Q3 Crypto Market Insights: Navigating Bearish Trends and Preparing for a Q4 Rebound

Key insights from CoinMarketCap (CMC) Research.

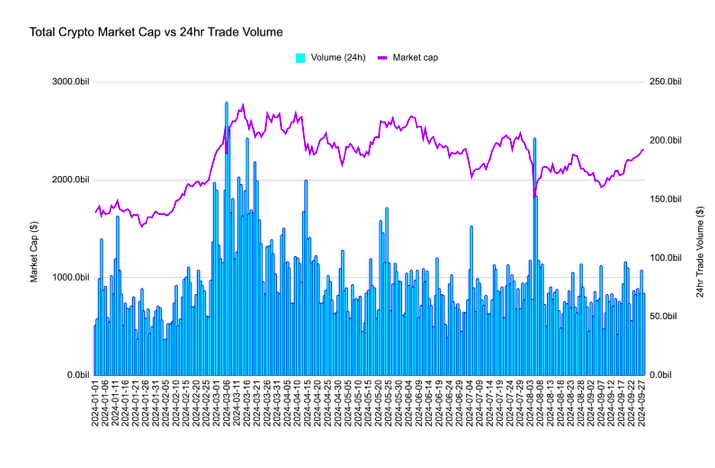

As we enter the final quarter of 2024, the crypto market remains in a state of flux. Q3 was characterized by bearish trends, but several indicators suggest that Q4 could bring a turnaround. This article delves into key insights from CoinMarketCap (CMC) research, covering market sentiment, Bitcoin’s performance, sectoral shifts, and what we can expect going into Q4.

1. Market Sentiment and Bitcoin Dominance

- CMC Crypto Fear and Greed Index: Hovered around neutral at 53, fluctuating between a low of 26 (Sept 7) and a high of 63 (July 22). The market sentiment has been largely bearish throughout Q3.

- BTC Dominance: Rose to 56.8%, the highest level since April 2021, indicating a shift in capital from altcoins to Bitcoin.

- Altcoin Season Index: Currently at 29, reflecting weaker performance across altcoins and increased Bitcoin dominance.

Stablecoin Market Cap Hits an All-Time High

- Stablecoin Market Cap: Surged to $160 billion, a 2.5x increase from April 2021 ($62 billion). This represents massive sideline liquidity, signaling that investors are cautious but ready to re-enter the market when conditions improve.

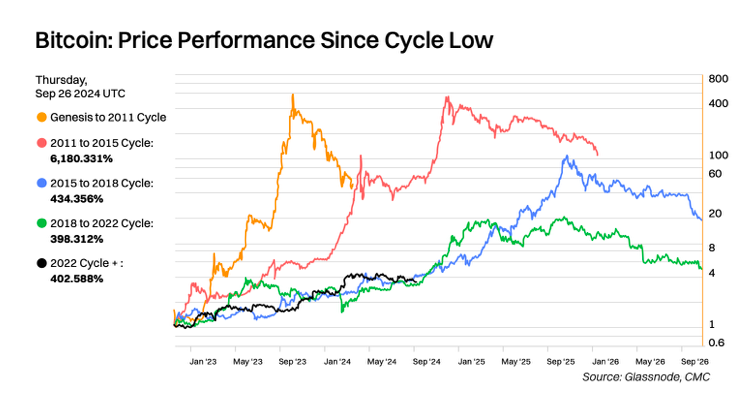

2. Bitcoin’s Halving Cycle: Breaking Tradition?

Bitcoin’s performance is ahead of historical trends, suggesting a potential break from its traditional four-year halving cycle.

- Current Bull Market Progress: We are 40.66% into the cycle, with Bitcoin accelerating by approximately 100 days ahead of its usual schedule.

- Next Peak Prediction: Historical trends suggest Bitcoin peaks between 518–546 days post-halving. However, the next peak could arrive sooner, potentially between mid-May and mid-June 2025.

- “Super Cycle” Indicators: Institutional adoption, Bitcoin ETFs, and market dynamics hint at the possibility of a super cycle that could break the traditional four-year pattern. Bitcoin’s growing correlation with traditional assets like gold and tech stocks underscores its maturation into a broader financial market asset.

