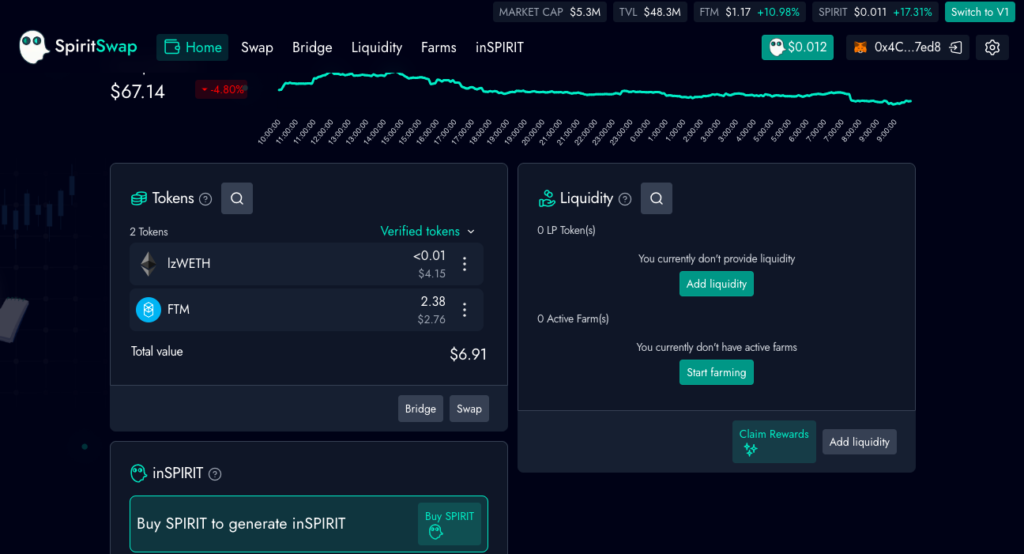

How to Use SpiritSwap DEX on Fantom

SpiritSwap decentralized exchange (DEX) on the Fantom Opera Chain Review.

What is SpiritSwap?

SpiritSwap, a decentralized exchange (DEX) on the Fantom Opera Chain, was initially modeled after Uniswap’s constant-product automated market maker (AMM) system. However, with the introduction of their Version 2 (V2) model, SpiritSwap has significantly diverged from Uniswap’s original aesthetics and functionality, opting for a completely redesigned code base specifically tailored for the Fantom community.

SpiritSwap’s appeal lies in amalgamating the finest elements of decentralized finance (DeFi) into a comprehensive DeFi hub. SpiritSwap’s AMM facilitates effortless token swaps by allowing liquidity providers to deposit token pairs, which are then automatically market-made by an algorithm, ensuring fixed swap rates.

How to Swap Digital Assets on SpiritSwap

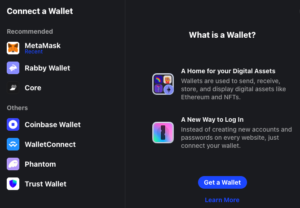

Connect your web3 wallet.

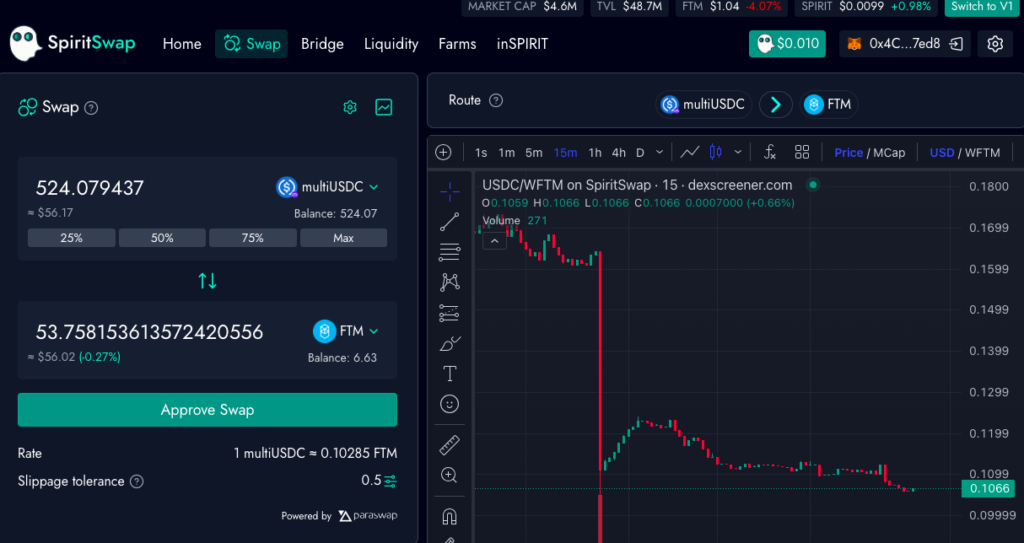

Once your wallet is connected, you can proceed to execute your swap.

