Maple Finance is an institutional capital marketplace and network, powered by blockchain technology. The protocol is live on the Ethereum mainnet and provides the infrastructure for credit experts to run on-chain lending businesses. The platform also connects institutional lenders and borrowers.

MPL is the protocol’s ERC-20 governance token. It has three core utilities i.e. protocol governance, providing Pool Cover or stake insurance to liquidity pools; and it’s also an incentive used to share network fees accrued to the Maple Treasury. MPL has a max total supply of 10 million tokens.

On Maple, users are able to access fixed-income yield opportunities by depositing capital into liquidity pools. These liquidity pools are managed by pool delegates who are effectively experienced investors. Pool delegates are there to conduct due diligence and agree terms with borrowers before funding loans from their designated liquidity pool. Liquidity providers can in turn earn yield through diversified exposure to premium institutions.

Institutional borrowers seeking transparent and efficient on-chain financing are able to then make requests for capital on Maple by simply leveraging their reputations in order to qualify for under-collateralized borrowing without the threat of liquidation and margin calls.

Lending on Maple Finance

The easiest way to earn with Maple Finance is through lending. Lenders are able to deposit into a pool to earn interest denominated in the pool’s liquidity asset. The loan terms set by pool delegates determine the interest.

Lenders do not need MPL tokens to participate in lending but they must have the pool denominated assets (e.g. USDC, wETH) in their Ethereum wallet and ETH for gas fees.

Getting started with lending on Maple is pretty straightforward. Users can simply go to the Maple Webapp to see an overview of all available pools.

Users can click on a pool to see more details:

What happens when a borrower defaults?

Pool delegates can execute defaults if a borrower has not made a payment (including non-payment or insufficient payment of principle, interest, or late fees as applicable) past the grace period on a loan. Typically, a default will:

- Reduce the pool’s value by the amount of outstanding principle on the loan and any interest accrued.

- Sell any collateral on the loan and increase the value of the pool to the value of the liquidated collateral.

- Move Delegate first loss capital to the value of the liquidation max per default into the pool.

What about Impairment?

The Maple platform provides Pool Delegates with the privilege to impair loans in the event of a potential non-payment or insufficient payment scenario, or in a scenario where a borrower has met another condition of default as articulated in the loan agreement. The impairment can be put in place to better distribute potential losses to all current lenders. Impairment prevents a situation where a loan is known to be compromised (by borrower distress or otherwise), and some lenders withdraw their capital prior to the loss, leading to the remaining lenders shouldering more of the burden of the lost capital. This may be done in a situation where the Pool Delegate believes they will be able to quickly recover a part or all of the loan’s value from the Borrower through collaborative efforts or restructuring. The Pool Delegate will maintain an active dialogue with the Borrower to recover funds through the legal process.

Lending Risks

Use of the Maple Protocol involves risks such as Smart Contract Risk, Default Risk, and Risk of Loss.

Withdrawals

Withdrawal requests are grouped into withdrawal cycles which ensures that users get a prorated distribution of cash in the event of partial liquidity in the system. To withdraw from the protocol, a user submits a request to withdraw during their current withdrawal cycle and users can execute their withdrawals during their eligible withdrawal window. Users can find the lengths of the withdrawal cycles and windows in the pool description of the relevant pool.

Borrowing on Maple Finance

Maple offers borrowers a capital efficient option in decentralized lending. Those accepted by Pool Delegates must go through a pool-specific underwriting process prior to receiving their loan.

A user needs to connect their wallet to the platform in order to access the borrowing features. They will be required to fill in a form in order to determine whether they are qualified to borrow on Maple.

How to Borrow

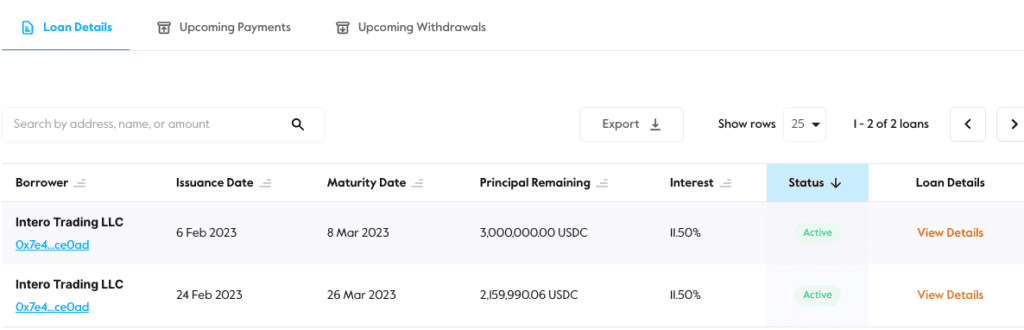

Borrowers can view their full loan histories including matured, active and unfunded loans on the dashboard.

