What is HMX?

HMX serves as a cutting-edge, decentralized perpetual protocol that incorporates cross-margin and multi-asset collateral support on the Arbitrum network. Unique features that HMX extends to its users include:

- The ability to establish long or short positions with leverage across a variety of asset classes like Cryptocurrency, Forex, and Commodities.

- An array of crypto assets are accepted for collateral, paired with cross-margin collateral support, facilitating versatile risk and position management.

One of HMX’s standout features is its collateral management. It’s the sole pool-based decentralized perpetual protocol providing cross-margin collateral management and the freedom to use a range of assets as collateral.

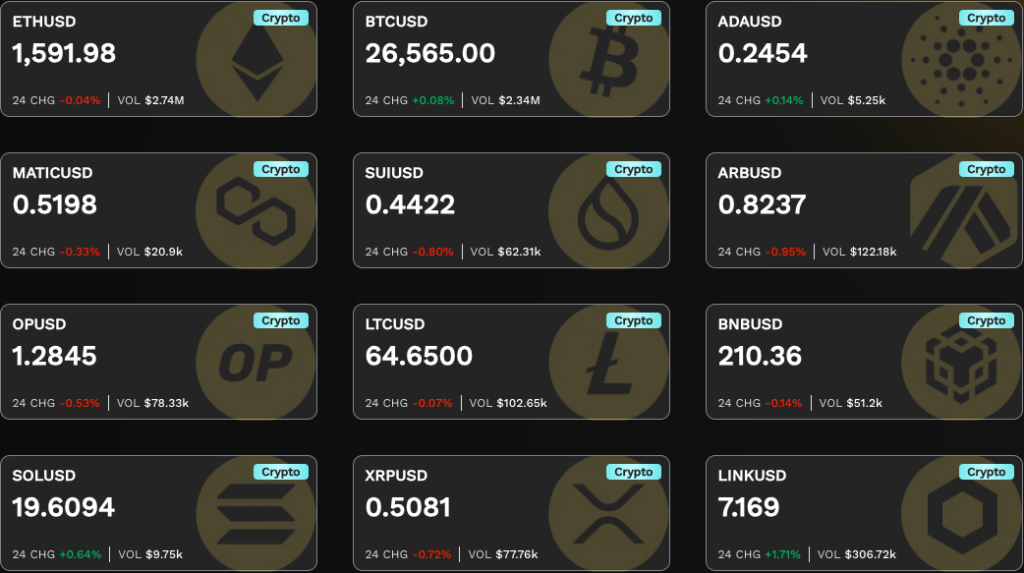

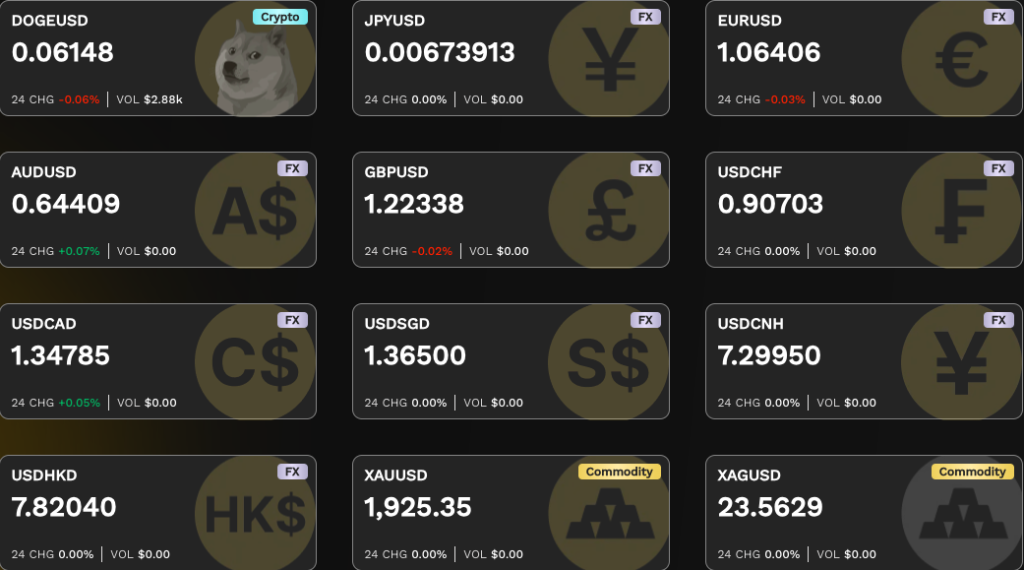

HMX Decentralized Exchange Markets

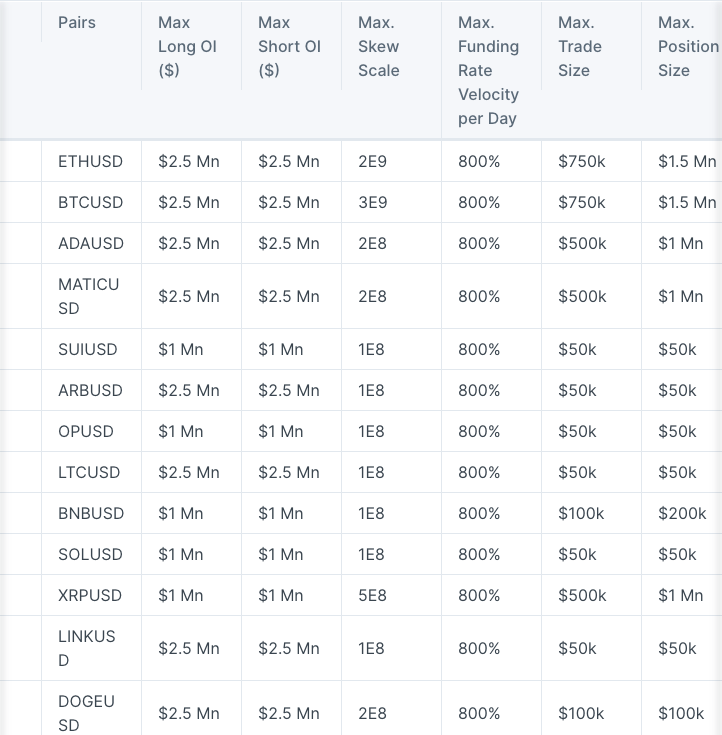

Cryptocurrencies:

