MUX Decentralized Leveraged Trading Platform Review

MUX Decentralized Leveraged Trading Platform Review.

Previously known as MCDEX, the MUX Protocol Suite is an intricate set of protocols designed to provide traders with reduced trading costs, substantial liquidity, a broad spectrum of leverage choices, and an array of market options.

The MUX Protocol Suite includes the following primary components:

MUX Leveraged Trading Protocol – This decentralized leveraged trading protocol delivers no price impact trading, up to 100x leverage, elimination of counterparty risks for traders, and a streamlined on-chain trading experience. Traders will engage with the MUX native pool (MUXLP pool) on the Leveraged Trading Protocol.

MUX Leveraged Trading Aggregator – As a part of the MUX protocol suite, this sub-protocol automatically chooses the most appropriate liquidity path and minimizes the combined cost for traders while fulfilling position opening requirements. Additionally, the aggregator can provide extra margin for traders, increasing leverage up to 100x on aggregated underlying protocols.

To long or short on MUX is pretty simple:

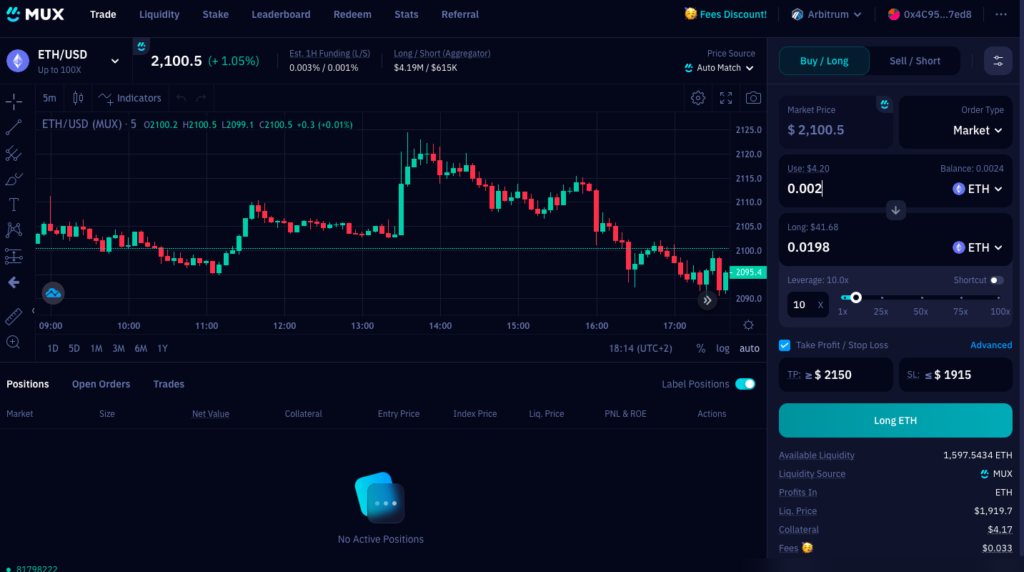

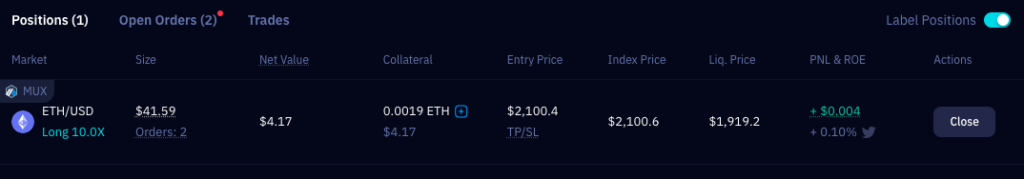

In this example we trade the ETH-USD pair at 10X leverage with as little capital as under $5 and we take a LONG position. Our Take Profit is $2150 and the Stop Loss is set at $1915.

