RubyDex Review: Multi-chain Perpetual Futures Platform for Crypto, Forex, Stocks & NFTs

How to Trade Using RubyDex Layer-2 Derivatives Decentralised Exchange.

What is RubyDex?

RubyDex introduces a groundbreaking Layer-2 Derivatives Dex, designed to deliver the trading experience akin to a CEX, while ensuring users retain complete control of their funds. This platform enables access to hundreds of linear contract perpetual futures across all major blockchains, without requiring users to relinquish control of their assets.

Key Features

A key feature that sets RubyDex alongside other decentralized exchanges is its non-custodial nature. Users are never required to create an account, share personal information, or deposit funds into controlled accounts. Unlike most competitors, which are limited to a few blockchains, RubyDex has plans to expand across all significant Layer-2s and networks, including Arbitrum, Avalanche, BSC, OP, Polygon, zkSync, and more, with each development phase.

Moreover, the Phase 1 release is set to feature over 100 crypto perpetual futures, despite the typically limited asset and currency selection among derivatives Dex. Their 2023 roadmap includes the introduction of crypto indexes and ETF perpetuals, and by year’s end, the addition of perpetuals for stocks, ETFs, stock indexes, commodities, and various traditional financial products. Their permissionless listing model suggests that this is merely the beginning of their market offerings.

To get started on RubyDex, simply visit their website.

Proceed to click the “Trade Now” button to access the trading interface.

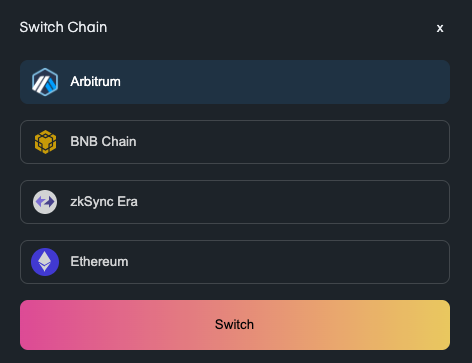

Proceed to connect your wallet and choose the blockchain network you want to transact with. In this demonstration, we will be using the Arbitrum network which provides fast and efficient transactions with low gas fees.

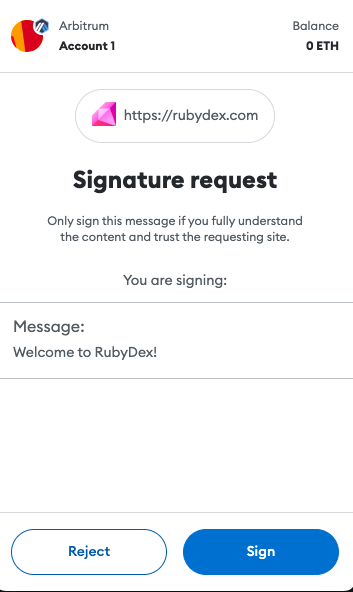

You may be required to sign a transaction depending on the web3 wallet you are using. In this instance we are using MetaMask wallet.

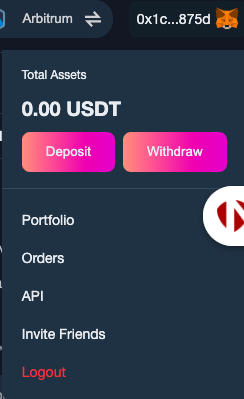

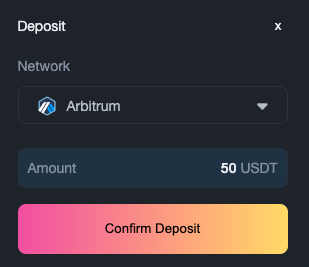

Once your wallet is connected, you’ll need to deposit funds.

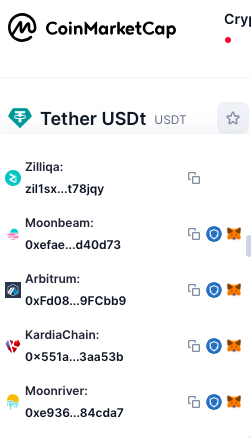

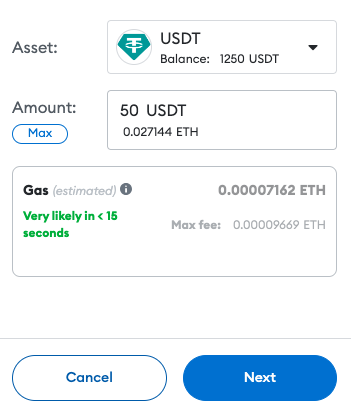

The base asset for trading on RubyDex is USDT.

