NESTFi Decentralized Perpetual Exchange Review

Why You Should Trade on NestFi Decentralized Perpetual Exchange.

What is Nest Protocol?

The NEST Protocol serves as a decentralized trading foundation, often referred to as a martingale network. It employs smart contracts to remove market makers and liquidity providers, offering traders virtually limitless liquidity via risk sharing.

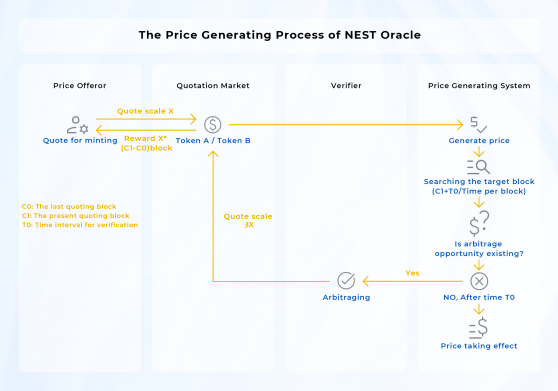

In addition to the NESTFi perpetuals DEX, NEST Protocol consists of three key components: NEST Oracle, NEST Assets, and NESTcraft. NEST Oracle delivers decentralized on-chain pricing data, while NEST Assets are created and destroyed by NEST smart contracts, supplying currency units for martingale transactions within NEST.

NESTcraft, on the other hand, transforms various on-chain random inputs into a comprehensive martingale function library, granting access to a wide array of customizable martingale trading alternatives.

NEST Protocol Features & Capabilities

The NEST Protocol offers a vast array of potential applications, with a few examples outlined below.

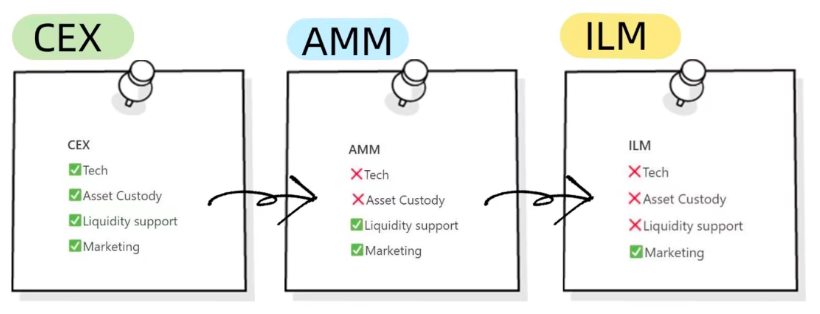

Decentralized Exchange

Derivatives exchanges must address technical support, asset custody (risk management), liquidity support, and marketing. By using the NEST Protocol, developers can create a decentralized exchange by simply designing a front-end page, thereby saving on the first three costs and allowing them to concentrate on marketing efforts.

Financial Derivatives Marketplace

Leveraging NESTcraft, numerous innovative financial derivatives can be devised, including barrier options, Asian options, two-way options, and appealing returns like square-root, squared, and exponential returns.

NESTFi is the Decentralized Perpetual Exchange by Nest Protocol.

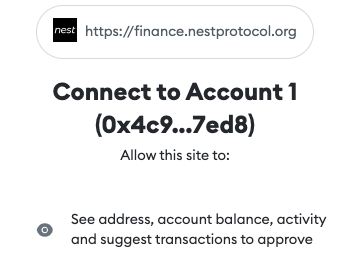

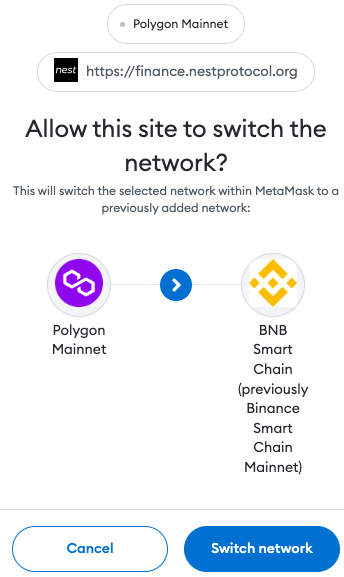

If your wallet is connected to another blockchain network e.g. Polygon instead of Binance Smart Chain, ensure that you’ve switched to the appropriate network.

