How Bitcoin Exposes the Fiat Ponzi and Accelerates the Multipolar World Order

Escaping the Fiat Trap in a Post-Dollar Era.

In the shadows of collapsing empires and eroding trust in financial institutions, a tectonic shift is underway. The Western-led proof-of-weapons fiat regime, built on coercion, debt monetization, and asset stripping, is being challenged – not by armies or political parties – but by protocol. Bitcoin, the ultimate instrument of peaceful resistance, is quietly replacing the dollar’s violent dominance with a new form of economic sovereignty rooted in proof-of-work. What we are witnessing is the great unwinding of the debt-fueled unipolar world – and the birth of a decentralized, multipolar era.

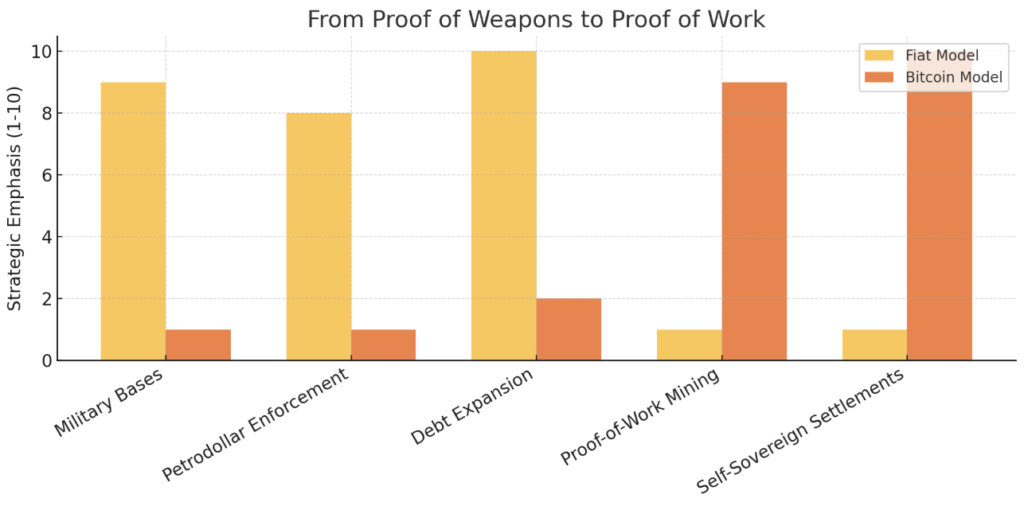

From Proof of Weapons to Proof of Work

Since World War II, the U.S. dollar has been propped up by a sprawling network of military bases, petrodollar agreements, and debt-fueled consumption. It was never merely a currency – it was a weapon. Through IMF structural adjustment programs, regime-change wars, and control over global settlement rails, Washington enforced its will, using debt as its primary export.

But the pillars are crumbling. The debt ceiling is a farce. Yield curves are distorted beyond recognition. The dollar’s global utility is decaying. And most tellingly, the very stewards of the system – bankers, technocrats, and hedge funds – are quietly abandoning ship.

Bitcoin stands in direct opposition. It is trustless. It is finite. It does not require allegiance to a nation-state or the whims of central bankers. It monetizes energy, not violence. And as major players accumulate it – while simultaneously inflating away the dollar – they are signaling the end of the fiat era.