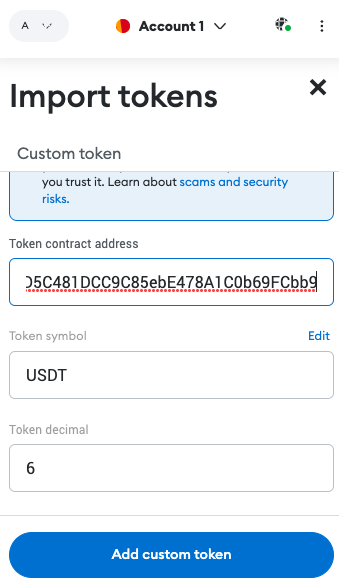

Make sure you add USDT on the Arbitrum network. The contract address for USDT on Arbitrum is 0xFd086bC7CD5C481DCC9C85ebE478A1C0b69FCbb9 and can be found on crypto aggregators such as Coinmarketcap or Coingecko.

Add the contract address to your MetaMask in order to add USDT on Arbitrum.

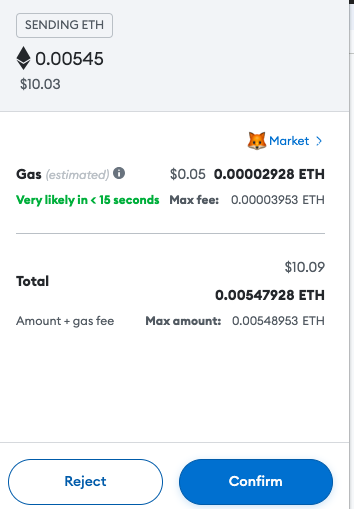

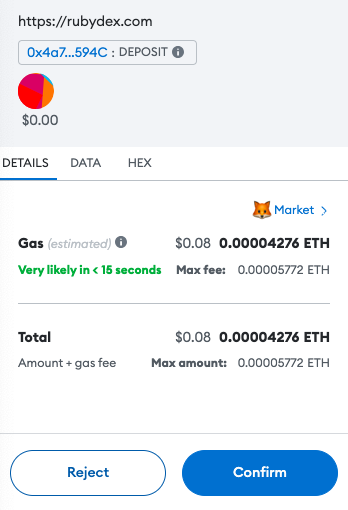

Remember that ETH is used for paying gas fees on Arbitrum network so ensure you have some ETH on Arbitrum network in your wallet as well for gas fees.

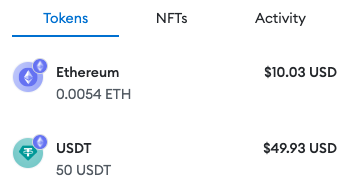

Once you have some ETH and USDT in your MetaMask Arbitrum wallet, you’ll be ready to start trading on RubyDex.

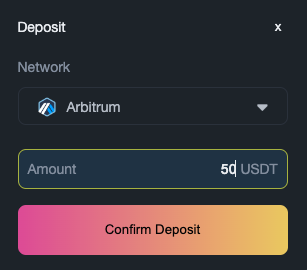

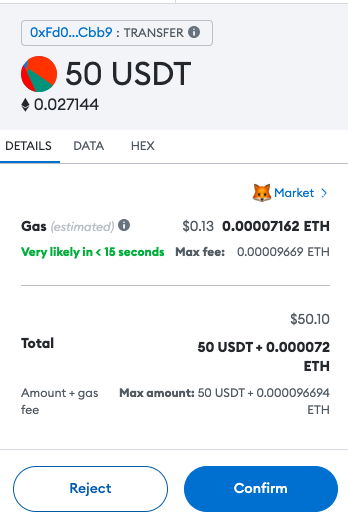

But first, you have to confirm your deposit into RubyDex.

