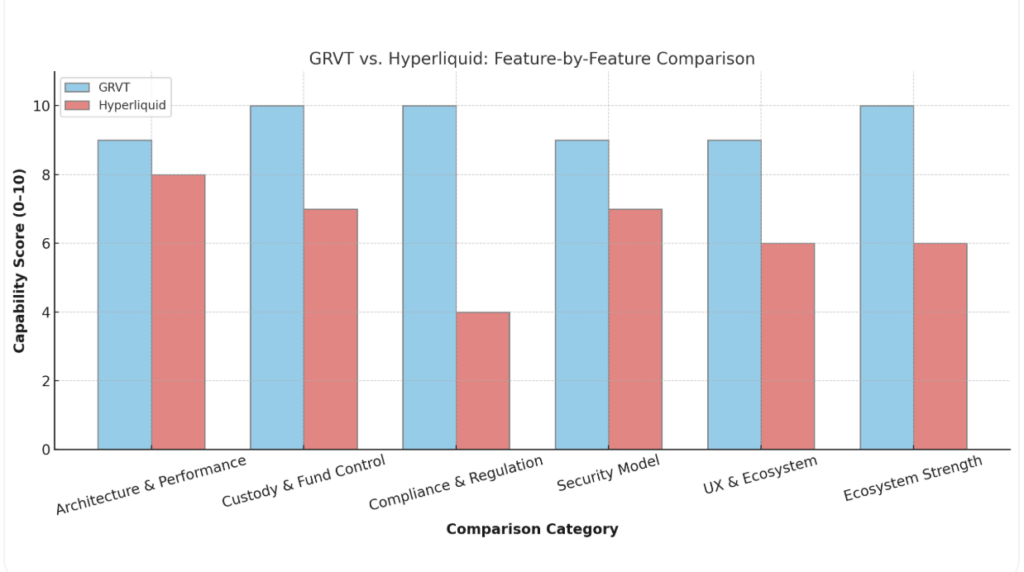

GRVT vs. Hyperliquid and the Future of Digital Exchanges

Feature-By-Feature Comparison: Architecture, Compliance, Custody, and Performance.

As the crypto industry matures, the demand for scalable, secure, and institution-ready exchanges has never been higher. In this arena, two standout contenders – GRVT and Hyperliquid – are taking radically different approaches to solving the core limitations of today’s trading infrastructure.

Both aim to redefine what it means to trade digital assets. But beneath the surface, their architectures, priorities, and user philosophies diverge significantly. Here’s a closer look at how GRVT and Hyperliquid compare – and why GRVT may be the one rewriting the rules of the game.