In this demonstration, we are going to swap multiUSDC (not a dollar-backed stablecoin) for FTM tokens.

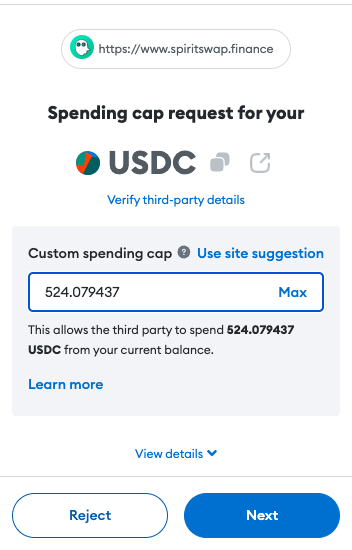

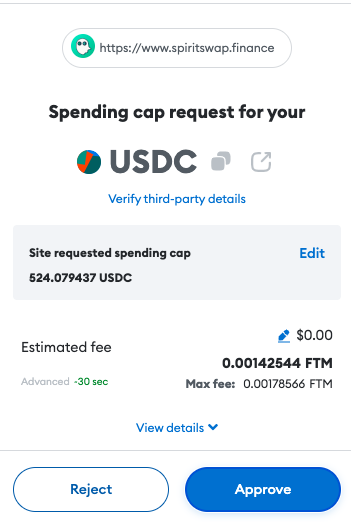

Set your spending cap to avoid spending more than you are willing to.

Pay the gas fee.

You’ll be notified once your swap is approved.

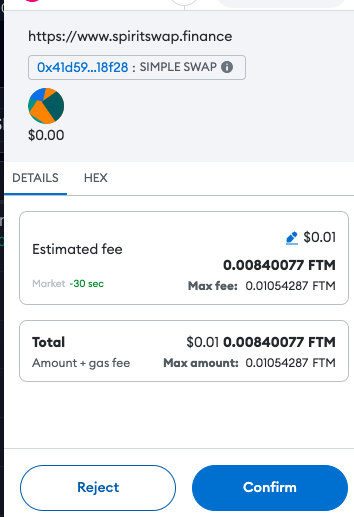

Pay the transaction fee.

Your transaction is processed and you’re notified on the status of the transaction.

SpiritSwap Fees

SpiritSwap charges a fee for each transaction, distributing the collected fees among partnership protocols, liquidity providers, and inSPIRIT holders. Presently, SpiritSwap’s V2AMM encompasses two types of AMMs: the variable AMM (vAMM), which utilizes a 50/50 token match following the X*Y=K formula, and the stable AMM (sAMM), which supports direct 1:1 pegged liquidity pairs, improving upon the solidly model.

Plans are in place to expand the V2 AMM to include four subtypes, aiming to enhance support for weighted pools and linear stable pools, thus increasing capital efficiency for stable pairings. SpiritSwap prides itself on integrating core DeFi solutions like yield farming, liquidity provision, and lending/borrowing, among others, into a singular, comprehensive DeFi platform.

The upgraded SpiritSwap V2 leverages multiple AMM models, unified through a master router to optimize benefits for both traders and liquidity providers. The exchange employs a mix of vAMM and Balanced AMM infrastructures, with future implementations aimed at minimizing impermanent loss (IL) and maximizing cost efficiency.

For token exchanges, SpiritSwap simplifies the process through its automated liquidity pools, with a notable reduction in vAMM fees from 0.3% to 0.18% to foster a more positive ecosystem feedback loop. A new competitive fee structure is also introduced for the stable AMM, set at a mere 0.01%.

Yield farms play a crucial role in SpiritSwap’s ecosystem, acting as incentives for users to provide liquidity by staking digital asset pairs in decentralized market-making pools. Liquidity providers are compensated with $SPIRIT tokens for their contributions, promoting the adoption and functionality of SpiritSwap as a DEX.

Tokenomics

In terms of tokenomics, $SPIRIT serves as the protocol token, rewarded to farmers and usable as collateral within SpiritSwap’s lending network. $inSPIRIT, a governance token, is non-transferable and offers various benefits, including farming multipliers and participation in governance decisions. $SPIRIT-LP tokens represent shares in liquidity pools, further enabling users to farm $SPIRIT by staking these tokens.