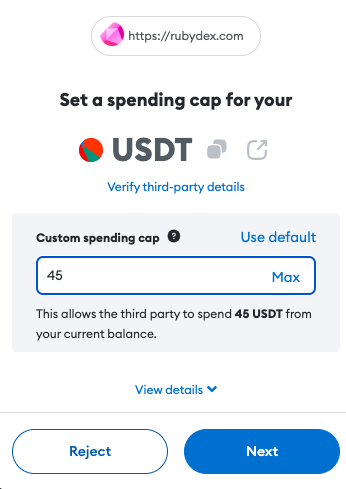

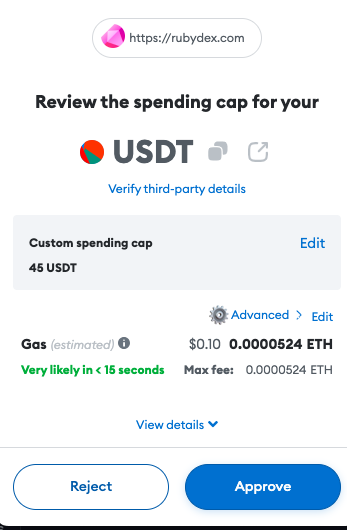

You can also set a spending cap of how much of the total funds you’d be willing to spend.

Pay the gas fee.

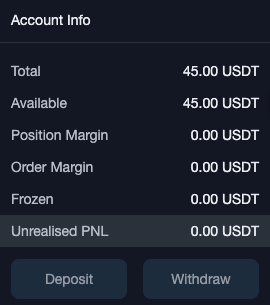

You’ll be able to see from the dashboard once your deposit is successful.

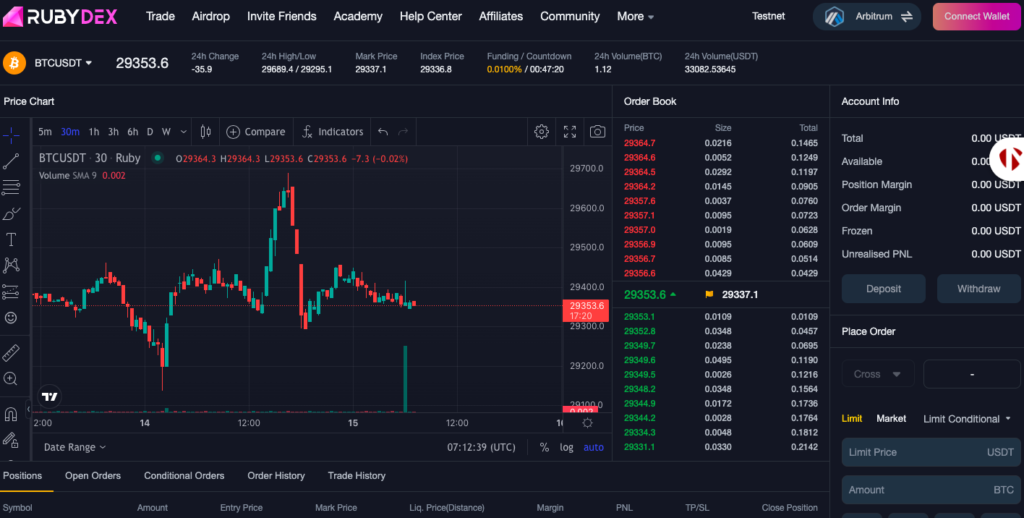

You can then proceed to place an order. You can use isolated or cross margin. Isolated Margin is like putting on your seat belt for a specific trade – it’s designed to limit the potential damage of that one trade. Cross Margin is like using your entire account as a buffer to absorb losses and avoid liquidations, but it could potentially wipe out your entire account if things go very wrong. Choosing between isolated and cross margin depends on your risk tolerance, trading strategy, and how you manage your capital.

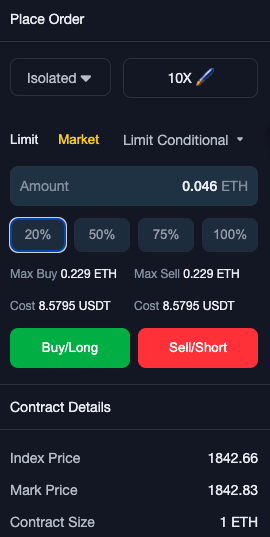

In this demonstration, we are going to be using the isolated margin option using 10X leverage. We are also going to be taking a LONG position on our trade.

