Morphex Decentralized Exchange Review

Morphex Decentralized Exchange for Spot & Perpetual Futures Trading.

Morphex is a decentralized perpetual trading platform inspired by GMX, featuring a vault, routers, price feeds, and the Morphex Liquidity Pool (MLP). The Morphex platform provides spot and perpetual futures trading and only necessitates a wallet connection for usage. All transactions are settled against the MLP, allowing users to supply liquidity using any approved asset and receive MLP tokens in return, signifying their portion in the diverse liquidity pool.

Morphex presents several benefits for traders compared to existing exchanges, including:

- reduced transaction fees

- no impact on prices

- protection against “scam wick” liquidations (while maintaining full control of users’ assets)

Pricing for the protocol is derived from Chainlink and Pyth price feeds, ensuring swift and precise updates. As the protocol develops, governance will progressively determine the majority of parameters, such as liquidity incentives for a particular MLP pool.

As a user of Morphex, you can trade cryptocurrencies on Fantom with up to 50x leverage directly from your wallet.

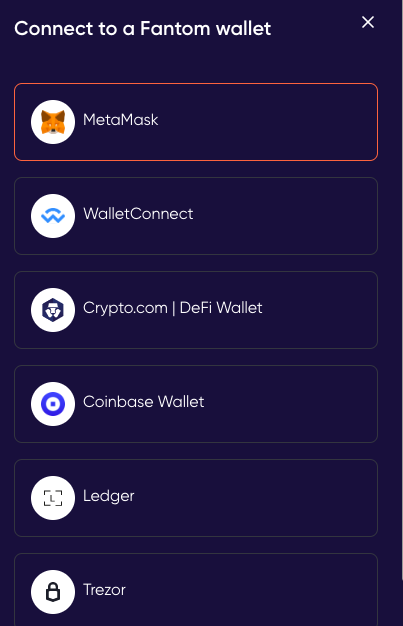

To get started on Morphex, simply connect your web3 wallet e.g. MetaMask. Firstly, go to https://www.morphex.trade/trade

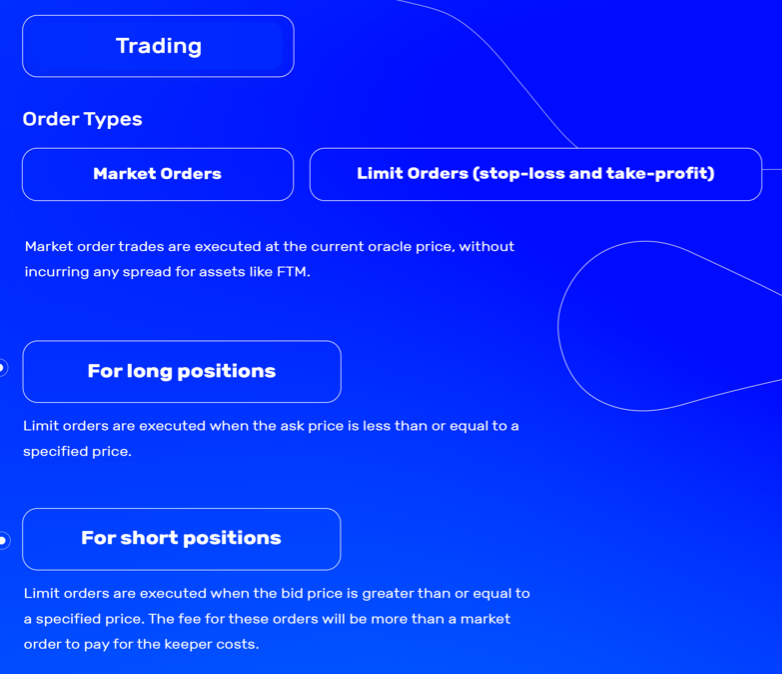

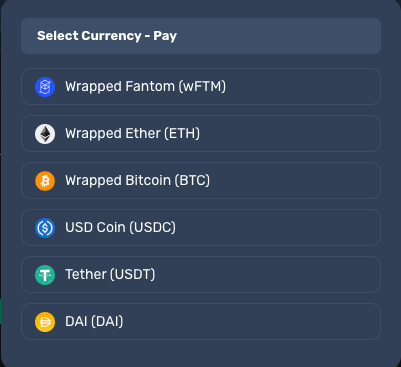

In order to open a LONG or SHORT position, select the collateral type you wish to trade with. You can trade with the Fantom native ecosystem token FTM or other assets including USDC, USDT, DAI, wETH, wBTC, etc.

Once you’ve selected your asset type, choose the amount of leverage you’d like to use up to 50X.

Once you’ve selected your asset type, choose the amount of leverage you’d like to use up to 50X.