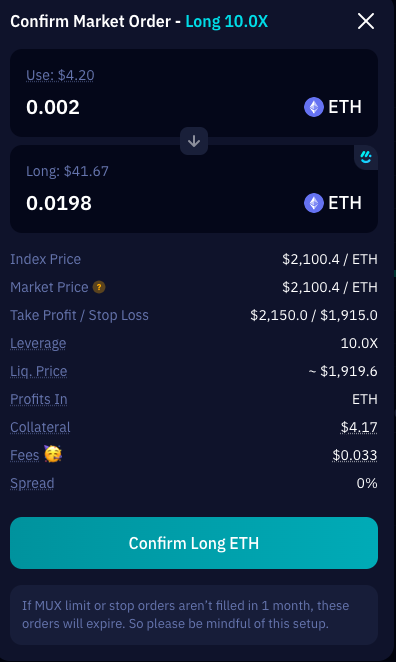

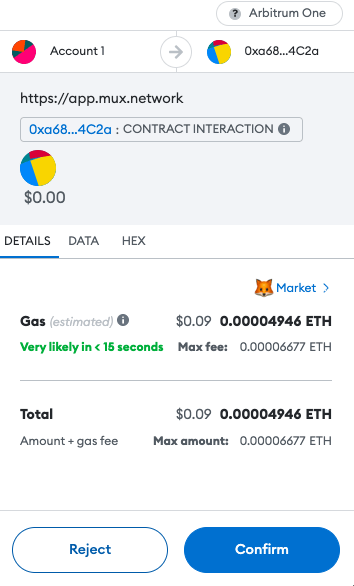

Confirm the market order.

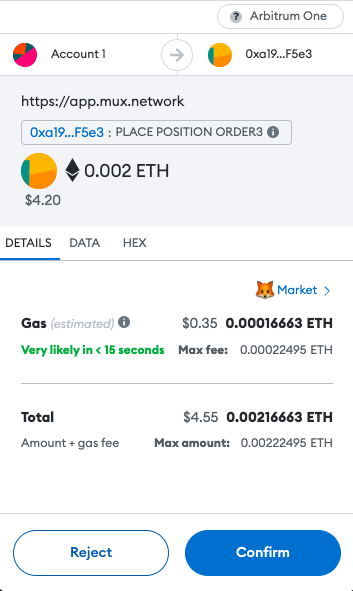

Confirm the transaction fee which is very low on Arbitrum network.

You can confirm your open trade easily on the dashboard.

MUX Leveraged Trading Protocol

The MUX leveraged trading protocol is a decentralized system that offers no price impact trading, up to 100x leverage, self-custody, aggregated liquidity, and an enhanced on-chain trading experience. Furthermore, MUX is the first multi-chain native protocol that unifies pooled liquidity across various chains to optimize capital efficiency.

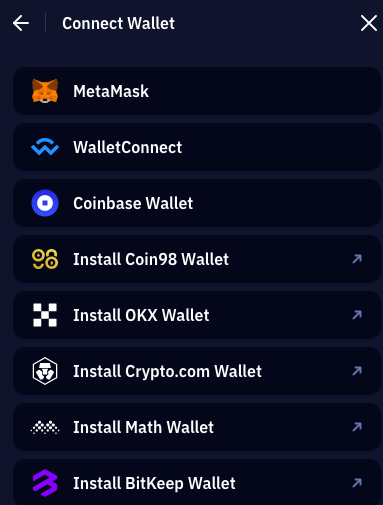

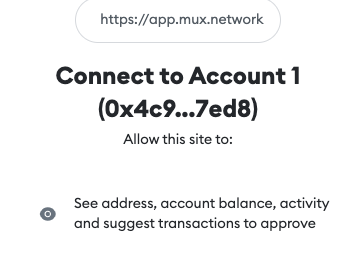

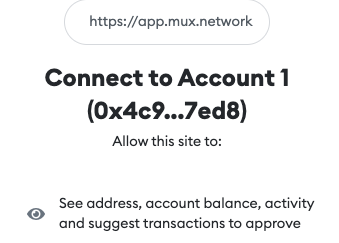

To get started, simply connect your web3 wallet e.g. MetaMask.

Traders can utilize MUX to:

- Open leveraged positions up to 100x with no price impact

- Trade at optimal costs

- Access aggregated liquidity

- Use various asset types as collateral

Liquidity providers can employ MUX to:

- Supply liquidity and receive MUXLP tokens

- Stake MUXLP to earn protocol income (protocol fees and third-party DEX mining yield) and MUX token rewards

MUX dynamically distributes liquidity for margin trading and third-party DEX mining.

