Opyn Squeeth DeFi Strategies & Perpetual Options Review

Opyn Squeeth (OSQTH) DeFi Yield Strategies & Power Perpetual Options Contracts.

What is Opyn (OSQTH)?

Opyn, Inc. operates the https://www.opyn.co/ interface which provides access to a decentralized protocol on the blockchain that allows users to transact certain digital assets through power perpetual contracts.

Opyn is designed to provide open finance through DeFi strategies and perpetual options. Credited with pioneering DeFi’s first options protocol and the first perpetual option – Opyn Squeeth; Opyn is also favoured for its strategies that are intended to help DeFi users put their digital assets to work by, for instance, by simply depositing USDC or ETH on the platform and letting the smart contracts do the rest.

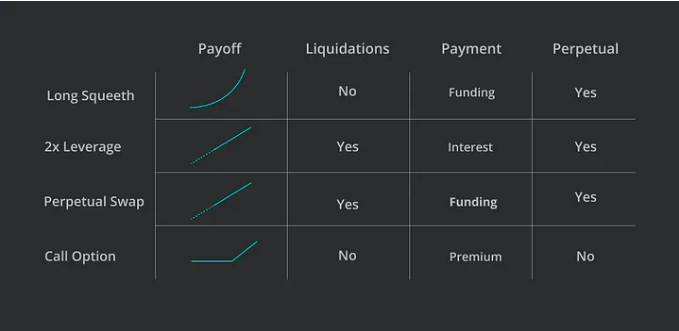

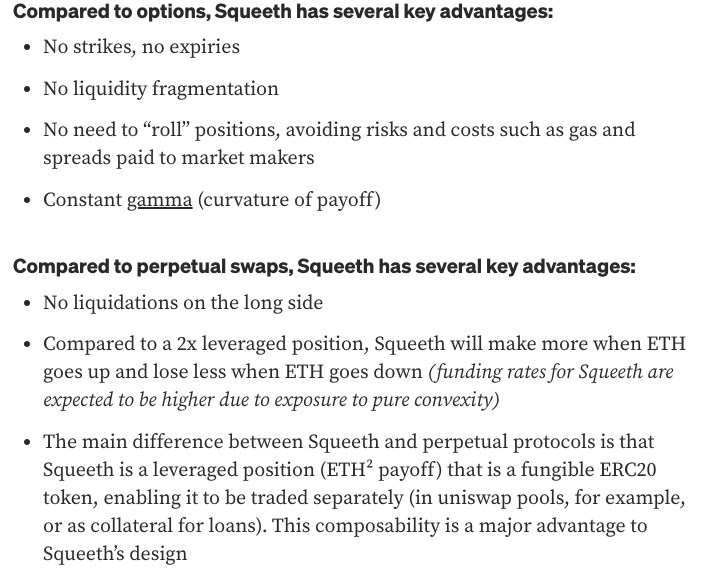

Squeeth (squared ETH) is described as a new financial derivative that was invented by the research team at Opyn. Squeeth is deemed the first Power Perpetual that gives traders perpetual exposure to ETH². Mechanistically, Squeeth functions similar to a perpetual swap, tracking the index of ETH² rather than ETH. It is meant to provide global options-like exposure (pure convexity, pure gamma) without the need for either strikes or expiries, effectively consolidating much of the options market liquidity into a single ERC20 token.

In short, Squeeth makes options perpetual and is a very effective hedge for Uniswap LPs, all ETH/USD options, and anything that has a curved payoff.

