What is Goldfinch?

Goldfinch is a decentralized credit protocol with global accessibility, aiming to consolidate the world’s credit activities on the blockchain while simultaneously promoting financial inclusion and broadening access to capital. The protocol enables cryptocurrency loans without necessitating crypto collateral, a crucial aspect that ultimately grants a majority of the global population access to digital currency capital.

By embracing the concept of trust via consensus, Goldfinch establishes a method for borrowers to demonstrate creditworthiness based on the collective judgment of other participants, as opposed to relying on over-collateralization with crypto assets. This approach lays the groundwork for creating an unalterable, blockchain-based credit history, which serves as a fundamental building block for any scalable lending model. Additionally, this credit history is a vital component that has been conspicuously absent in many burgeoning markets worldwide, thereby providing immense value to these growing economies.

The Goldfinch protocol leverages collective assessments as an indicator for capital allocation. Its decentralized community of investors extends loans to businesses that stimulate economic growth in their regions, with a primary focus on emerging markets. At present, all loans facilitated by Goldfinch are fully secured by off-chain assets.

By eliminating the necessity for crypto collateral and offering a mechanism for automatic yield distribution, the protocol significantly broadens the range of potential borrowers who can access cryptocurrency and the potential investors who can obtain exposure.

Essentially, Goldfinch is a decentralized credit protocol that enables crypto borrowing without the need for crypto collateral, as loans are entirely secured by off-chain assets. It is backed by notable investors including Coinbase Ventures and Andreessen Horowitz, among others.

A significant constraint of existing decentralized crypto lending protocols is the requirement for borrowers to overcollateralize their loans with crypto assets. This stipulation prevents the vast majority of global borrowers from participating in these lending platforms.

A significant constraint of existing decentralized crypto lending protocols is the requirement for borrowers to overcollateralize their loans with crypto assets. This stipulation prevents the vast majority of global borrowers from participating in these lending platforms.

By integrating the concept of “trust through consensus,” Goldfinch devises a method for borrowers to demonstrate creditworthiness based on the collective evaluation of other participants, rather than relying on their crypto assets. As it stands, all loans on the platform are entirely collateralized with off-chain assets and income streams.

How Goldfinch Works

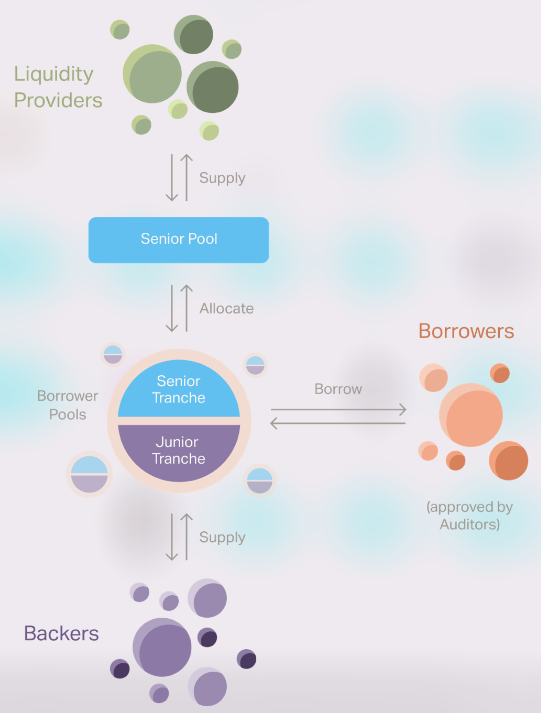

Borrowers (currently off-chain lending businesses) suggest deal terms for credit lines (Borrower Pools) to the protocol. Goldfinch’s community of Investors has the option to supply capital to these credit lines (Pools), either directly to specific Pools (as Backers) or indirectly by automatically distributing capital across the protocol (Liquidity Providers via the Senior Pool).

These Borrower businesses utilize their credit lines to draw down stablecoins, particularly USDC, from their Pool. Borrowers subsequently exchange the USDC for fiat currency and deploy it to end-borrowers within their local markets.

In this manner, the protocol delivers the utility of cryptocurrency – namely, its worldwide access to capital – while entrusting the actual end-borrower loan origination and servicing to businesses best suited to manage those tasks in their respective communities.