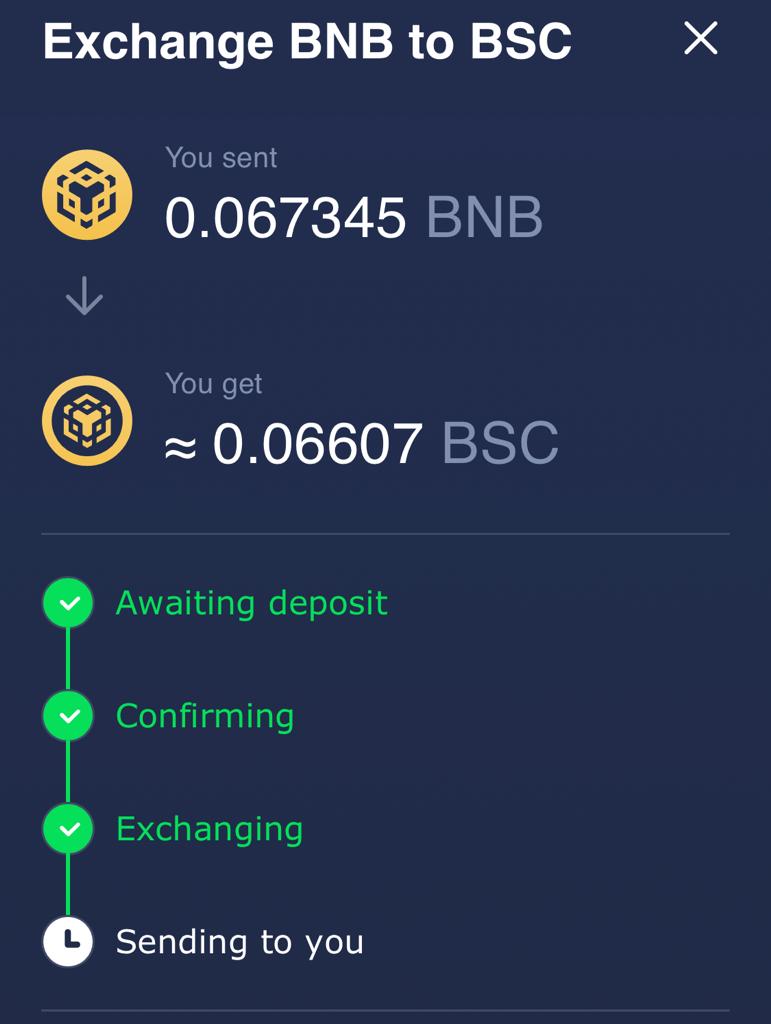

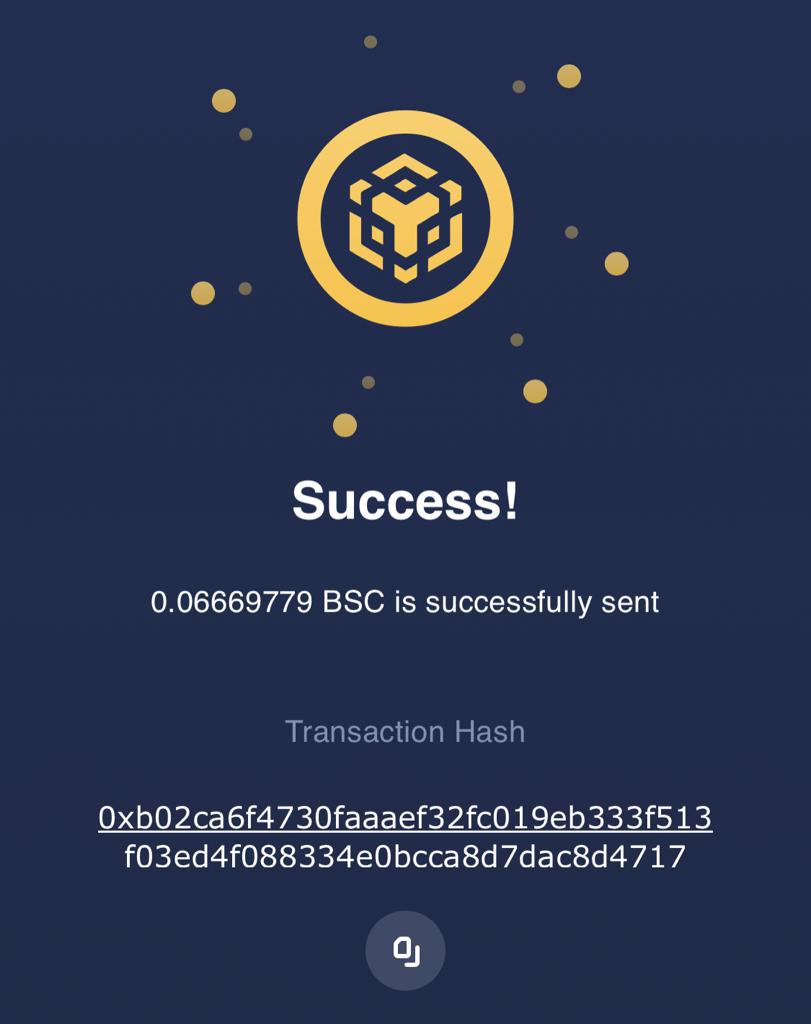

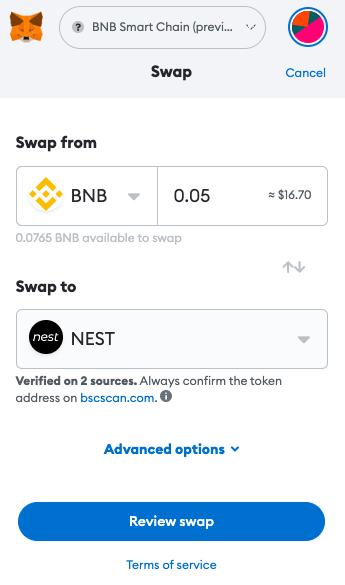

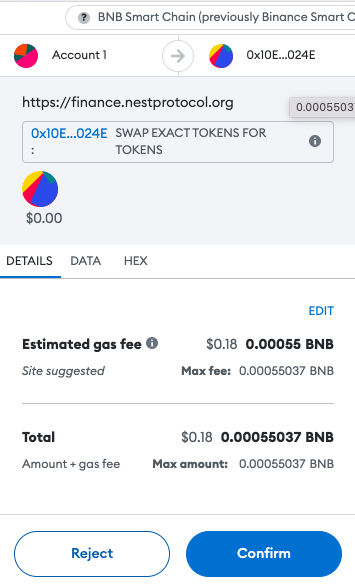

Since you need NEST tokens to trade on the NESTFi DEX, deposit funds to your BNB Smart Chain on your web3 wallet. In this example, we swap some BNB to