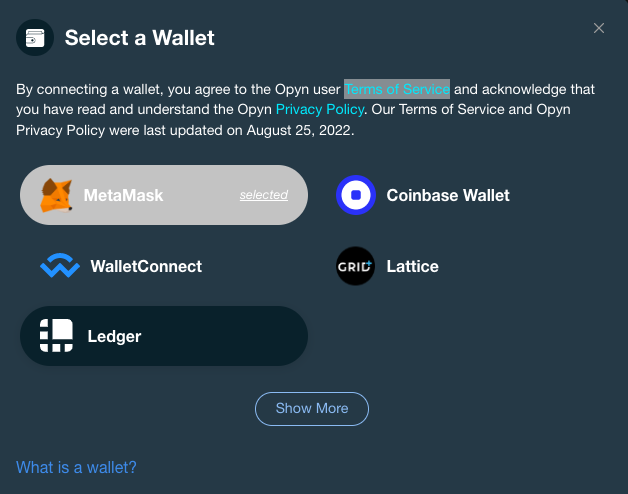

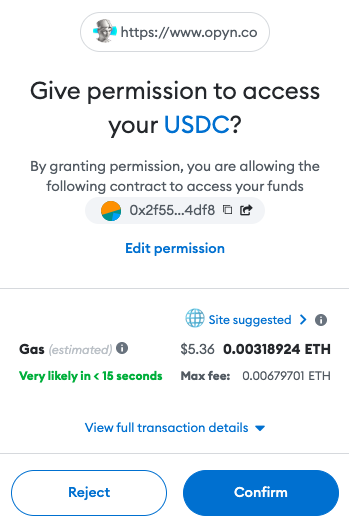

To get started on Opyn, you need to connect your web3 wallet e.g. MetaMask.

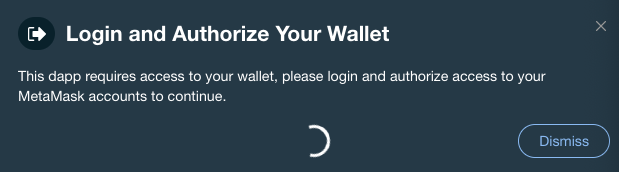

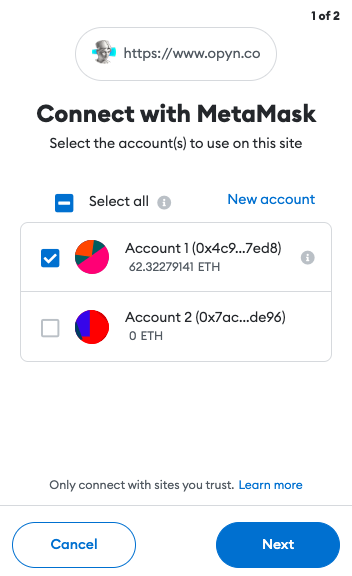

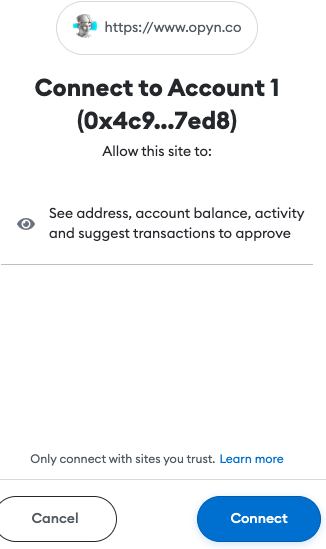

In order to allow the smart contracts on Opyn to interact with your wallet, you’ll be required to give authorization.

Once your wallet is connected you’ll be able to utilise Opyn’s strategies and also long/short Squeeth.