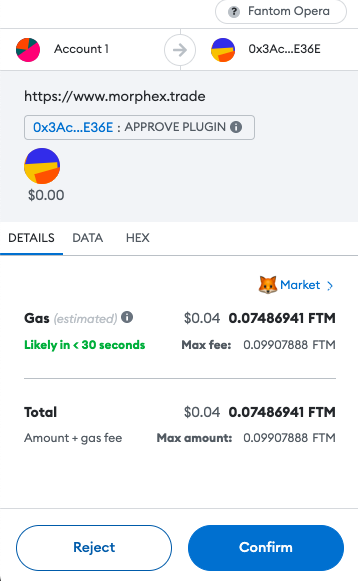

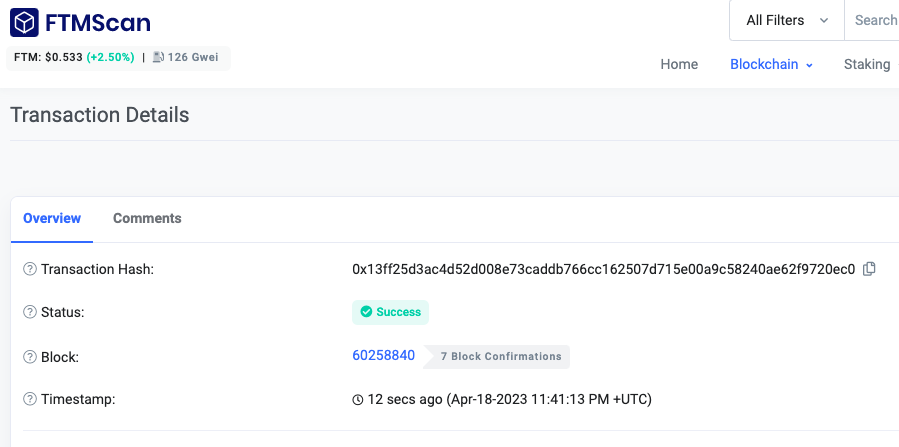

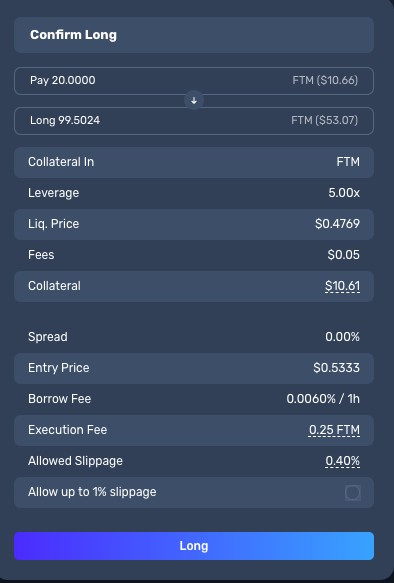

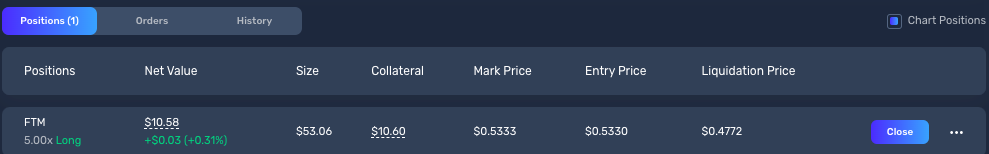

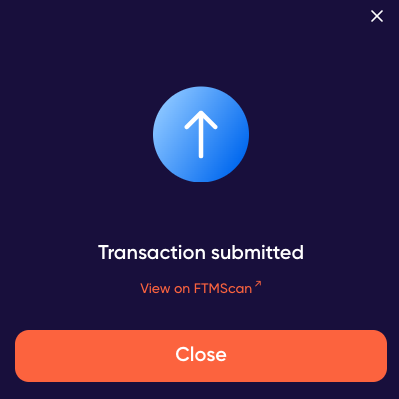

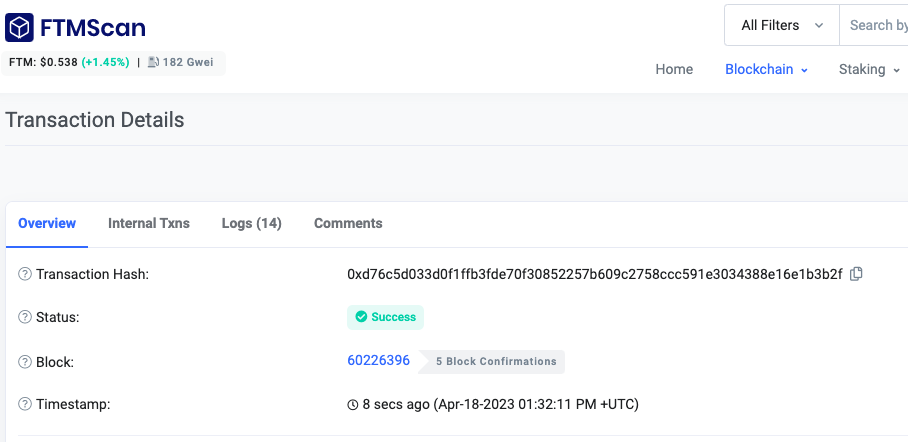

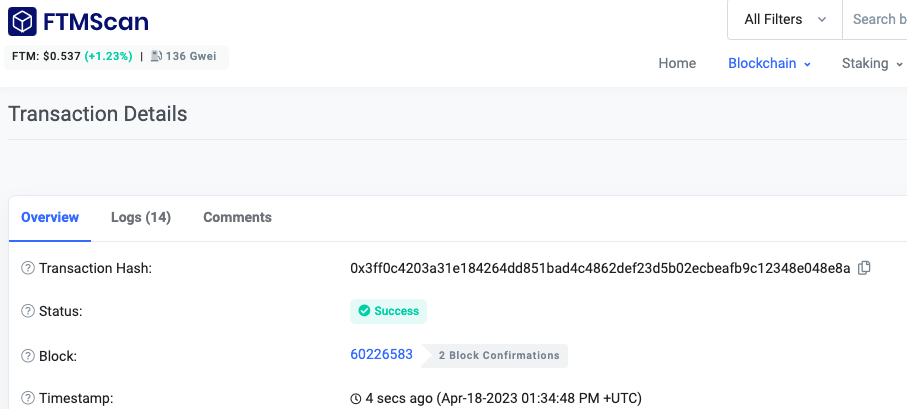

You can open a position with as little as $10. In this example, we take a 5x long position. Check the entry price and liquidation price. Click ‘enable leverage’ and confirm the gas fee.  You can confirm the status of your transaction on the Fantom block explorer, FTMScan.