Institutional Influence

- Institutional Adoption: Companies like MicroStrategy, hedge funds, and corporations are increasingly adding Bitcoin to their portfolios.

- Bitcoin ETFs: Could funnel significant capital into the market, further supporting the break from the traditional four-year cycle.

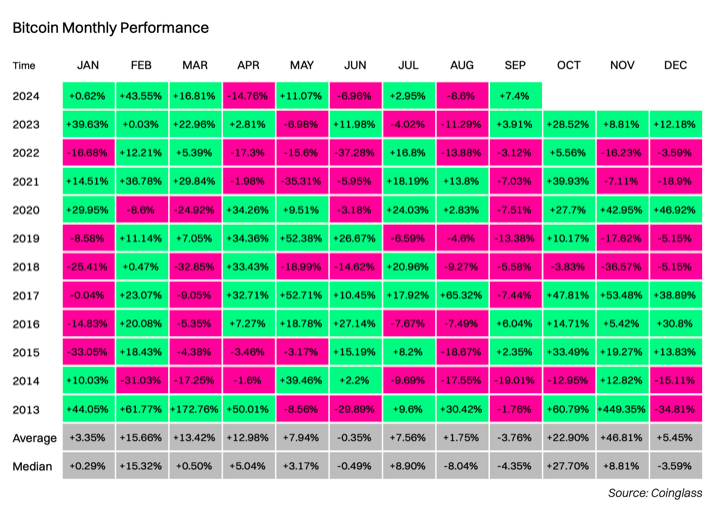

3. Q3 Performance: Bearish Trends with a Potential Q4 Rebound

Bitcoin faced bearish trends in Q3, but historical data suggests Q4 could bring a reversal.

-

Q3 Bitcoin Performance:

- July: +2.95%

- August: -8.6%

- September: +11.39%

-

Historical Q4 Performance:

- October: Averaged returns of +22.90% over the past decade.

- November: +46.81% returns on average.

- December: +5.45% average returns.

- 2024 Context: Earlier quarters saw strong performances (February +43.55%, March +16.81%), positioning Bitcoin for a robust finish to the year.

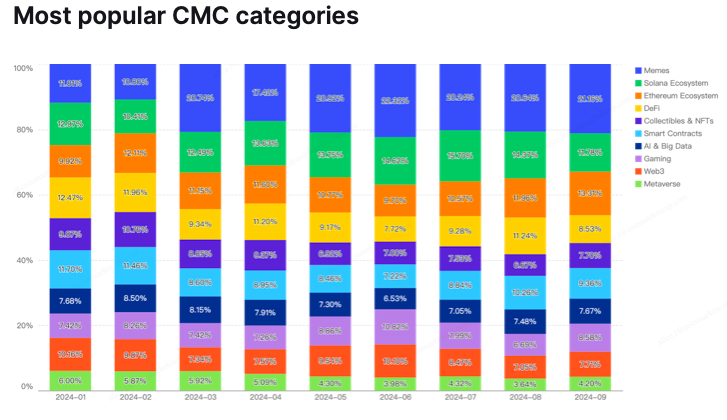

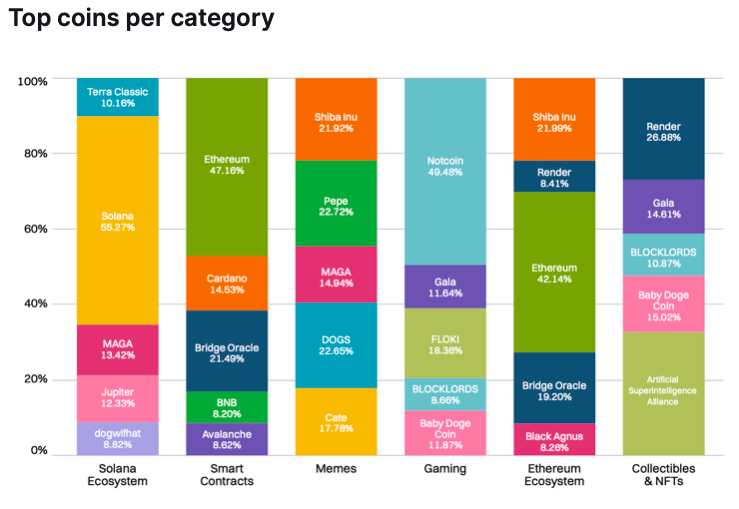

4. Sectoral Shifts in Q3: AI, Media, and Stablecoins Thrive

While some sectors experienced significant losses, others showed resilience and even growth.

