Flash crashes in crypto derivatives aren’t random – they’re precision-triggered avalanches set off by cascading liquidations, leverage spirals, and algorithmic panic. In this article, we dissect how they start, why they escalate so rapidly, and most importantly, how smart traders survive them.

Flash crashes are sudden, sharp market drops within seconds or minutes. They typically arise from a lethal mix of:

-

Excessive leverage across the market

-

Thin liquidity in the order books

-

Aggressive liquidations triggered by price moves

-

Systematic unwinding of large positions

These elements create a domino effect where automated sell-offs exacerbate the original move.

Imagine thousands of traders using 25x leverage. If Bitcoin drops just 4%, it can wipe out all those leveraged positions.

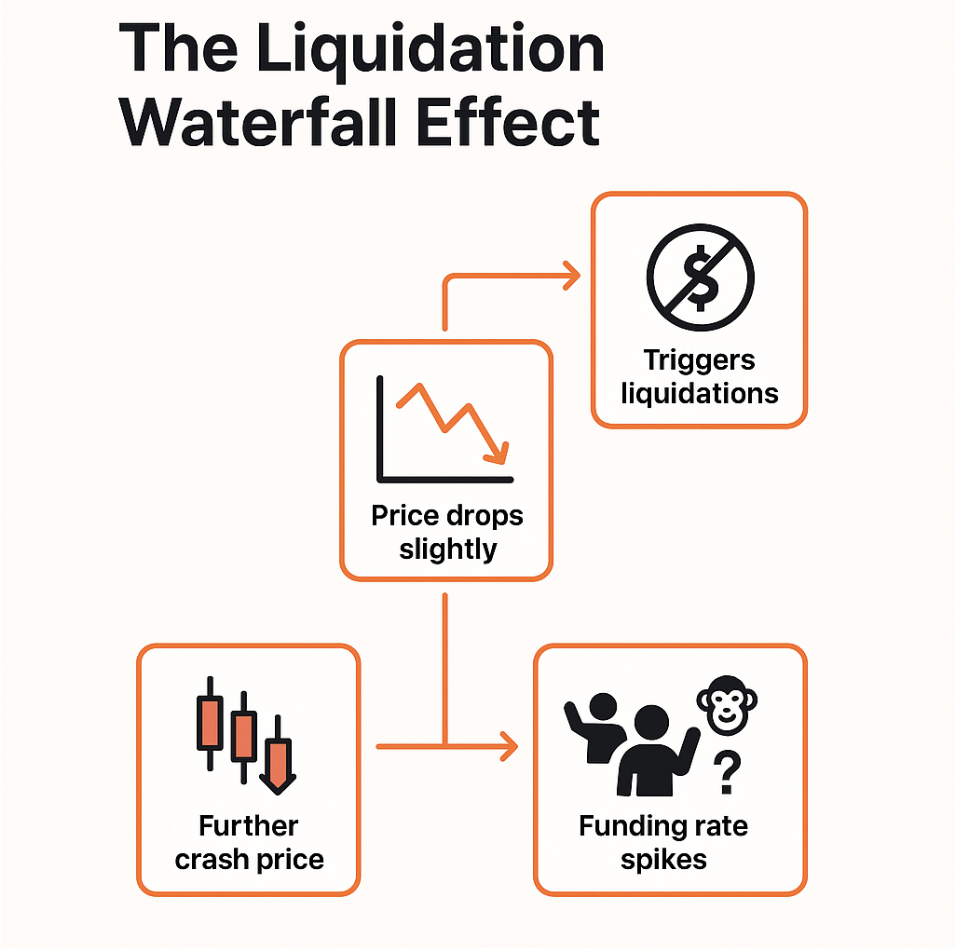

The Chain Reaction:

-

Price drops slightly → triggers liquidations.

-

Liquidations become market orders → further crash price.

-

More margin calls get hit → more liquidations.