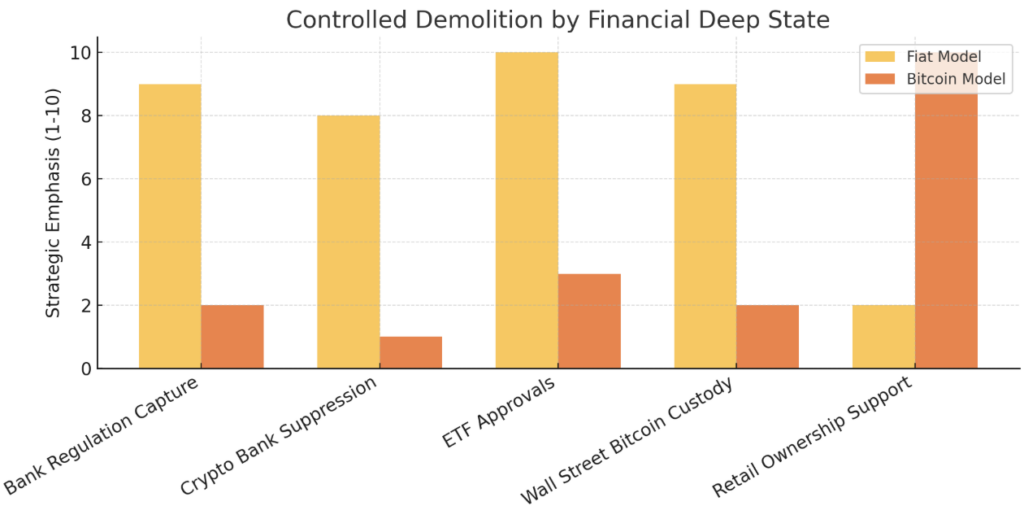

The Rise of the Financial Deep State

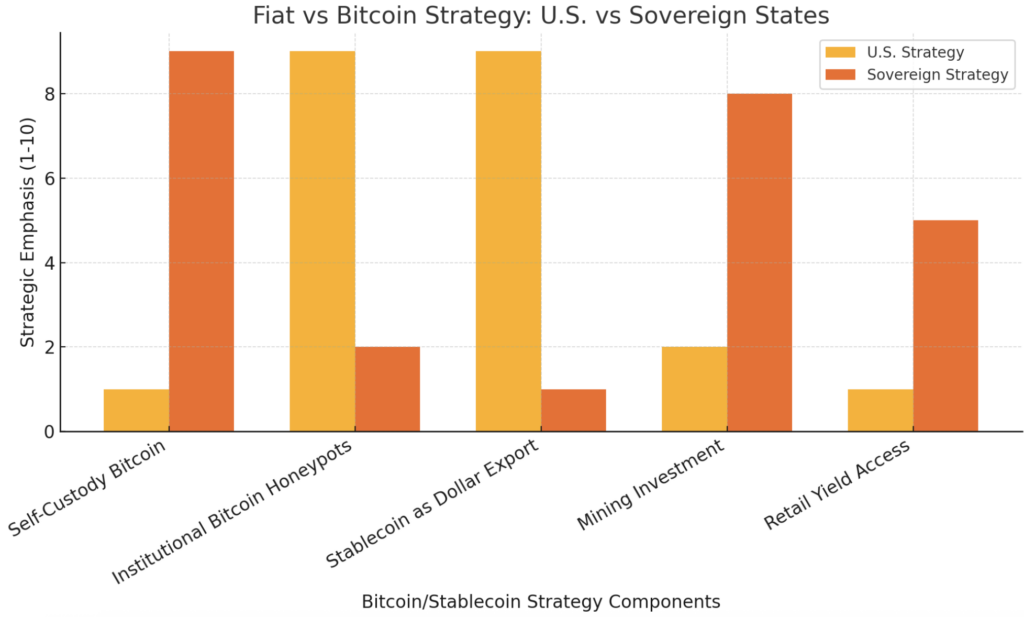

The collapse of the fiat system isn’t a chaotic accident – it is an engineered transition. From Operation Chokepoint 2.0 to coordinated bankruptcies of crypto-native banks, regulators have weaponized compliance to eliminate grassroots alternatives. The goal? To consolidate control under compliant entities like BlackRock, Galaxy Digital, and Canter Fitzgerald – firms now building “Bitcoin honeypots” for institutional capture.

Meanwhile, public figures like Trump are selling “economic nationalism” while quietly facilitating asset transfers abroad. Trump Towers are rising in Qatar, not Kansas. Foreign direct investment is euphemized as patriotism, while America’s industrial base is gutted to service yield extraction for pension funds and banks.

The playbook is clear: create a debt trap, crash the alternatives, monopolize the rails, and reintroduce Bitcoin as a collateralized asset controlled by Wall Street. This is not decentralization – it is enclosure.

