SharedStake Ethereum Liquid Staking Protocol Review

SharedStake Decentralized Open Source Protocol for ETH Staking.

What is SharedStake?

SharedStake is a user-friendly, Decentralized Open Source Protocol specifically designed to enable users to stake Ether of any quantity to Ethereum 2, while maintaining the liquidity and value of their staked amount. This innovative protocol ensures that your staked Ether remains an asset with value that can be used.

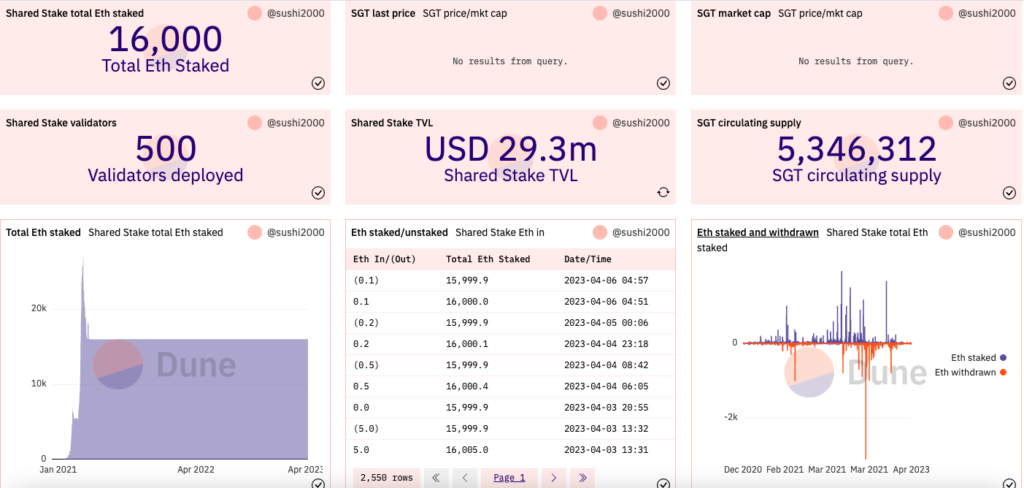

The primary goal of the SharedStake platform in the immediate future is to serve as a gateway for stakers. Simultaneously, it also offers a chance for yield farming with two significant assets generated by the protocol: the validator Eth2 (vEth2) and the SharedStake Governance Token (SGT).

Built to facilitate the transition to Ethereum 2.0 and beyond, SharedStake provides Staking-as-a-Service (StaaS) in a completely decentralized manner. This unique offering is designed to combat the high costs associated with Ethereum 2.0 staking, offering minimal fees as a cost-effective alternative.

As an initial custodial staking service, SharedStake provides an opportunity for anyone to stake their ETH without the burden of maintaining or overseeing validator nodes. In simpler terms, SharedStake alleviates the complexities inherent to ETH 2 staking. Users can stake any amount of ETH by pooling on SharedStake, without worrying about minimum staking requirements.

The platform’s validators are hosted on Amazon Web Services (AWS). Through the introduction of the derivative staking token, vETH2, SharedStake can create a liquid market. This enables participants to exit their positions or make use of DeFi applications even before the launch of Ethereum 2.

Depositing ETH into the SharedStake smart contract automatically mints your staking token. From this point on, you can sit back and relax, as no further actions are required from your end. This seamless process encapsulates the simplicity and ease of use that SharedStake aims to provide for its users.

SharedStake could be the ideal Staking-as-a-Service (StaaS) solution for you if you’re interested in gaining a stake in Ethereum 2.0 under the following circumstances:

- You lack the 32 Eth necessary to become a validator, an amount that equates to approximately $54,400 at the current market rate.

- You possess more than 32 Eth but not an exact multiple of this quantity, a requirement for participating in Ethereum 2.0 staking.

- You prefer not to run your own validator due to concerns about potential slashing penalties that could be triggered by unstable local energy conditions.