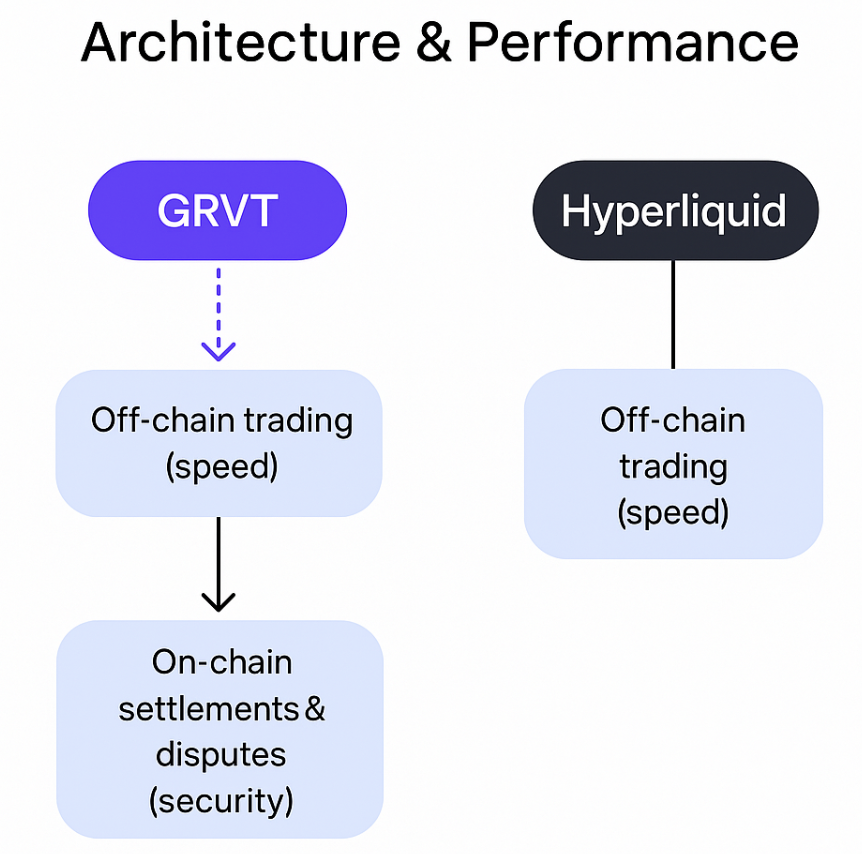

Architecture & Performance: Speed Is Essential, But Trust Is Non-Negotiable

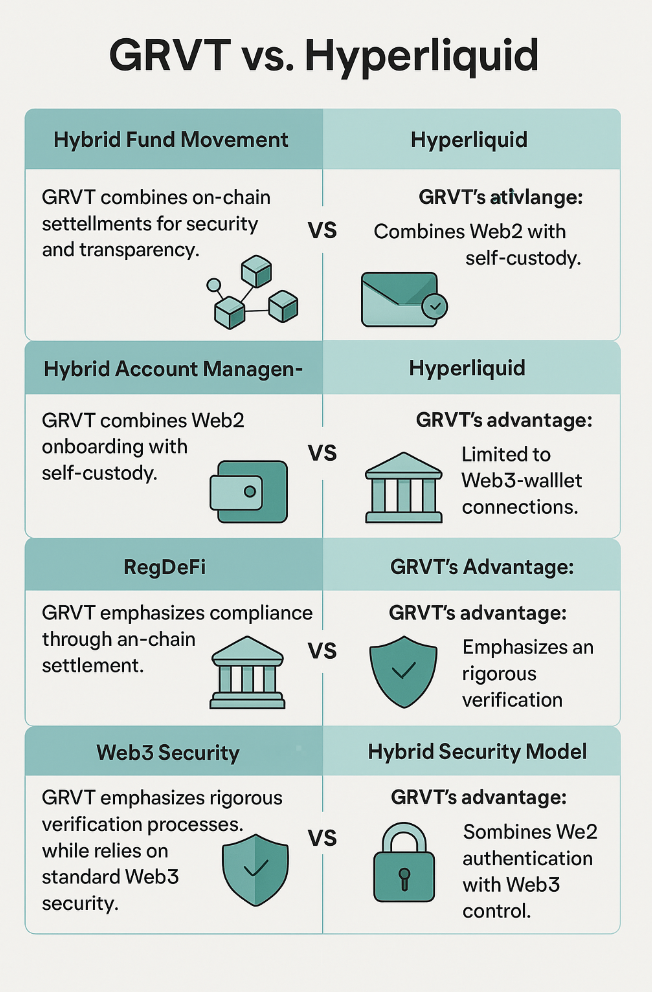

Hyperliquid built its reputation on blistering speed. With a fully off-chain trading engine and sequencer, it delivers lightning-fast execution for traders—ideal for scalpers, quant desks, and retail power users. However, this performance comes at a cost: centralized sequencing introduces counterparty risk, and the lack of verifiability over core processes can be a deal-breaker for institutions.

GRVT, on the other hand, embraces a hybrid architecture. Order matching is performed off-chain for speed (up to 600,000 TPS), but all settlements, account management, and risk actions are executed and verified on-chain via zkSync-powered smart contracts. This dual-layer system offers institutional-grade transparency, auditability, and compliance—without compromising on performance.

✅ Verdict: GRVT delivers both speed and trust, positioning itself as the only serious hybrid alternative for long-term institutional adoption.