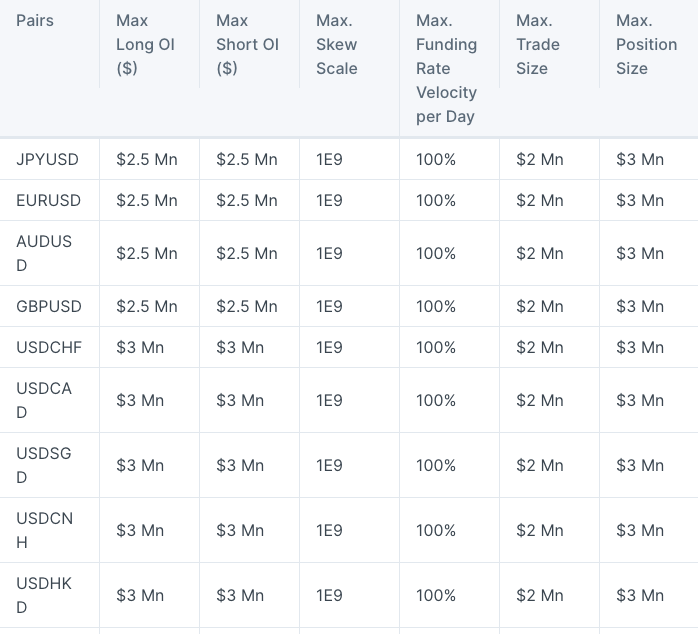

FX

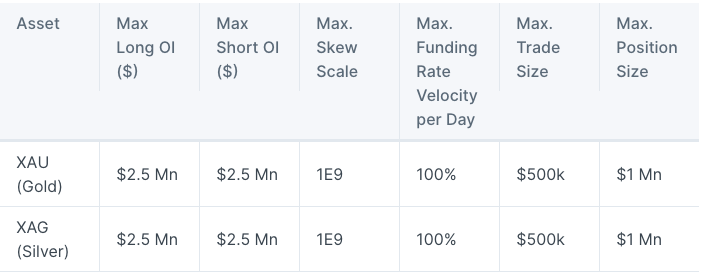

Commodities

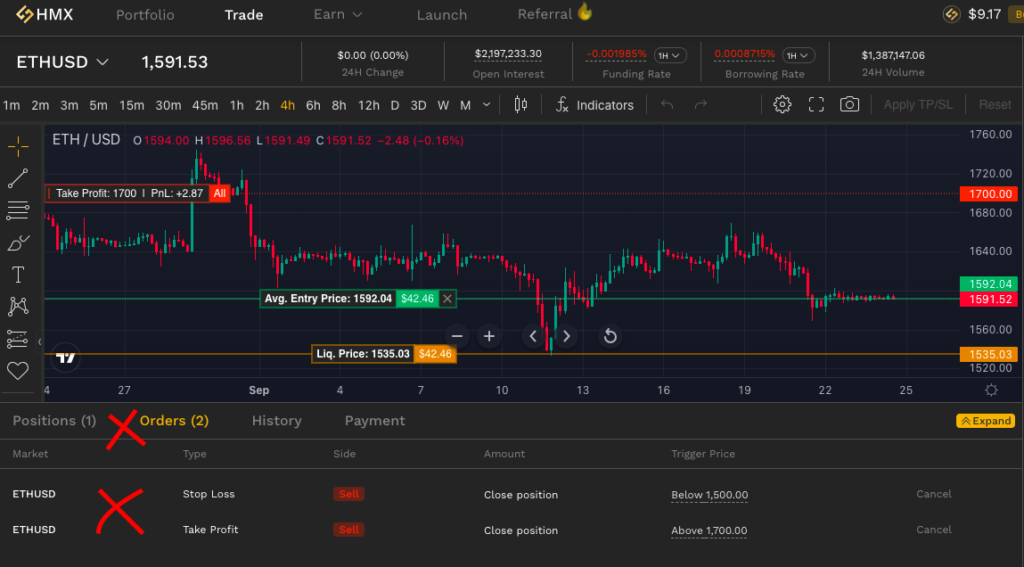

How to trade on HMX Decentralized Perpetual Exchange

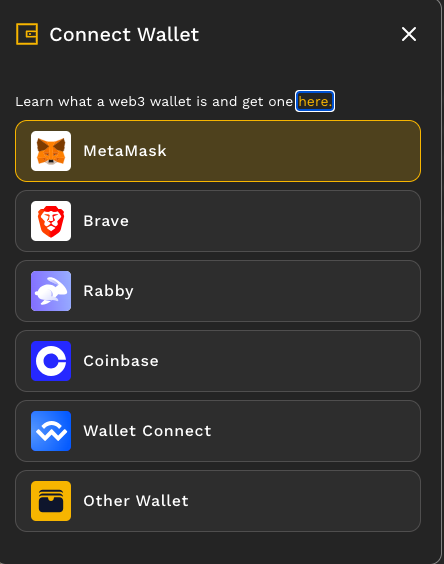

To get started, visit the homepage and connect your web3 wallet e.g. MetaMask.

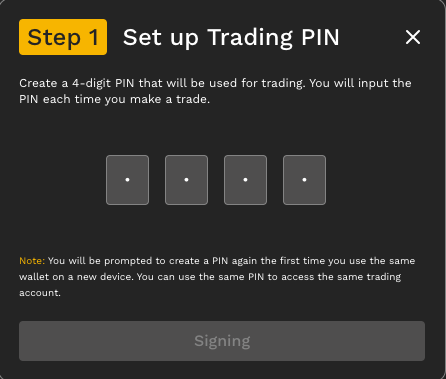

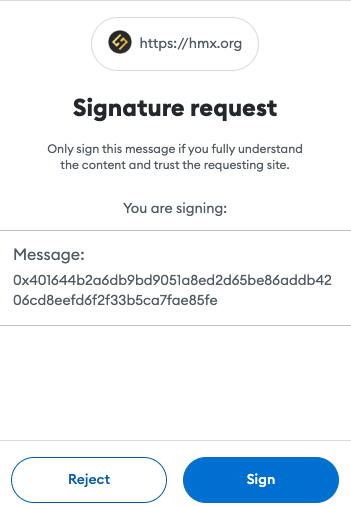

