Top 10 Crypto Market Makers of 2024

The cryptocurrency market is evolving rapidly, with market makers playing a critical role in maintaining liquidity and ensuring

The cryptocurrency market is evolving rapidly, with market makers playing a critical role in maintaining liquidity and ensuring stability across trading platforms. As the industry continues to grow, reaching an estimated revenue of $11.71 billion in 2023, the importance of reliable market makers has never been more pronounced.

These entities not only provide liquidity but also mitigate volatility, enhance price discovery, and support the overall health of the market. In 2024, several key players are leading the way, each offering unique services tailored to the diverse needs of the digital asset ecosystem.

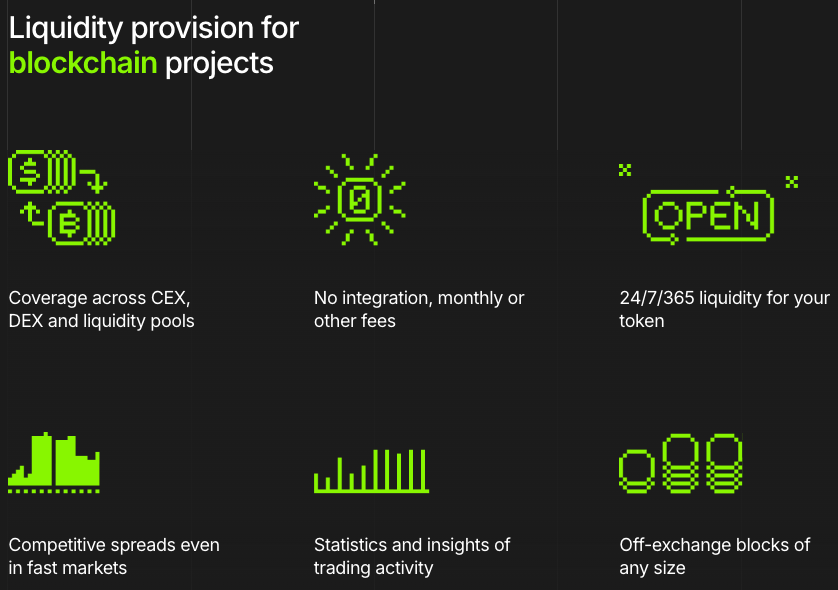

1. Wintermute

Wintermute is a powerhouse in the crypto market-making space, known for its extensive presence across over 50 exchanges. Specializing in algorithmic trading, Wintermute leverages AI-driven strategies to create highly liquid and efficient markets, particularly in decentralized exchanges (DEXs). Their deep involvement in both centralized and decentralized environments makes them a versatile player, offering liquidity for blockchain projects and engaging in off-exchange activities like over-the-counter (OTC) and treasury management.

2. Cumberland (DRW)

Cumberland, a subsidiary of DRW, stands out with its robust liquidity provision for institutional investors. With over a decade of experience in trading cryptocurrencies, Cumberland offers services such as OTC liquidity, spot trading, and derivatives. Their approach is highly institutional, focusing on large trades with minimal market impact, backed by advanced price improvement technologies.

3. Jump Trading

Jump Trading, through its crypto arm Jump Crypto, continues to be a leader in high-frequency trading and liquidity provision. The firm is recognized for its research-driven strategies, which combine cutting-edge technology with deep market insights. Jump Trading’s ability to execute trades with precision and its focus on major exchanges make it a trusted partner for both large institutions and emerging projects.

4. GSR Markets

GSR Markets blends traditional financial expertise with deep crypto market knowledge, providing tailored liquidity solutions across a wide range of digital assets. GSR is particularly noted for its structured products and ability to support complex trading needs, making it an ideal partner for projects requiring more than just basic market-making services.

