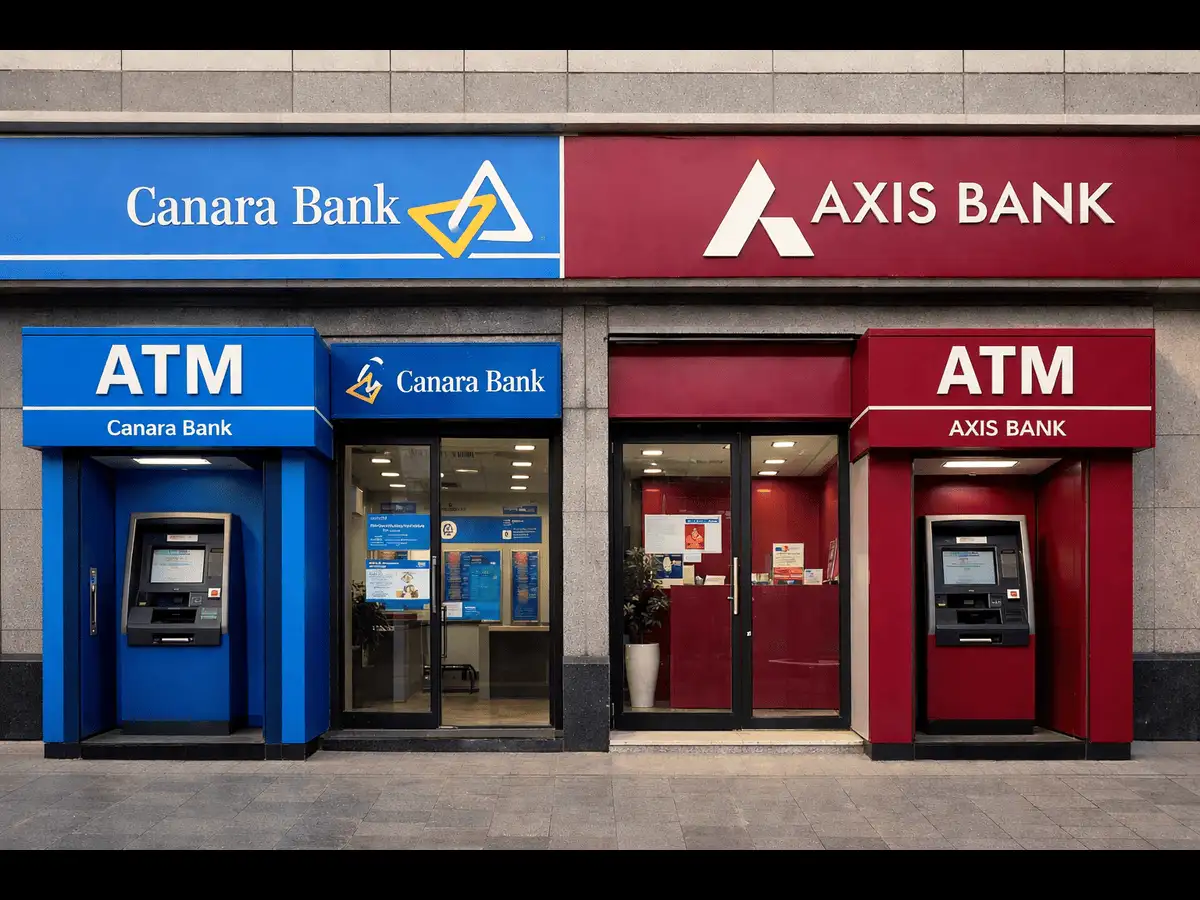

How bank insiders enabled cyber fraud: CBI exposes nexus among Canara Bank's manager, Axis Bank's BD and money mule operators

Central Bureau of Investigation (CBI) arrested two bank officials for accepting bribes. They helped cyber criminals open mule accounts for money laundering. These accounts were used to transfer funds from cyber frauds. The officials also advised criminals on …

Inside the Nexus: How Bank Insiders Facilitated Major Cyber Fraud Uncovered by CBI

The recent crackdown by the Central Bureau of Investigation (CBI) has unveiled a troubling alliance between bank insiders and organized cybercriminals, shedding light on sophisticated fraud operations that exploit vulnerabilities within India's banking sector. On December 24, 2025, two officials from Canara Bank and Axis Bank were apprehended for their roles in creating and managing 'money mule' accounts that served as conduits for laundering proceeds from cyber frauds.

Money mule accounts are essentially intermediary accounts used to obscure the trail of illicit funds, facilitating their swift movement and withdrawal without raising immediate suspicion. These accounts, when illicitly opened with insider assistance, become potent tools enabling cybercriminals to bypass conventional anti-money laundering (AML) measures. The arrested bank employees reportedly accepted bribes to authorize account openings without due diligence, and even provided strategic guidance on concealing fraudulent transactions.

The Modus Operandi and Its Wider Repercussions

This insider-enabled scheme emphasizes the critical risks posed by internal collusion in financial institutions. Exploiting trusted positions, these officials bypassed procedural safeguards, thereby amplifying the scale and impact of cyber fraud networks. The nexus also included money mule operators who played a pivotal role in layering stolen funds, converting cyber heist gains into ostensibly legitimate assets.

Such incidents expose systemic weakness requiring urgent attention—from strengthening KYC/AML compliance and employee vetting, to integrating advanced surveillance technologies such as AI-driven transaction monitoring systems. Regulatory bodies and banks must intensify efforts to educate front-line staff on fraud detection and enforce strict penalties to deter insider betrayals.

Ensuring Financial Integrity in the Digital Era

This case underscores how the convergence of human vulnerability and technological exploitation can undermine the integrity of financial systems. As banking digitalization accelerates, institutions must invest equally in secure processes and cultivating ethical work cultures. Vigilance, transparency, and cross-agency cooperation are paramount to dismantling such fraud racks and protecting consumers.

Ultimately, rooting out insider collusion to fortify institutional defenses will not only deter cybercriminal enterprises but also restore public confidence essential for fostering India's growing digital economy.

Original Source

Read the original article from The Times of India

Recommended Articles

‘On the bullish side of liquidity cycle’ – What does that mean for Bitcoin?

Institutions re-entered the market on the second-to-last day of the year.

4 crypto comebacks from 2025 that could help shape the year ahead

From Ross Ulbricht’s pardon to Ripple’s SEC victory, here’s a list of crypto’s most celebrated turnarounds this year and what they mean for the year ahead.

Elon Musk, Gina Rinehart and Larry Ellison: The world’s richest gain billions in 2025

The world’s 500 richest people added a record amount to their fortunes last year. Here are some of the year’s biggest winners and losers.