BSC using Atomic wallet and then send the funds to MetaMask so that we could swap the BNB Smart Chain to NEST.

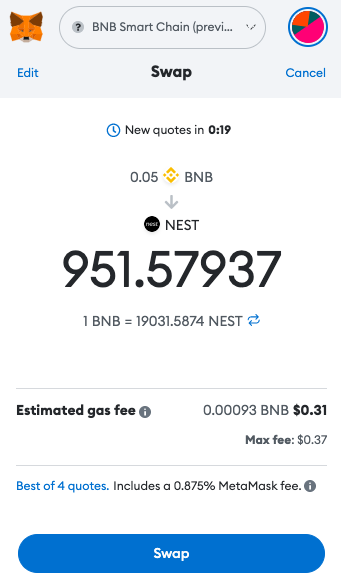

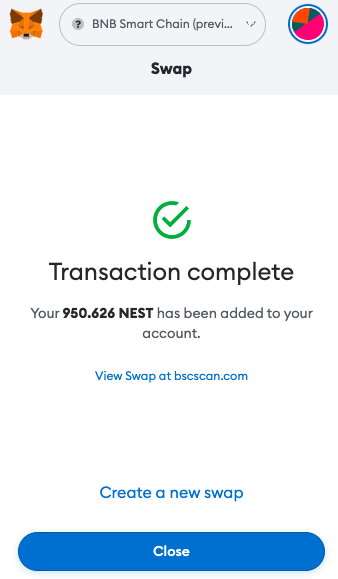

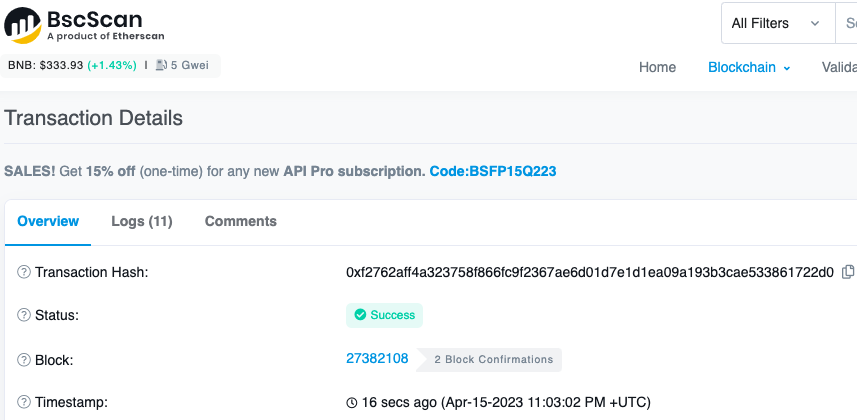

Once the funds are available in your MetaMask, you can then swap the BNB for NEST.