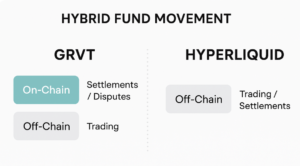

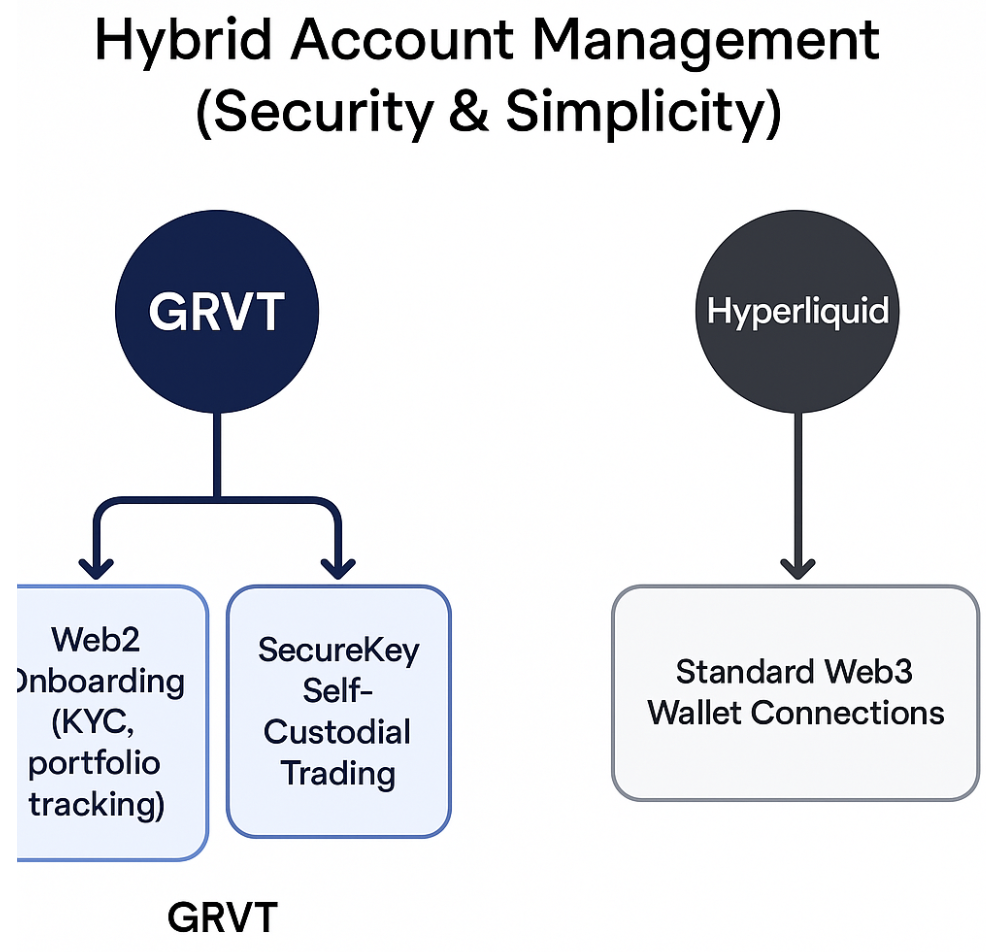

Self-Custody & Fund Control: Who Really Owns Your Assets?

Hyperliquid supports self-custody through standard Web3 wallet integrations. While this is sufficient for most crypto-native users, it lacks fine-grained control—particularly for institutions who need role-based access, multi-user permissions, or wallet recovery options.

GRVT redefines custodianship through a multi-tiered self-custody model:

GRVT redefines custodianship through a multi-tiered self-custody model:

- Native GRVT Wallet with biometric login and SecureKey (MPC-based) authentication.

- Support for external wallets (Metamask, Ledger, Coinbase Wallet).

- Role-based access control, allowing granular permissions (e.g., one user can trade, another can withdraw).

- Session keys for frictionless multi-trade sessions, without compromising control.

✅ Verdict: GRVT’s system mirrors enterprise-grade access control, offering the first truly compliant self-custody model for institutional DeFi.

