Kava – DeFi Lending Platform for Digital Assets

Review of Kava – the decentralised finance lending platform for cryptocurrencies.

To the untrained eye, the use case for cryptocurrencies is limited to trading and quickly transferring money across borders. Decentralized finance platforms have opened the door to seemingly limitless possibilities which appear impossible at first glance.

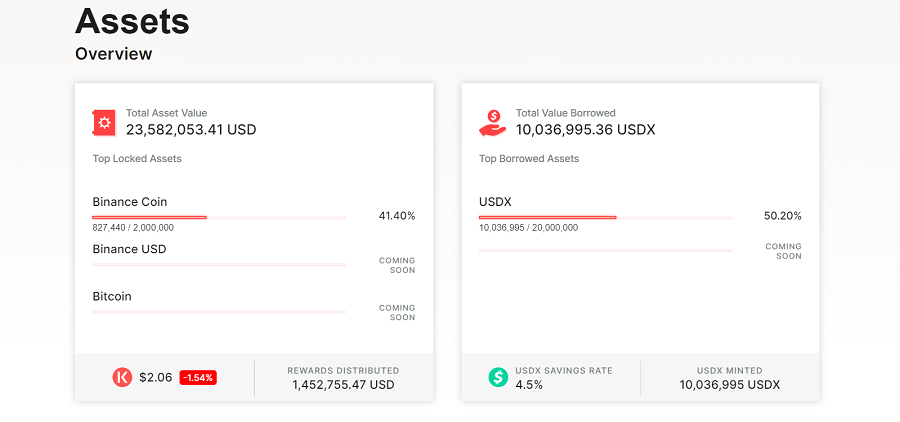

One of these is Kava, a cryptocurrency platform which makes it possible to create a stable cryptocurrency which mirrors the US dollar called USDx. It does this using volatile assets such as Bitcoin, XRP (Ripple), and BNB (Binance Coin). Not only that, but those who participate in its network can earn up to 20% on their assets.

Who created Kava?

Kava was created by San Francisco based Kava Labs, whose team has over a decade of experience in finance. Although the project received just over one million USD in funding, Kava’s valuation is over 70 million USD at the time of writing. Given that the project was launched just 2 years ago, it has made impressive progress and partnered with many notable players within the cryptocurrency space such as Binance, the largest cryptocurrency exchange. It has also issued over 10 million USD worth of its USDx cryptocurrency.

How does Kava work?

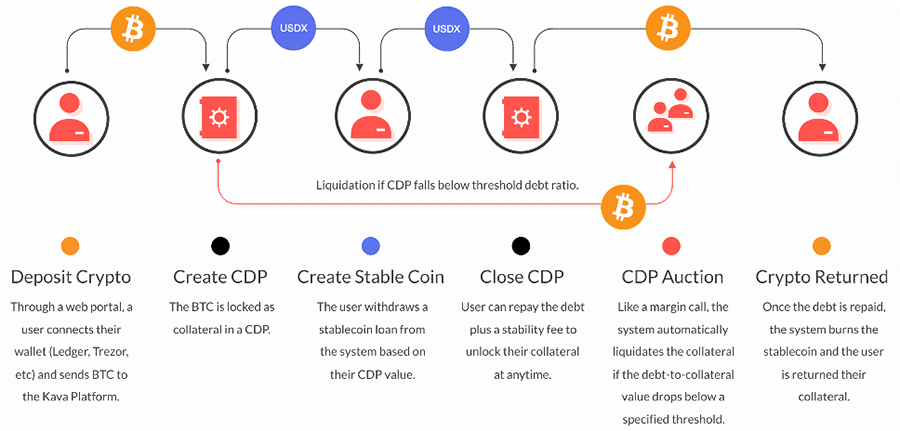

While most decentralized finance platforms are created using the Ethereum blockchain, Kava is built using a cryptocurrency called Cosmos which offers easy tools for developers to quickly build their own custom cryptocurrencies and platforms. This would normally be a problem since Kava would be isolated from most other decentralized finance platforms (since most are built on Ethereum). However, Kava is designed to be interoperable – to work with other cryptocurrencies including all of those in Ethereum’s ecosystem. Similar to DeFi platform MakerDAO, Kava will allow users to create collateralized debt positions (CDPs) on the Kava protocol in exchange for a stablecoin, USDX, pegged one-to-one with the U.S. dollar. Unlike Maker, though, Kava works with assets outside the Ethereum ecosystem.

To issue Kava’s USDx cryptocurrency token, users must lock their cryptocurrency assets (currently only BNB but soon Bitcoin and XRP). A program called a price oracle determines how many USDx can be minted (issued/created) based on the USD price of the cryptocurrency that was deposited as well as its general volatility (how much its price fluctuates). This USDx can be borrowed, lent, traded for other cryptocurrencies, and even withdrawn into fiat currency (actual USD). This entire process is regulated and maintained by smart contracts – automated application which ensures the entire system stays robust.

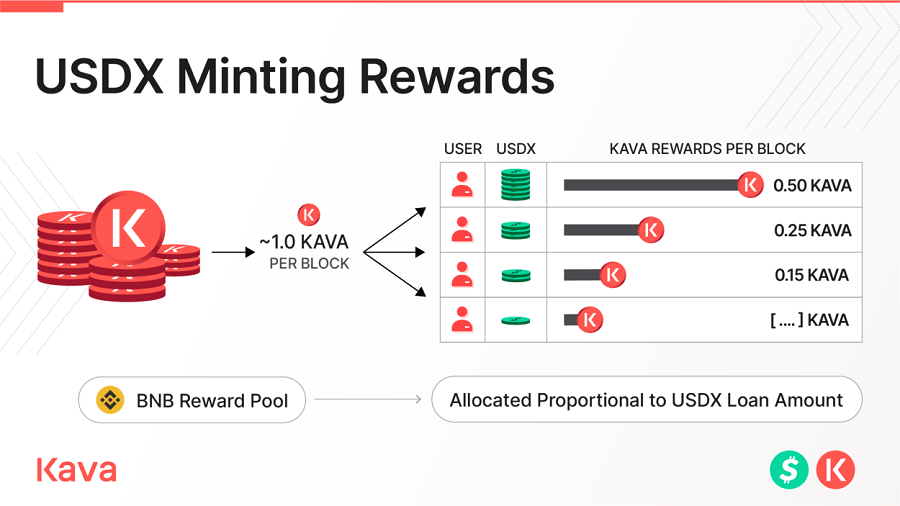

Kava’s brilliance comes from its use of financial incentives to maintain its network operations. For example, you are able to stake the KAVA token and receive anywhere between 3% to 20% interest per year (paid in KAVA tokens). Doing this also gives you voting power over what new features are implemented onto the platform. The interest rate you receive depends on network participation. If not enough people are staking, the rewards for staking will go up to incentivize users to be engaged with the platform.

Why is Kava important?

Some consider Bitcoin to be a form of digital gold. Projects like Kava take that perspective to the next level by allowing assets such as Bitcoin to become the asset which backs their own cryptocurrency based US dollar. This brings back the “gold standard” in a digital way while also giving financial incentives to users to ensure the platform continues to operate without issue. Not only that, the fact that you do not need any sort of personal documentation or credit checks to participate on platforms such as Kava opens up financial services to anyone with an internet connection.