Trust through consensus

To determine capital allocation from the Senior Pool, the protocol employs the principle of “trust through consensus.” This implies that although the protocol does not trust any individual Backer or Auditor, it places trust in the collective actions of numerous participants.

At a high level: when more Backers contribute to a specific Borrower Pool, the Senior Pool amplifies the leverage ratio. Since this approach depends on counting individual Backers, the protocol must verify that they are, in fact, distinct individuals. Consequently, all Backers, Borrowers, and Auditors require a “unique entity check” to participate.

Junior and senior tranches

Borrower Pool smart contracts include both junior and senior tranches, which together account for 100% of a Borrower Pool’s capital. Backers provide capital to the Pools’ junior tranches, while the Senior Pool contributes capital to the Pools’ senior tranches.

When a Borrower makes repayments to one of their Borrower Pools, the Borrower Pool first applies the payment towards any interest and principal due to the senior tranche at that moment, and subsequently towards any interest and principal due to the junior tranche at that moment.

This structure ensures incentive alignment. Backers, who actively evaluate the feasibility of individual Borrower Pools, assume the protocol’s highest risk by offering first-loss capital through junior tranches. This encourages Backers to adequately assess the viability of the Pools since they will be the first to miss repayment in case of default.

Liquidity Providers, who allocate capital to the Senior Pool, which is automatically distributed across Borrower Pools based on Backers’ actions, bear less risk by offering second-loss capital through senior tranches. This grants Liquidity Providers the added assurance that they will be the first repaid if a positively-evaluated Pool by Backers defaults.

To record the varying amounts investors contribute, Backers receive an NFT representing their deposit upon supplying capital. The NFT tracks the supplied amount and how much has been redeemed. This enables the protocol to guarantee that no one redeems more than their proportional share of total repayments as they arrive.

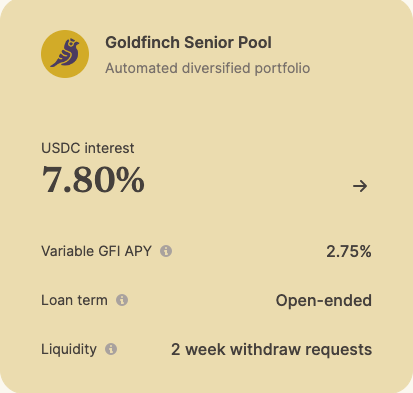

Senior Pool LPs obtain FIDU, an ERC-20 token representing their position that increases in USDC exchange value as interest and repayments are made to the Senior Pool.

At any point, a Backer can use their NFT to redeem their specific portion of the available repayments in the Pool. Senior Pool Liquidity Providers can withdraw their position in the Senior Pool whenever they choose by depositing their FIDU into a Withdrawal Request.

Focus on emerging markets

From the outset, Goldfinch aimed to cater to borrowers who could derive the maximum benefit and where cryptocurrency could wield the most significant impact. This led to an initial focus on lending businesses in emerging markets. The demand for cryptocurrency’s liquid, multinational nature is substantial in these areas, as businesses can reap numerous advantages from utilizing digital currencies due to the inefficiencies and obstacles present in traditional finance, which restrict capital flow into these regions.