You can enable one-click trading so that you don’t have to sign transactions each time you want to place a trade.

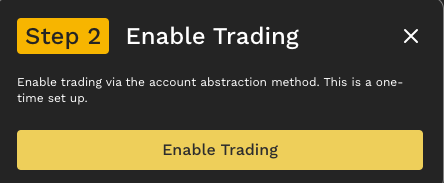

You can then proceed to enable trading.

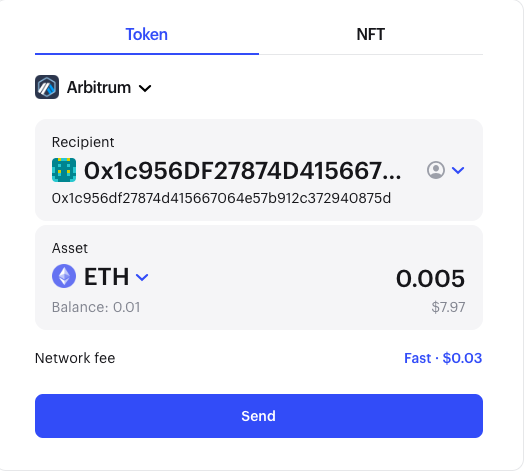

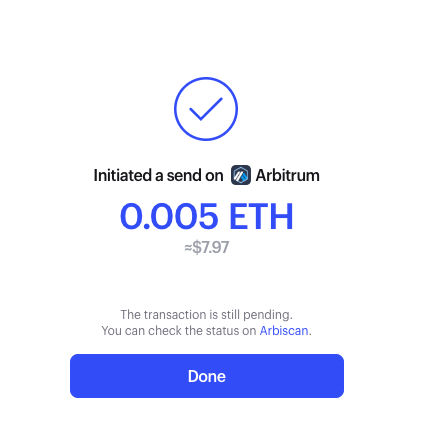

Make sure you top up your wallet with some ETH on Arbitrum. For the purposes of this demonstration, we sent a little bit of ETH from another wallet.

