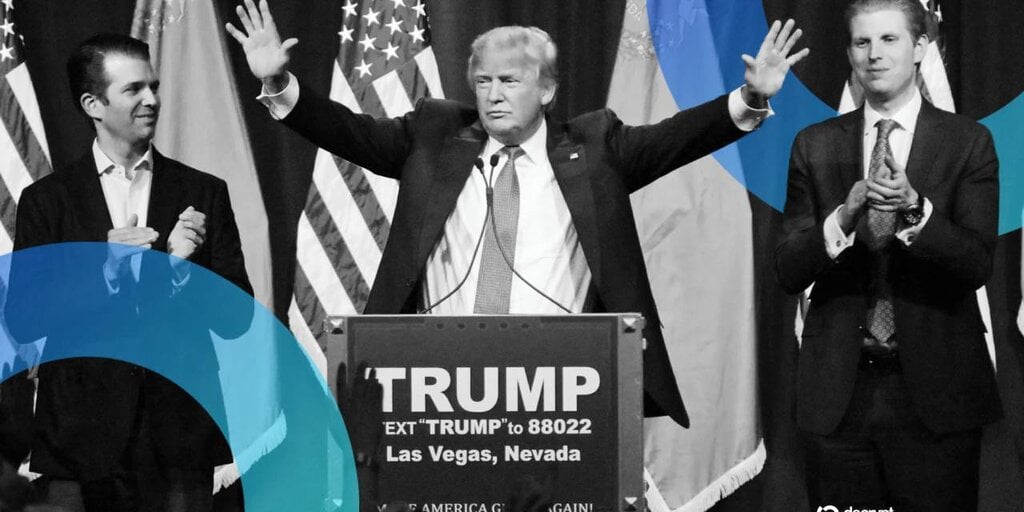

Trump Meme Coin’s First Year Leaves Crypto Policy in Limbo

From ethics violations to billion-dollar family profits, Trump's crypto ventures have triggered legislative warfare and industry backlash.

The first anniversary of the Trump meme coin has stirred considerable debate in the cryptocurrency community and policymakers alike. Officially trading at over $4 per token and boasting a market capitalization nearing $1 billion, the coin has rapidly climbed the ranks to become the sixth-largest meme coin globally. Yet its meteoric rise is shadowed by contentious discussions regarding ethics and regulatory oversight.

Behind the scenes, the Trump family has reportedly reaped over $1 billion in profits, fueling concerns about potential conflicts of interest and ethical questions surrounding the commercialization of the former president's brand within the crypto sector. These developments have incited legislative battles, with several U.S. lawmakers calling for heightened scrutiny and regulatory frameworks to govern such politically linked digital assets.

Industry Backlash and Calls for Policy Clarity

Crypto industry stakeholders have expressed divergent views on the coin’s implications for the broader market. While some see it as a playful yet lucrative token, others warn it reflects a worrying trend of politicizing crypto assets, potentially jeopardizing public trust and regulatory stability. This clash has left regulators in a quandary, struggling to devise clear policies that balance innovation with consumer protection.

The lack of definitive policies has created an environment of uncertainty, complicating compliance efforts for exchanges and developers alike. This limbo state is prompting calls for cohesive standards that address issues like marketing ethics, token governance, and financial disclosures within politically sensitive crypto projects.

Looking Forward: Navigating the Intersection of Crypto and Politics

The Trump meme coin saga underscores the broader challenges at the nexus of cryptocurrency, politics, and regulation. As digital assets increasingly intersect with political identities, the demand for robust regulatory frameworks will intensify to mitigate risks such as manipulation, misinformation, and financial misconduct.

Moving forward, stakeholders across government, industry, and civil society must collaborate to establish transparent and enforceable rules that preserve the integrity and promise of decentralized finance while protecting public interests amidst complex political realities.

Original Source

Read the original article from Decrypt

Recommended Articles

Chainlink Drops To $12.50, But Largest Whales Are Accumulating

On-chain data shows the largest of Chainlink whales have been accumulating recently even as the cryptocurrency’s price has slipped below $13.00. Top 100 Chainlink Whales Have Been Expanding Their Supply In a new post on X, on-chain analytics firm Santiment ha…

WISeKey to Unveil SEALCOIN Space-Based, Quantum-Resistant Crypto Transactions at Davos 2026

WISeKey to Unveil SEALCOIN Space-Based, Quantum-Resistant Crypto Transactions at Davos 2026 Geneva, Switzerland, January 21, 2026 – WISeKey International...

TST Images: Kings Deafeat Rangers, 4,3 at The Crypto.com Arena

LOS ANGELES, CALIF.