Delegates conduct financial due diligence on the borrower and agree to terms with the borrower off-chain. Borrowers then submit a new loan request on-chain that is viewable by Pool Delegates. Once the new loan request is submitted on chain it cannot be altered in any way. If there is an error a new loan request would need to be created.

Once a borrower is approved on the platform, they are able to submit loan requests in pools.

Once due diligence is completed, terms are agreed to, and the on-chain loan request is submitted, the Pool Delegate funds the loan by making the funds requested available for drawdown by the Borrower. It is at this point that the loan is finalised and the repayment schedule commences.

MPL Tokenomics

MPL utility is being enhanced and made central to the use of the Maple protocol through combined techniques, including:

- Using the establishment fee to buyback MPL and transfer it to holders of staked MPL (xMPL);

- Enabling MPL to be deposited single-sided as Pool Cover to receive fees without risking Impermanent Loss;

- Interest rebate to Borrowers who hold MPL;

- A separate Solana token, SYRUP, is seen as the most secure and non-dilutive method for initial launch;

- MPL holders will directly benefit from Maple on Solana as the Ethereum Maple DAO will be the largest holder of ‘SYRUP’, with generated fees used to buyback MPL for xMPL holders.

Staking MPL

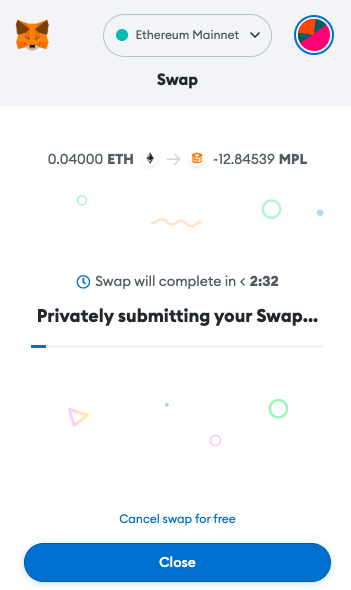

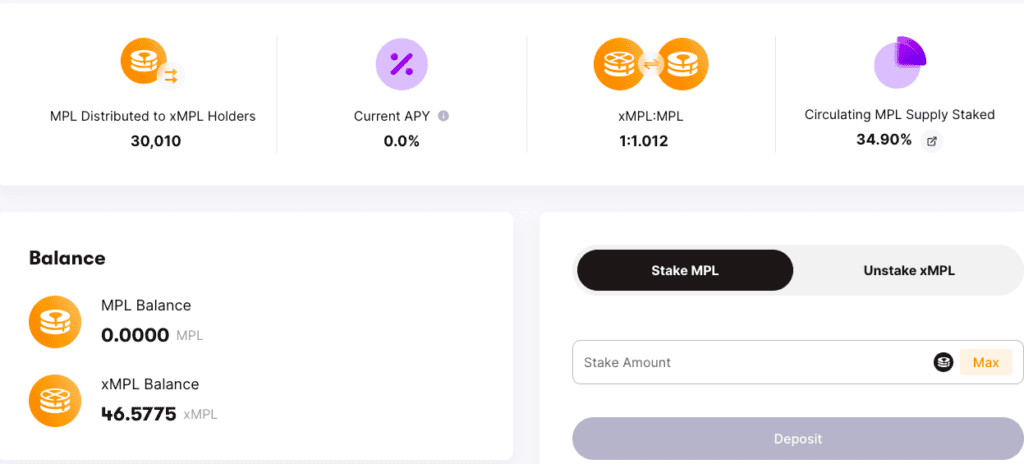

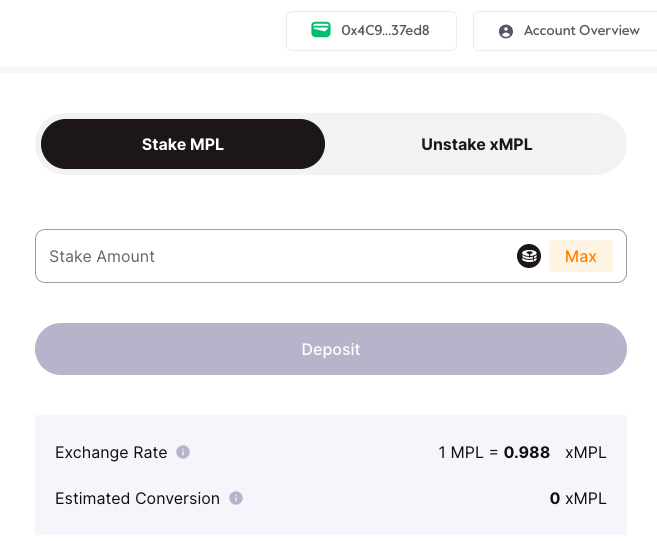

To get started with staking, visit https://app.maple.finance/#/xmpl and connect your wallet with your MPL balance. If you don’t already have MPL tokens, you can do a swap in your wallet e.g. using MetaMask.

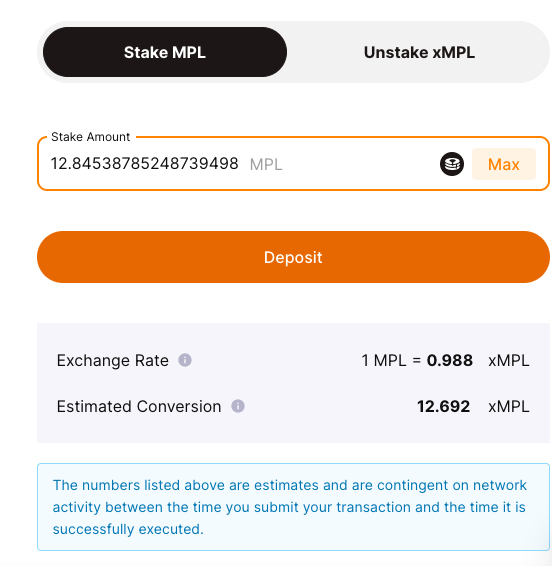

Enter the amount of MPL you wish to stake, and proceed. You will pay gas just once.

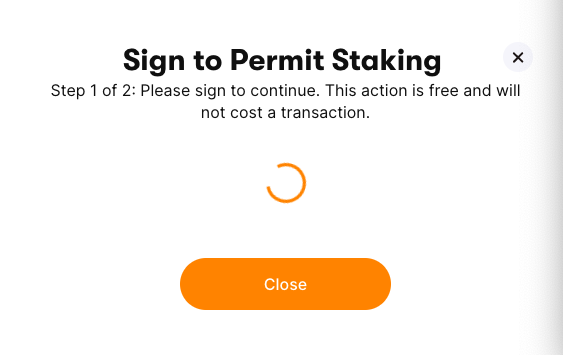

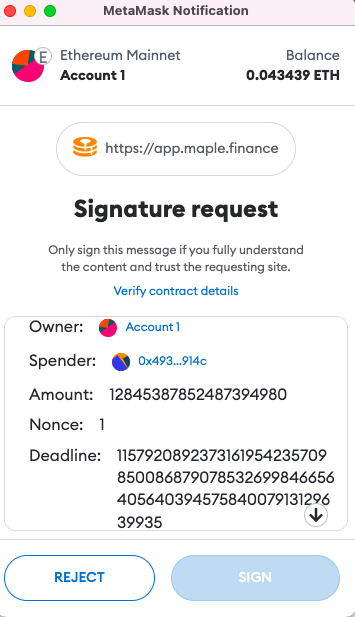

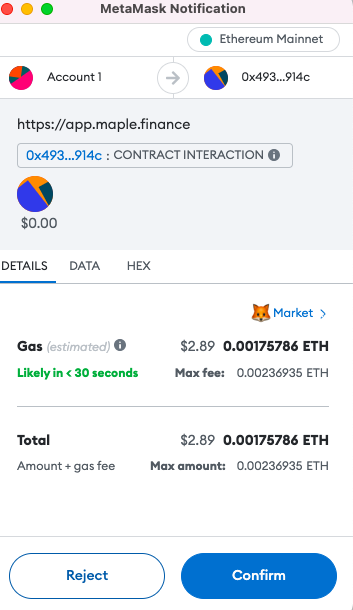

A user will have to sign a transaction to give the smart contracts permission to interact with their wallet.

