In the world of crypto derivatives, particularly perpetual futures, your margin isn’t just affected by BTC’s price action — it’s also driven by macroeconomic forces. Federal Reserve decisions, Treasury yields, dollar liquidity, and global risk appetite ripple across traditional finance into Web3 markets. Understanding this macro-derivatives connection is crucial for serious traders seeking an edge.

Fed Rates, Treasury Yields & BTC Futures Correlation

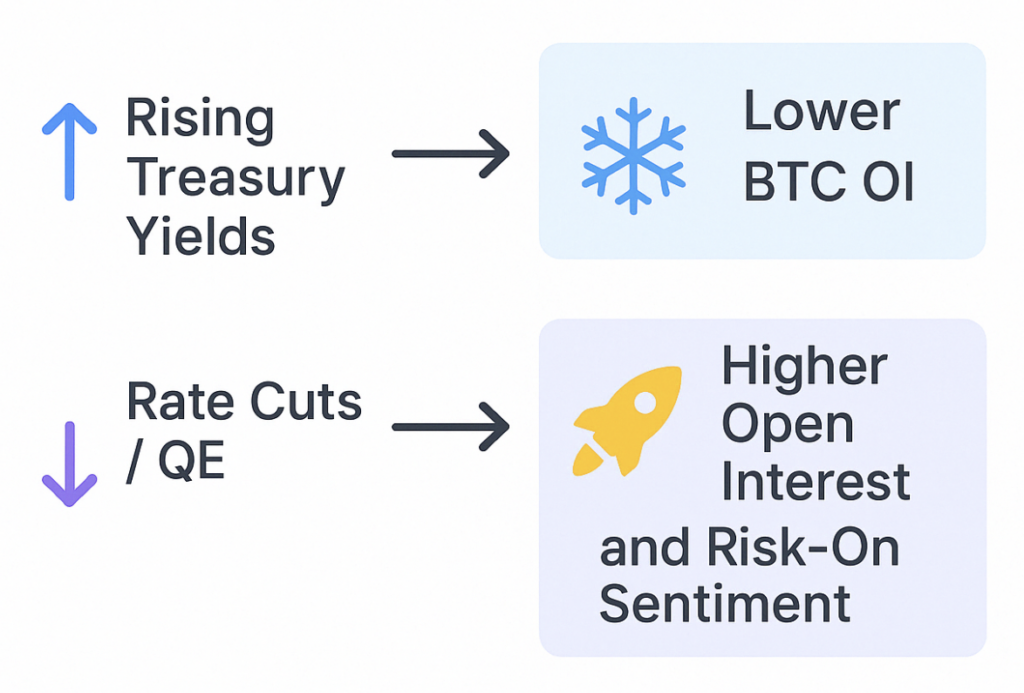

Interest rates shape everything. When the Fed hikes rates, risk assets like crypto typically see reduced flows, increasing the cost of leverage and reducing BTC futures open interest (OI). When the Fed cuts rates or injects liquidity via QE, traders flood into high-beta assets — and crypto perps are often first in line.

Liquidity Flows: Stablecoins, DXY, and USDT Dominance

Crypto doesn’t exist in a vacuum. Liquidity entering the market often arrives via stablecoins. Watch for these macro clues:

-

US Dollar Index (DXY): Weak DXY = easier global dollar conditions = crypto inflows

-

USDT/USDC Supply: Increasing supply = more fuel for derivatives

-

USDT Dominance in Futures Collateral: More USDT = higher leverage appetite

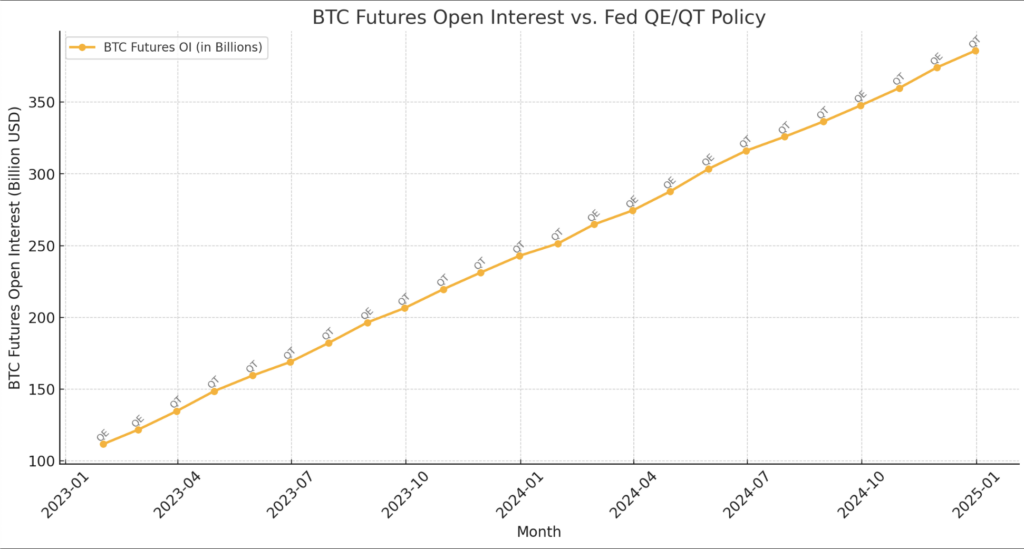

BTC Futures OI vs. Fed Policy (QE/QT)

Notice how BTC OI tends to climb during QE periods and decline during QT. These cycles can pre-signal tops and bottoms in leveraged positioning across exchanges like Bybit, XT.com, and Bitunix.

Strategy: How to Hedge Macro Risk with Derivatives

Pro trader checklist:

✅ Use BTC or ETH options to hedge downside risk

✅ Consider calendar spreads during high macro uncertainty

✅ Long volatility ahead of FOMC or CPI announcements

✅ Use inverse perpetuals (e.g., gTrade) to hedge spot bags without selling

Platforms With Best Macro Analysis Dashboards

-

Bybit: Real-time OI, funding rates, economic calendar integration

-

XT.com: Funding heatmaps + dollar liquidity tracker

-

Bitunix: Smart macro alerts + stablecoin inflow metrics

Macro Sentiment Trackers for Traders

Use these tools to gauge global vibes:

-

Crypto Fear & Greed Index

-

Funding Rate Aggregators

-

Inflation Swap Forecast Dashboards

-

DeFi Stablecoin Supply Trackers (e.g. Dune dashboards)

Key Takeaways

Crypto derivatives aren’t just a playground of apes and algorithms — they’re deeply intertwined with global liquidity trends and macroeconomic decisions. The more you track macro, the smarter your margin gets.