StakeLayer – The Pioneering Bitcoin Restaking L2 Solution

StakeLayer – the 1st-ever BTC Restaking L2 Solution Review.

What is StakeLayer?

StakeLayer introduces a transformative shift in utilizing Bitcoin, the globe’s most decentralized asset, within the expansive realm of cryptocurrencies. This initiative seeks to bridge a significant void in Bitcoin’s applicability across public blockchain networks. Through a groundbreaking framework underpinned by StakeLayer‘s proprietary technology, Bitcoin is positioned to play a pivotal role in enhancing network security and broadening its utility beyond simple transactions and serving as a store of value.

How StakeLayer Works

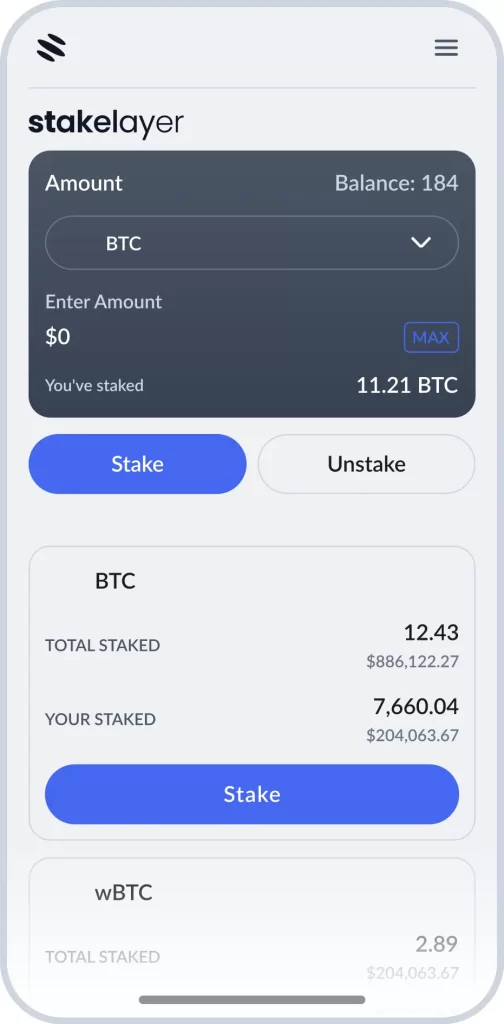

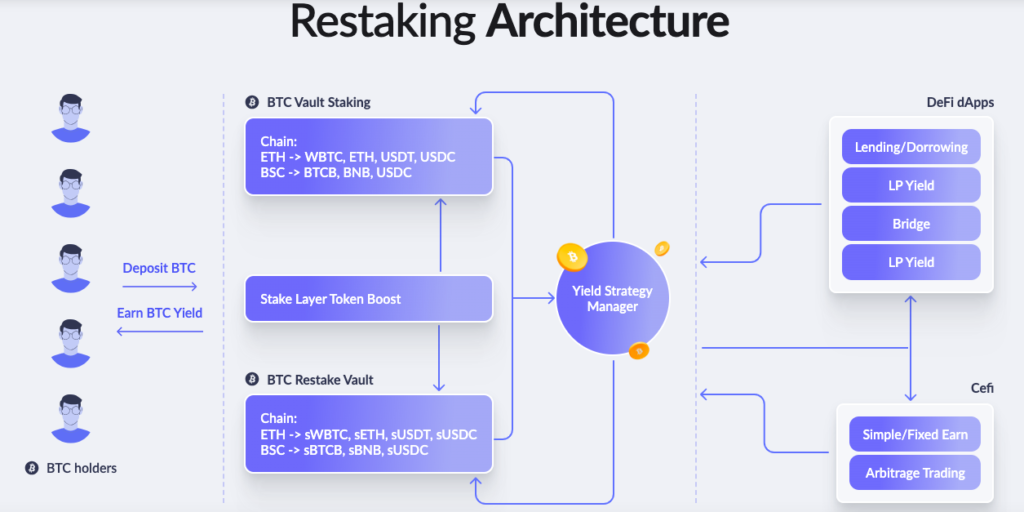

StakeLayer stands as a holistic yield aggregator, focusing primarily on assets such as BTC (WBTC, BTCB), ETH, and stablecoins like USDT/USDC. Its framework is anchored on a system of vaults that allow users to stake funds in exchange for staked tokens, such as sWBTC and sBTCB. The project further includes secondary vaults for staking these tokens, enhancing yield aggregation. A strategy manager backend complements this structure, tasked with identifying high-yield investments.