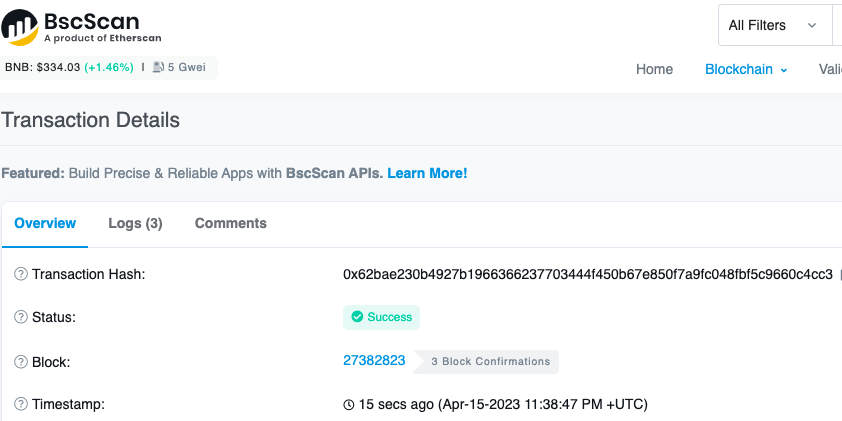

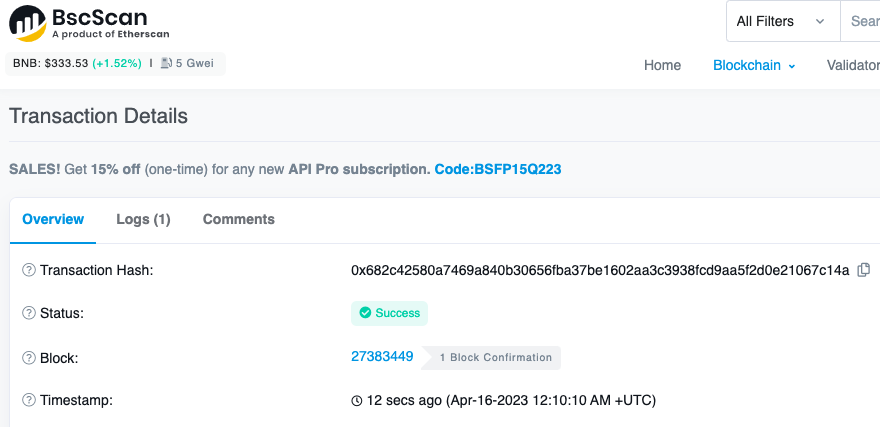

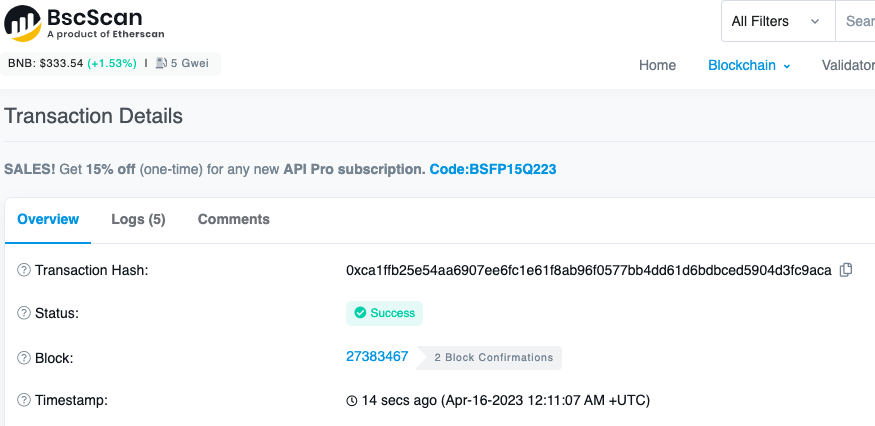

You can confirm the transaction on BscScan.

Once you have some NEST tokens you can proceed to trade on NestFi.

You can choose to take a LONG or SHORT position on your futures trade. Simply select the pair you want to trade e.g. ETH-USDT/ BTC-USDT / BNB-USDT.

How to Long on NESTFi Decentralized Perpetual Exchange

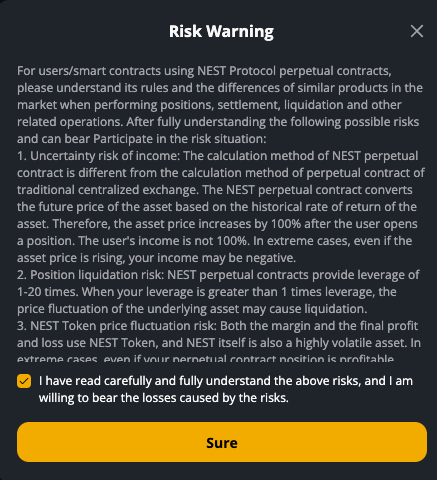

Read the terms and conditions and if you agree, tick the box to proceed.