-

Funding rates go haywire → panic exits or apes buy the dip.

This creates what’s called a liquidation cascade.

Case Study: Flash Crashes on Bybit, Binance, XT.com

| Exchange | Date | % Drop | Trigger Event | Recovery Time |

|---|---|---|---|---|

| Bybit | Mar 2020 | -47% | COVID crash + leverage wipe | ~3 days |

| Binance | May 2021 | -30% | China FUD + overleveraged longs | ~4 hours |

| XT.com | Oct 2023 | -22% | Sudden spike in funding rate | ~1 hour |

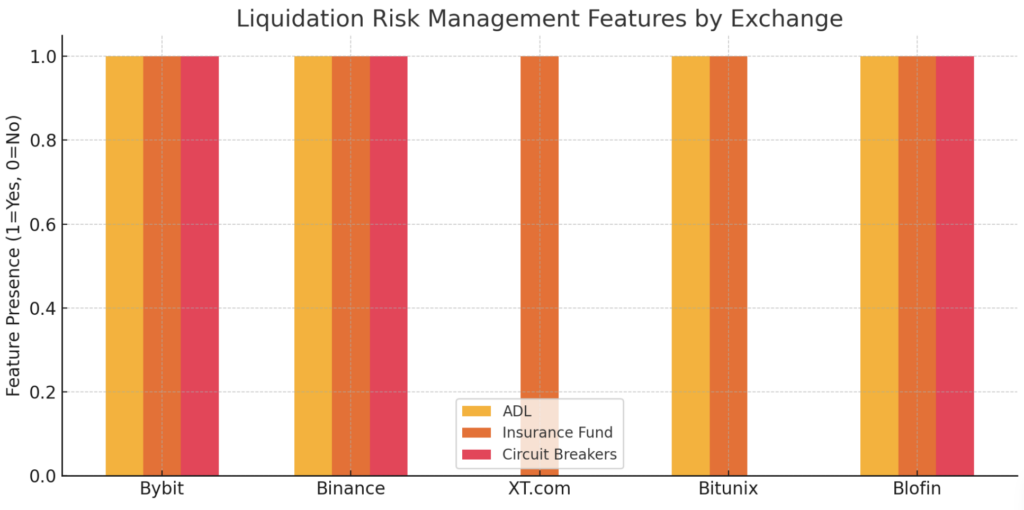

Platform Safeguards: ADL, Insurance Funds, Circuit Breakers

Different exchanges use various risk-control mechanisms:

Auto-Deleveraging (ADL)

-

Liquidates profitable traders to offset losing ones when insurance funds are depleted.

-

Common on: Bybit, Blofin, Bitunix

Insurance Funds

-

Used to cover bankrupt positions so users don’t face clawbacks.

-

Present on all major exchanges.

Circuit Breakers

-

Pause trading during extreme volatility to prevent chaos.

-

Available on Binance, Blofin

Liquidation Risk Management Comparison

| Exchange | ADL | Insurance Fund | Circuit Breaker |

|---|---|---|---|

| Bybit | ✅ | ✅ | ✅ |

| Binance | ✅ | ✅ | ✅ |

| XT.com | ❌ | ✅ | ❌ |

| Bitunix | ✅ | ✅ | ❌ |

| Blofin | ✅ | ✅ | ✅ |

Real-World Lessons from 2020 to 2024

-

Too much leverage = no room to breathe

-

Don’t counter-trade a cascade unless you understand funding pressure

-

Market depth can vanish in seconds

How to Avoid Getting Liquidated (Even at 25x)

✅ Use isolated margin, not cross

✅ Monitor funding rates and OI spikes

✅ Keep stop-loss orders and alerts set

✅ Don’t enter a market where everyone is on one side

✅ Check exchange insurance reserves and ADL rankings

Stay Prepared, Not Panicked

Flash crashes won’t stop. But armed with awareness, platform knowledge, and risk control—you can turn chaos into profit.