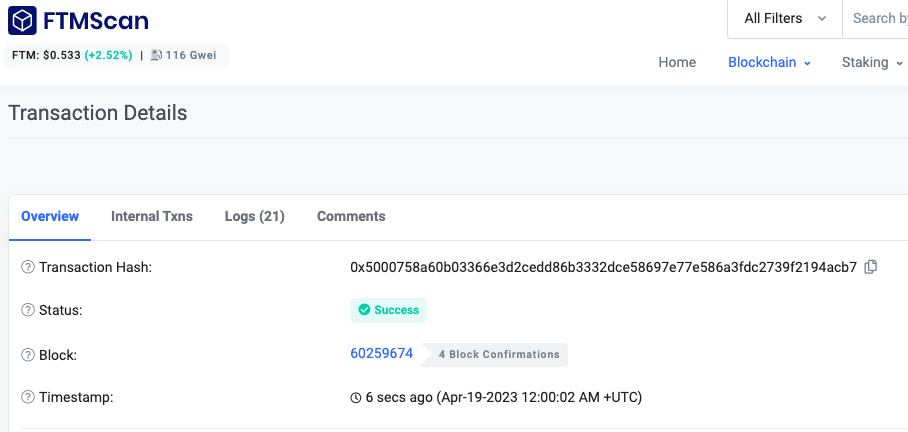

You can confirm the status of your transaction on the Fantom block explorer, FTMScan. Now that the contract is approved, you can proceed to execute the trade by confirming the long position for example.

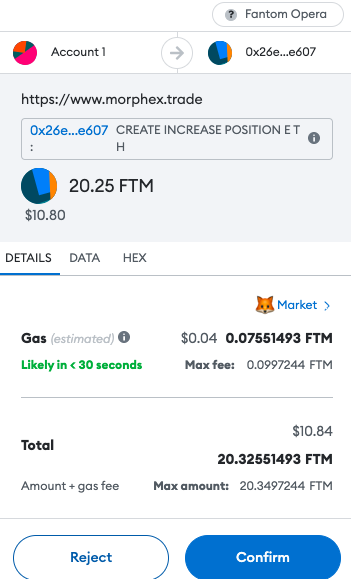

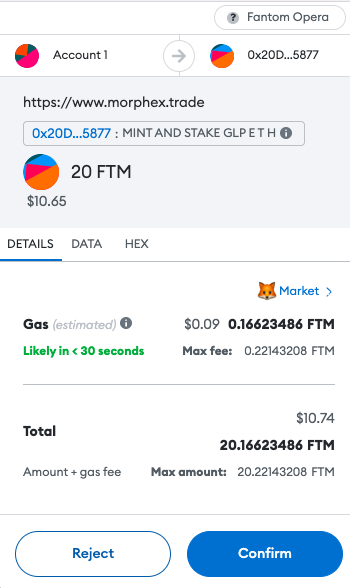

Now that the contract is approved, you can proceed to execute the trade by confirming the long position for example. Pay the associated gas fees.

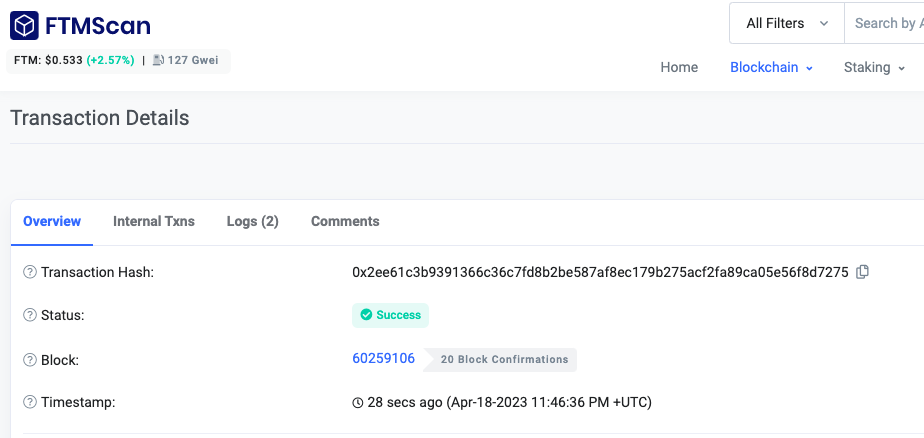

Pay the associated gas fees.  You can verify the transaction details on FTMScan.

You can verify the transaction details on FTMScan. You can also check your open positions on the dashboard.

You can also check your open positions on the dashboard.