- You don’t wish to engage in the complex process of creating your own Eth2 deposit credential through the command line interface.

- You are looking for opportunities to earn yield from investing in Ethereum 2.0 while keeping the risk minimal.

- You are keen on reducing validator node infrastructure costs by sharing them with other participants.

- You want the flexibility to use your Ethereum while simultaneously earning from your staking profits, which currently offer an attractive annual percentage yield (APY) of around 9%.

- You seek peace of mind, knowing that your staking is backed by industry-standard cloud infrastructure with guaranteed uptime, allowing you to sleep soundly without concerns about your investment.

All these features make SharedStake a compelling option for individuals interested in Ethereum 2.0 staking but who want to avoid the technical complexities and high entry threshold typically associated with it.

Benefits of Using SharedStake

One of the primary advantages of SharedStake is the instant gratification it offers to its users. There’s no need to wait to receive the Eth2 equivalent tokens or to file any sort of claim. SharedStakers are rewarded with vEth2 tokens immediately after their transaction has been approved on-chain, making the staking process incredibly seamless.

The user interface of SharedStake is designed to be simple and intuitive, allowing you to stake your Eth with just three clicks on the platform’s website, SharedStake.org. This ease of use significantly reduces the barriers to entry and makes staking accessible to a broader audience.

SharedStakers are also provided with the flexibility to un-stake their Eth at any time by burning their vEth2 tokens. This action is, however, subject to the amount of Ether available in the minter contract. SharedStake’s rolling method of staking and un-staking promotes a healthy growth in Total Value Locked (TVL), while simultaneously affording users the utmost freedom with their Ether.

In comparison, some other protocols have chosen to lock their stakers’ Eth immediately. Furthermore, the documentation provided by these protocols is often lacking in details regarding the possibilities of early withdrawal, leaving users uncertain about their options. In contrast, SharedStake’s transparency and flexibility make it a more attractive choice for those wishing to stake their Ether.

SGTv2 Tokenomics

Please note that there was no airdrop with SharedStake. Instead, a migrator contract was launched on the mainnet. This contract faclitates the conversion of SGT (SharedStake Governance Token) into SGTv2 for those users who choose to go through the process. Users need to activate a “migrate” function on the contract while having SGT in their wallet, which the contract is authorized to utilize.

Upon execution of the function, the contract will burn the specific amount of SGT indicated by the user and, in turn, send an equivalent amount of SGTv2 to the user’s wallet. It’s crucial to note that the conversion ratio will be 1:1 from SGT to SGTv2.

Following this conversion, the SGTv2-ETH liquidity will need to be locked into a VoteEscrow contract to generate veSGT. This token not only carries governance rights but also offers the highest rewards within the SharedStake ecosystem.

This process is designed with protocols such as Pickle, Curve, and Iron in mind. It aims to ensure long-term price stability and liquidity. Moreover, it serves to guarantee that those who have a vested interest in the protocol’s long-term success are the ones who participate in its governance. This strategy is integral to the sustainable growth and development of the SharedStake platform.

How to Buy SGTv2

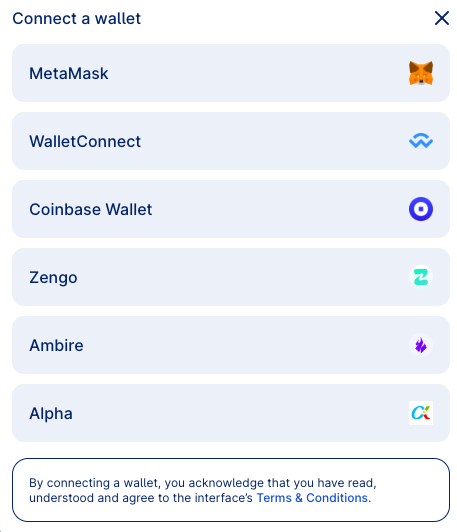

Purchasing SGTv2 tokens is simple. You can simply use a decentralised exchange such as SushiSwap, Uniswap or Balancer. Alternatively, you can use a web3 wallet such as MetaMask and swap another digital asset for SGTv2 tokens.

