What is Manilla Finance?

Manilla Finance stands out as a forward-thinking and expansible CeDeFi initiative that connects the conventional fintech offerings of Web2 with the innovative Web3 environment, aiming to facilitate the settlement of utility bills using native cryptocurrency tokens. This primary functionality underscores Manilla Finance, which additionally presents a transformative peer-to-peer (P2P) marketplace enhancing the ease of entering and exiting crypto investments.

The objective of the platform is to cater to millions of customers across more than 44 countries spanning four continents. Manilla Finance not only delivers a reliable and secure P2P trading framework but also extends a variety of services such as instant lending, crypto staking, event ticketing, utility bill settlements, and purchases of airtime/data with cryptocurrencies.

Manilla Technologies, together with worldwide ecosystem partners, drives the operations of Manilla Finance.

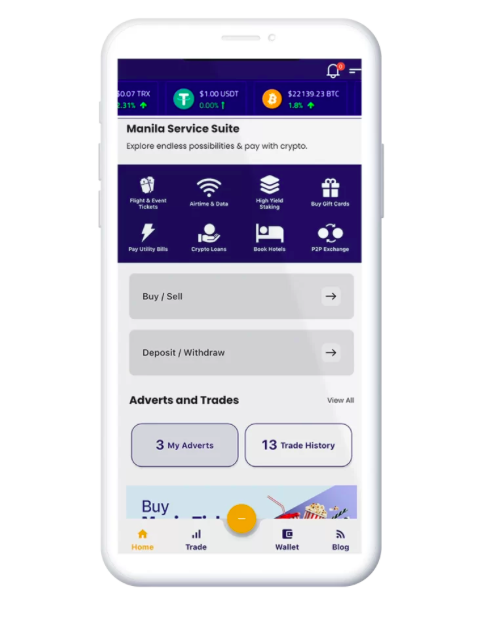

Features of Manilla Service Suite

P2P MARKETPLACE

Developed with a cutting-edge escrow system supported by blockchain, the Manilla P2P marketplace ensures a trustworthy space for users to exchange their digital assets. Competitive pricing and support for various devices are key benefits, with the platform accommodating tokens from the Binance, Ethereum, and Solana networks, allowing for a wide range of tokens to be listed for trading.

Developed with a cutting-edge escrow system supported by blockchain, the Manilla P2P marketplace ensures a trustworthy space for users to exchange their digital assets. Competitive pricing and support for various devices are key benefits, with the platform accommodating tokens from the Binance, Ethereum, and Solana networks, allowing for a wide range of tokens to be listed for trading.

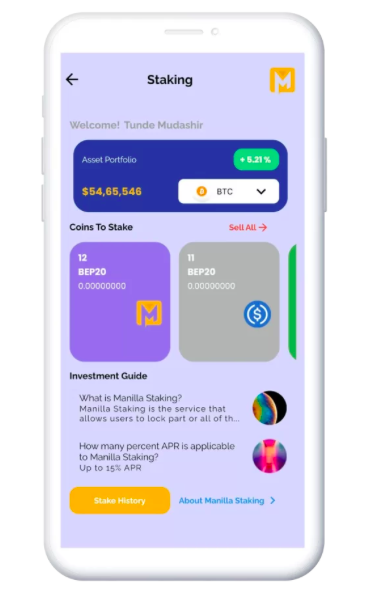

STAKING

Investors can enhance the value of their preferred digital assets through staking, securing attractive annual rewards. The staking service offers up to 15% APR and is exclusive to stablecoins. Moreover, owners of the platform’s native token, $MNLA, can participate in the governance through a profit-sharing scheme by staking their tokens in the designated vault.

Investors can enhance the value of their preferred digital assets through staking, securing attractive annual rewards. The staking service offers up to 15% APR and is exclusive to stablecoins. Moreover, owners of the platform’s native token, $MNLA, can participate in the governance through a profit-sharing scheme by staking their tokens in the designated vault.

MANILLA DEBIT CARD

The Manilla Debit Card, leveraging advanced fintech and blockchain gateways, enables users to conduct crypto transactions seamlessly. This card allows everyday purchases at retail outlets and online without the high fees typically associated with traditional banking.

