Paxos – Regulated Blockchain Infrastructure Platform Review

A Complete Guide to Paxos – USDP, PAXG, etc.

What is Paxos?

Operated by Paxos Trust Company, LLC – a New York State chartered limited purpose trust company, Paxos offers blockchain solutions to help tokenize, custody, trade and settle assets for enterprise clients.

Paxos is regulated by the New York State Department of Financial Services (NYDFS). Trust companies are typically subject to stringent regulatory oversight which makes them safer than most regulated exchanges that only have a BitLicense or Money Services Business (MSB) designation. Paxos has to undergo regular exams and independent third-party audits routinely to have its financials audited and controls assessed across financial reporting, operations, compliance and information security.

Paxos is also required to meet specific NYDFS capital reserve, consumer protection, compliance, and anti-money laundering requirements. Additionally, Paxos works with Withum, a nationally ranked auditing firm in the USA which independently verifies that the entire supply of USDP for instance, which is the stablecoin managed by Paxos, is consistent with USD reserves in Paxos accounts that are held at U.S. banks. Paxos also publishes monthly reserves holding reports.

Paxos – Company Profile

Paxos’ goal is to offer blockchain-based infrastructure that bridges traditional markets with digital asset ecosystems. Paxos has been an early mover in the digital asset space launching the first regulated crypto exchange, itBit in 2012. Paxos was also the first company to be granted a New York State Department of Financial Services Trust Charter for Digital Assets. In 2018, Paxos also made another historic achievement by issuing the world’s first regulated stablecoin, PAX which has now been rebranded as USDP. Paxos didn’t stop there, the following year it also issued the world’s first regulated gold-backed token known as Pax Gold (PAXG).

To date, Paxos remains the only company to receive SEC permission to pilot stock trade settlements using blockchain technology. It is also the first crypto-native company to receive preliminary approval for a de novo national Trust Bank charter. The board of Paxos includes credentialed experts including Sheila Bair, Former Chairman of the FDIC and Bill Bradley, Managing Director of Allen & Company and Former U.S. Senator for New Jersey.

With more than half a billion dollars in funding from leading investors such as PayPal Ventures, OakHC/FT, Declaration Partners, and Mithril Capital, Paxos focuses on three core areas of business operations:

- Enterprises Solutions – by providing turnkey APIs that make it possible to whitelabel stablecoins and enable crypto capabilities.

- Institutional Trading – by offering regulated tokenized assets and digital asset exchanges for institutions.

- Settlements – by providing blockchain-based settlement for securities and commodities.

What Products/Services Does Paxos Offer?

Paxos key product offerings include:

- PAX Gold – allocated gold stablecoin managed by the Paxos Trust Company, LLC.

- Pax Dollar or USDP – US dollar stablecoin managed by Paxos and formerly known as “Paxos Standard” or “PAX.”

- Exchange – over-the-counter trading services for Pax Dollar, PAX Gold and BUSD.

To get started with Paxos, a sign up and verification procedure has to be followed. Depending on whether you’re registering as an individual or institution, you’ll be required to submit various documentation and go through the relevant KYC and AML checks.

Some of Paxos’ clients include:

Paxos Crypto Brokerage

Paxos provides a crypto brokerage service and regulated blockchain infrastructure with qualified custody, licensing and trading. The capabilities are securely enabled via an API-first platform.

Paxos Stablecoins & Payments

Paxos provides blockchain-based solutions for payments, money movement and settlement with over $19B of stablecoins issued. Paxos reserves are held 100% in cash and US treasuries. This means that customer funds should always be available for 1:1 redemption.

What’s great about Paxos assets is that they are fully segregated. This means that in the event that Paxos Trust becomes insolvent, under New York banking law, customer assets would not be used to satisfy the debts of Paxos since client assets are actually supposed to be held bankruptcy remote.

Pax Gold (PAXG)

