The Art of Whale Tracking: Insights for Successful DeFi Investments

Decrypting Whale Moves: Lessons from Crypto Titans

Introduction to Crypto Whales

In the dynamic ocean of cryptocurrency, “crypto whales” are the large creatures whose movements make waves. These individuals or entities hold vast amounts of cryptocurrency, and their trades can significantly impact the market. Observing these whales offers a unique perspective into the world of DeFi (Decentralized Finance) investing, akin to a strategy of ‘copytrading.’

How Whales Influence the Market

Whales have the power to sway the crypto market in their favor. Their substantial trades can lead to market fluctuations, either by creating a selling frenzy to lower prices for their benefit or by buying in large amounts to spike the price before selling off their holdings.

Impact on Liquidity

- Holding: Some whales prefer to buy and hold, reducing the available cryptocurrency for trading. This scarcity can deter other traders due to concerns about liquidity.

- Liquidity Dumps: When whales sell large amounts of crypto, it floods the market, making the increased supply suspicious to other investors.

Price Manipulation

Whales can manipulate prices by mass selling to create panic or buying in large volumes to inflate prices. This capability allows them to enter or exit positions advantageously.

Why Track Crypto Whales?

For casual traders, whale movements might not be a crucial concern. However, for those heavily invested or actively trading in crypto, understanding whale behavior can be vital. Trading alongside or in anticipation of whale movements can significantly impact one’s investment success.

Tracking Whale Movements

While direct tracking of whales in real-time is challenging, certain tools and indicators can help investors keep an eye on whale activities. Platforms like Whale Alert, ClankApp, and Whale Watcher provide insights into significant transactions and wallet activities.

Whale Strategies Revealed

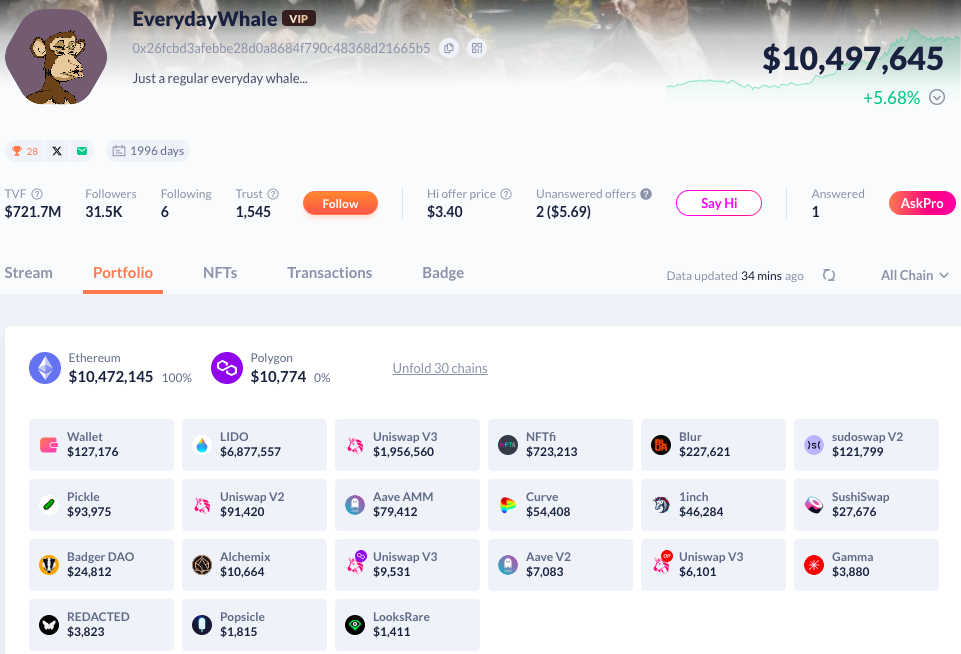

Whale #1 – “EverydayWhale“

-

- 15 Months Ago: $17.6M in Ethereum, earning yield through liquidity provision on Maker and Uniswap.

- Now: $9.9M, primarily staking ETH on Lido.

- Takeaway: Adaptability in investment strategies is key.