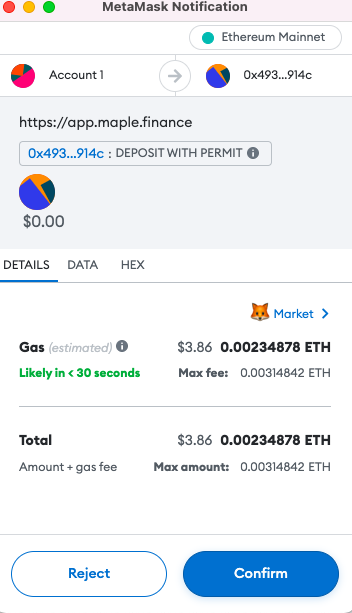

A user will have to pay the gas fee for the transaction to go through.

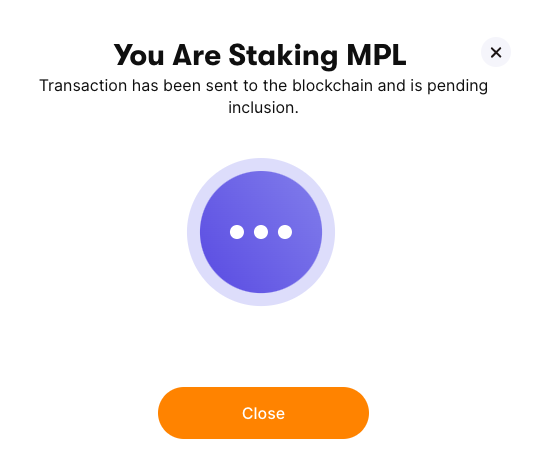

Once a user confirms, the staking transaction will be processed.

