What is the Orion Protocol?

Orion Protocol is a liquidity aggregator designed to aggregate the liquidity of crypto markets. The protocol is governed by a proprietary Delegated Proof of Broker staking mechanism. Orion is described as a DeFi platform that combines the best features of exchanges, brokerages, and instant trading apps.

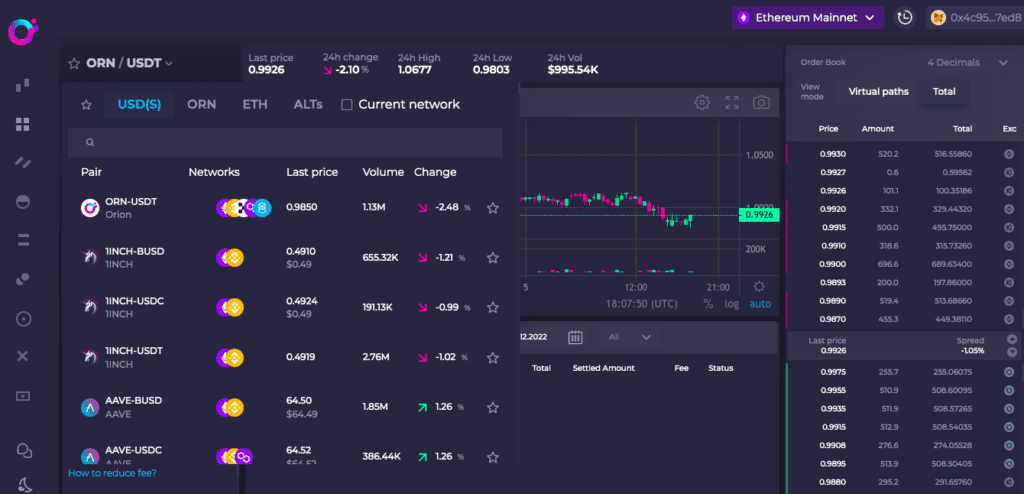

Through the liquidity aggregator, Orion connects to the major crypto exchanges and swap pools – both centralised and decentralised, and in doing so – makes it possible for users to access the best prices for their trades from a single portal.

Orion also offers tools for portfolio management and caters to both experienced and novice traders. The native token of the Orion platform is $ORN, an ERC-20 token. Orion Protocol is meant to be an open source repository for decentralised applications (dApps) which means enterprises and developers can also build custom tools.

Orion’s matching engine is designed to connect to dozens of different exchanges in real time. By utilising combined order books to enable users to trade cryptocurrencies at the best prices, Orion aims to save users on costs.

What makes the Orion Protocol unique?

-

- Orion protocol facilitates non-custodial portfolio management which means that users have the ability to give third parties their assets to manage, without having to give up custody of their digital assets.

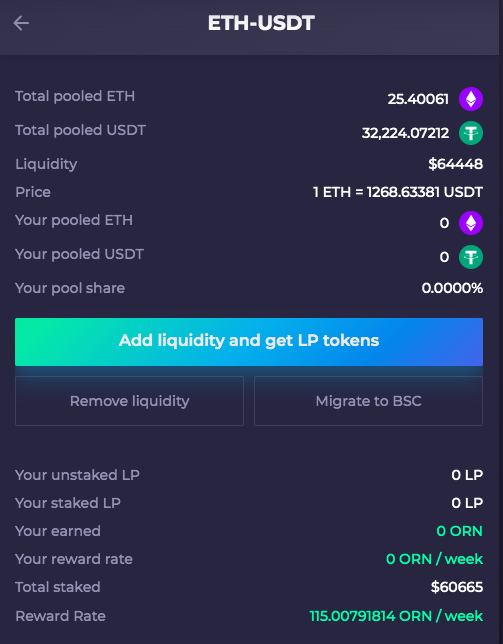

- Orion is meant to increase liquidity and market depth through combining order books from multiple exchanges.

- Orion trading platform allows traders to find the best available spot prices and submit their preferred trades.

- The trading terminal offers great price execution across all exchanges from a single account.

- Users don’t need to hold separate accounts for different crypto exchanges since Orion Terminal makes it possible for them to buy and sell popular digital assets for the best executable price and with the lowest possible fees.

- The interface is user-friendly for both professional and retail traders and has interactive charts, online analytics, etc.

- High frequency trades can be executed on Orion with trades on multiple exchanges possible with a single API.

- The protocol generates revenue from transaction fees and internal order matching.