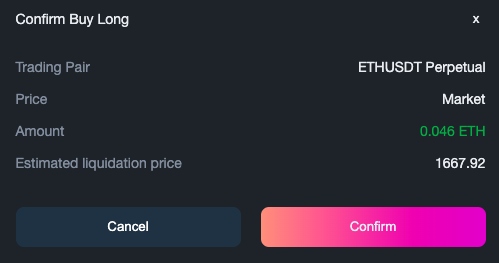

You’ll be able to clearly see on the trading interface the Trading Pair, Order Type i.e. Limit or Market order, Price, Amount and Estimated Liquidation Price.

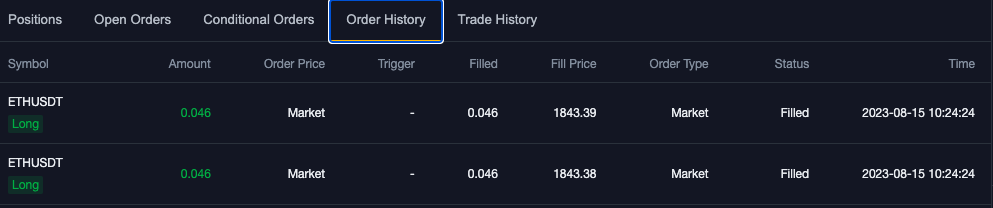

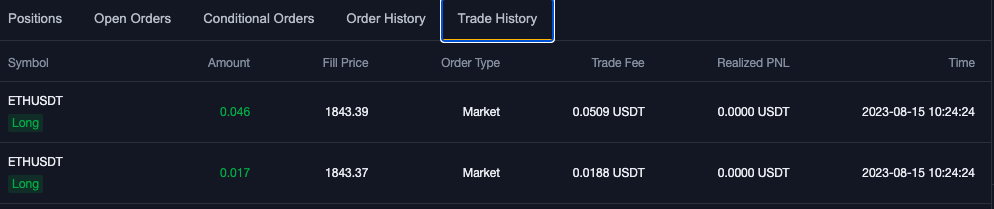

Once your order is successfully placed, you can also view the Position, Order History, and Trade History, etc.

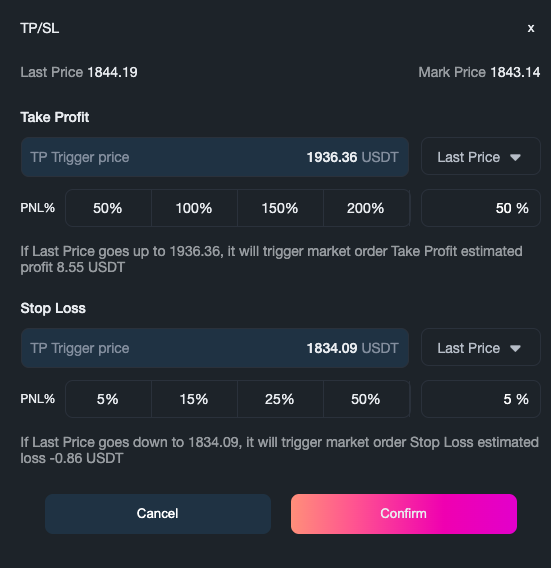

As you can see here, trading perpetuals on RubyDex is a simple and straightforward process. What’s even better is that you can also set your Stop Loss and Take Profit targets for peace of mind and better risk management.