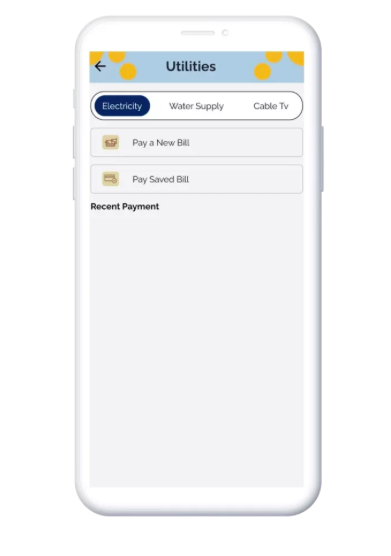

UTILITY BILL PAYMENTS

Users can effortlessly settle bills for services like electricity and water in five continents directly from their Manilla wallet, bypassing traditional currency systems. This feature will be initially available in select pilot regions, including Canada, Netherlands, Australia, and several African countries.

Users can effortlessly settle bills for services like electricity and water in five continents directly from their Manilla wallet, bypassing traditional currency systems. This feature will be initially available in select pilot regions, including Canada, Netherlands, Australia, and several African countries.

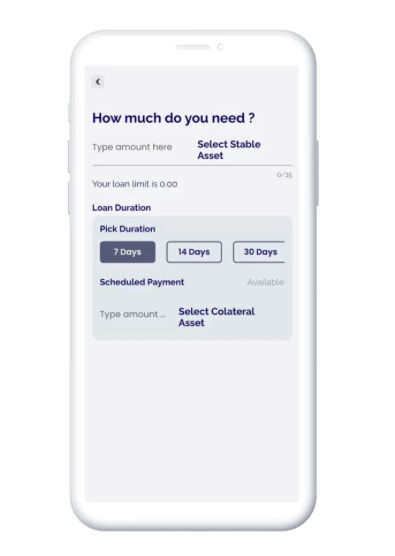

LENDING

With Manilla Finance, there’s no need to liquidate assets at unfavorable prices. Users can obtain loans against their digital assets held on the platform, enjoying low-interest rates over short durations, with the collateralized assets continuing to earn returns.

With Manilla Finance, there’s no need to liquidate assets at unfavorable prices. Users can obtain loans against their digital assets held on the platform, enjoying low-interest rates over short durations, with the collateralized assets continuing to earn returns.

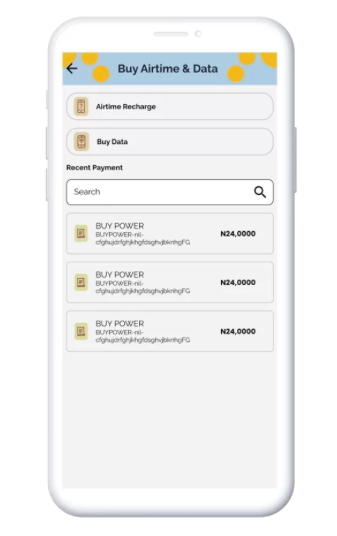

AIRTIME & DATA PURCHASES

The platform’s Airtime & Data service is designed for simplicity and global reach, connecting users with over 800 telecom providers worldwide. Initially, this service will be accessible in 44 countries.

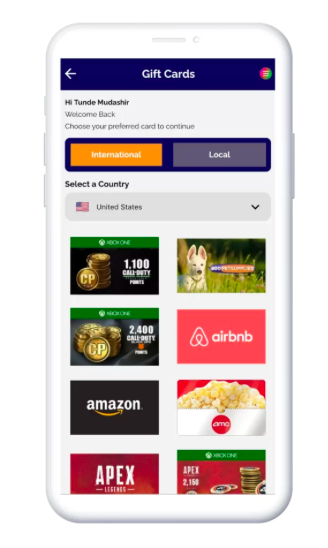

GIFT CARDS

Targeting a global audience, the Manilla gift card offering will initially reach 44 countries, allowing users to purchase, exchange, and gift cards accepted by major international brands.

Targeting a global audience, the Manilla gift card offering will initially reach 44 countries, allowing users to purchase, exchange, and gift cards accepted by major international brands.

SECURE NON-CUSTODIAL WALLET

Enhancing user services, Manilla Finance introduces an advanced non-custodial wallet featuring integrated web3 decentralized applications (DApps) and proprietary apps, addressing the issue of lost cryptocurrency tokens.