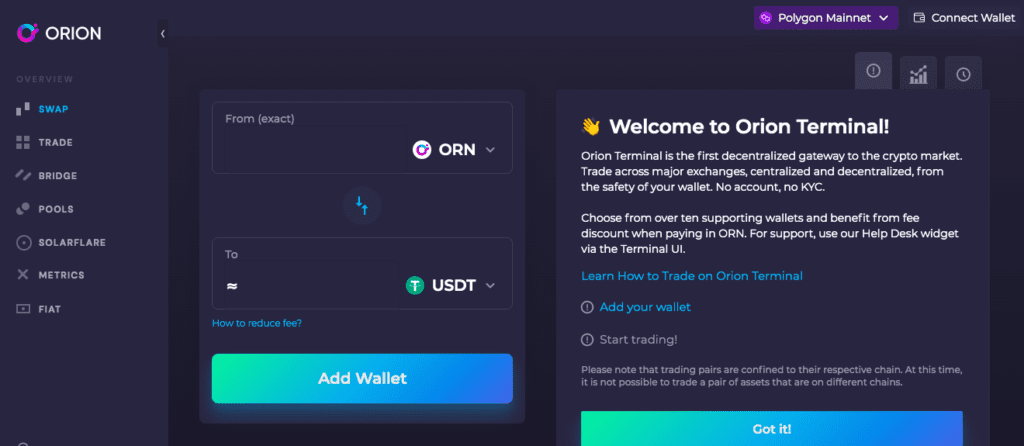

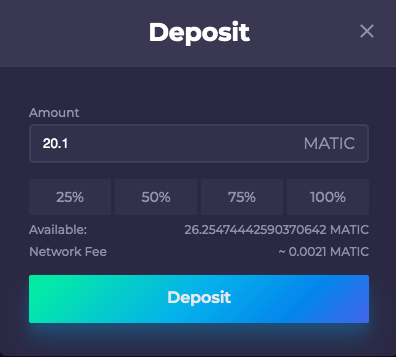

If interested in staking or trading $ORN pairs, you purchase the native token and deposit on the platform. Initially, we tried to connect to Orion on the Polygon network.

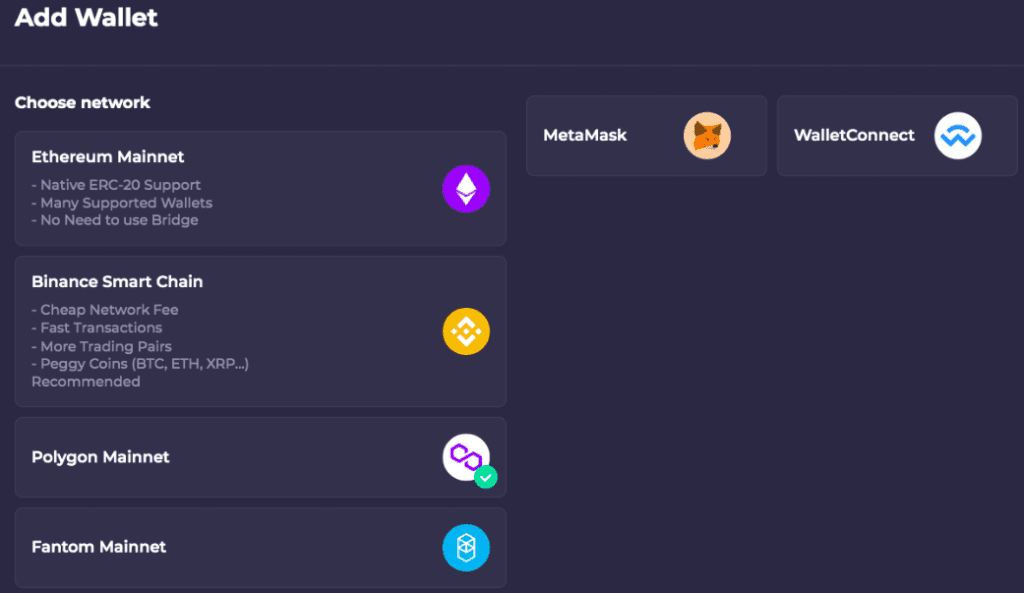

You will have to choose which wallet you’d like to connect using. In this case, we connected a MetaMask wallet.

Once you’re connected, you can then execute different functions including swaps.

We did note however, that Orion Protocol has more total value locked (TVL) on the Binance Smart Chain compared to Ethereum or Polygon.

You can switch to the network of your preference.

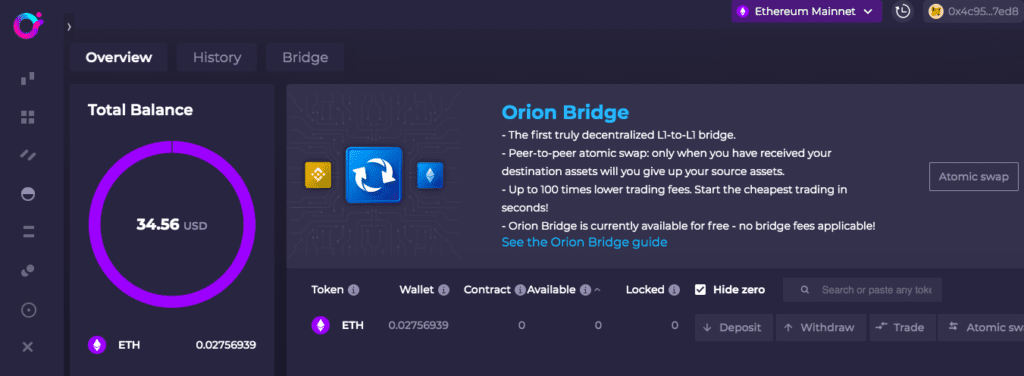

If you’d rather bridge assets from one network to another you can also do that.

As a test transaction, we’ll swap some $MATIC for $ORN.

As a test transaction, we’ll swap some $MATIC for $ORN.

Once you accept the gas fee you can then proceed to execute the swap.

Once the transaction is processed, you can verify the transaction on the blockchain using a block explorer such as Polyscan which is for the Polygon network.

Now that funds are deposited, you’ll be able to use the platform to trade, stake and participate in liquidity pools plus so much more.

Orion has a comprehensive resources page you can go through for more info. You can also read the whitepaper. Please do your own research before using any platforms and understand the risks involved when using any web3 tools.