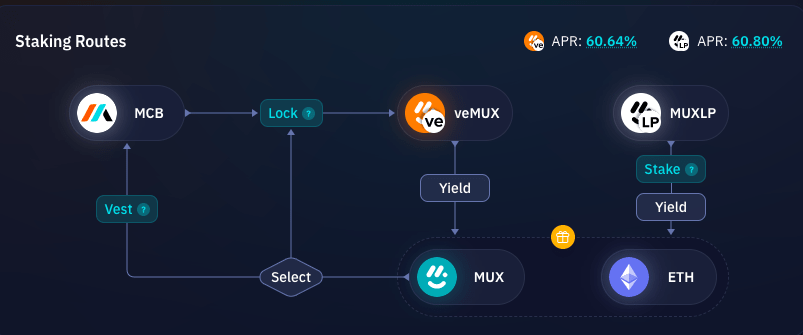

Community members can leverage MUX to:

- Lock MCB to obtain veMUX

- Hold veMUX to earn protocol income and MUX token rewards

MUX Aggregator

Leveraged trading is experiencing rapid growth in the DeFi space, with several leveraged trading protocols deployed across multiple blockchains. However, as the number of protocols increases rapidly, challenges begin to emerge:

- Liquidity is dispersed across various protocols, leading to underutilization.

- There is no native method for utilizing cross-chain liquidity when liquidity is fragmented across different chains.

- Due to significant differences in pricing mechanisms and margin parameters on each protocol, traders cannot easily access optimal pricing and trading experiences.

To address these issues, the MUX protocol has introduced the MUX Leveraged Trading Aggregator, a sub-protocol within the MUX protocol suite, to provide best-in-class trading experiences for traders.

Mechanisms

Liquidity Routing

When traders open positions on MUX, the MUX Aggregator dynamically compares trading prices offered by several leveraged trading protocols. Simultaneously, the Aggregator suggests an underlying protocol with the most suitable liquidity depth.

In leveraged trading, the “trading cost” comprises numerous factors, including price, spread, slippage, price impact, position fees, and other potential explicit trading costs. Implicit costs such as max leverage, maintenance margin, liquidation fees, and available liquidity are also considered. The MUX protocol thoroughly compares the trading costs on aggregated protocols, selecting the most appropriate liquidity path while minimizing the combined cost for traders and fulfilling their position opening requirements.

Position Container

The MUX Aggregator System governs an array of smart contracts designed to store traders’ positions, known as “position containers.” When a trader initiates a position via the MUX Aggregator, it generates a position container and employs it to open the position using the underlying leveraged trading protocol on the trader’s behalf. The position container contract is considered the direct user by the underlying protocol. Moreover, the MUX Aggregator offers an API for obtaining information about the traders’ addresses associated with their position containers.

Each position has its own position container, which helps distribute risk among users, a critical aspect for maintaining the safety of the MUX protocol.

Boosting Leverage

Various Initial Margin and Maintenance Margin requirements exist among underlying leveraged trading protocols, leading to differences in maximum open leverage and maintenance leverage. Additionally, protocols with substantial market liquidity may not provide the ideal maximum leverage to satisfy traders.

Cross-Chain Liquidity

For on-chain leveraged trading, liquidity and users are dispersed across multiple chains. The MUX Aggregator employs the MUX protocol’s Universal Liquidity mechanism to enable cross-chain liquidity aggregation, ensuring a seamless trading experience for users on different chains.

When a trader on chain A initiates a position, the broker module can direct the MUX Aggregator to open the actual position on an underlying protocol of chain B. Consequently, the trader can access liquidity on chain B for leveraged trading without directly interacting with chain B.

Aggregating Liquidity

When individual underlying liquidity protocols cannot accommodate traders’ position requirements, the MUX Aggregator consolidates liquidity from multiple protocols, providing a seamless and efficient trading experience. Traders can focus on the unified trading interface without being concerned with the liquidity provider behind the Aggregator.

For instance, if a user opens a $100M position through the MUX Aggregator, this aggregated position might consist of $50M on protocol A, $30M on protocol B, and $20M on protocol C. Addressing potential pricing discrepancies across protocols, the MUX Aggregator adopts the following measures:

- Collaborate closely with underlying leveraged trading protocols to obtain their guaranteed accurate pricing.

- The MUX Aggregator can absorb pricing differences within a specific range, providing traders with unified pricing.