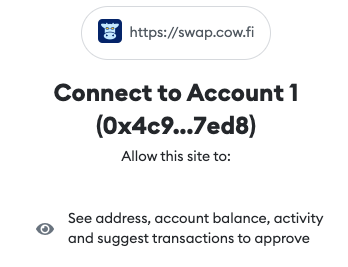

Connect your wallet and go to the Buy SGT $0.388736 tab on the home page. This will redirect you to Cow Protocol

Make sure you import the token contract address into your wallet so that you’re able to view balances.

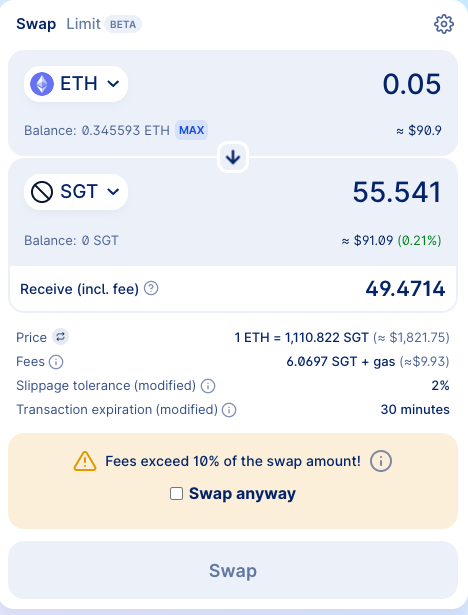

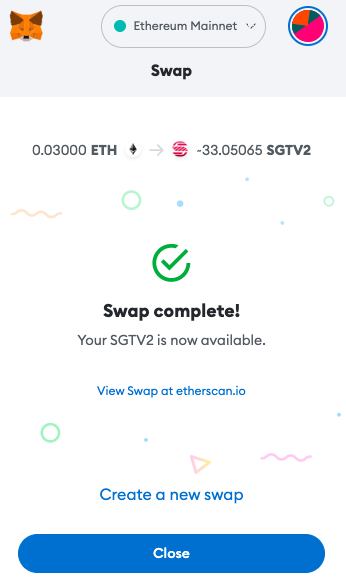

You can swap ETH for SGT.

Submit your transaction.

Your SGTv2 tokens will be credited to your wallet.

Staking ETH on SharedStake

To stake, go to the Stake tab on the home screen.

Choose the amount of ETH you’d like to stake.

Confirm the transaction and pay the gas fee.

You can also explore the farms on SharedStake by clicking the Earn tab on the home page.

Fees

SharedStake is committed to offering the most affordable rates in the market: a mere 0.315% of the deposit (equivalent to 0.1 ETH per validator) and only 5% of the accrued annual percentage yield (APY) after the migration to Ethereum 2.

It’s essential to note that operating a validator node isn’t cost-free. SharedStake, however, is dedicated to ensuring that its members retain as much of their Ether as possible, despite the inevitable infrastructure expenses related to staking setup and ongoing maintenance. Specifically, there is a 0.1 Eth fee per validator for validator lots of 10 and 100, which is utilized to cover infrastructure and labor costs, representing just 0.315% of the deposit. Moreover, since the official launch of Ethereum 2, a small 5% fee is now deducted from the accrued APY.

These fees are priced in vEth2, implying that the amount received after deposit may be marginally less than the initial deposit. Despite this, SharedStake’s rates remain substantially lower than those of competing platforms, representing significant savings for users.

The rate structure will continue to be reassessed through SharedStake Improvement Proposals (SIPs) to identify potential opportunities for further capital efficiencies for SGT DAO (Decentralized Autonomous Organization) members. This ongoing evaluation ensures that SharedStake remains competitive and continues to offer its members the best possible value.

For more check out their FAQ section. Make sure you understand the risks of using these types of platforms. Also check out the code audits.