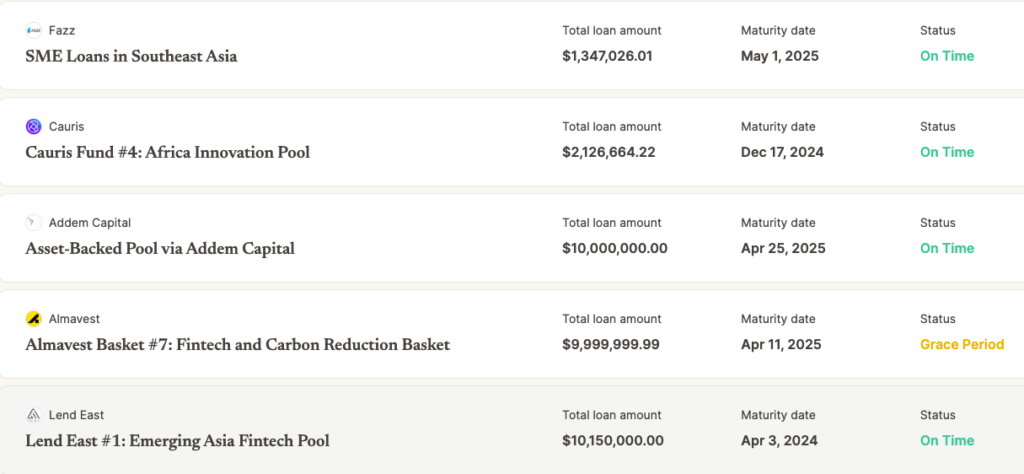

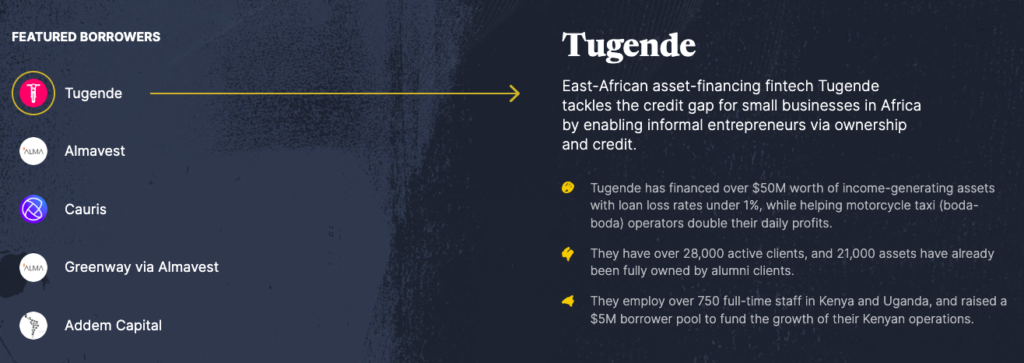

Goldfinch is currently extending financial access to thousands of individuals across the globe through its Borrowers, spanning more than 28 countries. Some of its Borrowers include PayJoy in Mexico, QuickCheck in Nigeria, Divibank and Addem Capital in Latin America, Greenway through Almavest in India, and Cauris in Africa, Asia, and Latin America.

Ecosystem Participants

The Goldfinch protocol features three primary roles: Investors, Borrowers, and Auditors. Additionally, Members are a distinct category of Investors who have augmented their involvement to promote the protocol’s growth.

Investors are participants who contribute USDC to the protocol for use by Borrowers. There are two avenues to become an Investor within Goldfinch: as a Backer or as a Liquidity Provider.

Backers prioritize yield and specificity. They evaluate individual Borrower Pools, determine whether to invest in them directly using first-loss capital, and earn the protocol’s highest yields in return.

Liquidity Providers focus on diversification and liquidity. They furnish second-loss capital to the Senior Pool, which automatically distributes its funds across all Borrower Pools based on Backers’ assessments.

Members are participants who allocate capital and GFI to a Goldfinch Membership Vault to bolster the network’s expansion and security. In exchange for their increased participation, they receive Member Rewards.

Borrowers are participants seeking financing through Goldfinch and propose Borrower Pools for evaluation by the network. Borrower Pools consist of smart contracts that outline the terms a Borrower desires for their loan, such as interest rates and repayment schedules.

Auditors are responsible for approving Borrowers, a necessary step before they can propose a Borrower Pool to Backers. The protocol randomly selects Auditors to perform a human-level verification to prevent fraudulent activity. In return for their efforts, Auditors receive rewards.

Tokens

Goldfinch has two native tokens: GFI and FIDU, both adhering to the ERC20 standard. Additionally, the protocol employs stablecoins, currently only USDC, for investments and loans.

GFI is the primary native token of Goldfinch, used for governance voting, Auditor staking, Auditor vote rewards, community grants, staking on Backers, protocol incentives, and depositing into a Member Vault to earn Member Rewards in exchange for supporting the protocol’s growth.

FIDU represents a Liquidity Provider’s deposit in the Senior Pool. Upon supplying to the Senior Pool, Liquidity Providers receive an equivalent amount of FIDU. FIDU can be redeemed for USDC in the Goldfinch dapp at an exchange rate based on the net asset value of the Senior Pool, minus a 0.5% withdrawal fee. The FIDU exchange rate increases over time as interest payments are made back to the Senior Pool.