Roadmap

As a vital component of the MUX protocol suite, MUX Aggregator sub-protocol will continuously evolve to meet traders’ needs.

- MUX Protocol V2: Integration with GMX and offering 100x leverage for traders

- MUX Protocol V3: Introduction of the cross-chain aggregation feature

- MUX Protocol V4: Consolidated management of underlying positions

Liquidity

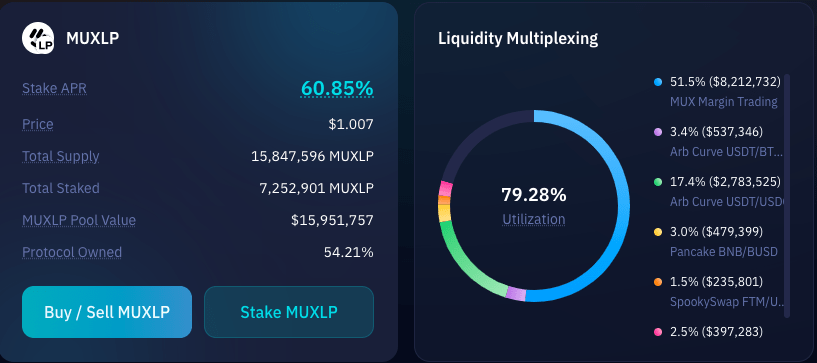

The MUX’s universal liquidity pool comprises a portfolio of assets, with each asset holding a target weight. Pooled assets are utilized for MUX margin trading and third-party DEX mining to generate fees.

Users can contribute liquidity by purchasing MUXLP tokens with assets allowed in the portfolio. MUXLP tokens are minted when buy orders are executed and burnt when sold. The MUXLP token price is determined by dividing the MUXLP pool value by the total MUXLP supply. After acquiring MUXLP tokens, users can stake them to earn protocol income and MUX rewards.

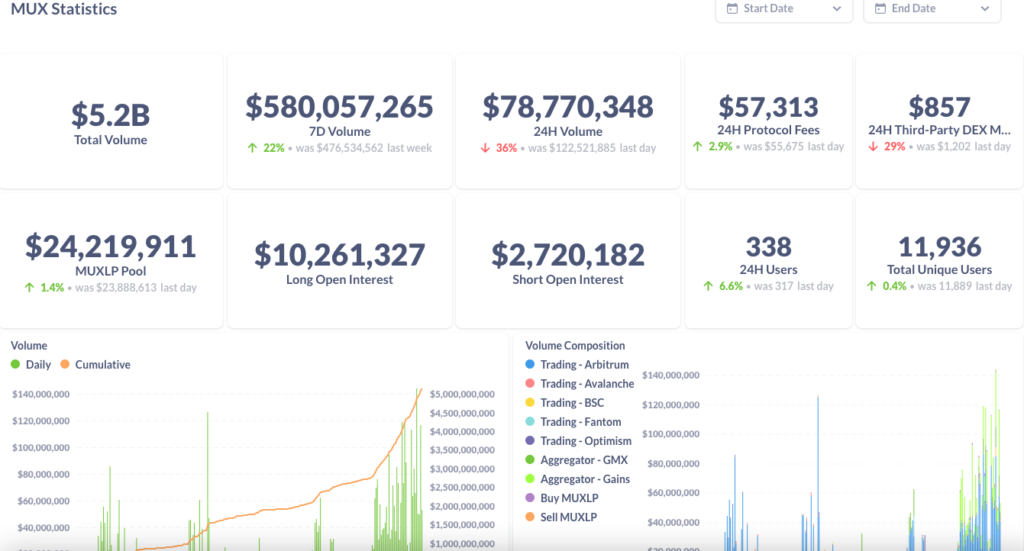

Liquidity-related metrics are available on MUX Statistics.

How to Buy / Sell MUXLP

Users can buy MUXLP tokens on all deployed networks with assets permitted by the portfolio.

After submitting a buy or sell MUXLP order, there is an extended pending time (currently set at 18 minutes) for the order to be completed. The order will be executed at the price at the time of order submission.

The pending time fulfills two functions:

Mitigate potential arbitrage risks affecting LP

- The MUXLP pool comprises a diverse range of assets, allowing users to purchase MUXLP with any supported asset. If front-runners execute rapid buy and sell orders using different assets, arbitrage opportunities may arise. The pending time serves to reduce this arbitrage potential.