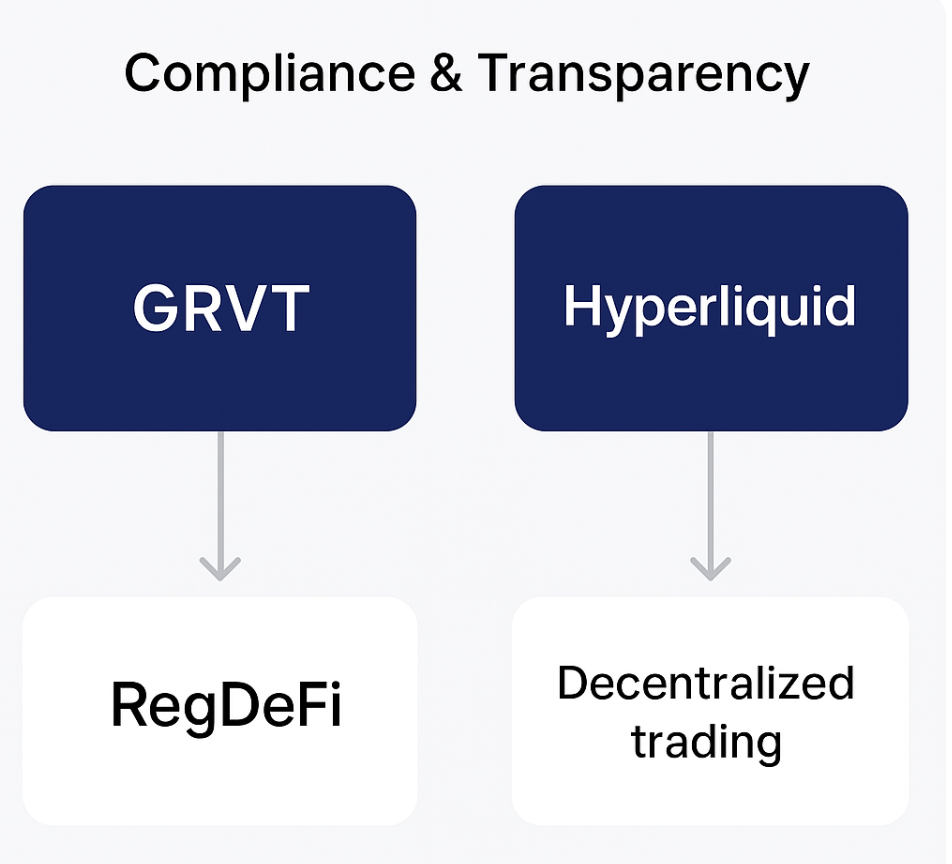

Compliance & RegDeFi: The Missing Bridge Between TradFi and DeFi

In today’s environment, compliance is no longer optional – especially for institutional capital.

Hyperliquid focuses on decentralization and performance, but it lacks formal KYC/AML processes, licenses, or regulatory alignment. For many institutions, this becomes an insurmountable barrier.

GRVT introduces a new category: RegDeFi – regulated decentralized finance. The platform integrates:

-

Full KYC/AML onboarding via ComplyCube.

-

Licensed trading framework.

-

On-chain settlement and auditability for every asset movement.

-

Reward incentives for verified users (ZK tokens + raffle entries).

✅ Verdict: GRVT’s RegDeFi model offers the regulatory certainty institutions require to participate in crypto markets confidently.

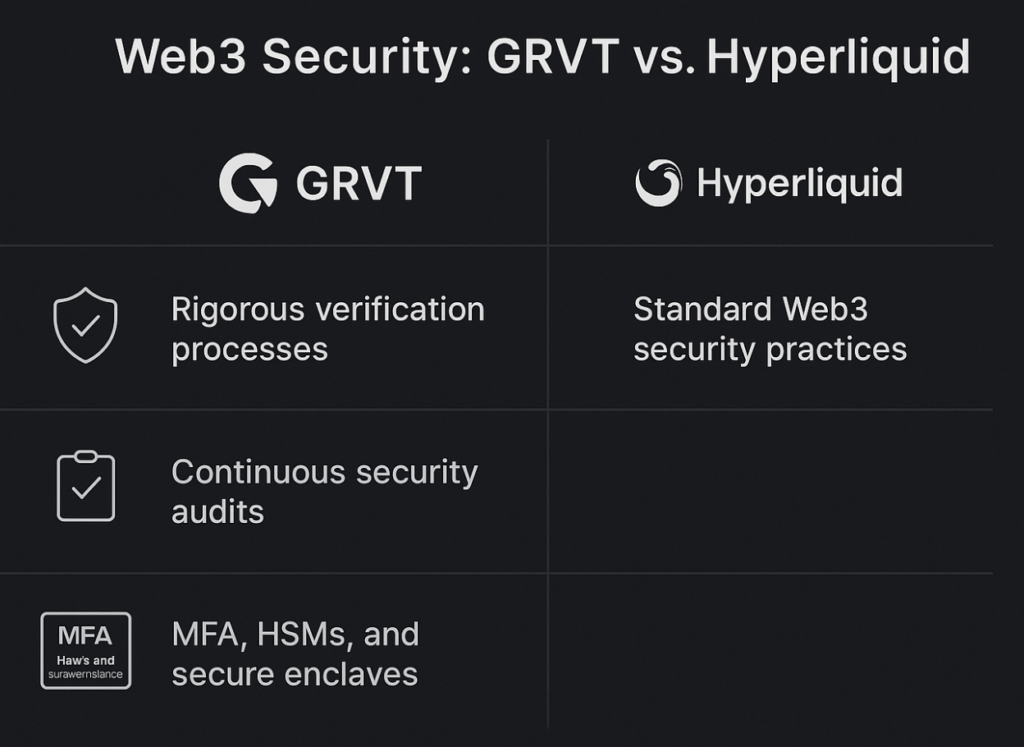

Security Model: Not Just About Code, But Process

Security in Web3 is about more than code audits. It’s about processes, people, and protocols working in harmony.