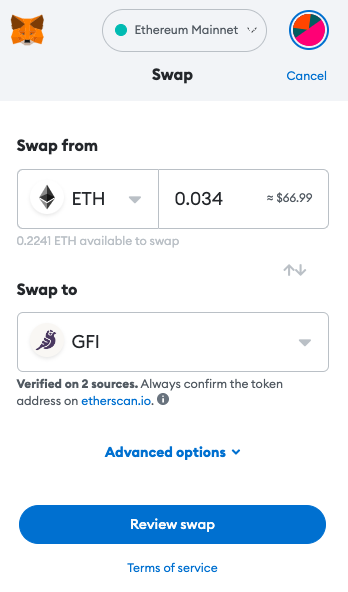

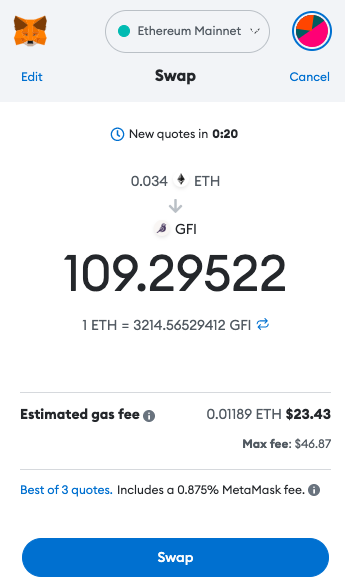

An easy way to acquire GFI tokens is to use decentralised exchanges such as Uniswap or swap from another asset using a web3 wallet e.g. MetaMask.

Borrower repayment incentives

Since Borrowers need to disclose their wallet address when proposing pools to Backers, their on-chain history becomes visible to future creditors, including off-chain creditors. As global finance increasingly moves on-chain, establishing a negative on-chain credit history is similar to creating a negative off-chain credit score or record.

Borrowers will likely desire continued borrowing from Goldfinch. The moment they miss any payment, Borrowers are unable to borrow further from any Borrower Pool. Though not explicitly supported by the protocol, Backers can form off-chain legal agreements with Borrowers, including requiring Borrowers to collateralize their on-chain loan with off-chain collateral. Backers may need such an agreement, either with them directly or with another Backer, to be willing to supply capital. In these instances, the legal agreement and potential Investor recourse serve as additional incentives for Borrowers. At present, all Goldfinch loans are fully collateralized with off-chain assets through this mechanism.

While occasional defaults are common in finance, Backers will likely cease supplying more capital to any of a Borrower’s pools if the Borrower consistently misses repayments. It is the Backer’s responsibility to assess whether Borrowers are eligible and possess a strong enough track record to warrant Backer investment in any future pools proposed by the Borrower.

Governance

Goldfinch operates as a decentralized, community-driven, and community-managed protocol. The community DAO governs and can perform maintenance functions and parameter adjustments via governance votes, including:

- Upgrading contracts

- Modifying protocol configurations and parameters

- Selecting Unique Entity Check providers

- Setting rewards and distributing GFI

- Pausing protocol activity in case of an emergency

Unique Entity Check

Since the protocol depends on “trust through consensus,” it is crucial to prevent Sybil Attacks by ensuring that each Borrower, Backer, and Auditor is a unique entity. As a result, they must each undergo a “Unique Entity Check” before participating.

Governance approves the protocol’s Unique Entity Check providers. Currently, Unique Identity (UID) serves this purpose, representing the world’s first NFT for identity verification.

UID is a non-transferrable NFT that represents Know-Your-Customer (KYC), Know-Your-Business (KYB), and/or U.S. investor accreditation verification on-chain.

Following ERC-1155 standards, it can be freely used by any other protocol. No personally identifiable data is stored on-chain. Warbler Labs, the core development team supporting Goldfinch’s growth, developed UID as a product.

The Goldfinch community can update or change how the Unique Entity Check is conducted at any time using the governance process, such as by introducing oracles that perform off-chain checks to validate wallet addresses as unique entities.

Also check out another DeFi credit protocol – Smartcredit.