Ensure accurate universal liquidity calculations across four networks

- The MUX protocol must account for varying network latency and finalization times when determining universal liquidity. The pending time contributes to accurate calculations and appropriate token distribution for MUXLP buyers and sellers.

MUXLP Staking

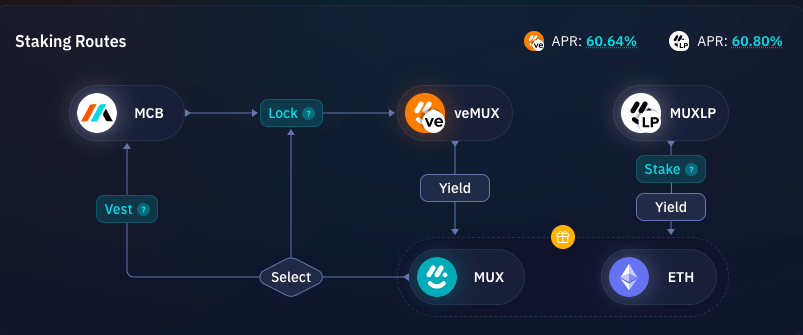

You can earn protocol income (protocol fees and third-party DEX mining rewards) and MUX rewards from veMUX locked-staking and MUXLP staking. All staking will take place on Arbitrum.

Once users have acquired MUXLP tokens, they can stake them on Arbitrum to earn protocol income (fees and external mining yield) and MUX rewards. For detailed rewards distribution formulas, consult the incentives section.

How to Stake MUXLP

MUXLP Pool Portfolio

The MUXLP pool consists of a portfolio containing blue-chip assets and stablecoins, with each asset assigned a target weight. When an asset’s weight fluctuates above or below its target, fees for buying or selling MUXLP with that asset will be adjusted accordingly.

Lower fees apply when buying MUXLP with an asset below its target weight, while higher fees apply when selling MUXLP for that asset. Conversely, if an asset’s weight is above its target, buying MUXLP with that asset incurs higher fees, while selling MUXLP for that asset results in lower fees.

Details on liquidity composition, weight, and multiplexing statistics are available on the MUX Liquidity page.

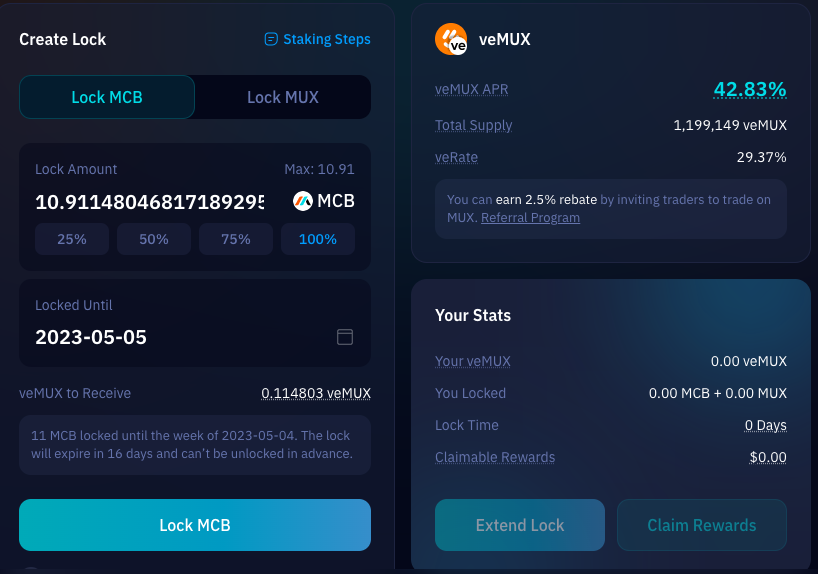

Staking MCB Tokens

MCB is the protocol’s main token. Holders can lock MCB to receive veMUX, then earn protocol income (protocol fees and third-party DEX mining rewards) and MUX rewards.

To get started, simply connect your wallet:

Once connected you can access the main trading interface:

Proceed to the staking tab on the main dashboard.

Now you can proceed to lock MCB or MUX on Arbitrum to receive veMUX and earn protocol income (protocol fees and third-party DEX mining rewards) and MUX rewards.