Incorporating a Mixed PoS Mechanism, StakeLayer enables the staking of Bitcoin as a means to fortify network operations. This not only diversifies the security framework of participant networks but also elevates Bitcoin’s utility, allowing holders to contribute to network security and accrue rewards.

Technological and Security Innovations

StakeLayer ensures compatibility with the Ethereum Virtual Machine (EVM), streamlining the transition of DeFi applications and liquidity into the Bitcoin sphere. This compatibility is key to expanding DeFi, fostering innovation, and developing new DeFi projects directly on Bitcoin, leveraging StakeLayer’s EVM-compatible execution layer.

On-Chain Mirror Mechanism and Vault System

At its core, the on-chain mirror mechanism acts as a crucial layer, replicating Bitcoin holdings onto a blockchain for seamless asset tracking and verification across DeFi and CeFi platforms. This system relies on smart contracts to generate on-chain Bitcoin representations, enabling participation in diverse blockchain-based financial activities without compromising wallet security.

The vault system is foundational to StakeLayer, offering a secure deposit avenue for users. Dedicated vaults for specific assets facilitate depositing and utilization of funds for yield-generating activities. Depositors receive staked tokens as ownership proof, which can further be staked in secondary vaults for enhanced yield optimization.

Strategic and Community Initiatives

StakeLayer’s native token vault encourages staking of its tokens, offering additional yield boosts. The project’s strategy manager backend autonomously navigates the market to maximize yield through dynamic asset allocation across various opportunities, including liquidity provision, lending, and yield farming in DeFi, as well as arbitrage in CeFi.

Emphasizing security, the project employs stringent measures like smart contract audits and risk management protocols to protect user assets. Transparency and governance are paramount, with mechanisms in place for community participation in decision-making processes.

Tokenomics and Roadmap

StakeLayer’s token distribution encompasses a total supply of 5 billion $STAKE, allocated across presales, community incentives, development, team, partnerships, liquidity pools, and marketing efforts. The roadmap outlines a phased launch, beginning with prelaunch initiatives, progressing through alpha release, and culminating in a mainnet launch and ecosystem development.