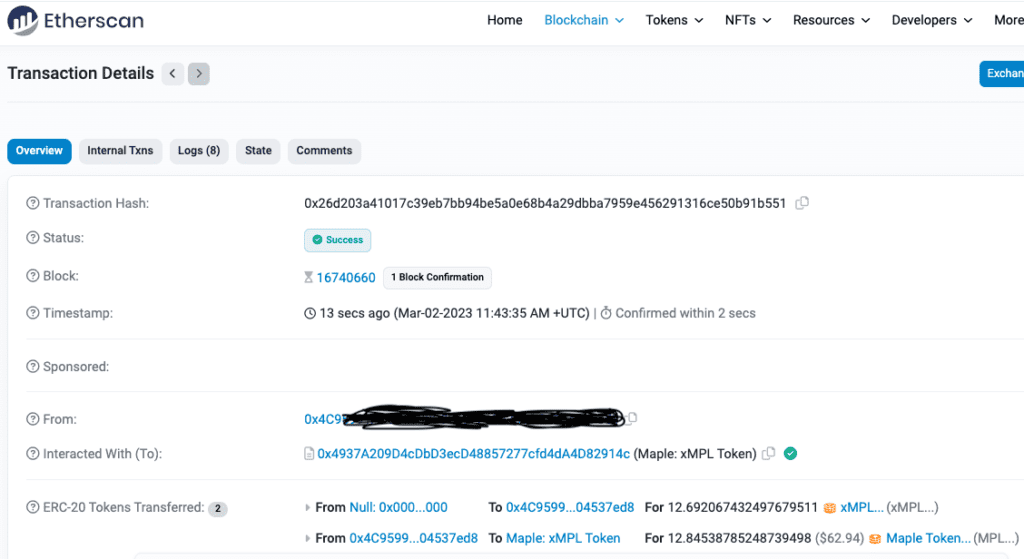

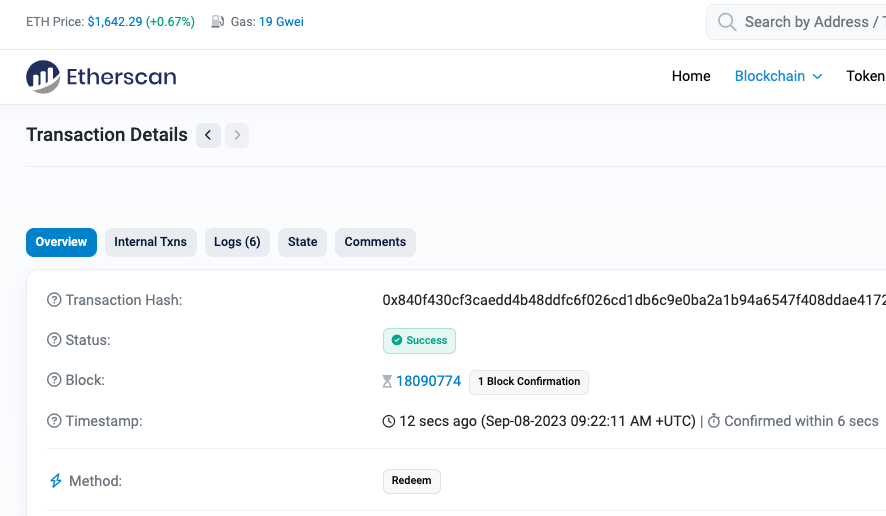

Users can verify the transaction on Etherscan.

And just like that, users will be able to stake their MPL for xMPL.

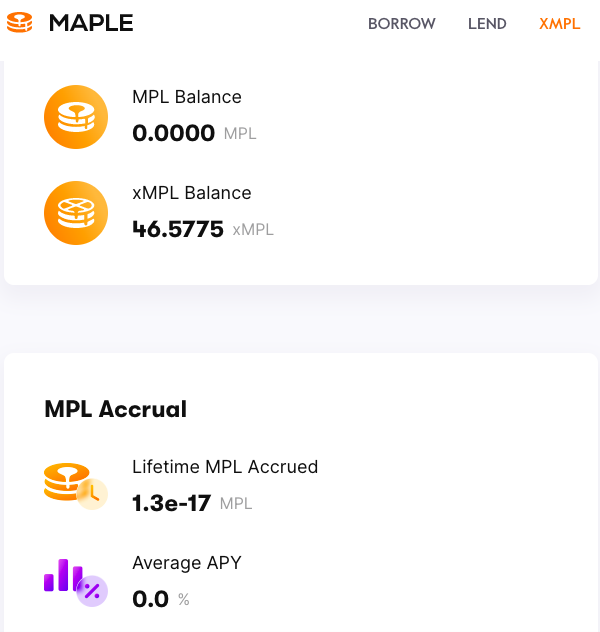

Users will see xMPL in their wallet (xMPL is the smart contract token which MPL accrues to).

Users can return to the same page to watch your MPL grow and compound, unstake your position at any time. Once you have xMPL in your wallet, you can participate in governing the Maple protocol. Users can use their xMPL to vote on key decisions, including revenue allocation used for MPL buybacks.

Staking MPL enables users to immediately begin to earn a share of protocol revenues. Users can also track their balances and compounding percentage gains by returning to the WebApp, or if they wish to – they can unstake at any time with no lock up period.

How to Unstake xMPL

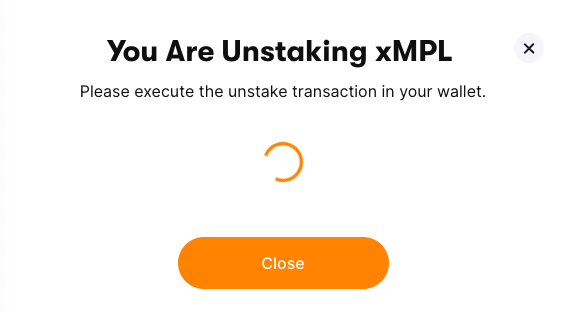

Unstaking xMPL for MPL tokens is a simple and straightfroward process. Simply go to the STAKE tab of the Maple dashboard.

Choose how much of your staked assets your want to unstake.

Approve the transaction via your web3 wallet.

Pay the associated gas fees.

You can confirm the transaction on Etherscan.

For more on Maple Finance, follow their socials. Learn more about Decentralised Finance. Stay awesome!