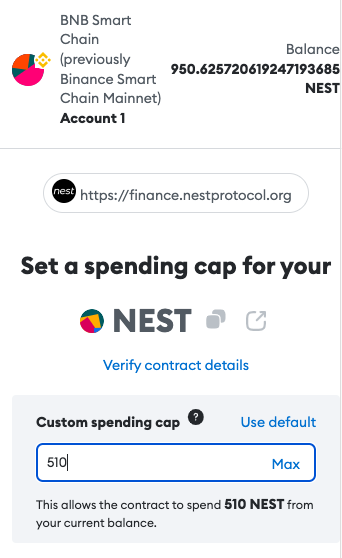

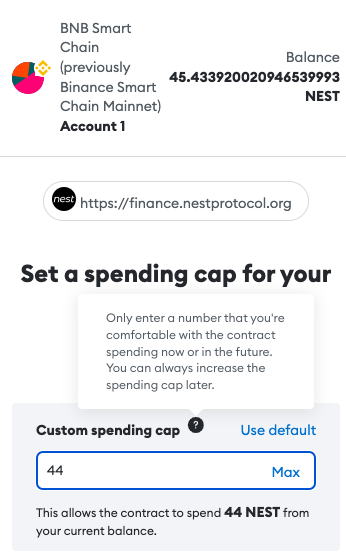

Set your NEST token spending cap.

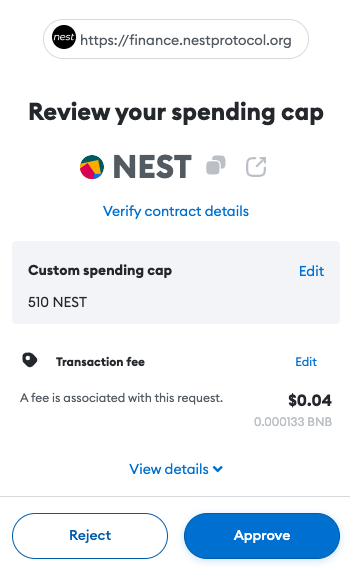

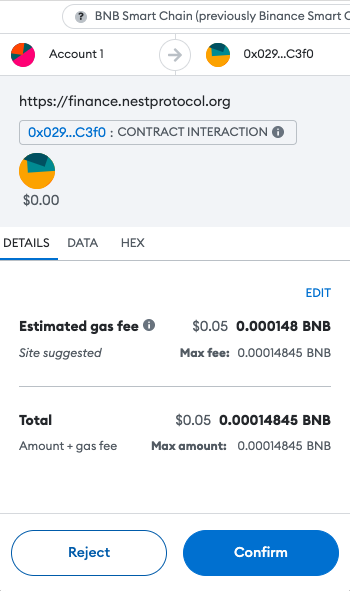

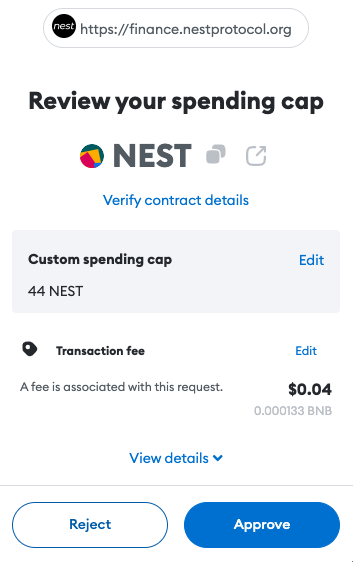

Pay the transaction fee.

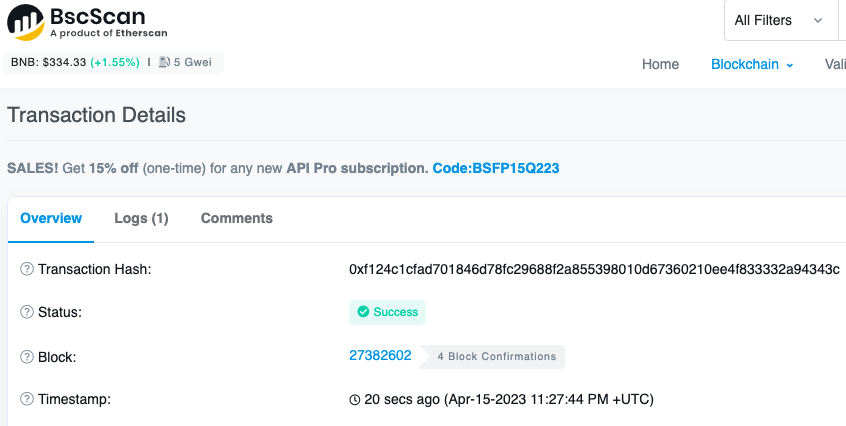

Once you’ve given the contract permissions to interact with your wallet and after setting your spending cap etc., you can confirm that all is set up properly by checking the transaction on the block explorer.