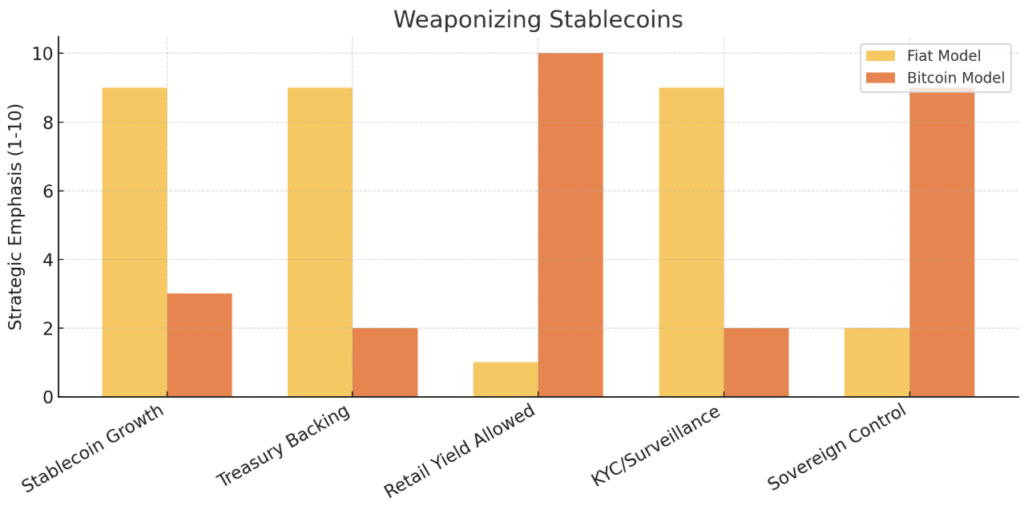

Weaponizing Stablecoins

While dollar demand collapses abroad, U.S. banks and shadow institutions are racing to issue stablecoins backed by treasuries. These instruments promise a digital dollar renaissance but are in fact Trojan horses. Designed to soak up global liquidity and funnel it into U.S. debt, they ensure the average investor becomes the final bagholder of a system no longer supported by international demand.

By restricting retail access to yield (e.g. denying stablecoin users the ability to earn treasury rates directly), the system consolidates profits among a select few – Canter Fitzgerald, BlackRock, and their stablecoin subsidiaries. Meanwhile, the Bitcoin they acquire with those profits is held in strategic reserves far from the hands of average citizens.

This is how the fiat Ponzi evolves: into a digital feudalism where your wallet becomes a node of surveillance and control, while capital quietly migrates offshore.

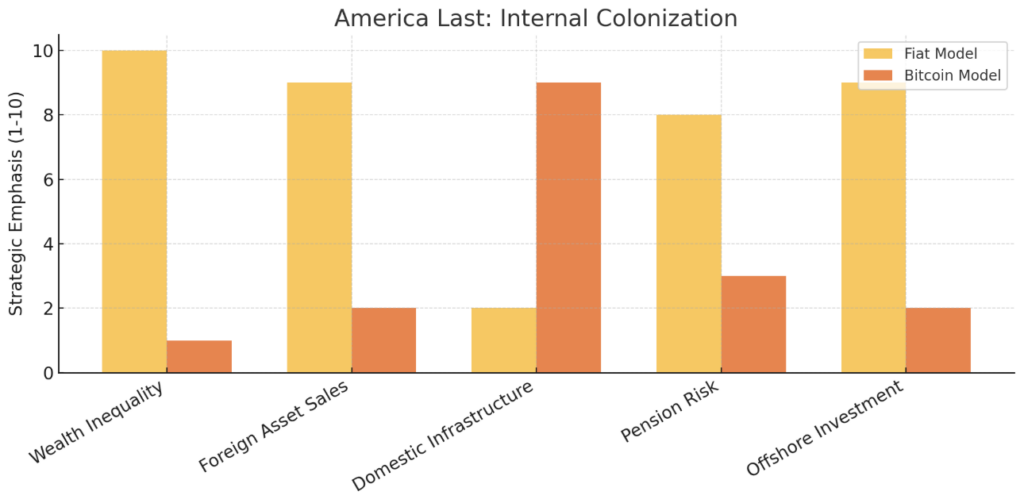

The Internal Colonization of the Republic

The most dangerous illusion is that this is being done in the name of “America First.” In truth, the U.S. has become the primary collateral pool in a global financial arbitrage. Homelessness, addiction, crumbling infrastructure, and civic decay are not signs of a nation under attack – they are signs of a nation being harvested.