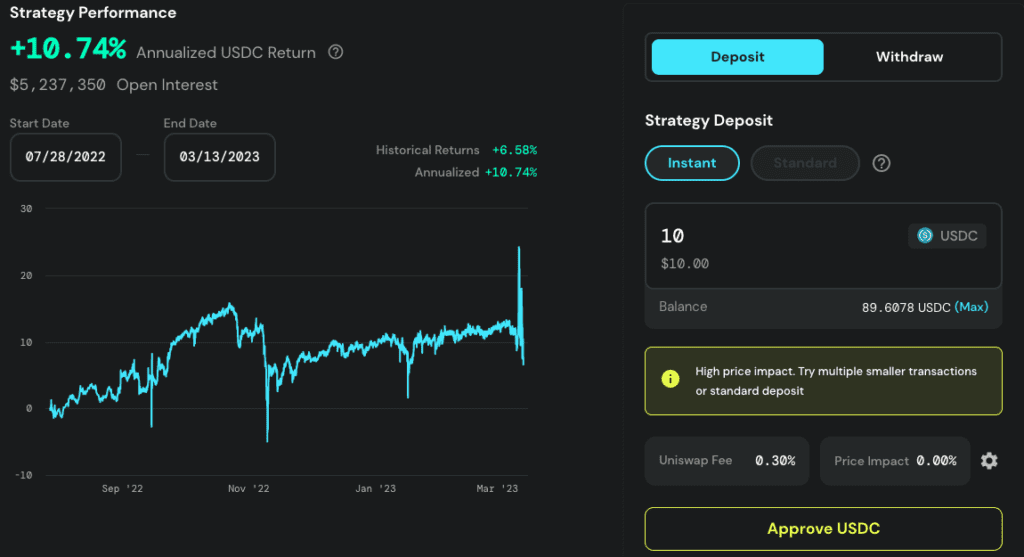

Crab Strategy (USDC) Explained

The Crab Strategy is Opyn’s first automated strategy which allows users to stack USDC when the price of ETH moves less than the market expects. The strategy is named the Crab since crabs tend to move side-to-side symbolising the steady sideways movement reflected by the strategy stacking USDC in stable market conditions. In other words, the ideal market for executing such a strategy is when the price of ETH is particularly calm or rather when the price of ETH fluctuates within a relatively stable range especially with periods of low volatility.

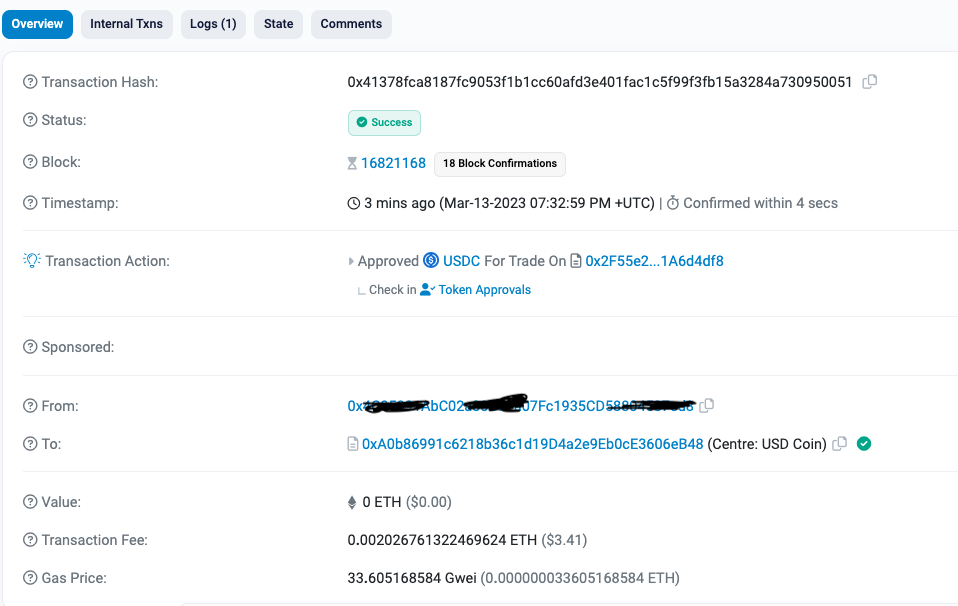

Users can deposit into a strategy easily. Due to the high price impact, in this example we deposit a small amount of USDC to do an instant deposit instead choosing the standard deposit option. A gas fee will be charged for making the deposit.

Once processed, a successful deposit notification pops up on the screen for a few seconds but if you can also check Etherscan to confirm the deposit.

Crab is a strategy that is built on top of an instrument called Squeeth. Squeeth is essentially a DeFi derivative that people pay to buy. Buyers of Squeeth pay premiums which go to the Crabbers.

In order to profit from stable ETH prices, Opyn’s Crab strategy leverages market expectations. The strategy indeed aims to generate returns by betting against high volatility in the ETH market, in essence, profiting when the price of ETH moves less than expected. On the back end, the strategies utilize Squeeth to help users stack ETH and USDC.