Liquidity Provisioning on Morphex DEX

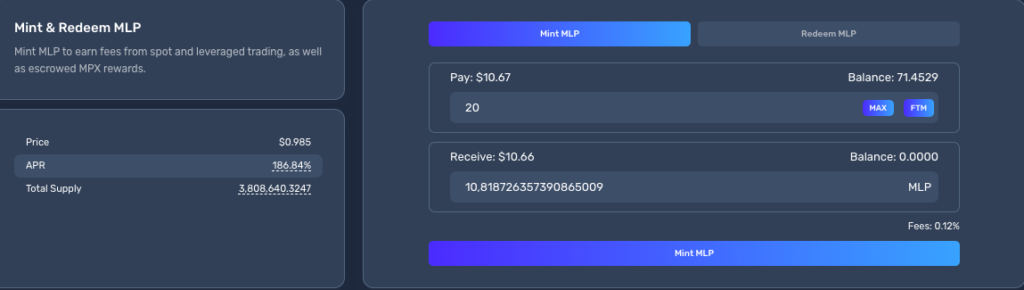

Visit the Liquidity tab to mint MLP and see a list of available MLP tokens. Choose the one with the lowest fees (located in the Save on Fees section) and enter the desired amount to purchase (with Mint MLP selected). The fee for acquiring MLP depends on the index’s asset balance, with lower fees for assets that the pool has less of compared to their target weight.

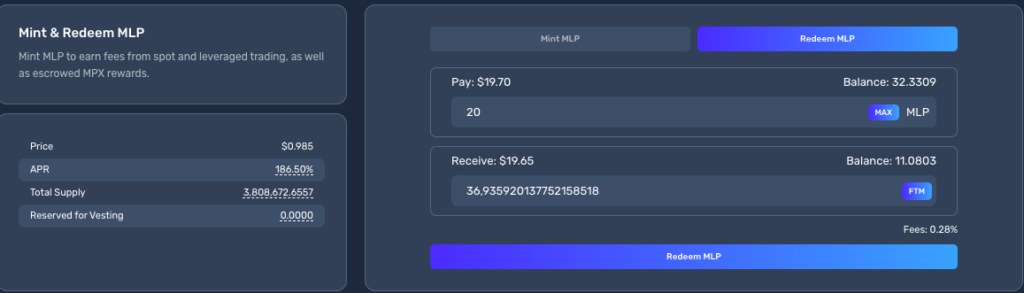

Upon purchasing MLP, it will be automatically staked, and you will begin earning Escrowed MPX and FTM rewards, visible on the “Earn” tab. To redeem MLP, enter the amount you wish to redeem on the Liquidity page with Redeem MLP selected.

You can Mint MLP to earn fees from spot and leveraged trading, as well as escrowed MPX rewards.

Simply go to: https://www.morphex.trade/liquidity

Select the asset you want to mint with and check the APR, etc.

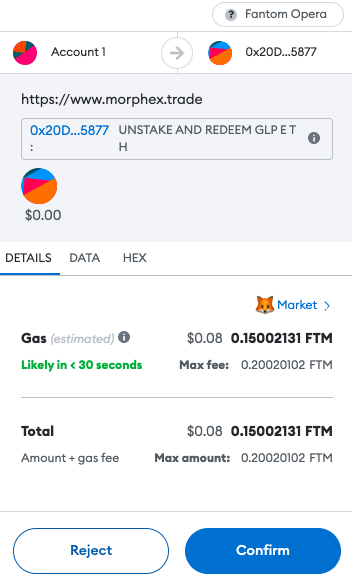

Pay the gas fee.

Once again you can confirm the transaction on FTMScan.

To redeem your MLP liquidity. Simply click ‘Redeem’ and choose how much of the liquidity you want to withdraw.

Pay the gas fee.

Rebalancing

Fees for minting/redeeming MLP and swaps depend on whether the action increases or decreases the index’s asset balance. For example, if the index has a large percentage of FTM and a small percentage of USDC, actions that increase FTM in the index will have a high fee, while those that decrease FTM will have a low fee. Token weights, or each asset’s proportion in the index, can be viewed on the Dashboard and are adjusted to protect MLP holders based on traders’ open positions.

If token prices rise, MLP’s price will also increase, even if many traders have long positions on the platform. However, if numerous traders are shorting a specific asset, leading to a higher weight for stablecoins, MLP holders will have synthetic exposure to the asset being shorted. For instance, if FTM is shorted and its price drops, MLP’s price will also decrease. If FTM’s price increases, MLP’s price will rise due to the losses of short positions.

Risks

Interacting with any smart contract or blockchain application carries risks, such as potential vulnerabilities in the smart contract code. Some risks include smart contract risks, counterparty risks (profits made by traders come from the MLP pool), and bridged token risk (potential for de-pegging due to bridge security risks).