From the Fed’s private shareholder structure to the revolving door between banks and regulators, the apparatus of the U.S. state has been financialized beyond recognition. It is no longer a government – it is a portfolio. And Americans are merely the underlying assets.

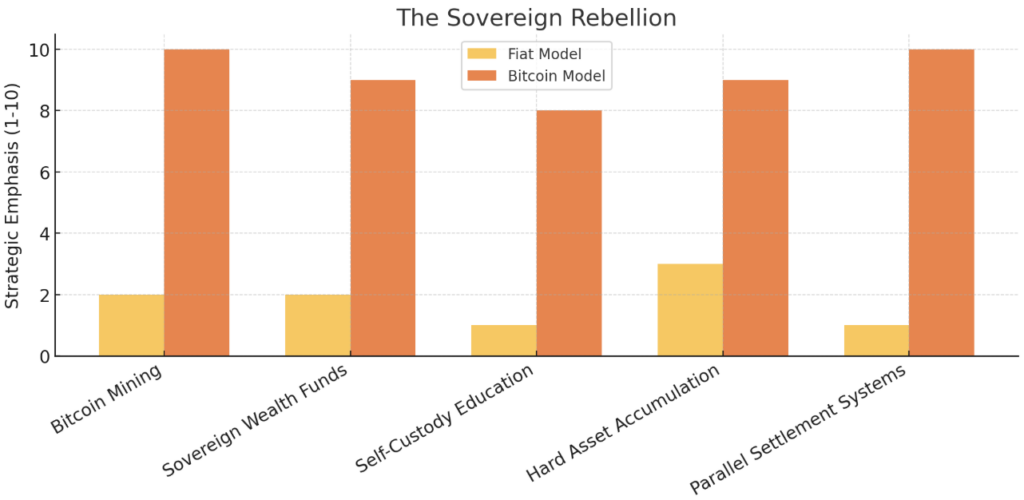

Bitcoin and the Global South

While the West retools its Ponzi for the digital age, the Global South is quietly preparing for the future. Sovereign wealth funds are stacking sats. Bitcoin mining is proliferating in energy-rich, debt-light jurisdictions. Settlements are shifting from SWIFT to Bitcoin rails. In this world, Bitcoin isn’t just an asset – it’s infrastructure.

From the UAE to Nigeria, from El Salvador to Kazakhstan, forward-looking nations are acquiring economic power not through conquest, but through protocol. These are not “emerging markets”- they are sovereign actors reclaiming the right to settle trade on their own terms, outside the dollar’s shadow.

How to Survive the Transition

You are not powerless in this shift. But you must act.

-

Self-custody is non-negotiable. Your Bitcoin is only yours if you hold your keys.

-

Avoid leverage traps. Every cycle, Wall Street creates products to strip you of your coins through rehypothecation and margin liquidation.

-

Watch what they do, not what they say. If BlackRock, Trump, and Elon Musk are accumulating Bitcoin while telling you to “trust the system,” believe their actions.

-

Exit the fiat illusion. Whether through spending locally, avoiding surveillance money, or investing in parallel economies, stop being the collateral.

-

Educate. Organize. Build. This isn’t just an economic reset. It is a generational reordering of sovereignty. And the lines are being drawn now.

The Final Pivot Has Begun

This is the final act of financial empire – a pivot from debt expansion to asset accumulation. The technocrats are shedding the dollar while offering you digital debt tokens in its place. They are building a new monetary order, but not for you.

You were never supposed to own the escape hatch. You were supposed to fund it.

Bitcoin is your out. But it is not a passive solution. It requires action. It requires courage. And it requires clarity.

Because while they orchestrate the controlled demolition of the fiat order, you must build the foundation of the next.

One block at a time.