More concisely, The Crab Strategy is effectively an automated vault strategy that makes it possible for users to benefit from going short Squeeth without actually taking a view on if the price of ETH will move up or down. The returns are made when vault pairs short Squeeth and long ETH in order to create a position that has an approximate delta of 0 to the price of ETH. This can be seen as a classic short volatility strategy.

With that understanding, it is easy to see that the Crab is similar to selling a continuous straddle, with regular adjustments to ensure it remains profitable. The strategy rebalances and adjusts three times a week to either realize a profit or loss on ETH price movements.

A daily funding rate must be paid by Long Squeeth holders. This daily funding is paid to users deposited into the Crab Strategy since Crab does in fact hold a short Squeeth position. The funding rate represents the returns that are earned by being deposited into the Crab Strategy. Funding rates are payments that are made by long Squeeth holders based on the disparity between the Mark Price or the current trading price of Squeeth and the Index Price (ETH²).

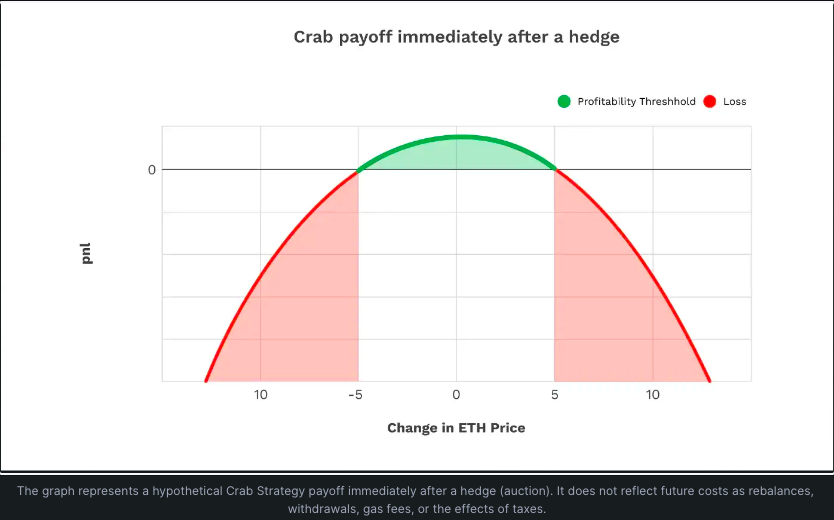

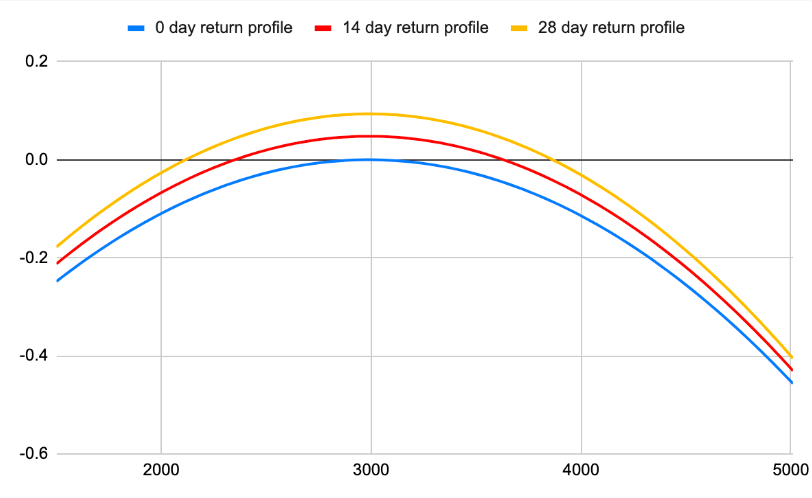

Payoff Diagrams

Crab excess return vs. ETH Price Change

- Payoff Profile: Upside down smile 🙃 (i.e. a hill, and you make the most money when you’re on top of the hill)

- Funding earned: Premium paid by Long Squeeth holders between rebalances (i.e. in-kind funding)

- Max Gain: Limited (amount of debt from short oSQTH)

- Max Loss: Limited (amount deposited to short oSQTH)

- Liquidation: While it’s possible for crab strategy positions to be liquidated, it’s unlikely due to automatic rebalances

Crab Strategy Payoff for 0, 14, and 28 days

- Payoff Profile: Upside down smile 🙃 (i.e. a hill, and users make the most money when they’re on top of the hill)

- Funding earned: Daily premium paid by Long Squeeth holders (i.e. in-kind funding).