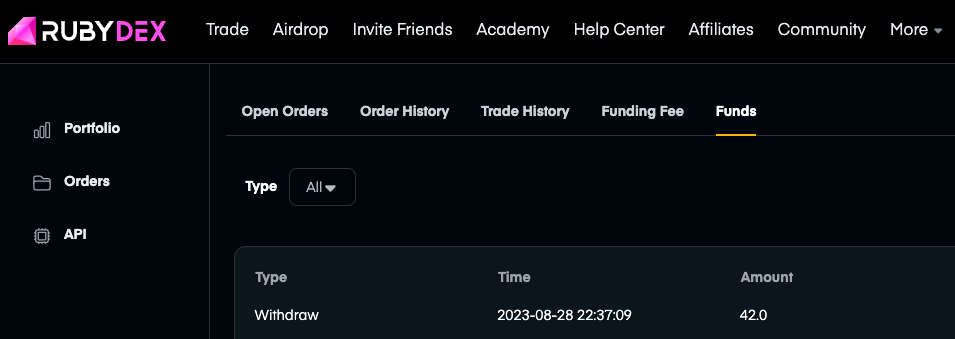

How to Withdraw Funds from RubyDex

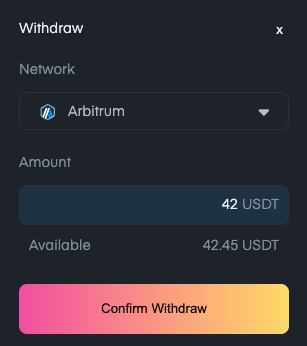

Simply select the wallet, blockchain network and amount you want to withdraw.

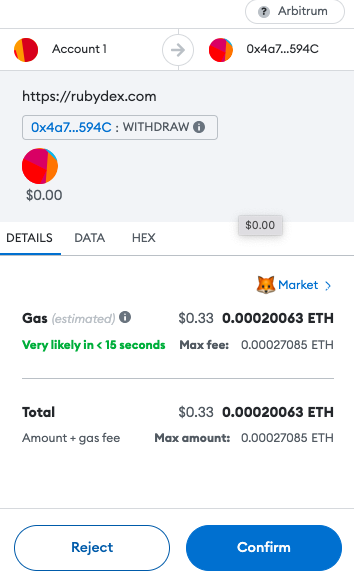

Pay the gas fee.

You can confirm withdrawal via a block explorer and you can also view the transaction history on the dashboard.

Why Use RubyDex?

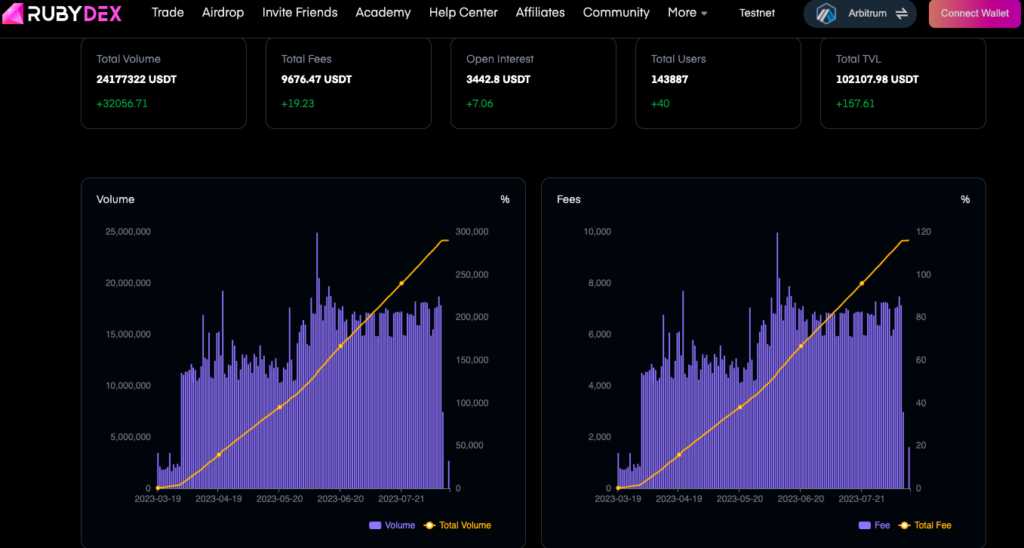

RubyDex distinguishes itself from competitors by its capacity to offer an efficient, liquid, and responsive trading experience, mirroring that of a centralized exchange.

The architecture of RubyDex is uniquely crafted to maximize efficiency, blending centralized and decentralized zones. Users’ funds are safeguarded, as wallets interact exclusively with the platform’s decentralized zones. Centralized zones, encompassing cloud servers, are utilized solely for housing their core trading engines, which are engineered to match the speed of any centralized exchange. Additionally, trading data will be regularly transmitted to their smart contracts to ensure that balances remain updated and accurate.

