How Stablecoins Could Supercharge U.S. Dollar Dominance

Stablecoins as Strategic Infrastructure As the U.S. Congress edges closer to passing stablecoin legislation -namely the STABLE Act

Stablecoins as Strategic Infrastructure

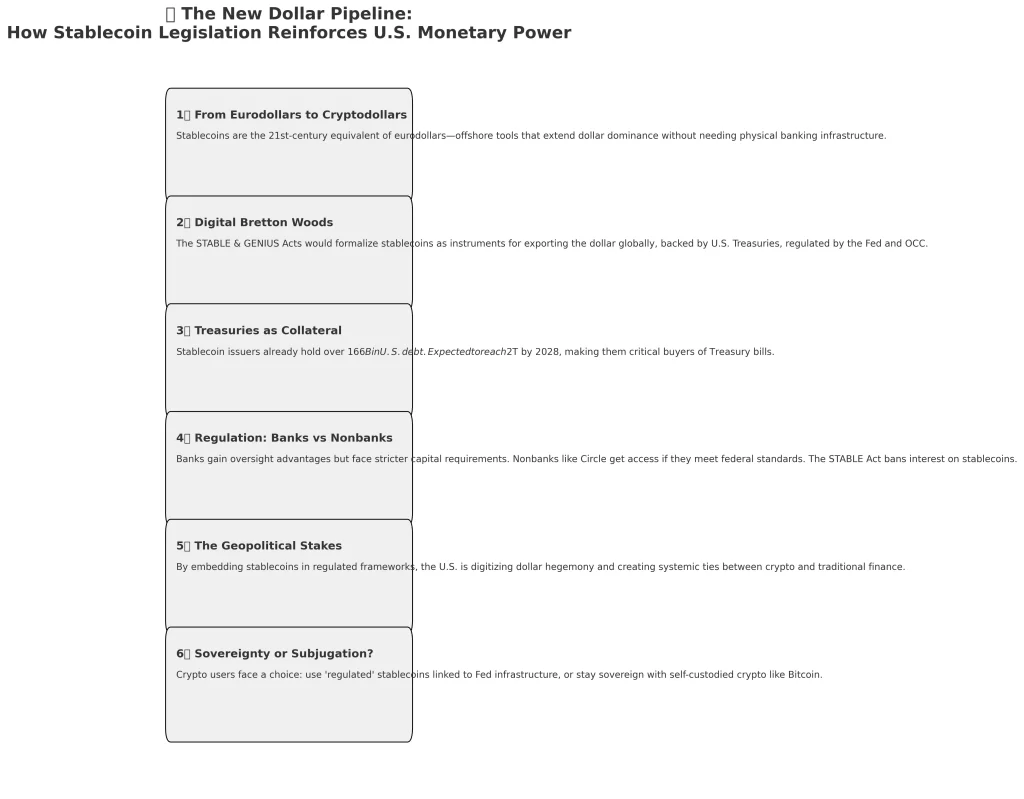

As the U.S. Congress edges closer to passing stablecoin legislation -namely the STABLE Act in the House and the GENIUS Act in the Senate – most headlines focus on regulatory clarity, consumer protections, and market stability. But a deeper analysis reveals something far more profound: stablecoins are not just a financial innovation – they’re fast becoming a central pillar in the geopolitical strategy to extend U.S. dollar dominance into the digital age.

With the dollar’s role as the world’s reserve currency under increasing pressure from multipolar rivals, stablecoins offer the United States a unique opportunity: to digitize, export, and entrench the dollar globally – outside traditional banking rails and into blockchain-native ecosystems.

From Eurodollars to Cryptodollars: A Historical Parallel

The rise of eurodollars – offshore U.S. dollar deposits held outside U.S. banks – transformed global finance in the mid-20th century. Today, we are witnessing a similar transformation with “cryptodollars,” i.e., stablecoins like USDT (Tether) and USDC (Circle) that digitize the dollar and enable its use across global crypto rails.

The parallels are striking. Both eurodollars and cryptodollars operate beyond traditional domestic monetary frameworks, but reinforce dollar usage and liquidity. While eurodollars relied on foreign banks, cryptodollars rely on blockchain networks and self-custody. In both cases, the result is the same: the expansion of dollar influence without needing military or banking infrastructure.

The Digital Bretton Woods Moment: Regulation as Empire

The GENIUS and STABLE Acts aim to formalize this emergent dollar pipeline by requiring stablecoin issuers to hold reserves in short-term Treasuries, cash, or equivalent safe assets. This effectively turns issuers like Circle and Tether into digital mutual funds of U.S. debt – helping underwrite American fiscal expansion while pushing dollar-denominated liquidity deeper into global markets.

This regulatory embrace isn’t just about safety – it’s about statecraft. Treasury Secretary Scott Bessent has emphasized that regulated stablecoins will “export dollars digitally,” while Bitwise CIO Matt Hougan frames it as “extending the dollar’s strength” via crypto rails.

These aren’t idle comments – they’re policy signals. As trust in traditional banking weakens and the demand for censorship-resistant money grows globally, the U.S. is positioning regulated stablecoins as the preferred alternative to Bitcoin or foreign CBDCs.

The Fed, Tether, and the Treasury Nexus

As of mid-2025, stablecoin issuers collectively hold over $166 billion in U.S. Treasuries, and that number is expected to swell to $2 trillion by 2028. This growing demand for short-dated sovereign debt not only creates a new class of Treasury buyers, but also exposes fixed-income markets to crypto volatility.

Moody’s analyst Cristiano Ventricelli warns that a confidence shock in the stablecoin sector – like a mass redemption event – could force large-scale Treasury liquidations, triggering ripple effects in bond yields and systemic stability.

In other words, stablecoins have become dual-purpose tools: they extend U.S. monetary power abroad while increasing financial fragility at home. They are both a geopolitical asset and a systemic risk vector.

Banks vs. Nonbanks: Who Wins the Race?

Both proposed bills attempt to strike a balance between federal control and private-sector innovation. Nonbanks like Circle would be able to issue stablecoins if they meet reserve, audit, and AML standards. Banks, meanwhile, enjoy implicit regulatory advantages but face heavier operational scrutiny.

This opens the door for competition – but also consolidation. Large banks with direct Federal Reserve access may soon use tokenized deposits to compete with stablecoins, while institutions like BlackRock are already lobbying for ETF-like wrappers around stablecoin products.

Crucially, the House’s STABLE Act prohibits paying yield on stablecoin balances – deliberately distinguishing them from bank deposits and protecting the banking sector’s funding base. It’s a classic example of regulatory moat-building.

Digital Dollar Hegemony vs. Financial Sovereignty

The implication is clear: stablecoins are becoming embedded in a new monetary infrastructure designed to reinforce dollar primacy in the global economy. But in doing so, they threaten to draw crypto users deeper into centralized, surveilled, and permissioned systems – undermining the very ethos that birthed Bitcoin.

Simon Dixon’s warning rings loud: “Above every Bitcoin-backed loan is a lender, and above that lender is a hedge fund, and above that is the Federal Reserve.” That chain of custody matters. Ownership without control is merely an illusion.

The Opportunity and the Trap

The GENIUS and STABLE Acts may usher in a golden age for stablecoins – but it comes with caveats. By tethering crypto to Treasuries, Washington is attempting to harness the innovation of DeFi while reinforcing the debt-driven status quo.

For the United States, this is strategic brilliance. For users, it is a trade-off: digital convenience in exchange for deeper entanglement in fiat finance. The pipeline is being built. The only question now is who controls the valves – and who ends up downstream.