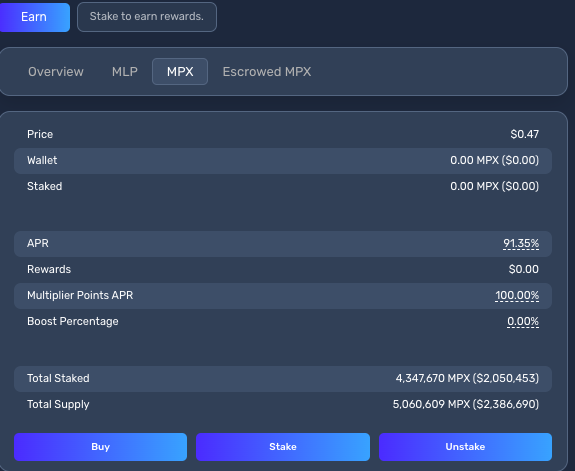

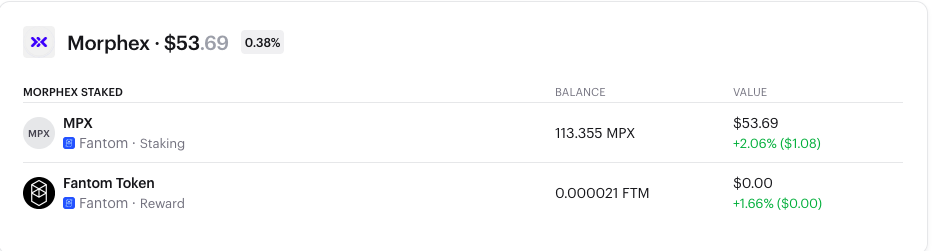

Staking MPX tokens on Morphex

Reward Structure and Mechanics

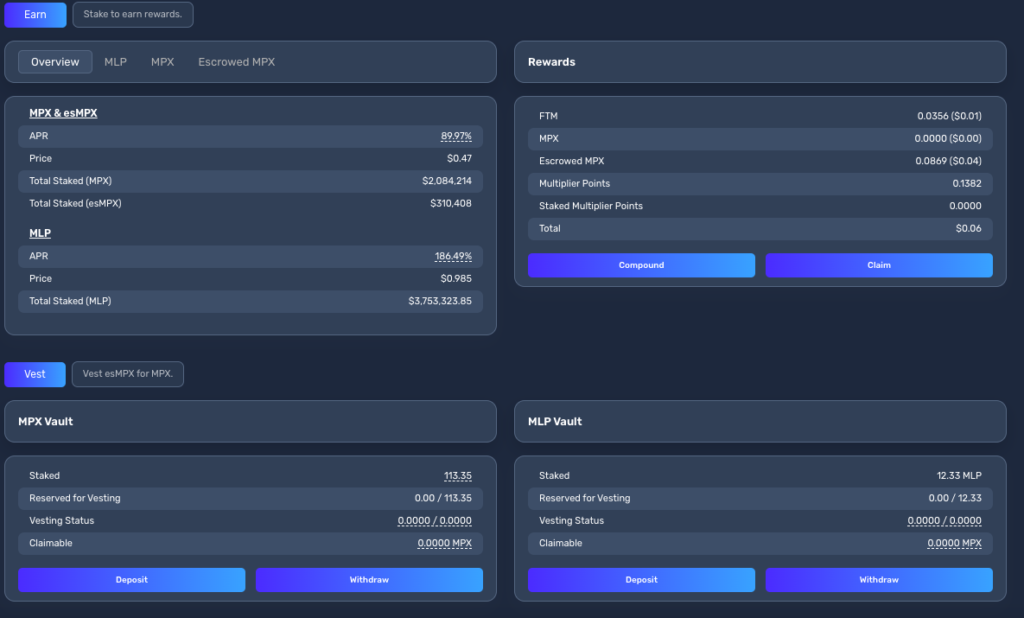

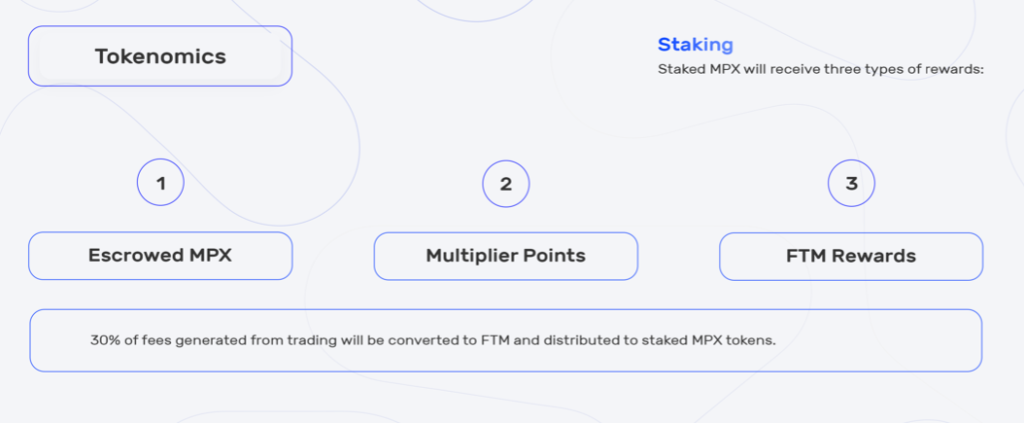

Three types of rewards are earned by staked MPX:

- Escrowed MPX

- Multiplier Points

- FTM Rewards

Trading fees account for 30% of the FTM distributed to staked MPX tokens. It’s important to note that the distributed fees are based on the amount remaining after subtracting referral rewards and the network expenses of keepers.

To stake your MPX tokens and start earning rewards, visit the Earn page on the website. There, you will find two options for obtaining rewards: “Compound” and “Claim”. Selecting “Compound” will stake your pending Multiplier Points and future Escrowed MPX rewards, increasing your overall rewards. By choosing “Claim”, your pending rewards will be sent to your wallet.