Hyperliquid adheres to standard Web3 security best practices—non-custodial wallet integration, permissionless access, and open-source audits.

GRVT goes further with a multi-layered security model:

-

Web2 standards like 2FA, HSMs, secure enclaves.

-

On-chain fund custody with EIP-712 wallet signatures.

-

Continuous third-party audits and penetration testing.

-

Institutional infrastructure with session-based controls and emergency recovery mechanisms.

✅ Verdict: For traders and institutions that prioritize operational integrity, GRVT offers security in depth—not just at the surface.

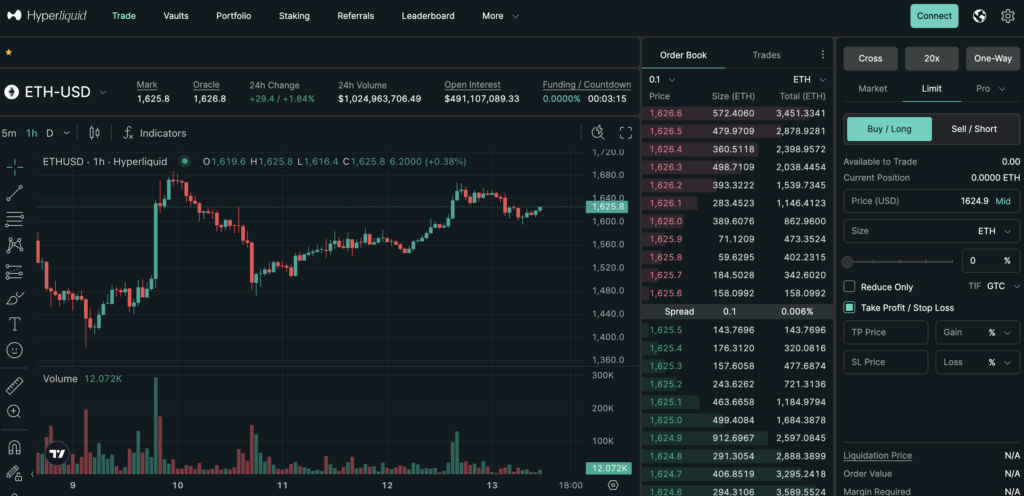

UX & Ecosystem: Built for Everyone, Powered by Institutions

Hyperliquid’s user interface caters well to advanced traders but lacks the onboarding tools that make DeFi approachable for the mainstream. Features like social trading or compliance dashboards are absent.

GRVT is built to onboard the next wave of users—both retail and institutional:

-

Web2-style login (OAuth/email).

-

Professional charting tools via TradingView.

-

“Trade Arcades” to gamify the trading experience.

-

API integration for algorithmic strategies.

-

A reward portal to incentivize participation and referrals.

-

Mobile app launching post-mainnet.

✅ Verdict: GRVT combines ease-of-use and enterprise sophistication, making it one of the most inclusive trading platforms to date.

Ecosystem Strength: Investors, Market Makers & Momentum

Hyperliquid is respected and growing, but operates more independently—with limited public information on strategic partnerships or liquidity guarantees.

GRVT, by contrast, has already assembled an impressive ecosystem of backers and collaborators:

-

Investors: Matter Labs, QCP Capital, Delphi Digital, Selini Capital, Pulsar, and more.

-

Market Makers: Over $3.2 billion in committed liquidity at launch, from major firms like Amber Group, Flow Traders, IMC, and Ampersan.

-

Partners: TradingView tech, zkSync infrastructure, Dfns wallet security.

✅ Verdict: GRVT isn’t just building a platform—it’s assembling an institutional-grade financial marketplace from the ground up.

Final Thoughts: Two Futures, One Clear Winner?

Both Hyperliquid and GRVT represent the bleeding edge of crypto exchange innovation. But where Hyperliquid prioritizes speed and decentralization for the crypto-native crowd, GRVT is positioning itself as the foundation for the next global financial system.

With its hybrid architecture, institutional-grade custody controls, regulatory alignment, and powerful ecosystem, GRVT isn’t just competing – it’s setting the new standard for what a next-generation crypto exchange should be.