- Top Performing Sectors:

- TRON Ecosystem, Media, and Stablecoins: Showed the most prominent growth in Q3, reflecting investor interest in speculative and consumer-focused sectors.

- AI Sector: Saw a notable recovery as blockchain projects began integrating AI capabilities.

- Struggling Sectors:

- DeFi and Infrastructure: Suffered steep market cap losses:

- Lending & Borrowing: -36.51%

- Storage: -39.21%

- Privacy: -30.75%

- Governance: -17.61%

- DeFi and Infrastructure: Suffered steep market cap losses:

Shift from DeFi to Consumer Sectors

The move away from foundational blockchain sectors like DeFi and infrastructure towards consumer-focused projects such as AI and media indicates changing investor priorities in a volatile market.

5. Bitcoin Holders: Long-Term Holders Outpace Short-Term Holders

A significant development in Q3 was the shift in Bitcoin holder dynamics.

- Short-Term Holders: Initially surged as BTC rallied from ~$38K to ~$71K between Dec 2023 and April 2024.

- Long-Term Holders: Since the market downturn in April, long-term holders have been accumulating more Bitcoin, outpacing short-term holders.

- Hash Rate: Despite a decline in miner revenue following the halving event, Bitcoin’s hash rate increased by 14.7%, reaching a record 692.28 exahash per second (EH/s) in September 2024. This shows the resilience of Bitcoin miners despite challenging conditions.

6. Layer-1 and Layer-2 Networks: Solana and Base on the Rise

Q3 saw significant developments across Layer-1 and Layer-2 networks.

-

Layer-1:

- Solana: Surpassed TRON in daily active addresses and saw consistent growth, though some activity was attributed to bots.

- Ethereum: Erased earlier gains YTD due to ETF outflows but bounced back later in September (+14.61% YTD).

- TRON: Gained 21.51% in Q3, driven by Justin Sun-backed initiatives and strong liquidity.

-

Layer-2:

- Scroll: The only Layer-2 to see TVL growth (+38.5%) in Q3, driven by airdrop programs and liquidity incentives.

- Base Network: Flipped Optimism in TVL and took the lead in daily active addresses following the launch of its “Onchain Summer” campaign.

7. DeFi Struggles Continue, But Bridges and Derivatives Gain Ground

-

DeFi TVL: Down 21.4% from its yearly high amidst challenging market conditions.

- Lending: Remains the largest DeFi sector but saw a 9% drop in TVL in Q3.

- Bridges and Derivatives: Showed gains in TVL, hinting at emerging opportunities in the cross-chain and financial derivatives space.

-

Lido: Continues to lead DeFi apps by TVL, though its market share fell from 31.9% to 28.4% in Q3 as new competitors entered the market.

8. Anticipating a Q4 Rally: Key Factors to Watch

As we head into Q4, several factors could drive a strong Bitcoin rally:

- Historical Q4 Performance: Bitcoin has averaged a 90.33% price increase in Q4 over the past 10 years.

- Stablecoin Liquidity: The $160 billion stablecoin market cap represents massive potential capital ready to re-enter the market.

- Institutional Inflows: Bitcoin ETFs and continued institutional adoption will play a critical role in boosting market confidence.

- Macro-Economic Conditions: Inflation, geopolitical tensions, and U.S. regulatory developments could either accelerate or hinder Bitcoin’s growth.

- Political Influence: U.S. election outcomes in November may stabilize market uncertainty, potentially triggering a stronger crypto market environment.

Conclusion: A Bearish Q3, But Q4 Could Bring a Strong Rebound

While Q3 saw a bearish crypto market marked by volatility and sectoral shifts, the outlook for Q4 remains optimistic. The combination of historical Q4 strength, institutional interest, and sideline liquidity suggests that Bitcoin and the broader crypto market could experience a strong finish to 2024. Investors should keep a close eye on key drivers, including ETF inflows, regulatory developments, and broader macroeconomic conditions, as these will likely determine the extent of the potential rally.

Credit: Coinmarketcap.