To achieve superior liquidity, RubyDex implements an Order Book Model, which minimizes slippage and supports limit, market, and various other standard trading functions. This model offers enhanced flexibility for both institutional and smaller traders. RubyDex further refines this approach by introducing an innovative liquidity pool system, geared towards lending assets to professional market makers. This system aids in enriching their order books. Market Makers (MMs) gain an immediate liquidity source directed into their DEX, while Liquidity Providers (LPs) in these pools benefit from flexible APYs, determined by the interest rates paid by market makers.

Complemented by personalized customer support, complimentary educational content, and versatile mobile tools or apps, RubyDex aims to surpass the offerings of any other DEX or CEX.

The Benefits for Traders

Traders using RubyDex are freed from having to entrust their funds to centralized institutions, thereby avoiding inferior service. The worries concerning the potential for CEO misconduct impacting users’ funds become obsolete.

RubyDex users can access the exchange from any chosen blockchain, while maintaining absolute control over their wallets and funds. They can delight in a vast array of listings, including unique perpetual futures of traditional financial assets. Users can trade employing the same order types, speed, and liquidity associated with centralized platforms, but without the associated downsides.

RubyDex invites you to be part of their revolution, aspiring to cultivate more fair and accessible financial opportunities for everyone, steadfast in their commitment to decentralization.

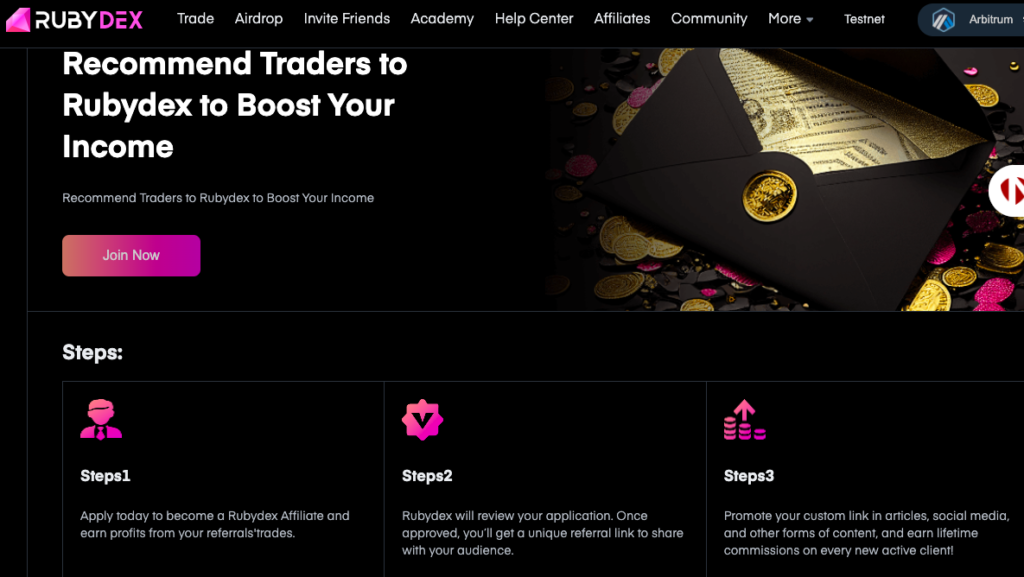

Affiliate & Referral Opportunities to Make Passive Income on RubyDex

Boost Your Income by recommending traders to RubyDex. Simply submit your application today to join the RubyDex Affiliate Program and profit from the trades of your referrals. Your application will be evaluated by RubyDex. Upon approval, a unique referral link will be provided for you to share with your audience. Amplify your earnings by promoting your personalized link through articles, social media posts, and other content channels. You will receive lifetime commissions for every new active client brought in through your referral!

Secure a passive income stream each month from every trader you direct to Rubydex. Benefit from earning 50% of the trading fees generated by your referrals. Additionally, earn a 10% commission on the earnings of your Sub-Affiliates.