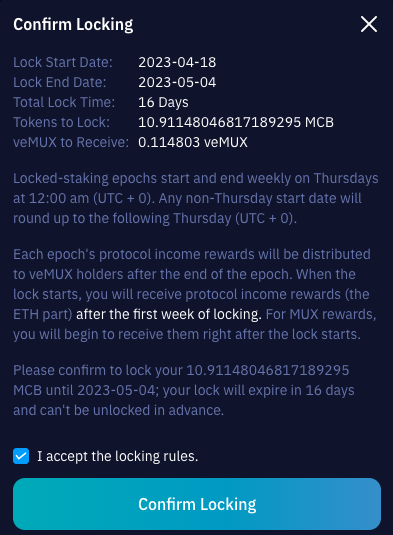

Choose the lock up period and how much you want to lock up.  After you select the amount you want to stake, confirm the lock-up.

After you select the amount you want to stake, confirm the lock-up.

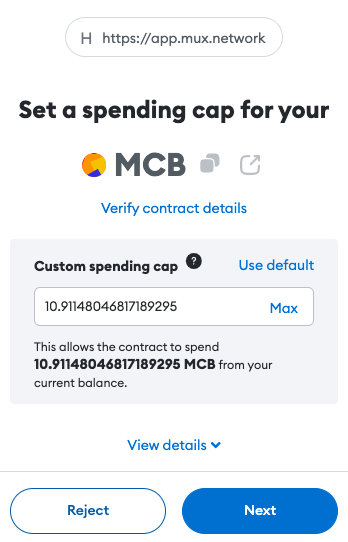

Set your spending cap.

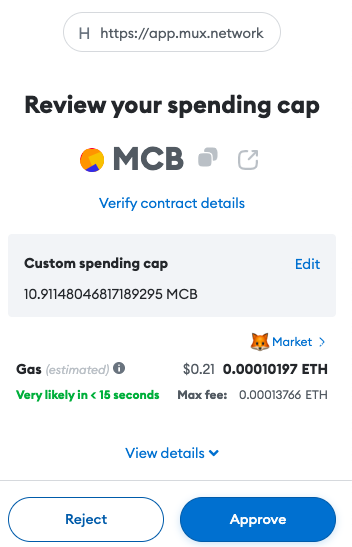

Set your spending cap.  Pay the associated gas fees.

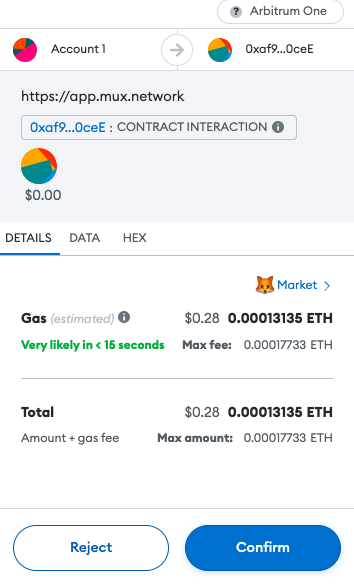

Pay the associated gas fees.

You can easily extend your lock up period to get more rewards or claim the rewards from the dashboard.

You can easily extend your lock up period to get more rewards or claim the rewards from the dashboard.

MUXLP Profits & Risks

MUXLP Profit Sources:

- A share of the protocol fees

- Funding payments

- Multiplexed third-party DEX mining revenue

- Liquidation penalties

- MUX token rewards

MUXLP Risks

As the MUXLP pool acts as the counterparty for traders, it carries position-related risks and may incur losses due to pooled asset price fluctuations.

Protocol-Owned Liquidity (POL)

Adequate liquidity is vital for trading protocols, as deeper pools enable higher open interest. However, relying solely on liquidity providers (LP) for acquiring and retaining liquidity can be expensive and unstable. Thus, instead of exclusively depending on external sources, the MUX protocol employs the POL mechanism to progressively achieve self-sufficiency.