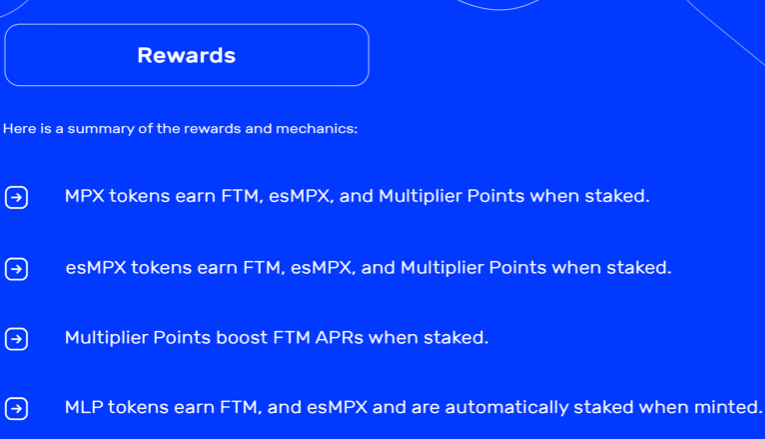

You can unstake your Escrowed MPX tokens for vesting at any point in the future if you opt to compound or stake them. When staked, MPX tokens earn FTM, esMPX, and Multiplier Points; esMPX tokens generate FTM, esMPX, and Multiplier Points; Multiplier Points enhance FTM APRs; and MLP tokens accrue FTM and esMPX, automatically staking when minted.

To get started, go to: https://www.morphex.trade/earn

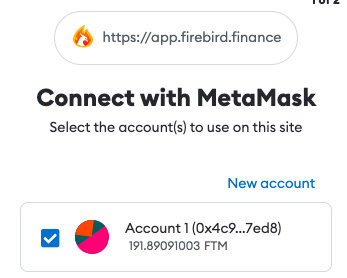

Connect your wallet to https://app.firebird.finance/

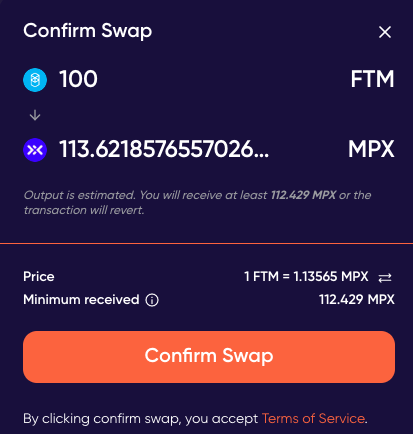

Swap your FTM tokens for MPX.

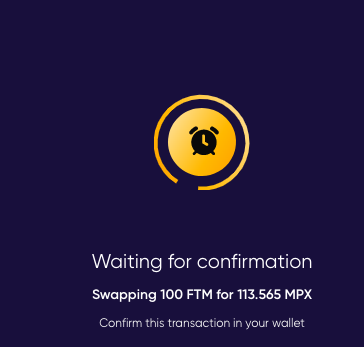

Confirm the transaction.

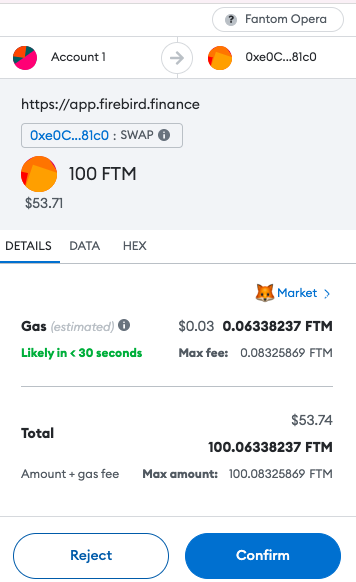

Pay the gas fee.

Check transaction status on FTMScan.

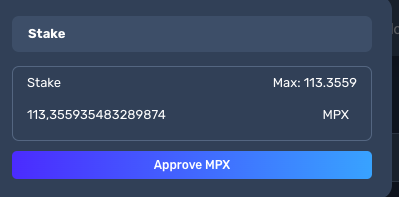

Now you can proceed to approve the stake.

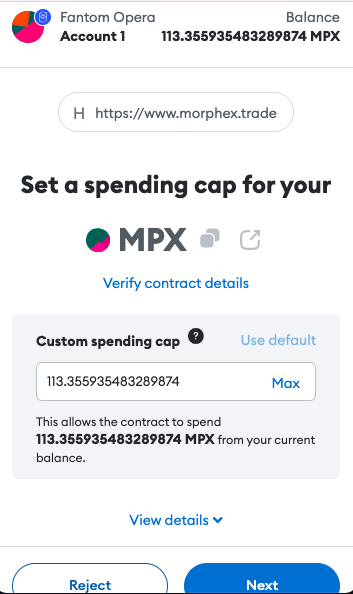

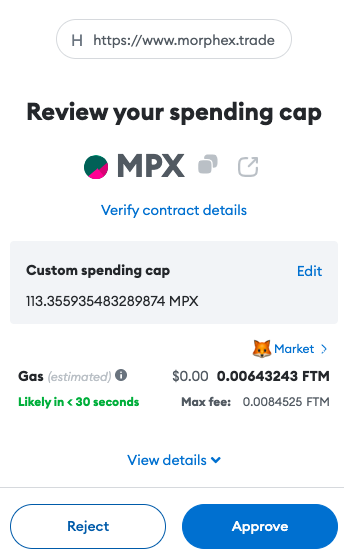

Set your spending cap if using MetaMask.

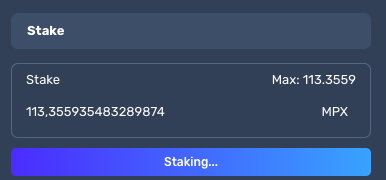

Verify your transaction and proceed to stake.