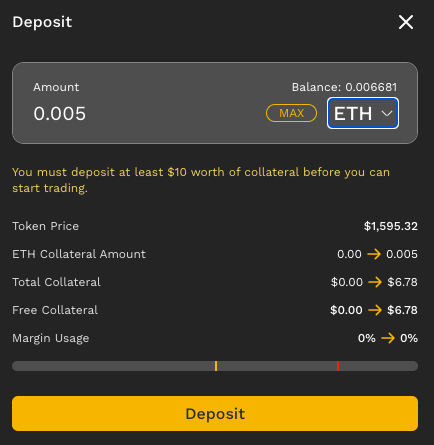

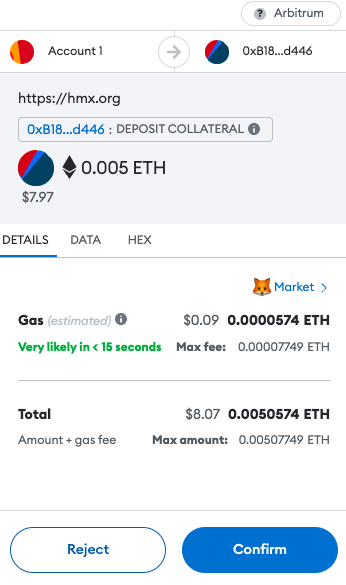

Once you’ve sent some funds to your Arbitrum wallet, proceed to deposit the funds into HMX.

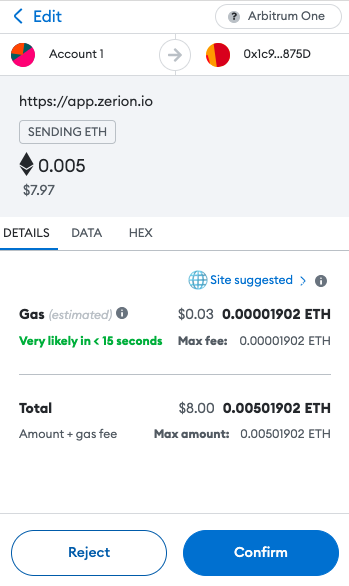

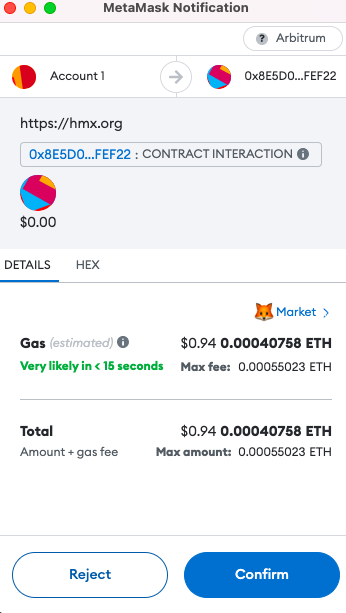

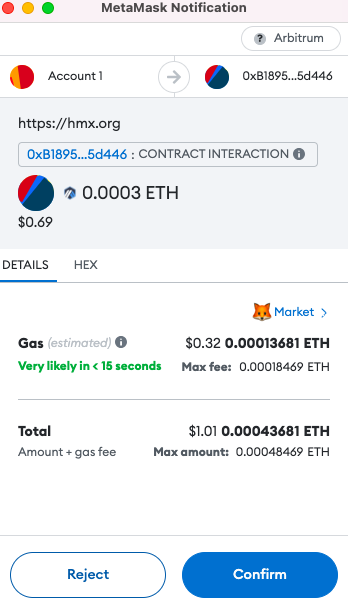

Pay the gas fee.

Now you can proceed to place your trade.

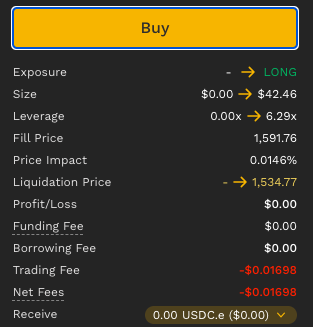

In this trade we’re taking to demonstrate how HMX decentralized trading platform works, we keep the position size very small. This shows how you can get started even with limited capital.

What’s great about HMX is that you can set your take profit/stop-loss, you can go long or short, and you are able to decide how much leverage you want to use.

The liquidation price and trading fees will also be clearly stated so that you’re well informed of the risk and costs of your trade.

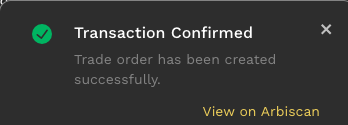

You’ll be notified when your trade is successfully placed.