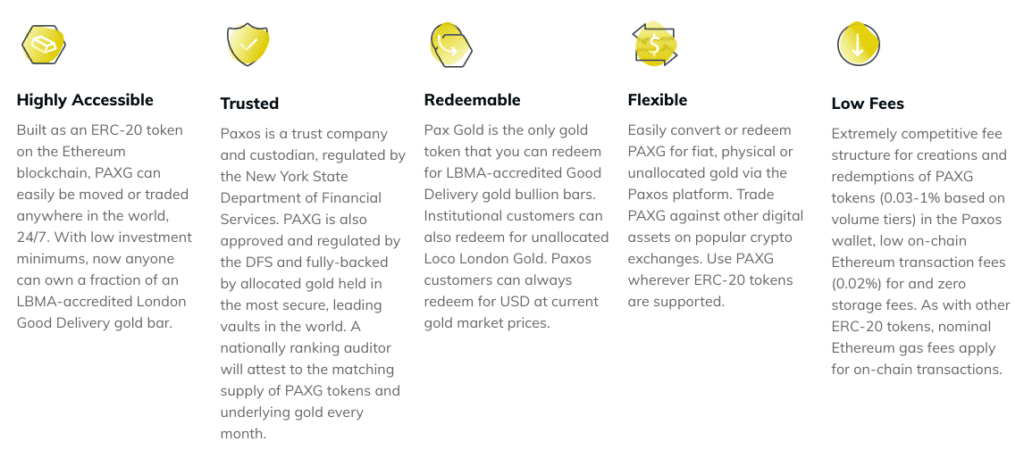

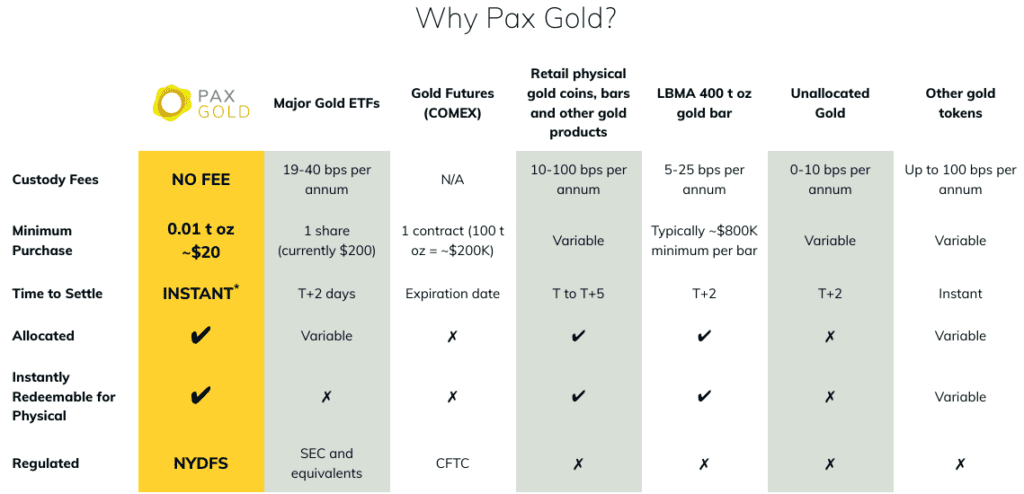

Paxos offers a digital token that is called Pax Gold (PAXG) and is backed by physical gold. Each token is essentially backed by one fine troy ounce (t oz) of a 400 oz London Good Delivery gold bar, stored in Brink’s vaults. Anyone who owns PAXG actually owns the underlying physical gold that is held in custody by Paxos Trust Company.

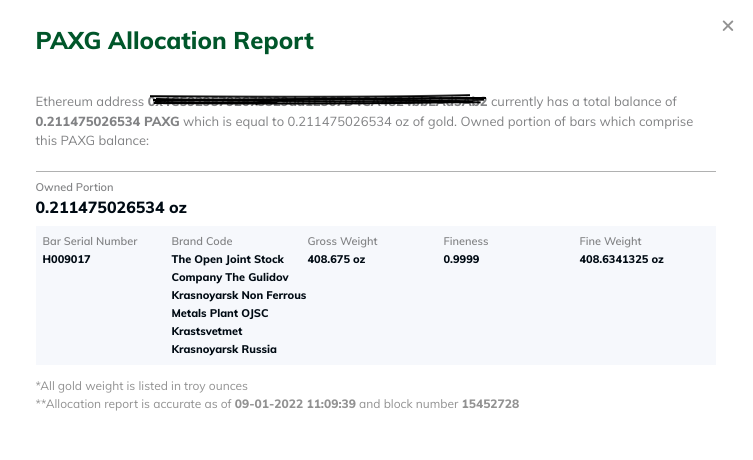

What’s great about Paxos is that you can also verify your gold allocation using your wallet address.