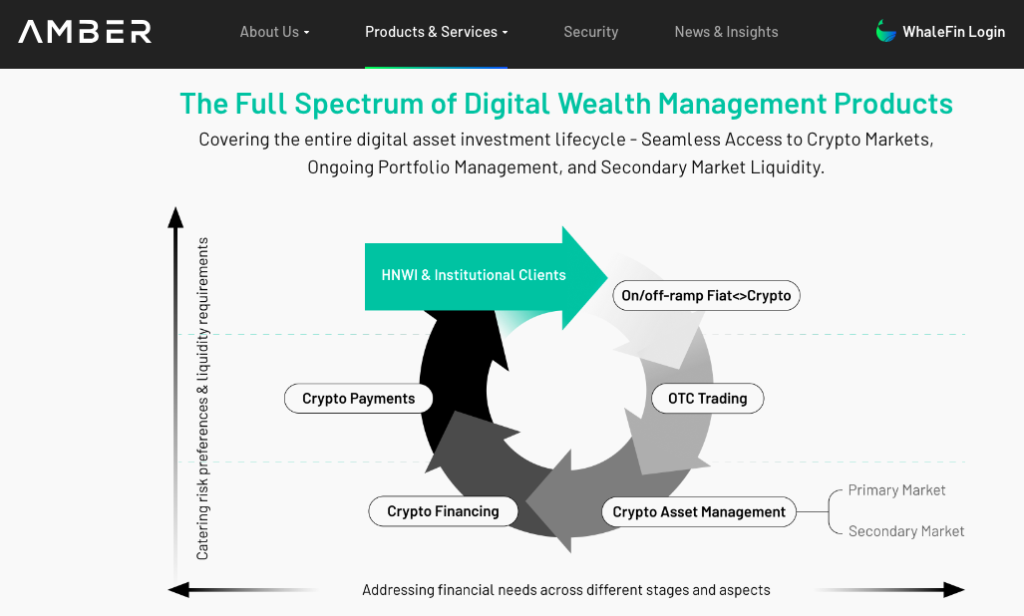

5. Amber Group

Amber Group has cemented its position as a global leader in crypto market making, particularly strong in the Asia-Pacific region. Beyond traditional market-making services, Amber Group offers a suite of crypto-financial products, including lending and asset management, which adds significant value to its liquidity provision services. The firm’s broad reach and comprehensive offerings make it a versatile player in the market.

6. Gotbit

Gotbit focuses on market-making services for Web3 projects, with a unique approach that emphasizes post-Token Generation Event (TGE) strategies. They support over 70 centralized exchanges (CEXs) and 50 decentralized exchanges (DEXs), using a combination of algorithmic trading tools and extensive market analytics to optimize liquidity and performance for mid-cap tokens.

7. Algoz

Algoz offers institutional-grade market-making services with a strong emphasis on algorithmic trading. Their strategies are built on advanced analytics and predictive algorithms, which allow them to provide deep liquidity and efficient market-making solutions. Algoz is particularly effective in markets that require complex, multi-strategy approaches.

8. Kairon Labs

Kairon Labs is known for its expertise in decentralized finance (DeFi), offering automated liquidity solutions that are highly tailored to the needs of decentralized exchanges. Their sophisticated algorithms and risk management tools make them a key player in the DeFi space, helping projects maintain liquidity and stability in rapidly changing markets.

9. Jane Street

Jane Street brings a research-driven approach to market making, employing machine learning and programmable hardware to optimize its trading strategies. Known for its wide range of asset class trading, including ETFs and cryptocurrencies, Jane Street’s global presence and technological prowess make it a formidable player in the crypto market-making arena.

10. Folkvang

Folkvang specializes in mid-cap tokens, bridging the gap between centralized and decentralized exchanges with algorithm-driven liquidity strategies. Their focus on DeFi and ability to adapt quickly to market trends makes them a valuable partner for projects looking to navigate the evolving landscape of cryptocurrency trading.

Conclusion

In 2024, the role of crypto market makers is more critical than ever, ensuring that digital assets remain liquid, stable, and attractive to investors. Whether through cutting-edge technology, extensive market reach, or specialized services, these top market makers are at the forefront of the industry, providing the infrastructure necessary for the continued growth and maturation of the crypto ecosystem. As the market evolves, these firms will continue to adapt, driving innovation and maintaining the delicate balance between liquidity and stability that is essential for success in the digital asset space.