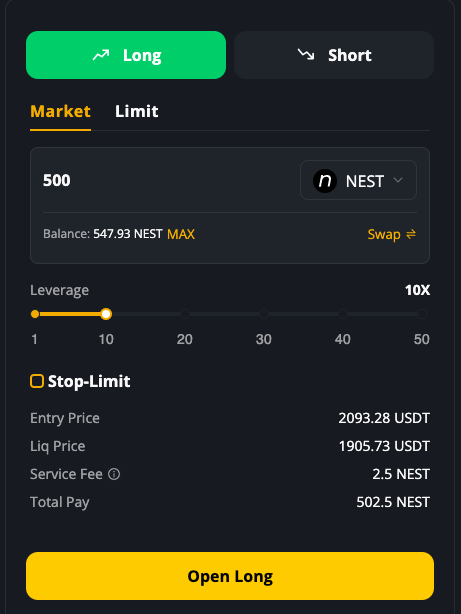

Now you can proceed to open your long position.

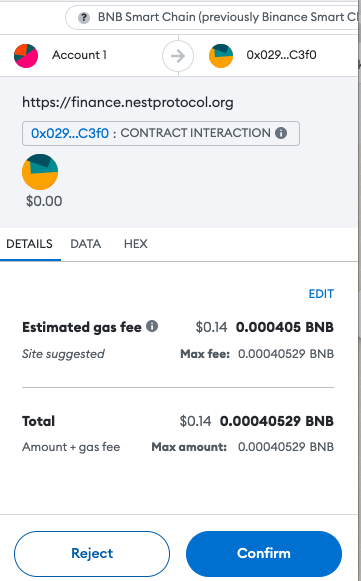

Pay the associated gas fees for opening your trade.

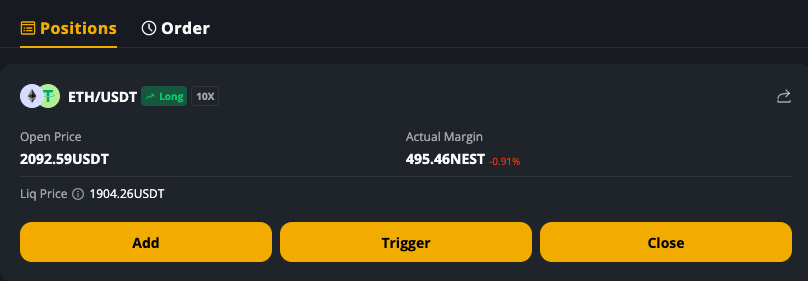

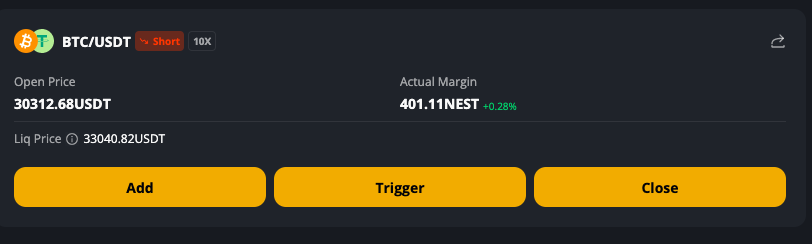

You can view the open position on your dashboard.