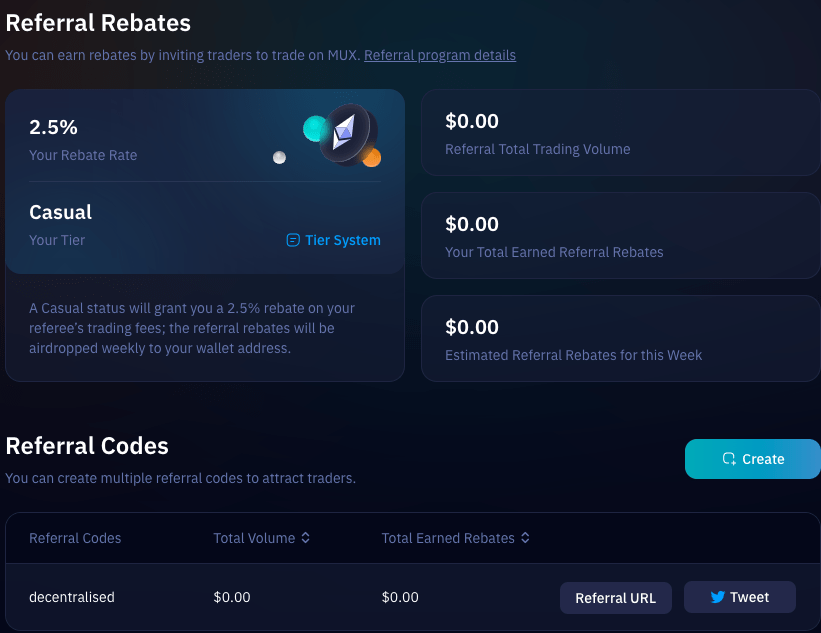

Referral Program

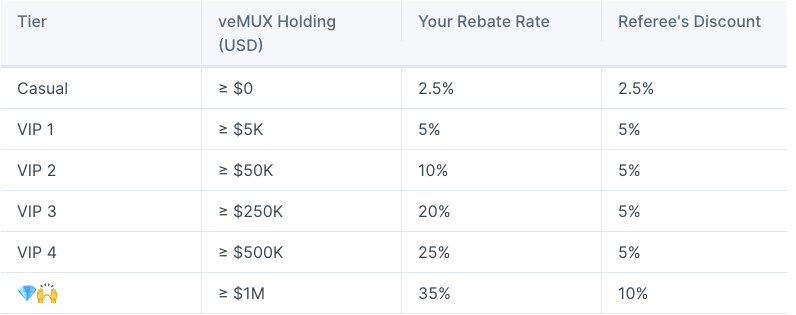

The MUX referral program enables referrers to earn a portion of the referees’ trading fees, while traders (referees) can benefit from trading fee reductions by using a referral code. Within the referral tier structure, all participants begin at the casual tier without any prerequisites, and users can advance through the tiers by increasing their veMUX holdings.

Referral rebate rates can reach up to 35%, and trading fee discounts can be as high as 5%.

Referral rebates and trading fee discounts are derived from leveraged trading position opening and closing fees, which are set at 0.1% of the position size. Rebates and discounts do not apply to the spread on BNB, AVAX, and FTM positions. An account’s veMUX holdings, as of Thursday at 0:00am UTC, determine the referral tier for the preceding week. The MUX protocol calculates users’ veMUX holding values using the average MCB token price from the previous seven days.

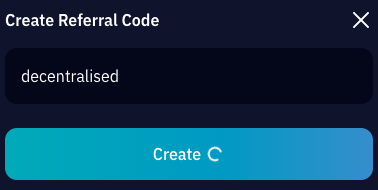

Simply connect your wallet to get your referral code from the MUX dashboard.

For trading fee discounts, traders can enter referral codes into their accounts to receive discounted rates based on the code’s percentage. Referral rebates and trading fee discounts are distributed as WETH tokens to users’ designated addresses every Thursday UTC.

Tokenomics

The protocol’s tokenomics involves four tokens:

- MCB

- MUX

- veMUX

- MUXLP

MCB is the protocol’s main token. Users can lock MCB to receive veMUX which entitles them to protocol income and MUX rewards.

MCB tokens are available on Arbitrum, BNB Chain and Ethereum. Since staking activities and rewards distribution will all take place on Arbitrum, it is recommended to bridge your MCB tokens to Arbitrum.

Recommended bridges for MCB:

Conclusion

MUX is a sophisticated crypto ecosystem that offers trading, staking and liquidity provisioning opportunities. Users can trade crypto with zero price impact, up to 100x leverage and aggregated liquidity. MUX protocol takes care of all the hassles so that users can experience optimized DEX trading on their platform.