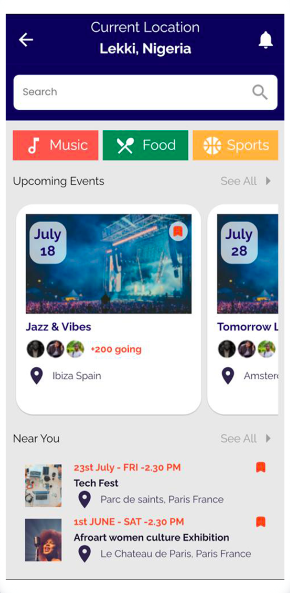

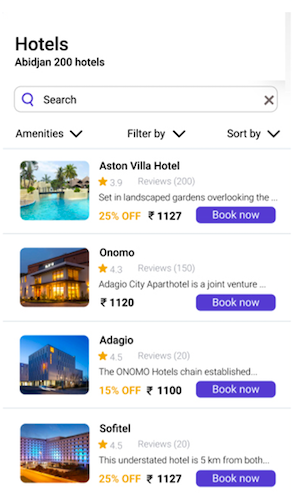

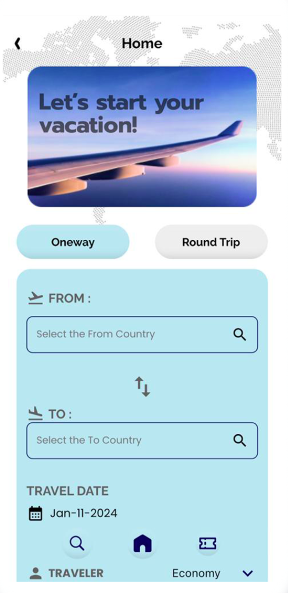

TICKETING SERVICES

The Manilla app also facilitates the booking of hotels, and the purchase of movie, event, and flight tickets with cryptocurrencies, streamlining processes that were previously cumbersome and inefficient.

The Manilla app also facilitates the booking of hotels, and the purchase of movie, event, and flight tickets with cryptocurrencies, streamlining processes that were previously cumbersome and inefficient.

Manilla App

Manilla Finance is bridging the traditional finance world with web3 and developing a suite of products that can be enjoyed by native crypto users and new entrants to the web3 world alike.

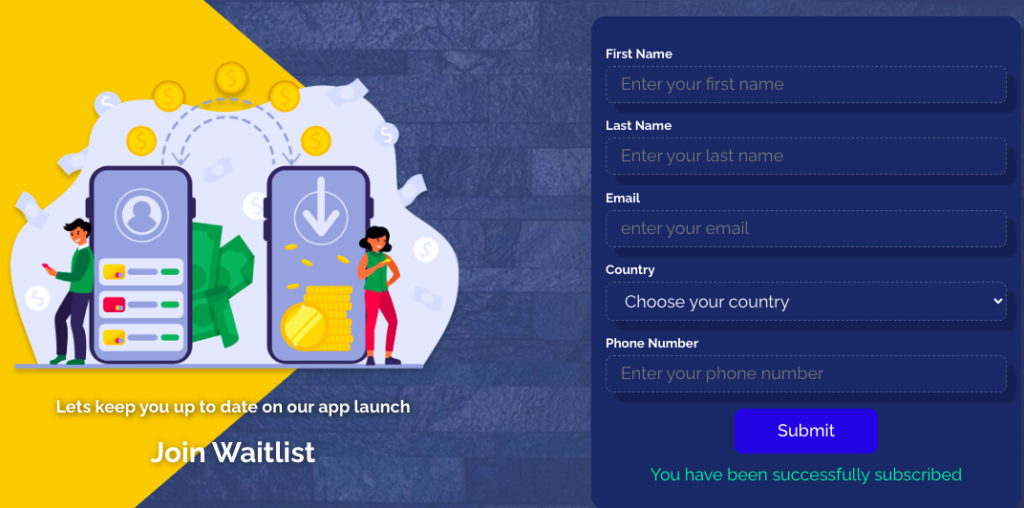

The ecosystem looks promising and if you want to stay updated on the ecosystem developments, make sure you follow the socials including X, LinkedIn and Telegram. You can also join the waitlist so that you’ll be among the first to get informed when the eagerly anticipated Manilla App launches.