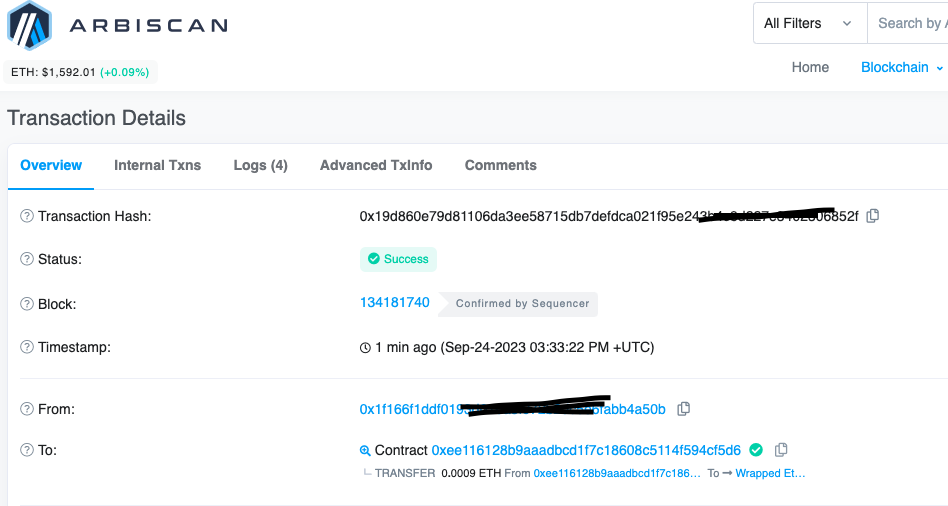

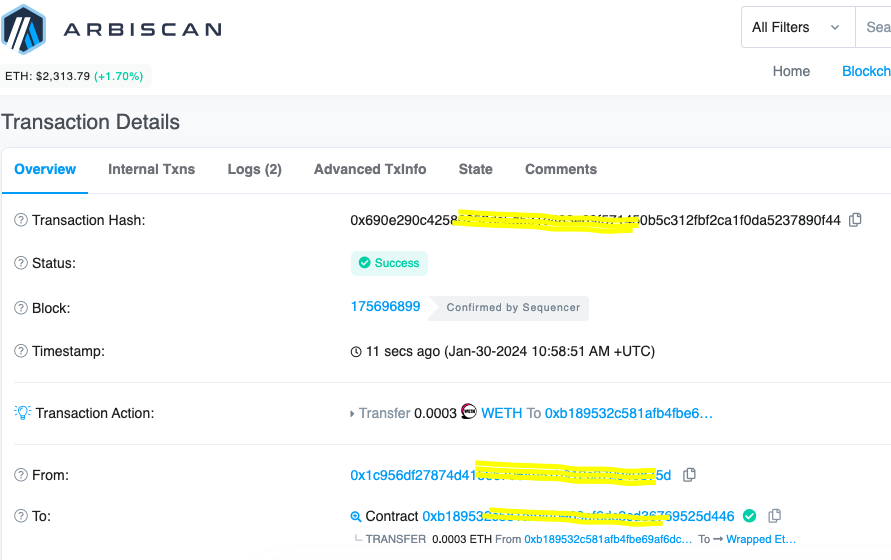

You can also check the transaction status on the Arbitrum block explorer, Arbiscan.

You will also be able to see your open position, the take profit and stop loss, etc.

Cross-margin Collateral

HMX enhances capital efficiency through its cross-margin collateral management, enabling the consolidation of margin balances across multiple trades. This offers a more streamlined and effective portfolio management process.

This feature positions HMX to deliver a user experience akin to centralized exchanges while retaining the security advantages of being decentralized.

Multi-Asset Collateral

HMX accommodates various assets as collateral, offering two significant advantages to traders:

- There’s no need to convert existing holdings into specific assets to commence trading.

- Multiple trading strategies like carry trade or max long strategy can be effectively implemented (e.g., using ETH as collateral to long ETH).

Risk Management

In the context of risk management, HMX assigns a loan-to-value (LTV) ratio to each collateral asset, which in turn establishes the borrowing power and liquidation thresholds for each account.

Currently supported assets on HMX are USDC, USDT, DAI, GLP, BTC, ETH, and ARB, covering three asset classes with varying maximum leverage:

- Cryptocurrencies: 100X

- Forex: 1000X

- Commodities: 50X

Fees

Leveraging re-hypothecated liquidity from GMX’s GLP, HMX offers trading fees below market rates. Fees are categorized into:

- Trading Fees: Calculated as a percentage of the position size and vary by asset class.

- Borrowing Fees: Aligned with the position size and compensate market makers (HLP depositors) based on the asset utilization rate.

- Funding Fees: Levied on trader positions to balance long and short open interest (OI), thereby protecting liquidity providers from excessive market exposure.