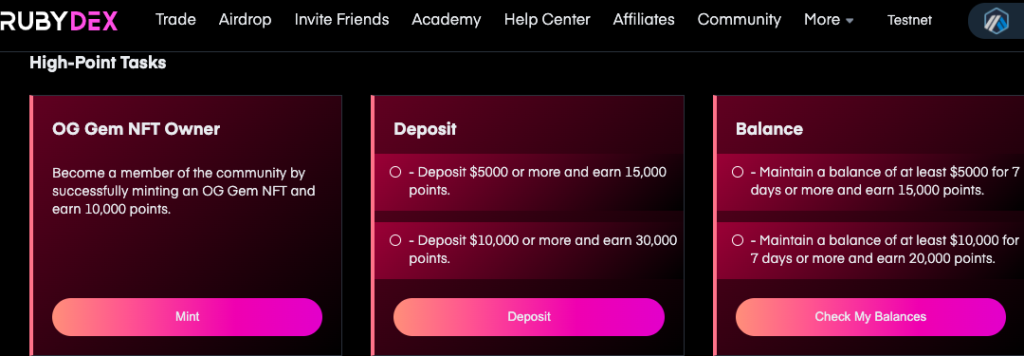

RubyDex Token Airdrop Event

Join in the exciting Airdrop Tasks to unlock remarkable rewards and become a part of the RubyDex token journey! RubyDex is launching a sequence of 3 Airdrop Missions, designed to grant you exclusive rewards. Earn points to access future token airdrop segments.

To participate in this event, ensure that your wallet is linked with RubyDex.

- Points accrued by each wallet address during the event are non-transferable to other wallet addresses.

- Accumulating more points leads to receiving a larger quantity of RubyDex Tokens in an upcoming airdrop.

- For “Asset Tasks,” points will be credited in the subsequent points update if your assets are retained for 7 days or longer within the event period. Retaining assets for less than 7 days will result in no points being awarded.

- “Trading Volume Tasks” involve the actual amount of your trades, multiplied by your applied leverage ratio.

- “High-Point Tasks” are one-off tasks, providing a singular opportunity to secure points rewards. To verify the authenticity of your NFT, make sure to mint the OG Gem NFT at the official RubyDex NFT page (https://rubydex.com/en/campaign/OG_Gem_NFT).

- “Weekly Tasks” are available for completion once a week. RubyDex will compute the points rewards for these tasks from Monday 0:00 am to Sunday 11:59 pm UTC.

- “Special Tasks” are structured to award a higher number of points compared to “Weekly Tasks.”

- Throughout the event, task specifics and associated points rewards are subject to periodic updates.

- All tasks are required to be finalized within the event’s timeframe; submissions post deadline will be considered invalid.

- RubyDex retains the authority to clarify the event’s rules as they find necessary.

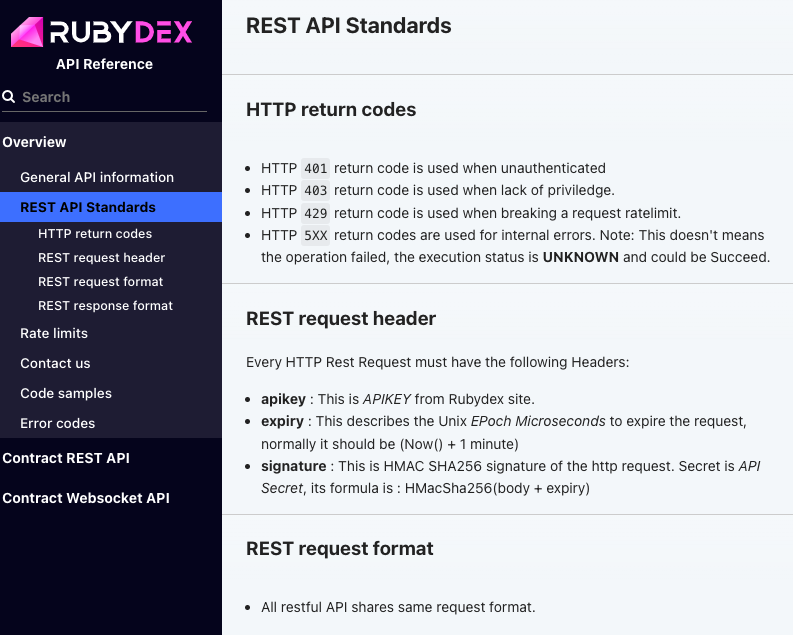

RubyDex APIs

RubyDex offers REST and Websocket APIs to interact with their systems.

RubyDex Blog & Academy

To keep abreast of all the latest news and ecosystem updates, make sure you check out the RubyDex blog where you can learn more about the developments and new feature releases and so much more.