How to Short on NESTFi Decentralized Perpetual Exchange

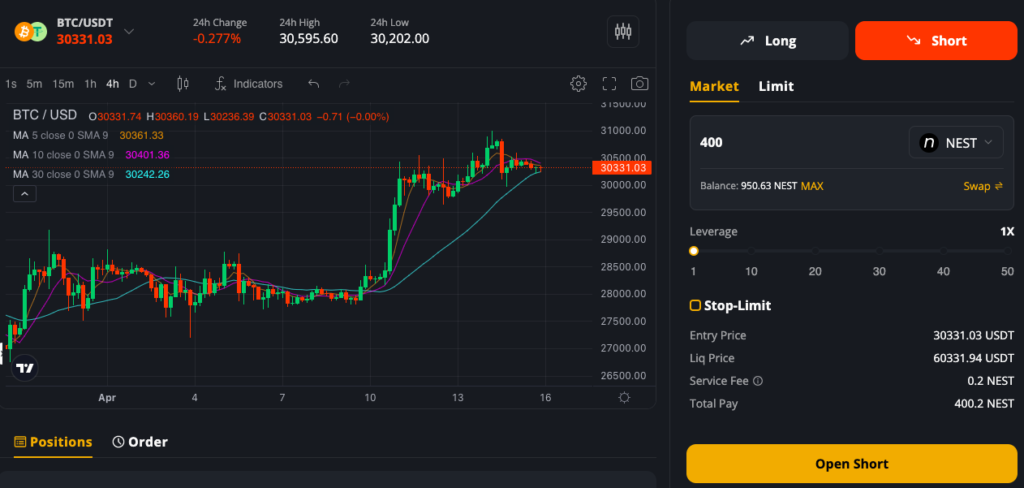

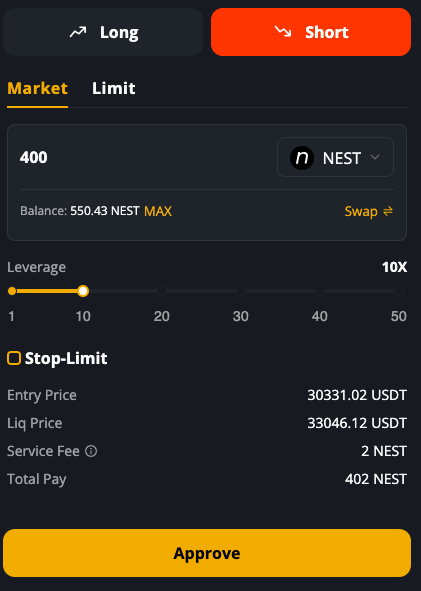

Shorting on NESTFi is also simple and straightforward. Simply choose the shorting option on the dashboard of the trading interface.

Give the smart contracts permission to interact with your wallet.

Choose the leverage amount you’re comfortable with between 1X-50X.

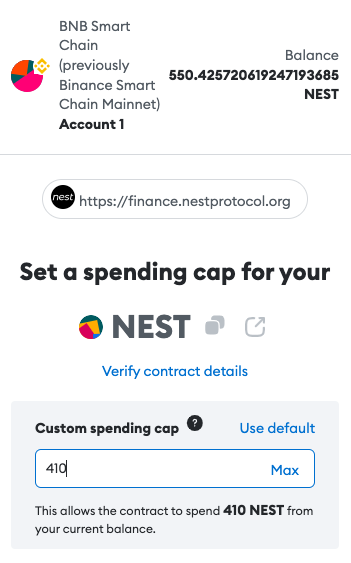

Set your spending cap.

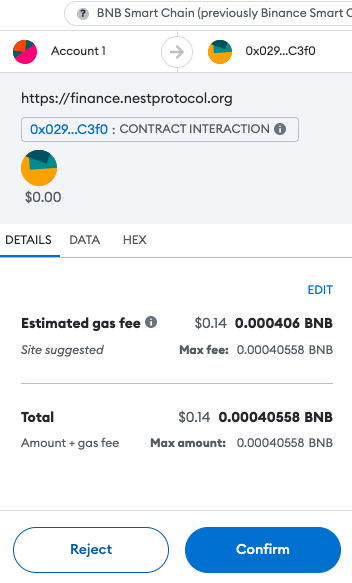

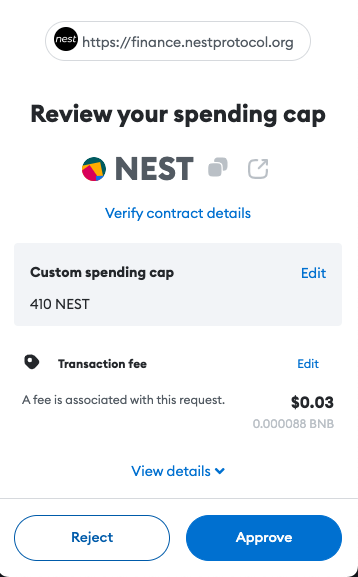

Approve the contract and pay the gas fee.

Verify the contract is approved.

Pay the associated gas fee for opening your short position.

You can check on your dashboard on the trading interface to see if your position has been added.

What’s great about NestFi is that you can open positions with very little collateral, you have custody of your assets and you can set your spending limits and also choose the amount of leverage that aligns with your risk appetite.