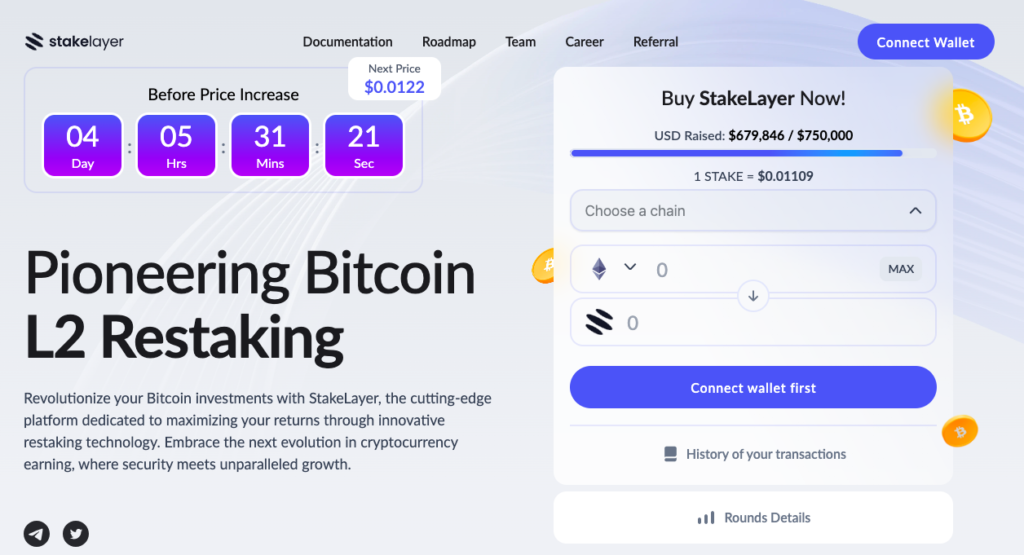

How to Participate in the StakeLayer Presale

Go to https://stakelayer.io/presale

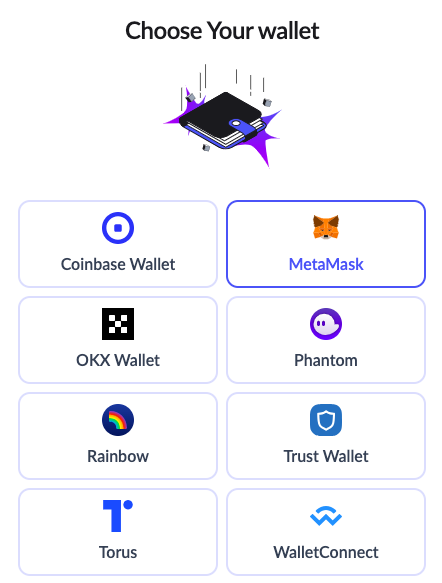

Connect your web3 wallet.

Here we’ll be using MetaMask.

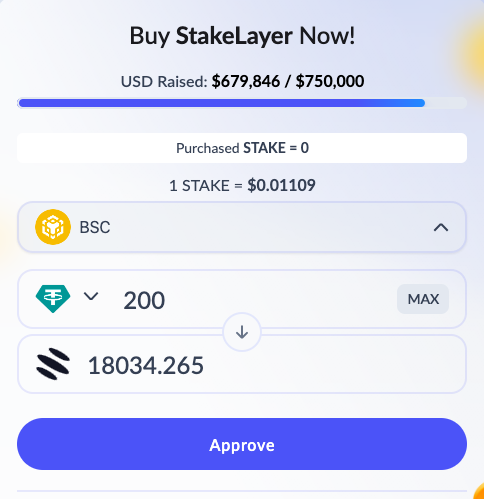

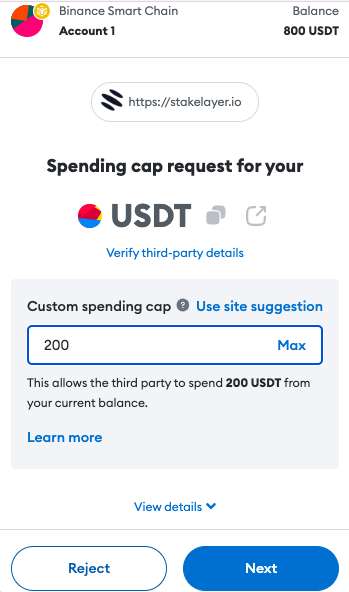

Choose the blockchain network you wish to transact with. We’ll be using the Binance Smart Chain.

Once you choose the amount you wish to spend to acquire $STAKE and approve, the transaction will be initiated.

Set your spending cap.

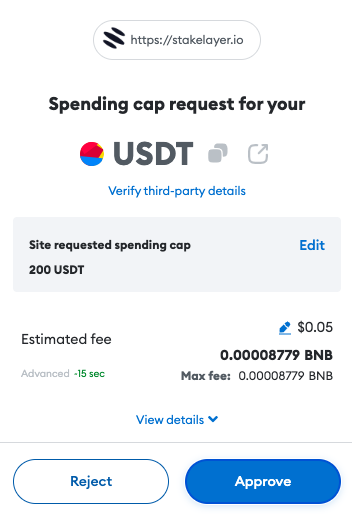

Pay the gas fee.

Your transaction will be initiated.

You’ll be notified once your transaction is processed.