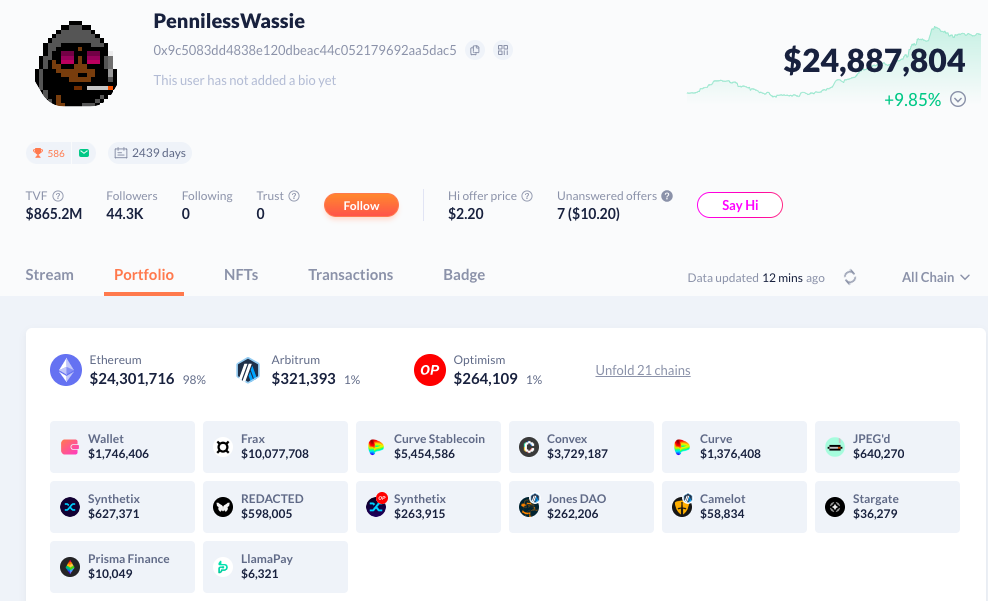

Whale #2 – “PennilessWassie“

-

- 15 Months Ago: $22M, focused on yield farming on Ethereum, Arbitrum, and Optimism.

- Now: $23.1M, still yield farming but with a shift in protocol preferences.

- Takeaway: Even conservative strategies like yield farming can be lucrative, especially with significant capital.

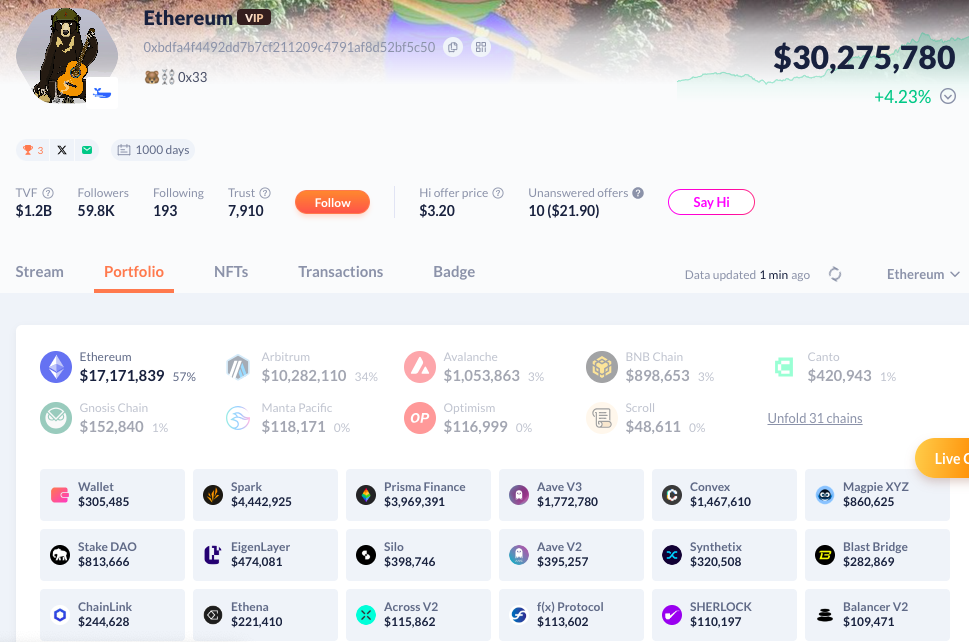

Whale #3 – “Ethereum“

-

- 15 Months Ago: $25.4M, diversified in yield farming across multiple blockchains.

- Now: $29.2M, engaged in a variety of DeFi activities like lending, borrowing, and staking.

- Takeaway: The DeFi landscape is evolving, offering new opportunities for diversified investment strategies.

Conclusion

In the realm of DeFi, following the trail of crypto whales provides invaluable insights. While each investor’s approach should be tailored to their risk tolerance and investment goals, understanding the strategies of these market movers can offer guidance and inspiration. Whether it’s through adapting to new trends or sticking to tried-and-true methods, the world of crypto offers numerous pathways to those who are vigilant and willing to learn from the titans of the trade.