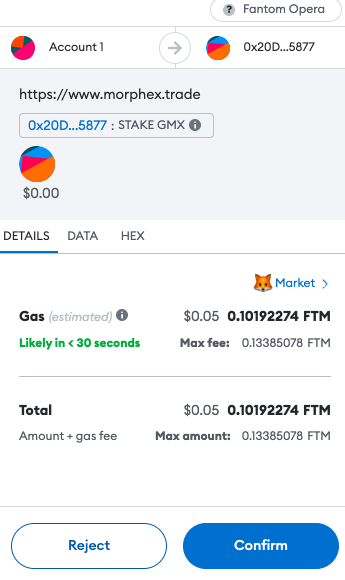

Pay the gas fee.

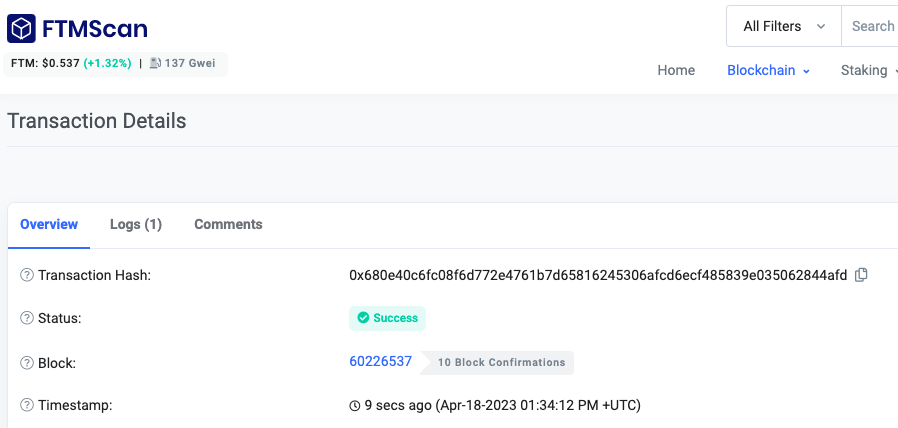

Check FTMScan to make sure the transaction has been processed.

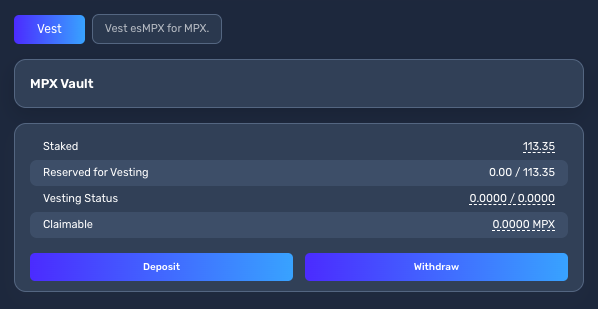

If you have successfully staked then you can also check the vault.

You can also easily make more deposits or unstake should you wish to do so. Also check the your stake is reflected in your wallet.

MPX Tokenomics

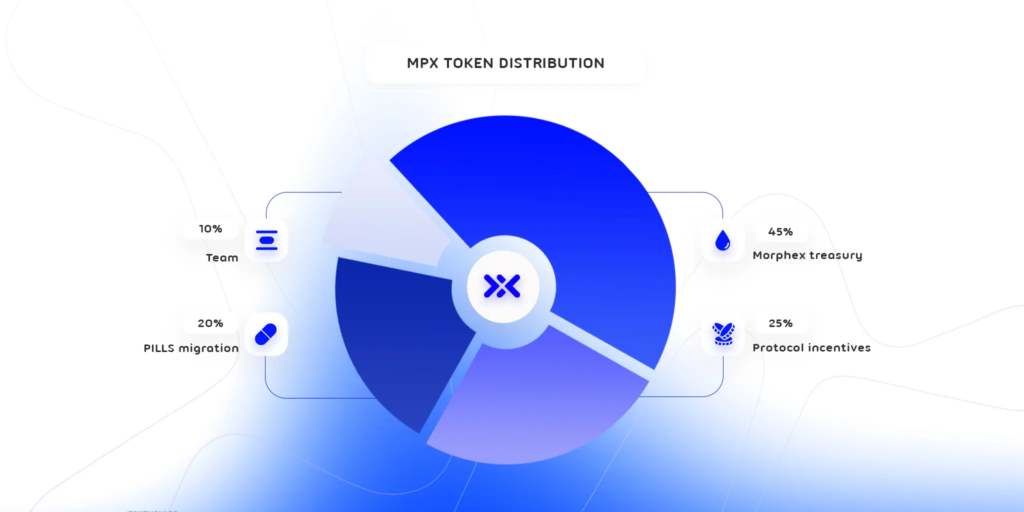

The maximum supply of MPX tokens is capped at 50 million, with the following intended token distribution:

- 20% of MPX reserved for PILLS migration, 50% available immediately upon launch and the remaining 50% vesting linearly over one year

- 25% allocated for protocol liquidity incentives in the form of escrowed token rewards (esMPX); the team will assess incentive performance and adjust accordingly, sharing results with the community

- 45% designated for the Morphex Treasury, used for marketing incentives, partnerships, fundraising rounds, protocol-owned liquidity, and community contributor compensation; treasury expenditures will be transparent and disclosed to the community

- 10% allocated to the team, adhering to the same vesting schedule as PILLS holders – linearly over one year

Escrowed MPX

Once launched, Escrowed MPX (esMPX) can be utilized in two ways:

- Staking for rewards, similar to standard MPX tokens

- Vesting into actual MPX tokens over a one-year period

Each staked esMPX token generates the same esMPX and FTM rewards as a regular MPX token. It is crucial to note that esMPX is not intended for transfer, except when transferring an entire account. The amount of MPX or MLP needed to vest esMPX is exclusive to each account and limited to the rewards earned by that account. Purchasing esMPX on the market or via OTC channels is discouraged since they cannot be vested.