itBit Exchange

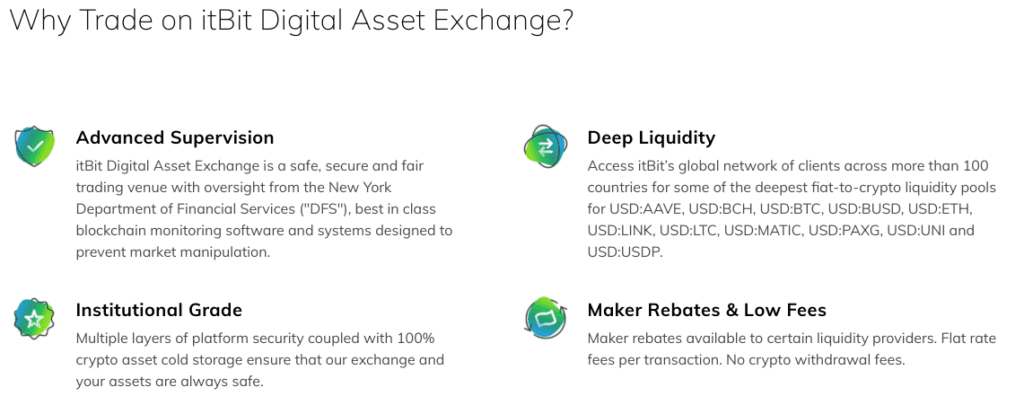

Paxos offers crypto asset trading that is tailored towards institutional investors via the itBit exchange platform which has automated trading solutions for institutions and algorithmic traders.

Paxos Settlement Service

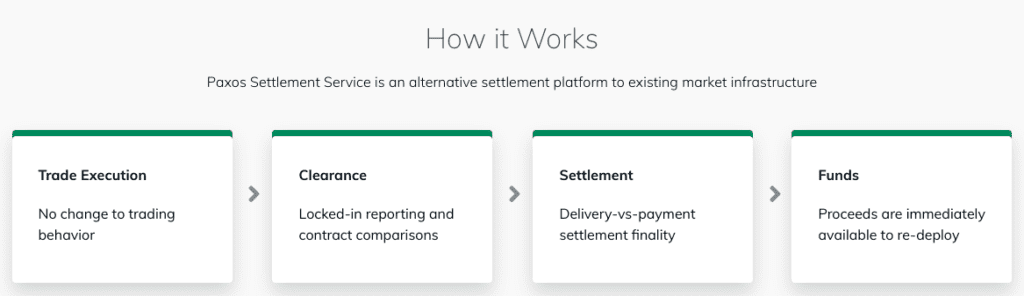

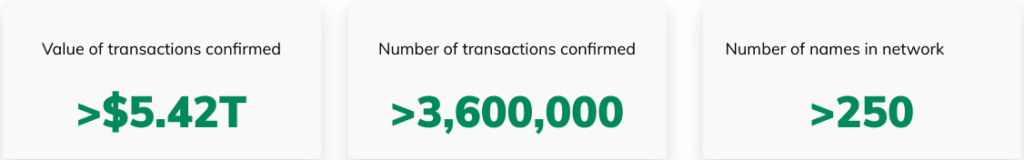

Built on a private permissioned blockchain platform that is interoperable with existing settlement systems, Paxos Settlement Service (PSS) utilizes a hybrid settlement model, improved margin, real time multilateral netting and scalable tech.

Paxos’ solution to clearing and settlement is aimed at increasing efficiency, saving capital and shaping future market infrastructure.

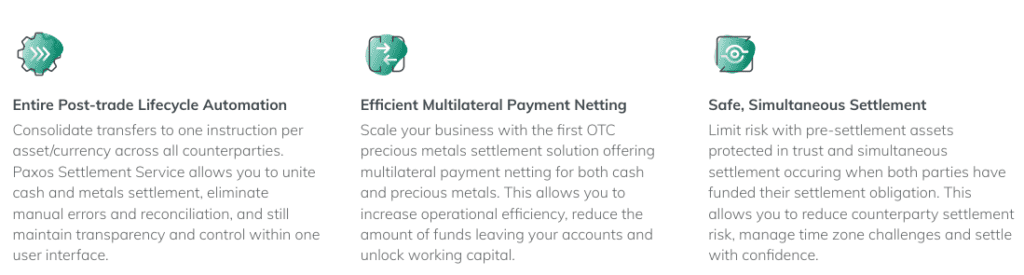

Paxos also offers a Settlement Service for Commodities that is meant to deliver fully automated management of the entire post-trade lifecycle; including multilateral payment netting and simultaneous settlement for the OTC commodities market.

Conclusion

Paxos is a new-age fintech company that is on a mission to modernize finance by mobilizing assets at the speed of the internet. The co-founder and CEO is Charles Cascarilla. Paxos uses blockchain technology to tokenize, custody, trade and settle assets. The entity operates a crypto brokerage, a US equities settlement service, post-trade automation for commodities and FX markets. Paxos also offers a US dollar-backed Stablecoin and PAX Gold – a digital token that is backed by physical gold. Paxos’ customers include PayPal, Revolut, Credit-Suisse, Societe Generale, among others.