In general, the strategies earn returns except when there is high ETH volatility in the market, when they may draw downwards. Most often, the strategies earn returns if ETH is within the below bands at the next hedge.

Long Payoff Comparisons: Squeeth, Options, Perpetual Swaps

Check out the guide to understanding Opyn’s implementation of Squeeth.

Zen Bull Strategy (ETH)

Zen Bull is an automated strategy that allows users to stack ETH when the price of ETH moves less than the market expects. The strategy uses a combination of the Crab Strategy and a leveraged long ETH position to earn returns from stable (not volatile) ETH prices. Zen Bull is a way for users to benefit from betting against high ETH price swings without losing ETH exposure.

Zen Bull is ideal for low volatility markets where the price of ETH trends upwards.

On the back end, Zen Bull uses the Crab Strategy to stack ETH. This is made possible because the people who buy Squeeth pay a premium and that premium goes to users in the Opyn Strategies.

Zen Bull is ideal for low volatility markets where the price of ETH trends upwards. This is because Zen Bull uses the Crab strategy, which performs best when the price of ETH fluctuates within a relatively stable range.

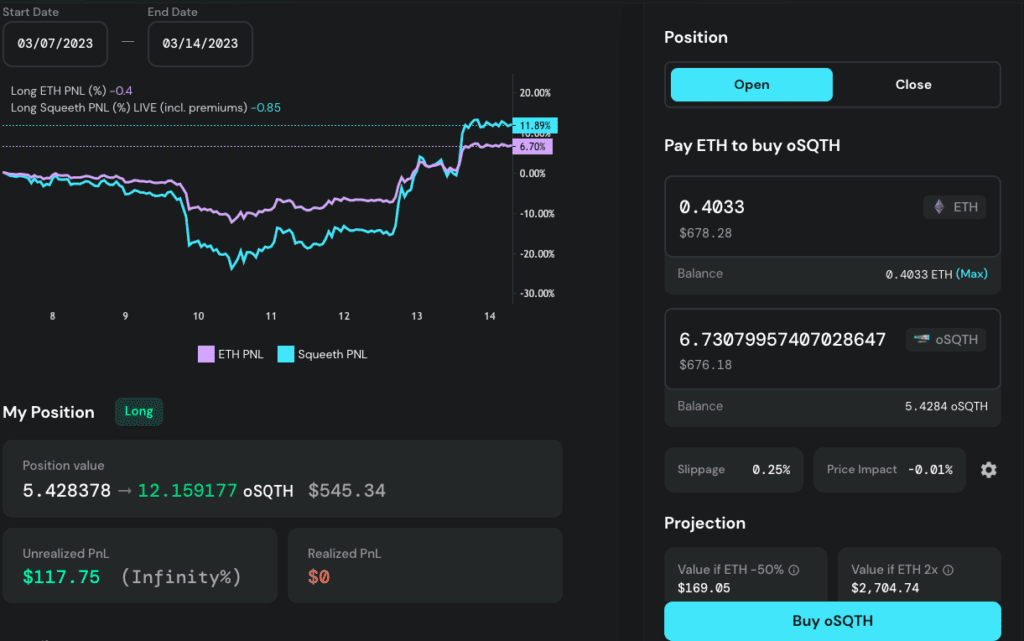

Different Ways To Squeeth

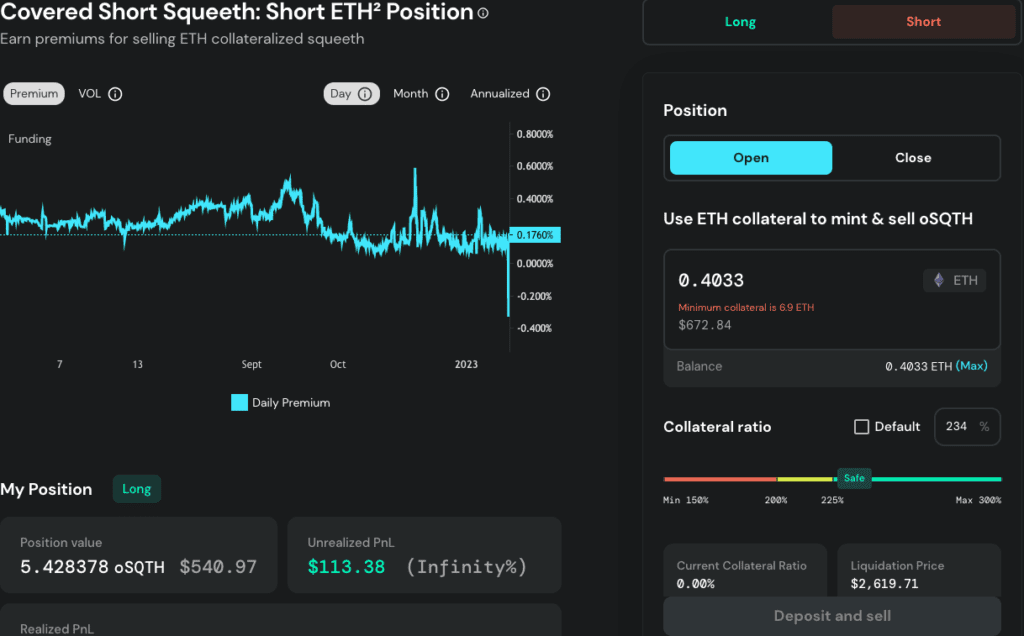

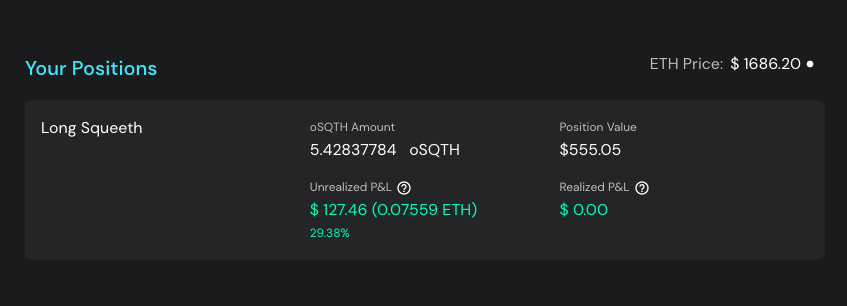

Long Squeeth

Long Squeeth is a leveraged position with unlimited ETH² upside, protected downside, and no liquidations. Long Squeeth offers pure convexity (ETH² payoff), giving it a more favorable payoff than 2x leverage. Compared to a 2x leveraged position, Squeeth will make more when ETH goes up and lose less when ETH goes down, but funding rates are expected to be higher due to exposure to pure convexity. Long Squeeth holders pay a funding rate for this position.

Short Squeeth

Short Squeeth is a short ETH² position, collateralized with ETH. Traders earn a funding rate for taking on this position, paid by long Squeeth holders. Short Squeeth positions can be liquidated. A user’s exposure to the price of ETH depends on the amount of collateral they have deposited, as well as if they own the collateral or have borrowed it with stablecoins elsewhere.

You can easily check your positions on the Positions tab of the dashboard.

Risks & Fees

Liquidation Risk

Crab Liquidation: If the Crab Strategy falls below the safe collateralization threshold (150%), the strategy is at risk of liquidation. Rebalancing based on large ETH price changes helps prevent a liquidation from occurring. To date, the vault has never been liquidated. Because both strategies use Crab, they both have this risk.

Zen Bull Loan: Zen Bull can be liquidated if the ETH debt in the USD loan is below margins.