HMX employs a velocity-based funding rate model that adjusts according to market skew, influencing the funding fee rate accordingly.

A flat liquidation fee of $5.0 is applied for liquidated high-risk positions to cover associated costs.

Margin Fractions

HMX sets two margin fractions that define margin requirements:

- Initial Margin Fraction (IMF): Determines the initial margin requirement, varying by asset class.

- Maintenance Margin Fraction (MMF): Establishes the maintenance margin requirement, also varying by asset class.

Adaptive Pricing Mechanism

To achieve balance between long and short open interest in trading assets, HMX utilizes an “Adaptive Pricing” mechanism. This system imposes a premium or discount on the oracle price, influenced by the resultant skew in open interest post-transaction.

A premium is added if long open interest outpaces short open interest and vice versa. This Adaptive Pricing mechanism aims to either encourage or discourage traders from opening specific long or short positions.

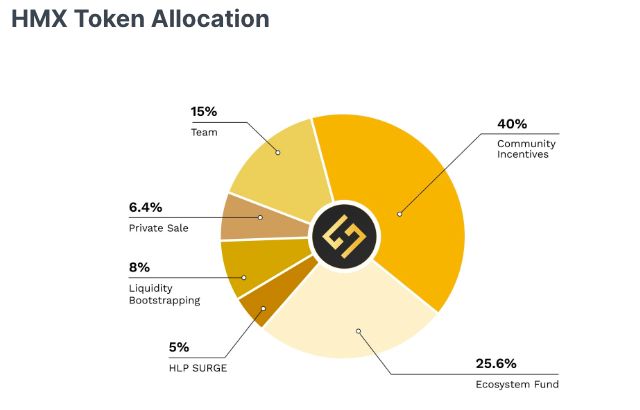

HMX Token

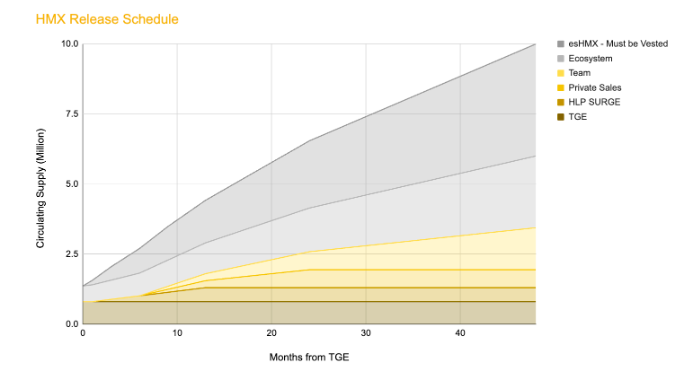

$HMX operates as the Governance token for the HMX Protocol, with a strictly capped supply of 10,000,000 tokens (ten million tokens).

Here are the existing and prospective utilities of the HMX token:

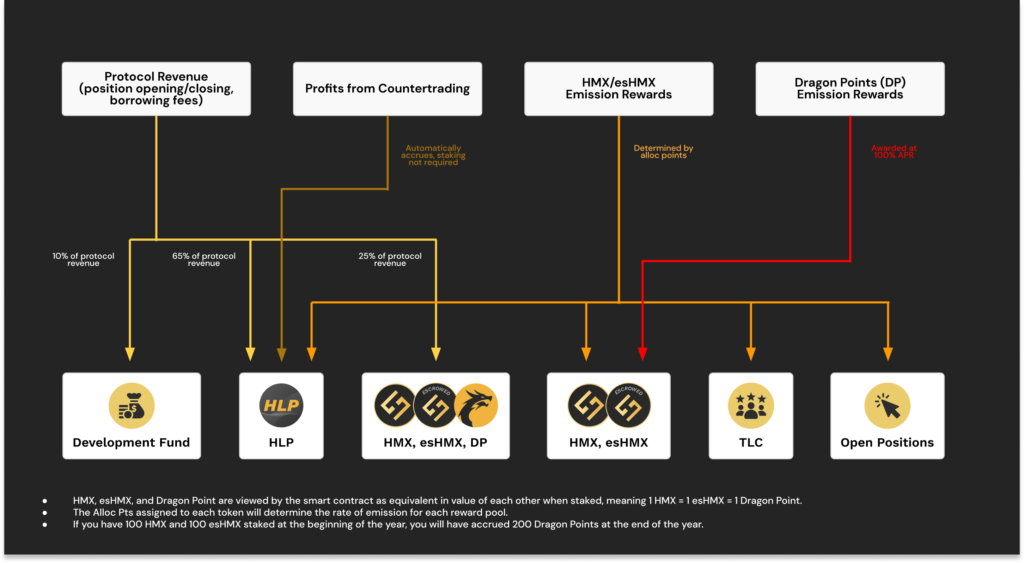

- When staked, it earns a 25% share of protocol revenue in stablecoins, shared with staked esHMX & (Dragon Points) DP.

