraction technology.

- Overview: Plena combines traditional exchange ease with full custody of assets. The platform integrates social networking, trading tools, and smart investment strategies.

- Project Highlights:

- 5M+ transactions and $30M+ funds deposited.

- The most-used Account Abstraction application with over 300k registered users.

- Investors: Big Brain Holdings, Galxe, ARK 36, among others.

9. bitsCrunch

An AI-enhanced data analytics and forensics protocol revolutionizing blockchain asset management.

- Overview: Provides smart insights on blockchain assets, utilizing AI/ML algorithms for analytics in NFTs, GameFi, and DeFi.

- Project Highlights:

- Raised $12M with 100k+ testnet users.

- Listing on major exchanges like Bybit, KuCoin, and Crypto.com in February 2024.

- Backers: Coinbase Ventures, Polygon Ventures, and Animoca Brands.

10. Rooch Network

Revolutionizing the Bitcoin ecosystem with a groundbreaking Native Application Layer powered by MoveVM.

-

Overview: Rooch Network offers a unique Stackable Layer 2 architecture, designed to bring native Bitcoin applications to life without relying on third-party custodians. With a non-custodial approach, Rooch enables users to securely develop and interact with Bitcoin applications, while generating yields for BTC in a flexible, stateful environment. Rooch’s hybrid model combines on-chain assets with a client-side-verifiable off-chain app framework, ensuring both security and usability.

-

Project Highlights:

- Testnet Success:

- 6 million transactions in the first week.

- 827 tBTC staked.

- 3.4k accounts created.

- Powered by Move Language, offering compatibility with Bitcoin’s UTXO system.

- Secured by Bitcoin network and partnered with Babylon Chain for enhanced security.

- Testnet Success:

-

Team:

- Yuanming (Jolestar) Wang, founder & CTO, initiator of MoveFunsDAO, and former Chief Architect at WestarLabs.

- Haichao Zhu, co-founder & CEO, with experience at Nervos, Solana, Algorand, and Aptos.

-

Backers: Sky9 Capital, Aptos, Gate Venture, GCR, and Ryan Fang (Ankr Co-Founder).

Learn More About Rooch Network

Key Steps to Investing in Crypto Presales

Once you’ve identified a promising project, it’s time to invest. Follow these key steps to secure your presale investment and maximize potential profits.

1. Research and Due Diligence

Before committing any capital, conduct thorough research. Read the project’s whitepaper, analyze its roadmap, study its team, and review its partnerships. Remember, this is a highly speculative investment space, so never invest more than you can afford to lose.

2. Join the Project’s Community Early

To participate in presales, it’s often necessary to join the project’s community channels (like Telegram, Discord, or Twitter) and stay updated on presale announcements. These platforms are typically where details are first shared. Be active and ask questions – early community involvement can sometimes get you access to exclusive whitelist opportunities.

3. Understand the Presale Structure

Presales can have different phases, such as private sales, seed rounds, or public presales. The earlier you get in, the cheaper the tokens usually are. However, earlier rounds may require higher investment amounts, and access may be limited to influencers or institutional investors. Make sure you’re clear on vesting periods (how and when tokens are unlocked) to avoid surprises.

4. Set Up a Secure Wallet

Most presales will require you to participate using specific cryptocurrencies, such as Ethereum (ETH), Binance Coin (BNB), or stablecoins like USDT or USDC. Set up a non-custodial wallet like MetaMask, Trust Wallet, or similar that supports these tokens, and ensure it’s secure. Don’t forget to double-check the contract address to avoid scams.

5. Monitor Gas Fees and Transaction Timing

If the presale is on a blockchain like Ethereum, monitor gas fees closely. High fees can eat into your profits, so aim to participate when network activity is lower. Timing your transaction can make a significant difference in the cost.

Risk Management: Avoiding the Pitfalls

Crypto presales, while profitable, carry a higher level of risk. To ensure you’re not caught on the wrong side of a trade, follow these risk management strategies:

1. Watch Out for Scams

Sadly, scams are common in the crypto space. Always verify the authenticity of a project by cross-referencing its information on multiple platforms. Look out for suspicious behavior, such as teams that are anonymous or reluctant to provide clear tokenomic structures.

2. Beware of Over-Promises

Some projects will make bold claims about their future, but if something sounds too good to be true, it usually is. Stick to projects with realistic goals, proven track records, and solid use cases.

3. Avoid Overcommitting

It’s tempting to go all-in on a presale, especially when there’s hype around it. But this is a speculative market, and not every project will succeed. Diversify your investments across several promising projects rather than putting all your capital into one.

4. Plan Your Exit

Even if you believe in a project long-term, having an exit plan is essential. Once the token lists on an exchange, there’s often a sharp price increase, followed by volatility. Decide beforehand whether you’re going to sell a portion of your tokens immediately, hold for the long term, or stagger your exits over time.

How Much Can You Profit?

Profits from presales can vary greatly depending on the project’s success. In 2021, early investors in Axie Infinity saw returns of over 200x their initial investment, while Solana delivered nearly 10,000x profits for those who got in early. However, not every project will provide these massive returns, so temper your expectations and be prepared for both wins and losses.

On average, well-chosen presale investments can deliver 2x to 20x returns, especially if you’ve done your homework. Timing also plays a critical role – selling at the peak and buying during the presale phase can dramatically increase your earnings.

These projects represent some of the most promising presale opportunities in the crypto space for 2024. Each brings a unique proposition, innovative technology, and a strong backing that makes them worth considering for anyone looking to invest early in the next big thing.