How to Trade Crypto Derivatives During High Volatility

Profiting from the Chaos in Crypto Markets.

Mastering Implied Volatility, Market Reactions & Trading Tools in the Derivatives Arena

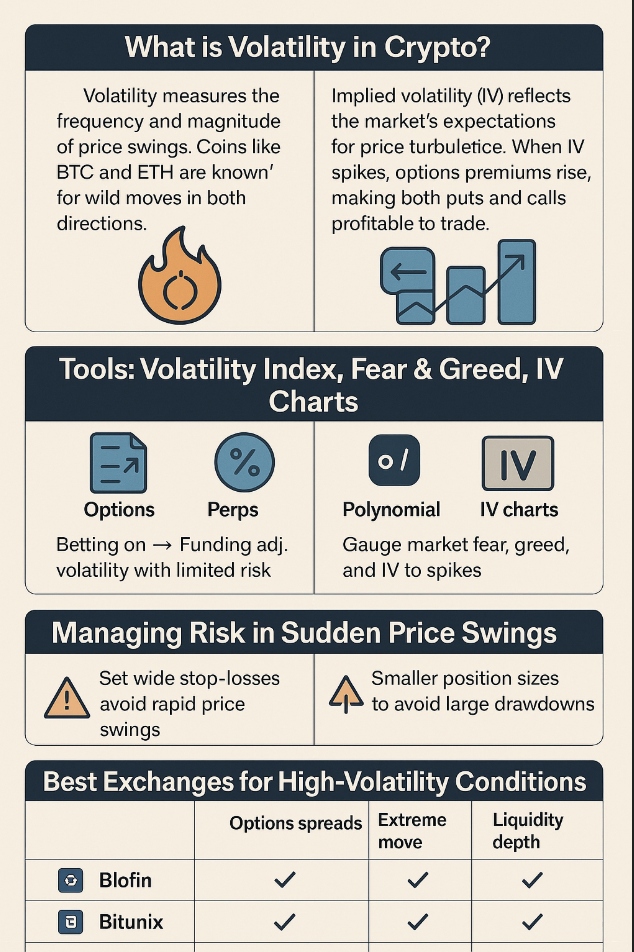

What is Volatility in Crypto?

Volatility is the heart of crypto trading. It refers to how drastically the price of a cryptocurrency moves over time.

In traditional markets, volatility is often seen as a risk. In crypto, it’s an opportunity factory. Price swings of 10–20% in a day are not uncommon, and that’s where sharp traders find alpha.

Key Features of Crypto Volatility:

-

24/7 markets with no downtime

-

Influenced by news, whales, liquidations

-

Global market with fragmented liquidity

-

Driven by sentiment and speculation more than fundamentals

Why High IV = High Opportunity

Implied Volatility (IV) represents the market’s expectations for future price movement. In the options world, high IV typically leads to higher option premiums.

When IV is High:

-

Options become expensive (great for sellers)

-

Perps funding rates spike

-

Volatility breakout traders sharpen their tools

Opportunity Zones:

-

After major market news (ETF approvals, hacks)

-

During funding rate divergence on perps

-

Leading into major expirations or unlocks

🎯 Volatility doesn’t just signal chaos—it signals liquidity, attention, and opportunity.

Trading Volatility: Options vs Perps

Options

-

Best for betting on magnitude of moves (not direction)

-

IV Crush happens when IV falls post-event, crushing premium value

-

Great for structured strategies (straddles, strangles)

Platforms:

✅ Deribit | ✅ Polynomial |

Perpetuals (Perps)

-

Ideal for quick directional trades during spikes

-

Use low-latency platforms with tight spreads

-

Great for breakout and mean-reversion setups

Platforms:

✅ Bybit | ✅ Bitunix | ✅ BingX

Tools to Trade Volatility Like a Pro

Here are some essential indicators and dashboards that every volatility-focused trader should bookmark:

| 🛠️ Tool | 🔎 Use Case | 🧪 Best Platform |

|---|---|---|

| Volatility Index (BVOL) | Gauge market-wide fear | Bybit |

| Fear & Greed Index | Sentiment snapshot | Alternative.me |

| IV Charts | Options pricing signals | Polynomial, Deribit |

| Funding Rate Trackers | Trend exhaustion alerts | Blofin, CoinGlass |

Best Exchanges for High-Volatility Conditions

Managing Risk During Volatility Storms

Tips to survive and thrive:

-

✅ Use tight stop-losses, especially at high leverage

-

Scale into positions, avoid full-size entries

-

Hedge perp positions with options

-

Monitor funding rates—they reflect crowd direction

💡 When others panic, the prepared execute.

Volatility Breakout vs Mean Reversion

| 🎯 Strategy | 📉 Setup | 📈 Signal | 🔧 Tools |

|---|---|---|---|

| Volatility Breakout | Price consolidating at range top/bottom | Volume spike + breakout | Bybit, XT.com |

| Mean Reversion | Overextended wick moves | RSI divergence + cooling volume | Blofin, Polynomial |

Key Takeaways

Volatility is the playground of pros. When the market panics, it’s not the loudest that win—it’s the ones with a plan. Whether you’re trading straddles on Deribit, scalping breakout perps on XT.com, or watching IV curves on Polynomial – volatility is your alpha.

So next time the market shakes, don’t flinch. Lean in.