- It accumulates a proportion of esHMX token emission upon staking.

- When staked, it garners DP at 100% APR.

- It bestows governance voting rights to influence pivotal decisions in the HMX exchange‘s evolution (Note: only HMX token holders possess voting power; esHMX and DP do not – this feature is upcoming…)

- It grants tiered trading fee discounts when staked (upcoming feature…)

Omnichain Fungible Token

The $HMX token is engineered with the vision of a multi-chain future, adopting the Layer Zero’s Omnichain Fungible Token (OFT) standard. This approach ensures that $HMX can effortlessly transit between different chains while preserving its security and decentralized nature.

As HMX broadens its reach beyond Arbitrum, bridging $HMX to other chains to sustain incentives and utilities for users across various chains will be straightforward.

Other HMX Ecosystem Tokens

HMX offers five distinct tokens issued by the platform, namely:

- HLP

- HMX

- esHMX

- Dragon Points (DP)

- Trader’s Loyalty Credits (TLC)

HLP

HLP tokens are granted to users who deposit assets into the HLP vault. These assets form the liquidity pool for leveraged traders on HMX. Each HLP signifies ownership share in the assets contained within the HLP vault.

How to acquire HLP:

- Depositing GMX’s GLP or USDC into the HLP vault.

Functions:

- Receives 65% of protocol revenue in USDC when staked.

- Garners a portion of esHMX token emission upon staking.

- Gains profits by serving as the counterparty for traders on the HMX Exchange.

- Accumulates full ETH yields (automatically re-invested as GLP into HLP) and countertrading profits from GMX.

esHMX

esHMX is deployed as an escrowed variant of HMX tokens, distributed as rewards to stakers of HMX & esHMX, and to depositors of GLP tokens on HMX. esHMX tokens, while untradeable, hold identical utilities to HMX tokens but need to be vested before trading.

How to acquire esHMX:

- Staking esHMX, HMX, or HLP.

Functions:

- Secures a 25% share of protocol revenue in USDC when staked.

- Entitles to a fraction of esHMX token emission upon staking.

- Accumulates Dragon Points at 100% APR when staked.

Dragon Points (DP)

DP is conceived to honor the sustained supporters of HMX, without inflating HMX tokens. DP holders can stake to earn a share of protocol revenue alongside staked esHMX & HMX.

How to acquire Dragon Points:

- Staking esHMX or HMX.

Functions:

- Captures 25% share of protocol revenue in USDC when staked.

- Upon unstaking esHMX or HMX, accrued Dragon Points, equivalent to the ratio of unstaking balance, will be automatically unstaked and discarded.

Trader’s Loyalty Credits (TLC)

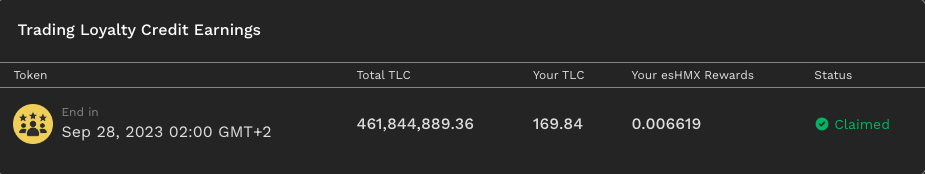

For each $1 of trade executed, users of HMX are awarded a minimum of 1 TLC. Weekly, esHMX rewards are allocated proportionally to traders based on their TLC holdings.

How to acquire TLC:

- Initiating a leveraged trade on HMX earns users a minimum of 1 TLC for every $1 of trade volume.

Functions:

- Entitles holders to a share of esHMX rewards.

Referral Program Framework

HMX orchestrates a distinctive referral program, allowing users to register and formulate their referral links. This program renders two prime advantages: *Fee rebates for referrers

*Trading fee reductions for those utilizing the referral codes

Rebates

Users on HMX have the opportunity to enroll as referrers. Those engaging in the HMX referral initiative have the potential to secure up to 15% in rebates on the trading fees incurred by users who employ their referral code. The classification of a referrer into a designated tier is influenced by the weekly aggregation of Trader’s Loyalty Credits ($TLC) acquired by the users applying their referral code within the week, coupled with the count of active users leveraging their referral code within the same timeframe. Distinct rebate rates correspond to each tier, as elucidated in the succeeding table:

Trading Fee Reduction

Individuals partaking in the referral initiative, upon utilizing a referral code, are eligible for trading fee concessions. The extent of the discount is defined by the participant’s discount tier, which is subsequently predicated on their consolidated Trader’s Loyalty Credits ($TLC) throughout the week. The ensuing table delineates the requisite TLC balance per tier along with its concomitant discount rate:

How Liquidations on HMX Decentralized Perpetual Exchange Work

HMX employs a stringent risk management procedure to safeguard both traders and market makers, maintaining equilibrium and impartiality for all involved parties. To comprehend the nuances of the liquidation procedure, it is crucial to acquaint oneself with the following terms:

Initial Margin Requirements (IMR): This is the USD equivalent of equity mandated to inaugurate a position or amplify the position size. Every market encompasses a parameter termed the “Initial Margin Fraction” (IMF), signifying the percentage of the position size deemed as IMR for that specific position, represented in USD.