Vesting

Converting Escrowed MPX (esMPX) tokens into MPX tokens is called vesting, which can be performed on the “Earn” page. When vesting begins, a specific number of MPX or MLP tokens are set aside, determined by the average quantity of MPX or MLP tokens used to earn the esMPX rewards.

Multiplier Points

Multiplier Points (MPs) are awarded to long-term MPX token holders and do not increase the total MPX supply. Staking MPX earns MPs at a fixed 100% APR rate. For instance, staking 1000 MPX for one year yields 1000 MPs. Additional rewards can be earned by staking MPs. Visit the “Earn” page and click “Compound” to do this. Each MP boosts the annual percentage rate (APR) of rewards at the same rate as a regular MPX token.

Morphex Liquidity Pool (MLP)

The Morphex Liquidity Pool (MLP) is an asset index used for swaps and leveraged trading. It can be minted using any index asset and redeemed (burnt) to obtain any index asset. The price for minting or redeeming MLP is calculated by dividing the total value of index assets, including profits and losses from open positions, by the MLP supply.

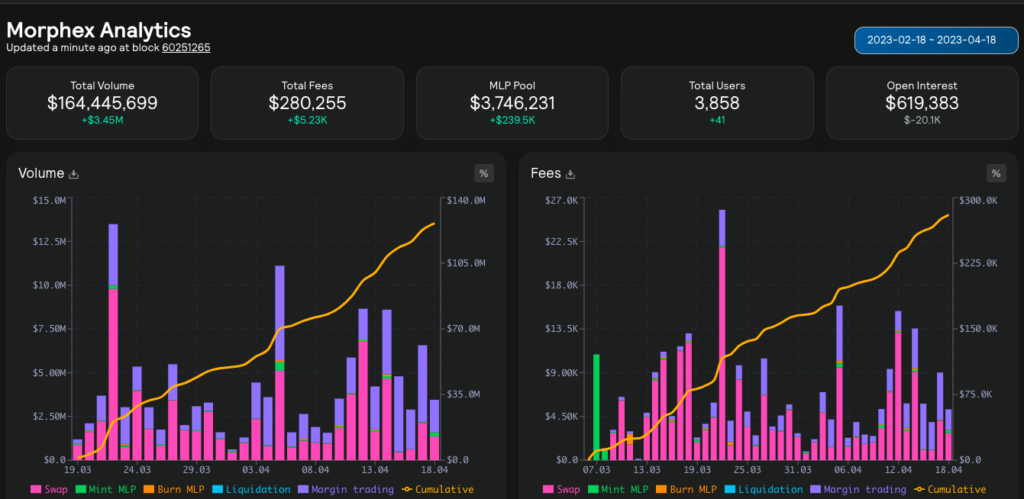

MLP holders earn rewards in the form of Escrowed MPX and a portion (60%) of platform fees paid in FTM. Note that fees distributed to MLP holders are computed after subtracting referral rewards and network expenses for keepers. If leveraged traders experience a loss, MLP holders profit, as they provide liquidity for trading (the reverse also applies). Past performance data, MLP price charts, and other statistics can be found on the analytics website.

Referrals

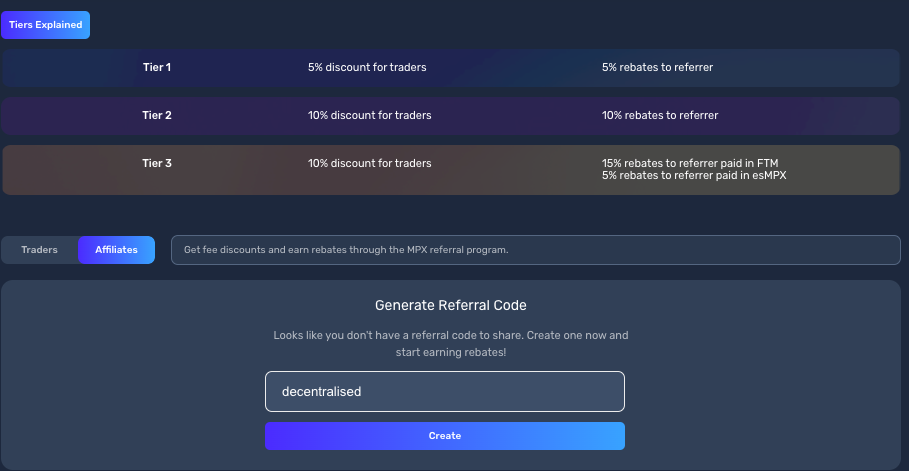

To earn rebates and discounts on the Morphex trading platform, create a referral code and share it with your network.

This way, you’ll be rewarded for bringing new traders to the platform, and they’ll save money on trading fees. The referral program features a tier system to reward active and successful referrers.