How Leverage Works in Crypto Trading (And When You Should Use It)

What is Leverage in Crypto Trading?

Crypto markets are exciting, volatile, and full of opportunity — and leverage is one way traders aim to maximize that opportunity. But used incorrectly, leverage can wipe out an account faster than a flash crash.

In this guide, we’ll break down what leverage is, how to use it responsibly, and how platforms like Bitunix, Tapbit, and Blofin give you the tools to trade smarter.

What is Leverage in Crypto Trading?

Leverage allows you to control a larger position with less capital. It’s like using borrowed money to amplify your trades.

Example:

Let’s say you have $100, and you trade with 10x leverage — now you control $1,000 worth of Bitcoin.

-

If BTC goes up 5% → you gain $50 (a 50% return on your $100).

-

If BTC drops 5% → you lose $50 (also 50% of your capital).

Leverage levels typically range from 2x to 100x — or even 200x on PrimeXBT.

Pros and Cons of Margin Trading

| ✅ Pros | ❌ Cons |

|---|---|

| Magnify potential profits | Amplify losses just as quickly |

| Trade large positions cheaply | Risk of liquidation |

| Flexible trading strategies | Requires active risk management |

Demo Use: Bitunix and Tapbit

Platforms like Bitunix and Tapbit offer fast, low-fee environments for leveraged trading:

-

✅ Tapbit: Beginner-friendly interface + USDT-settled contracts

-

✅ Bitunix: Pro-grade trading tools + risk calculator

Pro Tip: Use their testnet environments to simulate trades before risking real money.

Safety First: Leverage Risk Management

Using leverage? Follow these rules like your account depends on it — because it does.

-

Never go all-in: Only risk a fraction of your balance

-

Set stop-loss orders: Automatically cut losing trades

-

Use margin calculators: Blofin offers a clean and accurate PnL calculator

Use isolated margin to protect the rest of your account if one trade goes bad.

Platform Leverage Comparison

Use low leverage (2x–5x) if you’re just getting started.

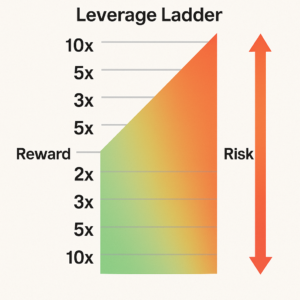

Leverage Quick-Reference Diagram

-

1x–5x = Safer, recommended for beginners ✅

-

10x–25x = High risk, only for experienced traders ⚠️

-

50x+ = Very high risk, used by advanced or algo traders 🧨

Key Takeaways

Leverage is a powerful tool — but also a dangerous one. Used properly, it can enhance your gains. Used recklessly, it can destroy your capital. Always start small, learn the platform tools (like calculators and stop-losses), and keep your emotions in check.

In crypto trading, survival = success. Master leverage step by step, not all at once.