Initial Margin Fraction (IMF): Set by HMX, the IMF is a crucial parameter utilized to ascertain the initial margin requirement, depicted as a percentage. Different asset classes will have varied IMF.

Maintenance Margin Requirements (MMR): This refers to the USD equivalent of equity needed to sustain a position before the platform enacts liquidation. Each market includes a parameter known as the “Maintenance Margin Fraction” (MMF), signifying the percentage of the position size considered as MMR for that particular position, exhibited in USD.

Maintenance Margin Fraction (MMF): This is another crucial parameter designated by HMX and is instrumental in defining the Maintenance Margin Requirement. Represented as a percentage, the MMF, akin to the IMF, will differ across various asset classes.

Equity Value: Representing the net worth of your sub-account, the Equity Value is the aggregate of unrealized gains/losses, unrealized fees (encompassing funding, borrowing, position initiation, termination, and liquidation), and the value of the collateral.

Collateral Value: This value is deduced from the collateral assets, where their pertinent market prices are multiplied by the collateral asset Loan-to-Value (LTV).

How to Withdraw Assets from HMX

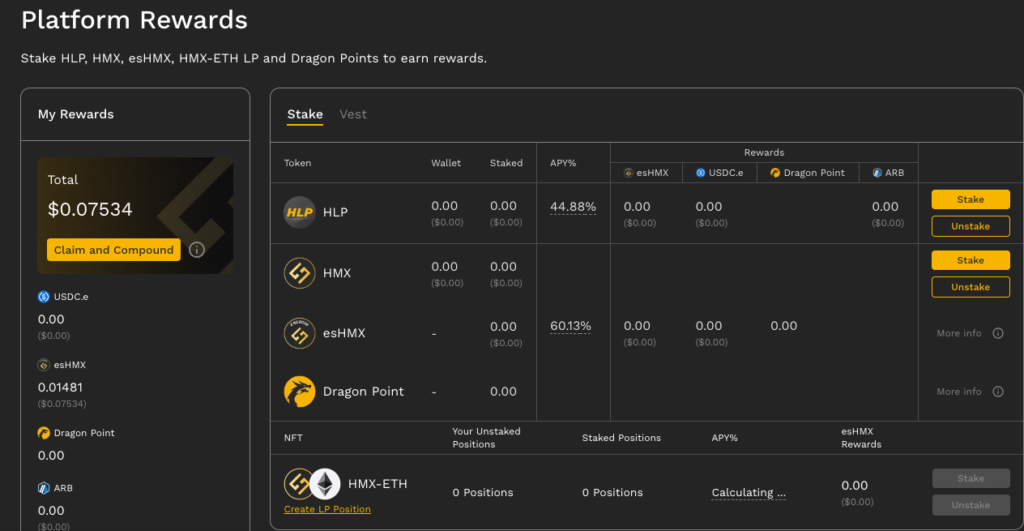

How to withdraw platform rewards

Visit the rewards dashboard.

Choose to claim and compound your rewards.

Pay the gas fee.

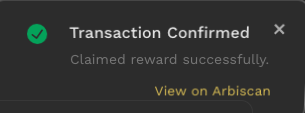

You can view your claimed rewards on the dashboard.

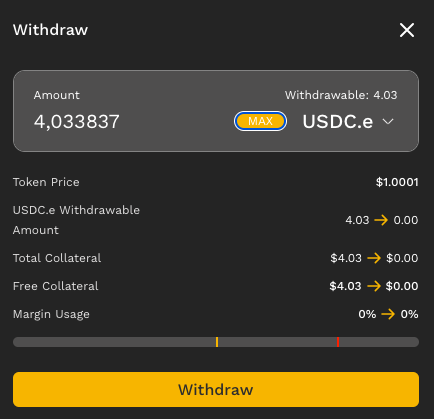

Withdrawing funds from HMX to Wallet

Select the collateral you wish to withdraw.

Pay the gas fee.

Once your transaction is confirmed , you can verify it on the block explorer.

Once your transaction is confirmed , you can verify it on the block explorer.

Conclusion

Conclusion

HMX is an upcoming perpetuals DEX which is well-designed and shows a lot of promise. For step-by-step guides on how to use HMX, check out the official documentation. HMX has been audited by Foobar & WatchPug.