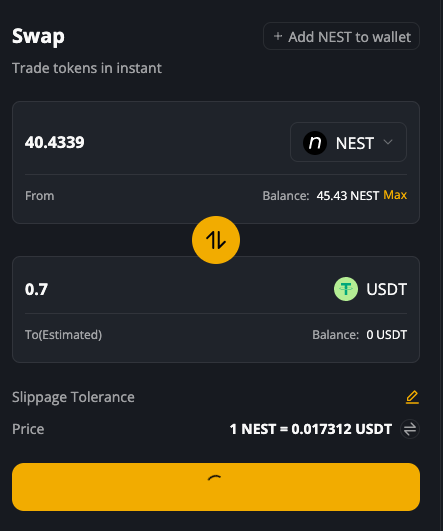

How to use the Swap Feature on NestFi Decentralized Perpetual Exchange

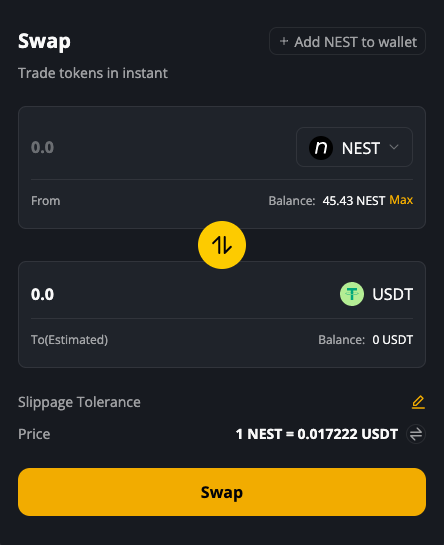

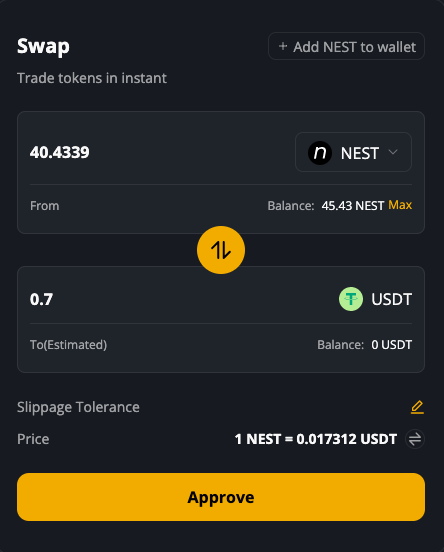

Swapping from NEST to USDT or vice versa is quite easy and intuitive on Nest. Go to the Swap tab on the exchange interface https://finance.nestprotocol.org/#/swap

Set your spending cap.

Review and approve the transaction.

Now that your wallet is ready to transact following your approvals, you can now proceed to swap.

Pay the gas fees for the transaction and verify that it has been successful using the block explorer.

On-chain and Off-chain Risk Hedging

As many off-chain hedging scenarios lack a supply side, NEST can facilitate numerous hedging transactions for off-chain trading without being influenced by market makers. Additionally, on-chain transactions can achieve one-click hedging using NEST, with UNISWAP‘s LP one-click hedging being a prime example.

Metaverse and GameFi Economic Structure

With NEST’s array of martingale functions, developers can create fair games centered around deterministic mathematical relationships, probability connections, and random processes by invoking NEST functions. This enables a unified value measurement across different games. Even if a game’s development ceases, its core value is preserved in NEST, facilitating integration and exchange across other NEST-based games.

Lotteries, Prop Synthesis, and More

Basic designs relying on randomness can be achieved using simple distribution functions.

Additional Unique Applications

An open network always presents more possibilities. With the existence of basic functions, numerous creative and valuable applications may emerge.

NEST’s application space builds upon Ethereum (ETH): while ETH manages general deterministic functions, NEST’s mechanism handles random functions. As ETH’s token issuance employs a deterministic algorithm independent of on-chain applications, its feedback on application-side information is limited. Conversely, NEST’s token issuance (increased issuance) follows specific scenarios, ensuring a market-clearing currency target at all times.

NEST Token Economics

Issuance and burning mechanisms:

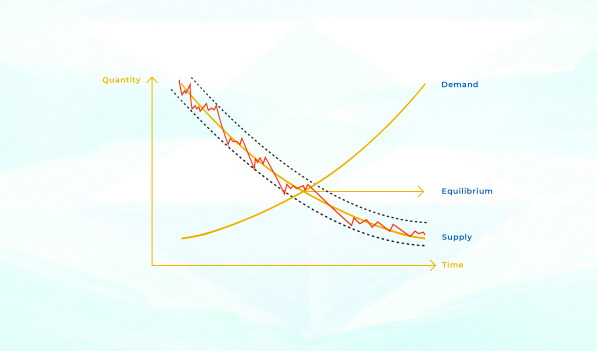

$NEST tokens can be either burned or generated based on the instructions of the on-chain protocol. The creation of financial assets will lead to the burning of NEST tokens, while the settlement of these assets will result in new NEST tokens being issued.

For instance, if you wish to purchase an option on NEST and burn 1,000 $NEST as the acquisition cost, you will then obtain the option. Upon reaching the exercise date, if the option’s payoff is 10,000 $NEST, the NEST smart contract will issue an additional 10,000 $NEST to you after exercising the option. Similarly, if the option’s payoff is 100 $NEST, the smart contract will issue an extra 100 $NEST to you.

All financial products can be traded via NEST smart contracts, eliminating the need for market makers or intermediaries and their associated costs. Additionally, all financial products can be settled, theoretically providing an almost limitless supply—hence the term “infinite liquidity.”

Risk sharing among token holders:

All NEST token holders collectively share the outcome resulting from changes in the total quantity of NEST tokens. As the overall supply of NEST tokens decreases over time, the long-term value of NEST tokens is assured to increase.

NESTFi Affiliate Program

NESTFi is one of the few decentralized perpetual exchanges offering 100% trading fees

as commission for referrers.

Copy Trading

Another great feature offered by NESTFi is the ability for traders to have others copy their trades. This is an essential tool for community building for KOLs and traders who are keen to spur crypto adoption while making passive income.