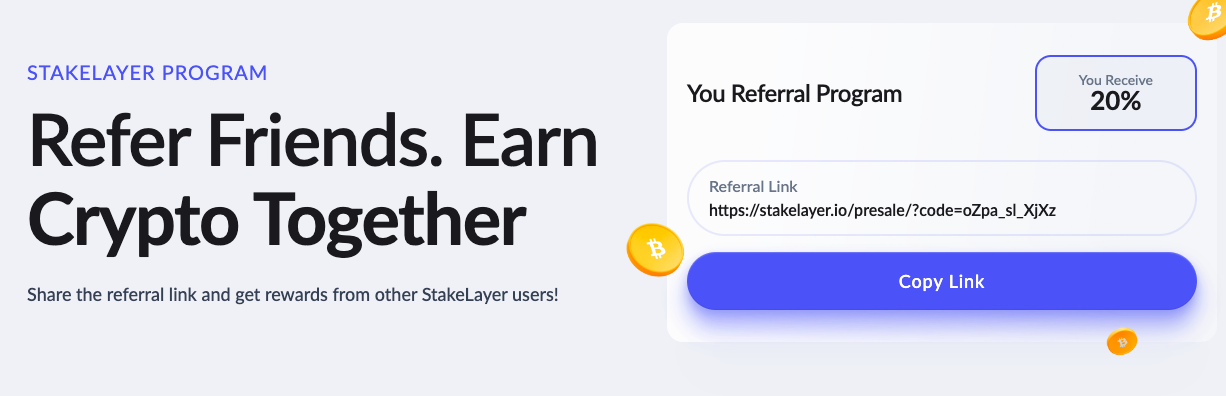

StakeLayer Referral Program

You can also invite friends to StakeLayer and earn rewards.

What Makes StakeLayer Unique?

Despite Bitcoin’s pioneering status and its widespread adoption, likening it to a digital gold standard, its potential to significantly impact decentralized finance (DeFi) and blockchain applications has been hampered by its isolation from current public chains and DeFi protocols.

Bitcoin’s limited supply, fixed at 21 million, underscores its scarcity and underlines its value, mirroring the concept of digital gold. As the blockchain and cryptocurrency domains evolve, integrating Bitcoin into the emerging Proof-of-Stake (PoS) economy becomes a strategic imperative. This integration aims to bolster network security, enrich economic incentives, and unveil new functionalities for Bitcoin, thereby fortifying the DeFi infrastructure and promoting a more inclusive, secure, and efficient blockchain ecosystem.

Understanding StakeLayer Solution

Addressing Core Challenges

StakeLayer confronts two primary challenges: Firstly, the constrained utility of Bitcoin within the prevalent DeFi landscape, primarily driven by Ethereum and other smart contract platforms. Secondly, the imperative for more diversified and secure consensus mechanisms within blockchain networks.

The journey to merge Bitcoin with the PoS economy is laden with hurdles, including technical complexities, regulatory uncertainties, and the challenges of widespread adoption. On a technical level, crafting secure and efficient conduits between Bitcoin and PoS blockchains demands innovative solutions to safeguard asset integrity and security across chains.

Regulatory dynamics require agile adaptation to align with international standards, ensuring the durability of these integrations. Moreover, achieving broad acceptance necessitates a collaborative push from developers, regulatory bodies, and the community to recognize and adopt this new paradigm.

Unlocking Bitcoin’s Restaking Potential

The concept of Bitcoin restaking opens new horizons in the cryptocurrency sphere. It enables Bitcoin owners to “restake” their assets, participating in network security enhancements or other rewarding activities, akin to the staking protocols in PoS cryptocurrencies. This initiative offers Bitcoin holders avenues to generate passive income, enhancing Bitcoin’s appeal not merely as digital gold but also as an actively rewarding investment.

Yield Opportunities for Bitcoin Owners

Presently, owners of Bitcoin, Wrapped Bitcoin, and Binance BTC face limited prospects for on-chain yield generation. This scenario leads to less than optimal capital utilization within the DeFi ecosystem. To address this, an inventive BTC mirror mechanism has been introduced, facilitating diversified income generation avenues for Bitcoin holders across various platforms.

BTC Mirror Mechanism

The BTC mirror mechanism aims to actively engage Bitcoin within both the decentralized and centralized financial sectors. By leveraging this mechanism, Bitcoin owners can now participate in income-generating activities through PoS systems in DeFi and traditional CeFi channels, without transferring their assets off-chain.

Expanding Yield Generation Avenues

This mechanism paves the way for Bitcoin holders to explore various yield-generating opportunities, effectively bridging the gap between on-chain and off-chain financial activities. By employing the mirror mechanism, Bitcoin can be utilized across liquidity pools, lending platforms, and other DeFi applications, while also capitalizing on arbitrage and lending opportunities within the CeFi sphere. This comprehensive approach to yield generation aims to enhance capital efficiency and provide Bitcoin holders with diversified and substantial income streams.

For more, follow StakeLayer on socials:

Official Website: https://stakelayer.io/

Telegram: https://t.me/stakelayer

X: https://twitter.com/StakeLayerIO